Chinese Inbound Coal Shipments Plummet 12.2%, Says BIMCO

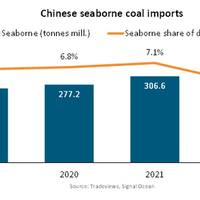

Weak economic activity, a 10.5% increase in domestic coal mining, and a recovery in coal imports from Mongolia via rail alleviated coal shipments to China in 2022. However, the end of China’s zero Covid policy and an anticipated recovery of the Chinese economy have strengthened expectations for the country’s coal imports in 2023. A return of import tariffs, the end of China’s unofficial ban on Australian coal, and the energy transition in China could shape the coal shipment outlook.Coal shipments fell 12.2% in 2022…

Baltic Dry Index Snaps Six-session Losing Streak

The Baltic Exchange's main sea freight index, tracking rates for ships carrying dry bulk commodities, ended a six-session losing streak on Monday, as an uptick in capesize rates outweighed losses in panamax and supramax segments.The overall index, which factors in rates for capesize, panamax, and supramax shipping vessels, edged up nine points, or 0.8%, to 1,139.The capesize index gained 84 points, or 5.56%, to 1,596.Average daily earnings for capesizes, which typically transport 150,000-tonne cargoes such as iron ore and coal, were up $694, at $13,237.China's state planner has allowed three c

Global Seaborne Coal Trade Up Nearly 6% in 2021

Global seaborne coal trade rose by 5.7% last year, driven by rising demand from steelmakers for coking coal and its products as economies began to recover from the coronavirus crisis, Germany's VDKi coal importers lobby group said.Imports and exports of hard coal across the globe stood at 1.18 billion tons in 2021, up from 1.116 billion in 2020, the Verein der Kohlenimporteure (VDKi) estimated.Trade in coking coal rose by 6% to 903 million tons while that of steam coal for power stations was up 4.9% at 277 million tons…

Baltic Dry Index Falls for 7th Day as Capesizes Drag

The Baltic Exchange's dry bulk sea freight index extended losses for a seventh straight session on Monday, as a drop in capesize rates offset gains in the smaller vessel segments.The overall index, which factors in rates for capesize, panamax, supramax and handysize vessels, fell by 122 points, or 2.5%, to 4,732.The capesize index fell 409 points, or 5.3%, to 7,358, its lowest since Sept.

China's Coal imports from Australia Plummet 98.6%, but India, S. Korea fill the Gaps

In the first seven months of the year Chinese coal imports from Australia have totalled just 780,000 tons as Chinese restrictions on Australian coal have started to hurt, according to Oceanbolt. This represents a 98.6% drop compared with 56.8 million tonnes in the same period in 2020.In the first seven months of 2020, 697 voyages were made carrying coal between Australia and China. Out of these, 59.1% were on Panamax ships while Capesize ships proved the second most popular, accounting for 35.3%.

China’s One-sided Recovery Drives Iron Ore Market Back Up -BIMCO

In the first two months of 2021, Brazilian iron ore exports have risen by 9.1% to 53 million tonnes, driven by China. So far this year, 35.2 million tonnes of iron ore has been exported to China, representing a 15.2% increase from the same period last year and standing in contrast to slightly declining exports to all other countries: down 1.2% to 17.8 million tonnes, continuing the trend from 2020.Despite the strong growth rates in the first months of this year, total exports of iron ore have failed to recover to 2019 levels following the 21.8% drop in volumes in 2020.

China's Ban on Australian Coal Forces Trade Flows to Realign

China's effective ban on imports of Australian coal is forcing a realignment of flows between the world's two biggest importers and two largest exporters.Indonesia and Australia dominate the global seaborne coal trade, with the Southeast Asian nation tops in thermal coal, used mainly in power plants, while Australia is the biggest shipper of coking coal, used to make steel, and the number two in thermal coal.China is the world's biggest coal importer, while India ranks second.China's major coal supplier was Australia…

Bottlenecks and Inefficiencies Are Key Upside Risks for Dry Bulk Market -MSI

Port days and diverted voyages are having an unusually strong impact on market balances and will play a key role in the short term outlook.Summer may be drawing to close in the northern hemisphere but for dry bulk shipowners, the positive tone could continue into early autumn as port delays and diversions provide continued upside, says Maritime Strategies International.July was another positive month for the dry bulk sector, with average monthly spot rates rising to their highest level this year for all benchmark vessels…

World Seaborne Coal Trade Rose 0.7% in 2019

Seaborne coal trade around the world grew 0.7% last year, helped by higher output in China and Indonesia and more export activity by Indonesia, Australia, Russia and Canada, Germany's VDKI coal importers lobby said on Friday.Imports and exports, counted together, rose to 1.218 billion tonnes from 1.210 billion tonnes in 2018, VDKI Managing Director Franz-Josef Wodopia said in an speech made available to Reuters, citing VDKI estimates.Within the 2019 total, trade in coking coal used for steelmaking dropped by 1% to 287 million tonnes as steel production declined, the Verein der Kohlenimporteure

Baltic Index Continues to Sink

The Baltic Exchange's main sea freight index slid for a 12th straight session on Thursday, hitting a six-month low, as reduced seasonal demand dragged down vessel rates across segments.* The Baltic index, which tracks rates for capesize, panamax and supramax vessels that ferry dry bulk commodities, dropped 70 points, or 5.7%, to 1,151 — its lowest level since June 19.* The capesize index declined 127 points, or 6%, to 1,976 — the lowest in over six months.* Average daily earnings for capesizes…

World Seaborne Coal Trade Rose 3.7% in 2018

World coal seaborne trade grew 3.7 percent last year helped by higher output in India, Indonesia and Russia, Germany's VDKI coal importers lobby said on Friday.Imports and exports rose to 1.202 billion tonnes from 1.159 billion tonnes in 2017, VDKI Managing Director Franz-Josef Wodopia said in an speech made available to Reuters.Of the total, trade in steam coal used in power stations rose by 3.6 percent to 920 million tonnes.Trade in coking coal used for steelmaking rose by 4.4 percent to 281 million tonnes…

World Seaborne Coal Trade Up in 2017

World coal seaborne trade increased by 1.5 percent last year due to a recovery in output in producer countries such as the United States, Russia and China and an accompanying rise in export activity, German coal importers lobby VDKI said on Friday. Looking ahead, Wodopia said that, price-wise, China remains in the driving seat as the size of its domestic production determines how much landed coal the country needs to import. "So far, persistent demand in Southeast Asia continues to offset declining tendencies in the Atlantic and supports coal prices," Wodopia said.

Dry Bulk Shipping Gets a Boost from US Coal -BIMCO

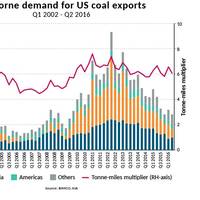

U.S. seaborne coal exports have turned years of negative growth around and seem to be climbing for a third quarter in a row. The increase in total volume is predominantly driven by a growing demand from European importers. East Asian buyers have also ramped up their import of U.S. coal, which is beneficial for the dry bulk shipping industry as it generates a substantial amount of ton-miles, relative to other destinations. BIMCO reported back in December 2016, that the ton-miles from U.S.

U.S. Coal Exports Soar, Revived in Part by New Energy Policy

U.S. coal exports have jumped more than 60 percent this year due to soaring demand from Europe and Asia, according to a Reuters review of government data, allowing President Donald Trump's administration to claim that efforts to revive the battered industry are working. The increased shipments came as the European Union and other U.S. allies heaped criticism on the Trump administration for its rejection of the Paris Climate Accord, a deal agreed by nearly 200 countries to cut carbon emissions from the burning of fossil fuels like coal. The previously unpublished figures provided to Reuters by the U.S. Energy Information Administration showed exports of the fuel from January through May totaled 36.79 million tons, up 60.3 percent from 22.94 million tons in the same period in 2016.

LNG-fueled Newcastlemax Bulk Carrier Design Unveiled

Project partners BHP, Fortescue, Mitsui O.S.K. Lines (MOL), Rio Tinto, SDARI, U-Ming, Woodside, and DNV GL presented the results from stage one of their “Green Corridor” joint industry project (JIP), which demonstrated the commercial potential and technical feasibility of bulkers fueled by liquefied natural gas (LNG) in the iron ore and coal trade between Australia and China. The result is an LNG-fueled Newcastlemax design which is in the process of receiving Approval in Principle (AiP) from DNV GL. The idea of developing LNG-fueling infrastructure for the vessels operating on the Australia–China iron ore and coal trade route has been contemplated by major charterers, ship owners and operators for many years.

Dry Bulk Shipping Remains Positive: Drewry

The outlook for dry bulk shipping remains positive given the shrinking supply-demand gap, according to the latest edition of the Dry Bulk Forecaster, published by global shipping consultancy Drewry. With high demolition activity and low deliveries the fleet is expected to grow at a slow annual rate of 1 percent over the next five years, while tonne mile demand will grow at a faster pace of around 3 percent per annum. As supply and demand becomes more balanced over the forecast years, charter rates are expected to improve gradually. Drewry has also researched and flagged the impact of renewables on the dry bulk trade, as this has the potential to reverse charter rates, and has built two scenarios based on current trade developments.

Great Lakes Shipping Season Kicks Off

The 2017 Great Lakes shipping season begins today when the U.S.-flag tug/barge unit Dorothy Ann/Pathfinder departs her winter lay-up berth in Erie, Pa., and sails to Cleveland, Ohio, where she will initiate the shuttle of iron ore from Cleveland Bulk Terminal to the ArcelorMittal steel mill at the end of the navigable portion of the Cuyahoga River on Wednesday. The vessel will load approximately 15,000 tons that was mined from Minnesota’s Mesabi Iron Range. The next vessel to get underway will be the cement carrier Bradshaw McKee/St. Marys Conquest on March 1.

Improved Demand Easing Dry Bulk Vessel Oversupply

With contraction in vessel supply and healthy demand growth, the dry bulk shipping market is expected to recover from 2017 onwards, according to the latest edition of the Dry Bulk Forecaster, published by global shipping consultancy Drewry. An impressive outlook for dry bulk demand coupled with a small orderbook of newbuilds as a percentage of the total fleet capacity will ensure a sustained recovery in the dry bulk market. Earnings in the dry bulk market are expected to improve from 2017 with a narrowing supply-demand gap. Demand is projected to grow at a healthy pace of 3% while supply is expected to grow by about 1% from 2017, making the dry bulk segment an interesting market to invest in. The growth in demand originates from a rise in iron ore and thermal coal trade.

Dry Bulk: Less Pain, Not Much Gain

The dry bulk market’s strong end to 2016 is unlikely to last long into 2017, according to the latest research from Maritime Strategies International. In its latest quarterly dry bulk market report*, MSI predicts a depressed year for rates in 2017, a year marked by multiple risks to recovery. Stronger freight markets in Q4 2016 had been broadly expected by MSI, albeit for slightly different reasons. While iron ore trade undershot its expectations, coal trade overshot them with geographical imbalances playing a key role.

Big Slowdown for US Coal Exports -BIMCO

Since Q1 2013, the significance of U.S. coal exports has seen a considerable setback, with 2016 achieving the same levels as 2009. This is due to the long-haul routes carrying coking coal from the U.S. East Coast and U.S. Gulf Coast to East Asia, are not operating to the same extent and the EU is demanding less thermal coal, says shipping organization Baltic and International Maritime Council (BIMCO). When BIMCO first published its story concerning U.S. coal in 2013, U.S. coal exports had the most significant coal trade in the world, measured by metric-ton-miles.

BIMCO: Shorter sailing distances limit upside of two-year high Chinese coal imports

Australia and Indonesia, being the main exporters of coal to China, are growing their market share at the expense of longer haul exporters like the US and South Africa. Therefore, dry bulk shipping demand does not enjoy full tonne-mile demand, when the imported coal volumes increase. The high level of coal into China for Q3 2016 shows the growing importance of Chinese coal imports for the shipping market, since mid-April 2016. The State Administration of Work Safety in China enforced in mid-April a policy of 276 working days per year, upon the coal mines. A decrease in operational days of 16%, to handle the overcapacity in the domestic coal mining industry.

‘Frothy’ Capesize Sector Threatens New Year Hangover for Dry Bulk

Maritime Strategies International (MSI) is forecasting a firm festive season for the dry bulk market, swiftly followed by a New Year comedown. In its latest Dry Bulk Freight Forecaster* MSI notes that after a steady fall in average daily TCE spot earnings in October, November saw an inflection point for Capesizes, with rates soaring to over $16,000/day, the highest since mid-2015. Some of this strength has translated to the Panamax market, although Supramax and Handysize earnings have been broadly unaffected.

Q4 Bounce Forecast for Dry Bulk Market

The Q4 bounce – a seasonal staple of the dry bulk markets – looks likely for Capesize and Panamax segments, but the effects may be limited. Independent research and consultancy firm Maritime Strategies International (MSI) is forecasting a fourth quarter bounce in dry bulk market earnings, driven by improving iron ore, coal and grain trades. In its latest Dry Bulk Freight Forecaster, MSI sees positive signs beyond the traditional summer lull in chartering activity for both the Capesize and Panamax sectors.