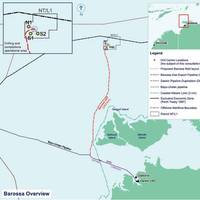

Allseas Makes Progress on Santos’ Barossa Gas Export Pipeline in Australia

Offshore installation contractor Allseas has made progress on the installation of the pipeline for Santos’ Barossa Gas Export Pipeline (GEP) project offshore Australia.Allseas’ Audacia pipelay vessel has installed her largest ever PLET in S-mode, concluding several years of in-house engineering, fabrication and testing, the Swiss-based contractor said.Due to the weight of the pipeline end termination structure, Allseas’ production crew had to install it separately to the connector head.Audacia vessels is being supported with four other vessels - Fortitude…

Gearbulk Orders Ammonia/Methanol-ready Bulk Carriers

Gearbulk announced it has signed a contract for delivery of up to four ammonia/methanol-ready, 82,300 dwt open hatch newbuildings. The contract is firm for two vessels, with an option to purchase a further two.The Swiss-headquartered company said it has secured financing for the vessels, and CSSC Huangpu Wenchong Longxue shipyard will deliver the first two vessels in the first half of 2027.“This contract for four newbuildings marks a significant milestone for Gearbulk as these vessels are set to be the largest and most efficient in the company’s history…

Esgian Week 14 Report: Major Jackup Contract Suspensions

Esgian reports various drilling contractors disclosing details of discussions with Saudi Aramco regarding jackup contract suspensions in its Week 14 Rig Analytics Market Roundup. These contractors include Shelf Drilling, ADES, Borr Drilling, Arabian Drilling, COSL, and ARO Drilling.Meanwhile, Transocean, Noble, and COSL rigs have firmed up new work in the US Gulf of Mexico, Suriname, and the North Sea, respectively.Report overview:ContractsShelf Drilling has received a notice of suspension of operations on four jackup rigs from a customer in the Middle East.

Red Sea Attacks Temporarily Increase Demand for Ships

The BIMCO Container Shipping Market Overview & Outlook for March 2024 has been published, and Niels Rasmussen, BIMCO’s Chief Shipping Analyst, highlights that ship supply is expected to grow on average 9.1% in 2024 and 4.1% in 2025.Rerouting via Cape of Good Hope is assumed to impact the first half of 2024. Ship demand increases an estimated 9.5% in 2024 and falls 0.5% in 2025. The supply/demand balance is expected to tighten in the first half of 2024 but then weaken when ships can return to the Suez Canal routing.According to the IMF…

Schottel Breaks Ground for Rudder Propeller Factory Expansion in Germany

Schottel has marked the symbolic start of construction for the expansion of its rudder propeller factory in Dörth, with the construction already advancing towards the planned commissioning in 2025.Schottel is expanding its rudder propeller factory by adding a logistics center measuring around 4,000 m2.As the official ground-breaking ceremony was delayed, it has now taken place symbolically against the backdrop of the shell construction that has already begun.The total investment volume amounts to €9.5 million…

Twin Disc Inks Deal to Acquire Katsa for $23 Million

U.S. based power transmission equipment manufacturer Twin Disc announced it has entered into a definitive agreement to acquire Katsa, a Finnish-headquartered manufacturer of power transmission components and gearboxes for industrial and marine markets, in an all-cash transaction valued at €21 million (approximately $23 million).The transaction is expected to close in the first half of calendar year 2024, subject to customary closing conditions, including regulatory approval, Twin…

DHT Orders Four VLCCs

DHT Holdings announced it has entered into agreements to build four very large crude carriers (VLCC) in South Korea for delivery between April and December 2026.Two of the large tankers will be constructed at Hyundai Samho Heavy Industries and the other two at Hanwha Ocean (formerly known as Daewoo Shipbuilding & Marine Engineering), for an average price of $128.5 million. The contracts include options for an additional four vessels that can be delivered during the first half of 2027.The vessels have been ordered to Super Eco-designs and have carrying capacity of about 320,000 metric tons.

Kraken Robotics Delivers Minehunting Systems to Royal Danish Navy

Canadian company Kraken Robotics has completed deliveries and sea acceptance tests of all systems for its minehunting sonar equipment under the contract with Royal Danish Navy.The contract was signed in September 2020, following a competitive bidding process. Under the contract with the Danish Ministry of Defence Acquisition and Logistics Organization (DALO), Kraken has delivered four complete turnkey minehunting systems.Each system consists of a KATFISH towed Synthetic Aperture Sonar…

Diana Shipping Orders Two Methanol Dual-fuel Bulkers

Greek shipowner Diana Shipping on Wednesday announced it has placed an order for two new methanol dual-fuel Kamsarmax bulk carriers from China's Tsuneishi Group (Zhoushan) Shipbuilding Inc.The 81,200 dwt newbuilds were ordered at a purchase price of $46 million each, Diana said. The vessels are expected to be delivered by the second half of 2027 and the first half of 2028, respectively.Diana in September 2023 announced it signed a letter of intent (LOI) to order the ships through…

US Import Volumes Seen Rising Despite Red Sea Disruptions

Inbound cargo volume at the United States’ major container ports is expected to see year-over-year increases through the first half of the year despite attacks on ships in the Red Sea, according to the Global Port Tracker report released by the National Retail Federation and Hackett Associates.“Only about 12% of U.S.-bound cargo comes through the Suez Canal but the situation in the Red Sea is bringing volatility and uncertainty that are being felt around the globe,” NRF Vice President for Supply Chain and Customs Policy Jonathan Gold said. “U.S.

Carnival Warns of Hit to 2024 Earnings After Rerouting of Red Sea Itineraries

Carnival said on Tuesday that its annual earnings would take a hit as the cruise operator reroutes its ships that were due to pass through the Red Sea, a key transit route linking Asia and Europe.A growing list of companies have rerouted vessels as the Houthis, a Yemeni militant group, steps up attacks on Israeli ships or ships heading towards Israel, in solidarity with the Palestinians.The rerouting by Carnival is expected to have an impact of 7 cents to 8 cents on its adjusted earnings per share for full-year 2024, with the majority of the impact coming in the second quarter.

Drone Attack: Russia Suspends Operations at Ust-Luga

Russian energy company Novatek said on Sunday it had been forced to suspend some operations at a huge Baltic Sea fuel export terminal due to a fire started by what Ukrainian media said was a drone attack.The giant Ust-Luga complex, located on the Gulf of Finland about 170 km (110 miles) west of St. Petersburg, is used to ship oil and gas products to international markets. It processes stable gas condensate - a type of light oil - into light and heavy naphtha, kerosene and diesel to be shipped by sea.It was not clear how long the disruption would last…

Australian Court Lets Santos Build Barossa Pipeline

Australia's Santos can proceed with construction of an undersea pipeline vital to its $4.3 billion Barossa gas project after a court on Monday ruled in favor of the oil and gas firm in a dispute with an Indigenous man looking to pause the work.Work on the pipeline, which will connect the Barossa gas field to a processing plant in the northern Australian city of Darwin, was paused by court order in November after a suit by a member of an Indigenous group regarded as traditional…

Polish Seaborne LPG Import Growth Slowed to 7% in 2023

Growth in sea-borne imports of liquefied petroleum gas (LPG) to Poland slowed 7% last year to 1.084 million metric tons, from a jump of more than 70% in 2022, with sea terminals working almost at capacity, according to traders and LSEG data.Sea-borne imports account for some 35% of total LPG supplies to Poland, while deliveries by rail was more than 50%.Poland also remained the main destination for Russian LPG, which was banned by the European Union last month over the conflict…

Mixed Feelings in Ship Recycling Market

Cash buyer GMS reports that the international ship recycling community is finishing the year with mixed feelings.“On the one hand, we have seen comparatively more deals concluded in 2023 than we did in 2022, with 2022 being the weakest of years over the last decade (in terms of the volume of vessels recycled in a single year).

Cognitive Technology to Reduce Motion Sickness in Amphibious Vehicles

Hyundai Mobis has signed a Memorandum of Understanding (MoU) with the Republic of Korea Marine Corps for cooperation on technology that is expected to alleviate motion sickness for marines traversing rough terrains from sea to land, enhancing combat performance.Last year, Hyundai Mobis developed the 'Smart Cabin Controller,' analyzing a driver's posture, heart rate, and brainwaves to prevent drowsiness, stress, and motion sickness.The MoU marks the first application of the technology in the broader mobility sector…

Russia Oil Price Cap Coalition Toughens Shipping Rules

The U.S.-led coalition imposing a price cap on seaborne Russian oil announced changes on Wednesday to its compliance regime the Treasury Department said will make it harder for Russian exporters to bypass the cap.The Treasury also imposed fresh sanctions on a ship manager owned by the Russian government and three oil traders involved in Russian oil trade.The Group of Seven (G7) industrialized countries last year imposed a price cap of $60 per barrel on Russian oil shipments in…

Harim Preferred Buyer of HMM

Harim Holdings on Tuesday said it has been chosen as the preferred bidder to buy control of South Korea's biggest container shipping company HMM in what people with knowledge of the matter said was a 6.4 trillion won ($4.92 billion) deal.Harim and HMM creditors Korea Development Bank and Korea Ocean Business will negotiate a final deal by the first half of 2024 for 58% of the shipper, said the people, declining to be identified as they were not authorised to discuss terms.Harim entered bidding via a consortium led by its bulk shipping unit Pan Ocean.

Star Bulk and Eagle Bulk Agree to $2.1 Billion Merger

Dry bulk shipping companies Star Bulk Carriers and Eagle Bulk Shipping have reached a deal to merge in a $2.1 billion all-stock deal.The terms of the definitive agreement have received unanimous approval from the boards of directors of both New York-listed ocean carriers, and the companes expect the deal to close in the first half of 2024 following approvals from regulators and Eagle shareholder.Eagle shareholders will receive 2.6211 shares of Star Bulk common stock for each share of Eagle common stock owned.

Plans in Progress for New North Sea Wells

Esgian has published its Week 49 Rig Market Roundup highlighting new drilling activity in the North Sea and a new licensing deal in Morocco.Drilling Activity and DiscoveriesSerica Energy is continuing with plans for its four-well drilling campaign in the UK North Sea, scheduled for 2024 and early 2025. The campaign will be carried out using the semisubmersible COSLInnovator. All four wells are production wells. The first well in the campaign will be a sidetrack of an existing well (B1z) on the Bittern field.

BIMCO Adopts Four ETS Clauses

BIMCO’s Documentary Committee has adopted a new Emission Trading Scheme Allowances Clause for BIMCO’s ship management agreement, SHIPMAN, and three ETS clauses for Voyage Charter Parties. The clauses aim to facilitate collaboration and provide clarity and certainty between parties as new regulations come into force, changing the way the industry operates to achieve compliance and cut emissions.On January 1, 2024, the EU Emissions Trading System (EU ETS) will be extended to cover CO2 emissions from ships of 5,000GT and above calling at EU ports, regardless of flag.

Bab al-Mandab Shipping Lane Becomes Target as Israel Fights Hamas

Yemen's Houthis have been targeting vessels in the southern Red Sea and the Bab al-Mandab Strait in attacks that the Iran-aligned group says aim to support the Palestinians as Israel and Hamas wage war.Several freight firms including MSC, the world's largest container shipping line, said they would avoid the Suez Canal as a result, which could mean having to circumnavigate Africa instead.War risk insurance premiums have risen as a result.WHAT ARE THE RECENT HOUTHI ATTACKS?* Dec.

Maersk to Deploy First Large Methanol-Enabled Vessel on AE Trade

A.P. Moller - Maersk is about to launch the first of its 18 large methanol-enabled vessels currently on order. On February 9, 2024, it will enter service on the AE7 string connecting Asia and Europe, which includes port calls in Shanghai, Tanjung Pelepas, Colombo and Hamburg, with Ningbo, China, being its first destination.The container vessel built by Hyundai Heavy Industries (HHI) in South Korea has a nominal capacity of 16,000 TEU and is equipped with a dual-fuel engine enabling…