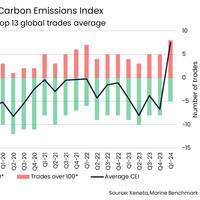

Red Sea Conflict Brings Massive Carbon Emissions Increases

Conflict in the Red Sea has brought massive carbon emissions increases in ocean freight container shipping, according to data just released by Xeneta.The Xeneta and Marine Benchmark Carbon Emissions Index (CEI), which measures carbon emissions per ton of cargo transported across the world’s top 13 trades, hit 107.4 points in Q1 2024 - the highest it has been since the index began in Q1 2018.For containers being shipped via ocean from the Far East to Mediterranean, the CEI reveals carbon emissions increased by 63% in Q1 2024 compared to Q4 2023.

Baltimore Bridge Collapse Could Disrupt Supply Chain -Xeneta

The containership allision that caused the collapse of the Francis Scott Key Bridge in Baltimore could cause "significant disruption" to shipping supply chains, according to industry analyst Xeneta.The 10,000 TEU Singapore-flagged Dali was operating on a 2M alliance service between Baltimore and the Far East when it struck the bridge around 1:35 a.m. on Tuesday, sending cars and people plunging into the river below."The immediate focus is the rescue operation, but there will clearly…

Red Sea: Far East-US Spiraling Ocean Freight Rates Set for Decline

Spiraling ocean freight rates from the Far East to the United States, caused by the Red Sea crisis, may have peaked, with some relief on the horizon emerging for the shippers, according to the latest analysis from Xeneta, and ocean and air freight rate benchmarking and market analytics platform.The latest data released by Xeneta indicates a peak may have been reached after spot rates from the Far East into the US declined slightly since the last round of General Rate Increases (GRIs) were implemented at the start of February.Into the US East Coast…

Markets Spike Following Houthi Attacks on Shipping

Continued missile attacks on merchant ships in the Red Sea have plunged supply chains into chaos, and consumers around the world will have to pay the price, according to Xeneta.Latest data from the industry analyst shows spot rates in the ocean freight shipping market spiked by 20% since Friday after major shipping liner companies such as Hapag Lloyd, MSC and Maersk announced they are avoiding the Red Sea amid the attacks by Houthi militia.Xeneta chief analyst Peter Sand said…

Xeneta Data Points to "Brutal" 2024 for Ocean Freight Carriers

Latest data from Xeneta suggests 2024 could be even more brutal than expected for carriers in the ocean freight shipping market, as the Xeneta Shipping Index (XSI), which tracks real-time developments in global long-term contracted rates, today stands at 158.5 points, which is 62.3% lower than November 2022.“The XSI is an average of all long term contracts on the market – so in essence the global index is currently being propped up by those older contracts which were signed back in 2022 when rates were much higher," said Emily Stausbøll, Market Analyst, Xeneta.

Nokian Tyres Commits to Wastewater Project in Baltic Sea

Nokian Tyres has made a commitment to the not-for-profit Baltic Sea Action Group (BSAG) covering, 2023–2026, to cooperate on BSAG's Ship Waste Action initiative.The goal of the initiative is to establish an operating model in which wastewater from cargo ships is discharged on shore in the harbor and the utilization of nutrients is enabled by circular economy solutions."The discharge of wastewater from cargo ships into the sea is still legal, and many shippers may not even know that wastewater from their transports is likely to end up in the Baltic Sea.

Xeneta Sees Storm Clouds Gathering for 2023

After over two years of rising rates and overstretched capacity, the rapidly cooling ocean freight market looks set for an “extremely challenging” 2023, according to Oslo-based Xeneta. An in-depth analysis of the latest real-time ocean and air freight rates, combined with expert trend forecasts, suggests that ocean cargo volumes could fall by up to 2.5%, rates will drop “significantly” and weak demand will force increased idling of vessels. The air freight market, analysts predict…

GateHouse Maritime Debuts OceanIO Data Platform

GateHouse Maritime, a provider of ocean supply chain visibility and predictability services, has announced the introduction of its new data platform, OceanIO. The new feed is scalable to support the rapidly increasing number of data points anticipated from the growing use of IOT technologies fitted to shipped and shipping assets.Martin Dommerby Kristiansen, CEO at GateHouse Maritime, said, “The digital transformation of the logistics sector is creating a tsunami of data. At GateHouse…

Western Supply Chains Buckle as Coronavirus Lockdowns Spread

Freight carriers are struggling to deliver goods by land, sea or air as the coronavirus pandemic forces Western governments to impose lockdowns, threatening supplies of vital products including medicines into the most affected areas, such as Italy.While China's draconian steps to stop the spread of the virus are now allowing its economy slowly to come back online, supply chains are backing up in other parts of the world.Problems ranging from finding enough truck drivers to restrictions on seafarers and a lack of air freight are hitting the smooth flow of goods…

DCSA Releases Cyber-Security Guide

The Digital Container Shipping Association (DCSA), a non-profit group of nine major ocean freight carriers, has rolled out its cyber security guidance to prepare shipowners and vessels for the International Maritime Organization’s pending cyber security mandate.The best practices outlined by DCSA provide all shipping companies with a common language and a manageable, task-based approach for meeting the IMO’s January 2021 implementation timeframe, DCSA said in a statement.IMO’s Resolution MSC.428(98) on Maritime Cyber Risk Management in Safety Management Systems was adopted in 2017 to ensure that vessels’ cyber risks are appropriately…

DCSA Sets Track and Trace Standards

The Digital Container Shipping Association (DCSA), a non-profit group of nine major ocean freight carriers, published track and trace standards in an effort to unify information sharing and further digitalization goals."This is the first of many initiatives to be put forth by DCSA to transform inefficient practices and accelerate digitization through a unified industry effort," said the Container line group.Carriers, shippers and third parties can use track and trace standards to "enable cross-carrier shipment tracking" and can download the standards from the DCSA website, DCSA said.The data model ensures track and trace data definitions are consistent for all users…

TTS Worldwide is OL USA

OL International Holdings LLC (OL International) today announced the renaming and rebranding of TTS Worldwide as OL USA. Effective February 1st, 2017, the change is the latest and most symbolic development in an aggressive, multi-year strategic expansion plan for OL International’s businesses – now with representatives on the ground in over 140 countries. The announcement follows quickly on the heels of the launch of OL South Africa and OL Dubai in recent months. The far-reaching NVOCC network now encompasses 14 offices and more than 210 agents worldwide, many of which are part of the Oceanwide Logistics Global Network. This integrated structure allows OL International’s offices and affiliates to deliver seamless door-to-door service with local expertise to and from ports worldwide…

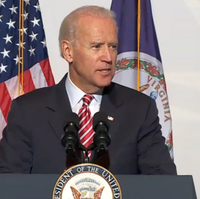

Biden Champions Maritime at Port of Virginia

Carrying 95 percent of U.S. foreign trade, our maritime transportation system, which includes America’s ports, is a crucial component of our nation’s economy. And with our growing population—and the associated need to increase the amount of freight our transportation network carries—maritime’s value will only grow in the future. This point is not lost on the Obama Administration, and it’s the reason why Vice President Joe Biden joined U.S. Senator Mark Warner (D-Va.), U.S. Rep.

Latest Shipbuilding Contracts Include VLCC Order for Philippine Yard

Clarkson Hellas understand that Golden Union have declared options for three further 81,200 DWT Kamsarmax at AVIC Weihai Shipyard for deliveries throughout 2016 and 2017 to add to their existing two units currently under construction. Clients of Sealink Navigation have contracted two firm 63,000 DWT Ultramax with Imabari Shipbuilding in Japan for deliveries in 2016 for the first unit and in 2017 for the second. Also, although understood to have been signed last month, it came to light this week that they have also placed an order for two firm 34…

Ingram Barge to Participate in EPA’s SmartWay

Ingram Barge Company announced its participation in the new Barge Freight component of the SmartWay Transport Partnership, a public-private partnership between the U.S. Government’s Environmental Protection Agency (EPA) and the country’s leading private industry freight carriers and freight users aimed at reducing carbon, oxides of nitrogen and particulate matter emissions. Ingram has been involved with the EPA in helping to develop, test and pilot the tool since 2010 and Ingram hopes that others will follow its lead in committing to improve efficiency and reduce pollution. SmartWay, currently composed of more than 3,000 truck and rail carriers and the shippers that hire them, is adding a new Barge Freight component this year.

American Maritime Industry Praises Obama, Foxx for Port Visit

The American maritime industry today praised President Barack Obama and Transportation Secretary Anthony Foxx for visiting the Port of Jacksonville, Florida to talk about jobs and economic growth. Thomas Allegretti, the Chairman of the American Maritime Partnership, noted that the Port of Jacksonville alone is homeport to four American-owned freight carriers. “It is good to see the President recognizes that the American maritime industry continues to play an important role in the nation’s economic future and wants to make investments in infrastructure to support that industry,” Mr. Allegretti stated. The domestic American maritime industry in Florida supports more than 27…

Interferry Seeks Ro-Ro Recruits to boost IMO Voice

Trade association Interferry is mounting a membership drive with ro-ro operators among key targets in a further move to strengthen its representation at the International Maritime Organization. Interferry, which has had IMO consultative status since 2003, recently became an associate member of the influential International Chamber of Shipping (ICS) and has just set up a regulatory committee to direct safety and environmental submissions by its newly expanded delegation. Now the association – formed 35 years ago by passenger sector interests - is aiming for more ro-ro members after becoming increasingly involved in issues that also affect freight-only ferries.

Tests on New Technology To Secure Cargo Movement

U.S. Transportation Secretary Norman Y. Mineta announced the successful completion of a test of new technology that will help to secure cargo containers entering ports and border crossings throughout the United States. The test, carried out through the U.S. Department of Transportation’s Intelligent Transportation Systems (ITS) program, involved the use of electronic seals (E-Seals), a radio frequency device that transmits shipment information as it passes reader devices and indicates if a container has been compromised. “This new technology will help to enhance the security of our nation’s transportation system by enabling us to track cargo shipments into the United States,” Secretary Mineta said.