SMD on Digitalisation in the Maritime Industry

300 students from Institute of Technical Education, junior colleges, polytechnics, and universities participated in the 6th edition of the Singapore Maritime Dialogue (SMD), which featured a lively panel discussion on the theme of ‘Maritime Singapore in the Age of Digitization’.The group exchanged views on the digital revolution taking place in the maritime industry with invited panelists comprising Guest-of-Honour, Dr Lam Pin Min, Senior Minister of State for Ministry of Transport and Health; Mr John Hahn, CEO and Co-Founder of Ocean Freight Exchange; Mr Richard Koh, Chief Technology Officer of Microsoft Singapore; and Ms Melissa Kee, Chief Human Resources Officer of Kuok Singapore Ltd.

Weak US Imports Push European Gasoline East

Unusually bloated gasoline inventories in the U.S. during peak summer driving season has kept the transatlantic arb barely workable. EIA data indicates that gasoline imports into the U.S. East Coast (PADD 1) for June averaged 549 kb/d so far, down by 15.4 percent m-o-m. As such, an atypical influx of LR tankers carrying gasoline from Europe have been fixed to the East in recent weeks. At least 6 LR2 and LR1 tankers loaded with gasoline are heading from the ARA region to AG/Singapore in June.

Signs of Recovery Seen in Asian MR Market

A new lease of life has been breathed into the ailing Medium Range (MR) tanker market in Asia. The MR market has been mired in a slump in recent months, with TC11 rates sinking to a multi-year low of $240,000 in April on the back of lower product exports from China and South Korea. The lumpsum rate for TC11 has since rebounded by $50,000 to $290,000 due an influx of activity in North Asia. Overall Chinese product exports touched a three-month low at 3.5 mmt in April, down by 22.6 percent m-o-m and 4.9 percent y-o-y which contributed significantly to the previous decline in MR rates.

Long-haul Arbitrage Trades to Benefit VLCCs

The OPEC production cuts since the start of 2017 has tightened supplies of medium and heavy sour crudes, leading to a narrowing Brent-Dubai EFS. This has made long-haul crude trades from the Atlantic Basin to the Far East economically viable, resulting in a surge in flows from the North Sea as well as Americas which has in turn boosted ton-mile demand in the VLCC sector. Growing ton-mile demand has helped to halt declining rates in a sector flooded with newbuild deliveries in Q1. VLCC rates for the benchmark AG/Japan route rebounded from w46 end-March to current levels of w65.

A Glimmer of Hope for Asia Dirty Tankers

As we enter Q2 2017, Asia’s crude tanker market finds itself flooded with a flurry of newbuilds that hit the water over the last quarter. According to Lloyd’s List Intelligence, new tonnage delivered hit 15m dwt in Q1 and is expected to stand at 8.7m dwt in Q2. The gradual but steady unwinding of floating storage in global hotspots due to a flattening Brent futures curve is likely to release a constant stream of tonnage into the market, exacerbating the situation of oversupply.

Asia Tankers-VLCC Rates Uncertain on Tonnage Woes

MidEast tanker rates fall to $22,000 a day, below breakeven; 52 VLCCs to be delivered this year, highest since 2011. Freight rates for very large crude carriers (VLCCs), which fell to four-month lows this week, face an uncertain direction next week as refinery maintenance and excess tonnage pressure rates even as owners resist moves by charterers to push rates lower, brokers said. Meanwhile, rates on routes from the Middle East and West Africa to China rose slightly this week after falling since Feb. 10. "I think there will be a shallow recovery over the next two-three weeks," said Ashok Sharma, managing director of BRS Baxi in Singapore.

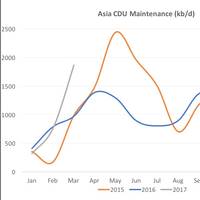

More Room for Asian VLCC Rates to Fall

VLCC rates on the AG/Japan route tumbled by nearly w10 points within a day to w60 on Tuesday, after news of S-Oil placing Australis on subs for an AG/Onsan run at w54.75, loading March 13-15 basis 274kt, broke. Charterers went for the jugular, with at least four older vessels fixed within the range of w55-w58 for an AG/East voyage. We believe that VLCC rates will remain depressed in the short term due to the upcoming refinery turnaround season in Asia, diminishing floating storage inventories that will free up more tonnage as well as OPEC production cuts.

LR Tankers Taken for Gasoline Storage in Asia

Singapore gasoline cracks have averaged $10.72/bbl in February so far, down by 12 percent y-o-y but still relatively firm. Robust demand from the Middle East and intra-Asia as well as a flurry of both planned and unplanned refinery outages have been supporting gasoline cracks. ADNOC recently bought nine 27 kt cargoes over March-April delivery as its 127 kb/d RFCC remains shut from a fire. The shutdown of Pertamina’s 125 kb/d Balongan refinery and TPPI’s reformer in Tuban also led to firm buying from Indonesia, Asia’s largest gasoline importer.

Aframaxes Taken for Short-term Time Charters in Asia

The Asian Aframax market is currently stable but seems to be facing a more positive outlook on the back of short-term time charters as well as an increase in third decade cargoes. Rates for an Indonesia/Japan run basis 80 kt are hovering around w100 to w102.5, while rates for the AG/East route basis 80 kt stand at w115. Reflecting firmer owner sentiment, TD14 inched up steadily w-o-w to w100.78 which translates into daily earnings of around $8,700/day. At least three Aframaxes…

Has the Asian LR Tanker Market Hit Bottom?

The Long Range (LR) 2 tanker market in the East of Suez has been languishing in the doldrums for almost two weeks. LR2 rates on the AG/Japan route, basis 75 kt, nosedived from w120 at the beginning of January to current levels of w80. Earnings for a round voyage on the benchmark route are hovering around barely breakeven levels at $2,000/day. A slew of refinery outages which have lowered CPP exports as well as a pile up of prompt tonnage in the region have culminated in the perfect storm.

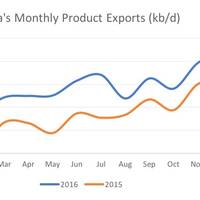

China’s Fuel Exports and Crude Imports End 2016 with a Bang

China’s product exports in December eclipsed yet another record set in November, up by 23.8 percent y-o-y and 10.3 percent m-o-m to hit 1.27 mmb/d. The surge in exports can be attributed to Chinese refiners’ attempts to fully utilize their leftover export quotas for the year, as well as destocking ahead of the nation-wide switch to China V emission standards. The boost in Chinese crude throughput was also a contributing factor, as refinery production hit a new high of 11.3 mmb/d (up by 3.7 percent y-o-y).

Asia Gasoline Demand Draws European Cargoes

Robust Asian gasoline demand has drawn more cargoes from Europe over the past week. At least five LR2 vessels have been fixed within the week to load 80kt cargoes of gasoline and gasoline blendstocks from NWE (mostly Mongstad) to Singapore. Gasoline from Europe typically moves to Asia on an opportunistic basis. The sharp increase in fixtures can be attributed to the recent surge in Singapore gasoline cracks. Singapore gasoline cracks jumped to an almost t10-month high last Wednesday…

A Tale of Two Tanker Classes

In a stark reminder of how volatile shipping markets can be, sentiment in the previously weak Asian Aframax market has flipped while the LR2 market continues its downward slide. The Aframax market in the East of Suez firmed rapidly with rates for the Indo/Japan route up by w22.5 points w-o-w to w132.5 due to a flurry of pre- Lunar New Year activity. Among fixtures heard, BP placed a vessel on subjects for an Indo-Aus voyage at w132.5 basis 80,000 mt. Rates for the AG/East route gained by w5 points from the previous week to w115.

Start of 2017 Looks Rocky for Asian Tankers

Asia’s crude tanker market faces the double whammy of a flood of newbuild deliveries and a cut in OPEC production in Q1 2017. On the supply side, net capacity growth is estimated to be around 5 percent for VLCCs, 9.6 percent for Suezmaxes and 7 percent for the Aframaxes/LR2 segment in 2017. At least 50 percent of the newbuild VLCCs and Suezmaxes will be delivered in Q1, worsening the oversupply of tonnage. On the demand side, OPEC’s planned output cut of 1.2 mmb/d starting January will lead to less crude export cargoes with the VLCC segment bearing most of the brunt.

Global Container Fleet Market to Grow 3% in 2017-21

A report forecasts the global container fleet market to grow at a CAGR of 3.19% during the period 2017-2021. The report says key vendors in the market are Maersk, CMA CGM & MSC. To calculate the market size, the report by Research and Markets considers volume based on container fleet capacity for the respective region or the container type. It considers freight volume based on the freight volume shipped by the vendors operating in the market making use of the containers. The latest trend gaining momentum in the market is increasing use of fleet management system. Fleet management systems are formed by the integration of hardware, software…

North Asian MR Rates Rise on Strong Winter Demand

The medium range (MR) tanker market in the North Asia has firmed this week, with rates recovering from last month’s lowest levels in 2016 as charterers rushed to fix an influx of fresh cargoes before the holiday season. Rates for the key South Korea-Japan route grew by $20,000 w-o-w to $290,000 while rates for the key South Korea-Singapore route jumped by $75,000 w-o-w to $380,000. Rates for the key Singapore-Japan route basis 30kt were up by w17.5 points w-o-w to w125 points. Robust winter heating demand, increasing Chinese product exports as well as weather delays lent support to MR rates.

Further Upside Seen for Asian Aframax Rates

The Asian Aframax market has been strengthening steadily, with rates for the Indo/Japan route up by w25 points w-o-w at w135. The Baltic Exchange’s benchmark TD14 route reached w127.50 Tuesday, jumping by w29 points w-o-w. This is partly due to underlying seasonality as refiners in the region typically raise utilization rates during Q4 in order to meet winter demand. An early and colder-than-usual winter in North Asia has led to increased heating fuel demand, lending further support to refinery runs.

Feature: Short Sea Shipping-Nurturing a Modal Shift

Swelling U.S. interest in fostering the development of coastwise shipping may be set against the backcloth of an anticipated 55 percent growth in demand for domestic freight transport over the period 2000-2010. Aside from its breathtaking scale, one of the most remarkable aspects of the U.S. projection is its similarity to the forecast, 50-percent increase in European road freight volume within the same timeframe. U.K.-based technical consultancy BMT Nigel Gee and Associates, no stranger to the North American market, has prepared a high-speed RoRo freight and passenger carrier design for SeaBridge, a new company founded by Mediterranean shipping and North American trucking interests. While offering a solution to U.S.

Internet Ship Broker Goes Live

Internet ship-brokerage Levelseas went live this week, saying it would add functionality to allow cargo-owners and shipowners to trade with each other directly before October. "This initial release of LSX is LevelSeas' first step towards building a global, web enabled freight exchange and voyage management system," said CEO Richard Hext. Hext said that cargo owners and ship owners already did "a hell of a lot" of business directly without the use of a broker, and it was too early to know whether this would increase. "They will make the decision as to whether they'll do more direct, or do more through brokers, or whether they'll work with the smarter brokers who are on the system," he said.

Promoting A Modal Shift

The actual extent of European public funding to promote a modal shift from road to waterborne transportation has up until now — been far outweighed by political discourse on the subject — no doubt designed to appeal to the popular, environmentalist vote. However, a recently more pragmatic approach by government to the issue, coupled with the maritime industries' development of new technical solutions for efficient, intra-regional freight exchange, suggests that the tide might be turning in favor of short-sea shipping. An appreciation that economic and environmental considerations are increasingly intertwined, and that environmental performance bears more and more on competitive position…