LNG Jumps Ahead of Methanol Fuel in Latest Vessel Ordering

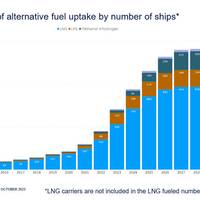

According to the latest figures from DNV’s AFI platform, 21 LNG alternative fueled vessels were added to the database in August. It was the second strongest month for LNG orders in over a year. September saw continued growth with eight LNG fueled vessels in the orderbook.LNG container vessels represent the larger share of newbuilds in August and September with car carriers and tankers not far behind. There are currently 978 confirmed LNG fueled ships on order or in operation.After a record month for methanol orders in July, August saw no new orders.

Gulf LNG Orders Four New Tugs

Gulf LNG Tugs of Brownsville has ordered four new tugs to serve the Rio Grande LNG export facility (RGLNG), which has commenced construction in Brownsville, Texas.Gulf LNG Tugs is a joint venture formed between Bay-Houston Towing Co., Moran Towing Corporation and Suderman & Young Towing Company to provide tug services for RGLNG under a long-term tug services agreement.The company announced Tuesday it signed construction contracts with Coden, Ala. shipyard Master Boat Builders and Port Neches, Texas shipbuilder Sterling Shipyard.

Spot LNG Freight Rates Plummets in Q1: Flex LNG

During the first quarter 2019, spot LNG freight rates plummeted from the record levels seen in the previous quarter, said Flex LNG, the company controlled by billionaire John Fredriksen.Asia winter demand came in lower than expected due to an unseasonably mild weather in northern Asia, coupled with Japanese nuclear power plants restarting as well as an oversupplied LNG market due to start-up of new LNG production, said the emerging player in the LNG shipping.Asian LNG prices moved lower, trading closer to or at par with key US and European LNG markers, preventing arbitrage opportunities between the markets. Despite significant growth in liquefaction and exported volumes…

LNG REPORT: 143 LNG-Powered Vessels in Operation, 270 to Come

Currently, the liquefied natural gas (LNG)-powered fleet has grown globally from 118 LNG-powered vessels in operation in 2017, to 143 LNG-powered vessels in operation – with a further 135 on order and 135 LNG-ready ships either in operation or on order.According to the LNG bunkering coalition SEA\LNG, Orders for LNG-powered vessels span a variety of vessel types including tankers, cruise ships, container ships, car carriers, and Very Large Ore Carriers (VLOC)s.A press note issued by Peter Keller, SEA\LNG Chairman revealed that in 2018, new LNG-fuelled vessels included ESL shipping’s delivery of its second LNG-fuelled 25,000 DWT bulker Haaga and Crowley’s combination container/roll on-roll off (ConRo) El Coquí.

FLEX LNG Orders Five LNG Carrier Newbuilds

Flex LNG, the shipping company controlled by billionaire John Fredriksen, is entering into a transaction for the acquisition of five 5th generation LNG newbuildings comprising three MEGI LNG carriers and two X-DF LNG carriers.According to a release from the shipping company, that owns and operates LNG carriers, and floating storage and regasification units, the MEGI LNG carriers are currently under construction at Daewoo Shipbuilding and Marine Engineering Co. Ltd. (DSME) with scheduled delivery in 2020.The X-DF LNG carriers are currently under construction at Hyundai Samho Heavy Industries Co., Ltd. (HHI) with scheduled delivery in 2021…

China's Yangzijiang Triples Q3 Profits

Chinese Shipbuilding Group Yangzijiang posted a third quarter net profit of $130 million which is more than a tripling of its profits in the third quarter last year. The group also managed to exceed its target of $1.5 billion in annual orders. This caused the share price to hit a six year high at $1.64 and the group to increase its annual target for orders to $2 billion for this year and and $2 billion for next year. The group expects to construct and deliver up to 50 vessels each this year and the next in spite of increasing steel prices and the Renminbi appreciating against the dollar. Plans to increase capacity were announced that will allow the builder to attract more value added contracts.

Höegh LNG Orders 4 FSRU from Samsung Heavy

South Korea's Samsung Heavy Industries Co has won one firm Shipbuilding Contract (SBC) and an agreement for three optional floating storage and regasification units (FSRUs) from Hoegh LNG Holdings. Under the deal with Norway-based Hoegh LNG Holdings Ltd., the shipyard will build the vessel by May 2019, the company said in a regulatory filing. Samsung has an option to build three more FSRU units, it said. Höegh LNG's President and Chief Executive Officer Sveinung J. S. Støhle said in a comment: "We are very pleased to have completed this agreement with SHI, a yard we know well as SHI built Höegh LNG's first two FSRUs. These units have shown excellent performance since their delivery. Firm FSRU will be delivered in may 2019 and optional FSRUs will be delivered with approx.

Höegh LNG Orders Four FSRUs at Samsung Heavy

Norway’s floating liquefied natural gas company Höegh LNG has signed a Letter of Intent (LOI) for one firm and three optional floating storage and regasification units (FSRUs) at South Korea’s Samsung Heavy Industries (SHI). Complete shipbuilding contract for the firm vessel is expected to be signed by mid-January 2017. According to a statement by Höegh LNG, the vessels have scheduled delivery dates of two units in 2019 and two vessels in 2020. The 170,000-cbm FSRUs will have a regasification capacity of 750 MMScf/day and full trading capabilities. President and Chief Executive Officer Sveinung J.S. Höegh LNG provides floating energy solutions and operates world-wide with a leading position as owner and operator of floating LNG import terminals…

Golar LNG Orders Two Ships for $400m

Golar LNG Limited announced details of an expansion to its fleet, saying that it has entered into two newbuilding contracts for 162,000 cu. m. new buildings with fixed priced options for a further two with the Korean shipbuilder Hyundai Samho Heavy Industries Co., Ltd. One vessel will deliver during the third quarter of 2014 and the other will deliver during the fourth quarter of 2014. The total cost of the two vessels is slightly above $400 million. As with Golar's existing newbuilding orders, the vessels will be delivered with tri-fuel diesel electric engines. The new engines will be more fuel efficient and will also have lower emission levels of pollutants and CO2.

Golar LNG Q1 Results 2011

Golar secures charters for its 4 modern vessels of between 12 and 18 months. In April 2011, Golar LNG acquired shares in subsidiary company Golar LNG Energy Limited via private placement share swaps and cash purchases that increased its ownership to 95.1%. A voluntary offer has subsequently been made for the balance of the outstanding shares of Golar LNG Energy Limited and Golar LNG currently owns 99.4 % of the shares. Golar LNG Limited ("Golar" or the "Company") reports…

Daewoo wins $1.1B LNG Orders

South Korea's Daewoo Shipbuilding and Marine Engineering, the world's second-largest shipyard, said on Monday it has won orders worth $1.1 billion for four LNG (liquefied natural gas) ships. The company said in a filing to the Korea Stock Exchange Bergesen of Norway had placed an order for three LNG carriers, although did not give the buyer of the fourth ship.

FLEX LNG Orders Third LNG Vessel

FLEX LNG ordered its third 90,000 cubic meter (3.1 MMcf) SPB liquefied natural gas (LNG) vessel this year from Samsung Heavy Industries. The vessel will be identical to the two others ordered in March of this year. The third vessel is expected to begin operations in the fourth quarter of 2011. [Source: http://www.energycurrent.com]

Iran Increases LNG Orders

The National Iranian Tanker Co (NITC) -- Iran's state tanker company -- has invested about $2 billion on 17 new oil tankers, and could order at least 30 more liquefied natural gas (LNG) carriers by the end of the year, a senior official said, according to a Reuters report. NITC aims to become a global player in energy transportation and will register the ships outside Iran under financing agreements, to keep operating in the event of sanctions from its nuclear spat with the West. He said that NITC was currently awaiting the delivery of 13 VLCCs of 315,000-318,000- tons each, expected between the end of 2007 and early 2009. This will see their supertanker fleet size grow to 28.

Hyundai Heavy Wins LNG Orders

South Korea's Hyundai Heavy Industries won $340-million orders to build two LNG carriers for Golar LNG of Norway. One of the ships would be delivered by December 2003 and the other by July 2004, said a spokesman for the world's largest shipbuilder. With the new contracts, LNG orders for Hyundai Heavy have risen to six ships this year, worth about $1.02 billion, he said.

Daewoo Lands $340 Million LNG Order

South Korea's Daewoo Shipbuilding and Marine Engineering said on Tuesday it had won a combined $340 million order to build liquefied natural gas (LNG) carriers from Belgium and Norway. Daewoo Shipbuilding won orders to build a $170 million LNG ship each from Belgian shipping group CMB unit Exmar and Golar LNG of Norway, a company spokesman said. Daewoo's LNG orders totaled 10 ships worth $1.7 billion so far this year, he said.

South Korean Yards Expected To Nab 75 Percent of LNG Orders

South Korean shipyards are expected to win about 75 percent of an estimated 48 orders for liquefied natural gas (LNG) carriers this year, industry officials said on Wednesday. "There are virtually no rivals to compete with Korean shipbuilders in making LNG carriers in terms of price and quality," said Yoo Jae-won, a spokesman for the Korea Shipbuilders' Association. Surging demand for environmentally friendly LNG was expected to raise the number of LNG carrier orders to around 48 this year from only 14 last year. "Korean shipbuilders are poised and look likely to grab most of the orders," Yoo said. Daewoo Shipbuilding and Marine Engineering, the world's second-ranked yard, said its LNG orders totalled 10 ships worth $1.7 billion so far this year, with options for 12 more.