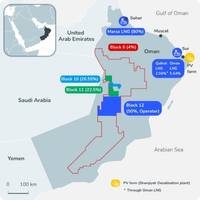

TotalEnergies, OQ Reach FID for Marsa LNG Project in Oman

French energy giant TotalEnergies and Oman National Oil Company (OQ) have reached the final investment decision (FID) on the Marsa LNG project, which will feature an LNG plant completely powered by renewable energy that will produce LNG for use as a marine fuel for maritime transportation.Through their joint company Marsa Liquefied Natural Gas (Marsa), TotalEnergies (80%) and OQ (20%) have launched the integrated Marsa LNG project which combines upstream gas production, downstream gas liquefaction…

QatarEnergy Charters 25 Nakilat LNG Carriers

QatarEnergy signed time-charter party (TCP) agreements with Qatar Gas Transport Company (Nakilat) for the operation of 25 conventional-size LNG vessels as part of the second shipowner tender under QatarEnergy’s LNG fleet expansion program.Seventeen of the 25 LNG vessels are being built at the Hyundai Heavy Industries (HHI) shipyards in South Korea, while the remaining eight are being built at Hanwha Ocean, also in South Korea.These agreements firm up last month’s selection of…

Qatar's Bigger LNG Expansion to Squeeze US, Other Rivals

Qatar's planned expansion of liquefied natural gas (LNG) production could see it control nearly 25% share of the global market by 2030 and squeeze out rival projects including in the United States where President Biden paused new export approvals, market experts say.Qatar, one of the world's top LNG exporters, plans an 85% expansion in LNG output from its North Field's current 77 million metric tons per year (mtpa) to 142 mtpa by 2030, from previously expected 126 mtpa.Some market experts said that the move will have an impact on global projects in the United States…

QatarEnergy Expanding North Field LNG Development

QatarEnergy has announced that it is proceeding with a new LNG expansion project, the “North Field West” project, to raise the nation’s LNG production capacity to 142 million tons per annum (MTPA) before the end of this decade.This represents an increase of almost 85% from current production levels.Saad Sherida Al-Kaabi, Minister of State for Energy Affairs and President and CEO of QatarEnergy, made the announcement during a press conference on Sunday. He said that extensive appraisal…

Samsung Heavy Industries Gets $1.5B FLNG Order

Samsung Heavy Industries (SHI) has secured an engineering, procurement and construction (EPC) contract for a new floating LNG production unit worth $1.5 billion.SHI formed a consortium with Black & Veatch for the delivery of the new FLNG unit, subject to final investment decision for the project (FID) being developed by the 'North American client'.Undisclosed by SHI, the client is most likely Haisla Nation and Pembina Pipeline Corporation (Pembina), a partner in the development of the proposed Cedar LNG project…

Sinopec Signs 27-Year LNG Supply Deal

State-owned Chinese firm Sinopec signed a new 27-year LNG supply and purchase agreement with QatarEnergy, the two companies said on Saturday.Under the agreement, the two companies will cooperate on the second phase of the Gulf Arab state's North Field expansion project, which will supply 3 million metric tons of LNG per year to Sinopec.A partnership agreement was also signed under which QatarEnergy will transfer a 5% interest to Sinopec in a joint venture company that owns the equivalent of 6 million tons per year of LNG production capacity in the North Field South project.The deal, signed at

Tango FLNG and Excalibur FSU Set to Begin Journey from Dubai to Eni's Congo LNG Project

The sailaway ceremony for the Tango floating liquefied natural gas (FLNG) unit and Excalibur floating storage unit (FSU) was held Saturday to mark the vessels' sail away from Dubai to Congo, where they will serve Eni's Congo LNG project, whose first phase will start in December 2023.Tango FLNG, which has a liquefaction capacity of approximately 1 billion cubic meters per annum of gas (BCMA), will be moored 3 kilometers offshore along with the Excalibur FSU upon their arrival to Congo.EXMAR is serving as the engineering, procurement and conversion (EPC) contractor for this project, and has desi

QatarEnergy Orders 17 Ultra-Modern LNG Carriers for $3.9 Billion

Qatari oil and gas company QatarEnergy has ordered 17 "ultra-modern" LNG carriers from South Korea's HD Hyundai Heavy Industries (HHI).The deal, signed at a ceremony in Seoul, is valued at 14.2 billion Qatari Riyals (currently around $3,9 billion), and marks the start of the second phase of QatarEnergy's LNG ship acquisition program, which will support its expanding LNG production capacity from the North Field LNG expansion and Golden Pass LNG export projects as well as its long…

US Regains Crown as World's Largest LNG Exporter

The U.S. regained its crown as the world's largest exporter of liquefied natural gas (LNG) in the first six months of this year, according to the U.S. Energy Information Agency (EIA).US exports of the superchilled gas, particularly to Europe, have jumped in the last year as buyers looked for alternatives to Russian gas imports and to fill Europe's storage inventories, the EIA said.An average 11.6 billion cubic feet per day (bcf/d) of the superchilled gas was exported through June, up 4% from the same period a year-earlier, the U.S. Department of Energy (DOE) said.The increase in U.S.

US LNG Exports Slip in August

U.S. exports of liquefied natural gas (LNG) fell in August as some processing plants reduced output and a heat wave increased gas demand for power, leaving less gas available for LNG production, according to vessel monitoring data and analysts.Above-normal temperatures and drought hit the U.S. Southwest last month, triggering record electricity demand and forcing providers to ask users to voluntarily reduce consumption. Maintenance outages also curbed processing at two Cheniere Energy facilities: Sabine Pass in Louisiana and Corpus Christi in Texas.Gas supply to the seven largest U.S.

Asian Buyers May Seek US LNG if Australian Disputes Worsen

Major Asian buyers of LNG could seek US cargoes in the coming weeks if worker-related disputes at key LNG facilities in Australia escalate, analysts said, as electricity demand continues surge due to warm weather.Uncertainty over labour disputes at western Australian facilities run by Woodside Energy Group and U.S. major Chevron have spurred Asian LNG prices to their highest in five months, and analysts say they could rise further.As many as 700 workers at the Australian facilities could potentially down tools over pay and job security, the first of them as early as Sept.

Hanwha Completes Purchase of DSME

The Hanwha Group has completed its take over of Daewoo Shipbuilding & Marine Engineering (DSME), renaming it Hanwha Ocean.Hanwha Vice Chairman Kwon Hyuk-woong has been appointed as CEO of the shipyard.The Korea Times reports that DSME suffered a 1.6 trillion won operating loss last year and 1.7 trillion won the year before. During the first three months of this year, it suffered 62.8 billion won in operating losses.Hanwha has already established a network of businesses that address renewable energy.

Asia Demand to Drive Cheniere's LNG Shipments this Year

Cheniere Energy expects to ship more liquefied natural gas (LNG) to Asia this year, after European customers took the lion's share of its 2022 cargoes, an official said on Monday.The top U.S. exporter of LNG shipped a total of 638 cargoes last year, with slightly over 70% delivered to Europe, Chief Operating Officer Corey Grindal said at the CERAWeek energy conference.Cheniere last year gave the financial go ahead for an expansion of its Corpus Christi, Texas, liquefaction plant and has sought an early environmental review with federal regulators for an expansion at its Sabine Pass…

TOTE Sells LNG Bunker Barge to Seaside LNG

Seaside LNG announced the acquisition of the liquefied natural gas (LNG) fueling barge the Clean Jacksonville from TOTE Maritime Puerto Rico, LLC, a subsidiary of TOTE Group, LLC.Seaside LNG’s maritime transportation company, Polaris New Energy, has contracted to continue fueling TOTE’s Marlin Class LNG-powered containerships and other commercial customers with its fleet of LNG bunker barges. The Clean Jacksonville recently reached a significant milestone having successfully completed…

Freeport Gets US OK to Begin Steps to Restart LNG Plant

Freeport LNG, the second-biggest U.S. liquefied natural gas (LNG) exporter, got approval from federal regulators on Thursday to take early steps to restart its fire-idled LNG export plant in Texas.Freeport, however, has not yet sought permission to restart the liquefaction trains that turn natural gas into LNG for export. That resumption of LNG production will have to come in a later request with federal regulators.Energy analysts have said they still expect most of the plant's…

Electricity Constraints Force Canada's First LNG Terminal to Delay Renewable Shift

Shell PLC's LNG Canada export project in British Columbia plans to start building its proposed second phase with natural gas-powered turbines and switch to electricity as more renewable power becomes available, a top executive said, a decision that means the expansion project will initially generate high greenhouse gas emissions.LNG Canada, in which Japan's Mitsubishi Corp owns a 15% stake, is set to be Canada's first liquefied natural gas (LNG) export terminal. The first phase…

Russian Pipeline Gas Exports to Europe Drop to a Post-Soviet Low

Russian gas exports to Europe via pipelines plummeted to a post-Soviet low in 2022 as its largest customer cut imports due to the conflict in Ukraine and a major pipeline was damaged by mysterious blasts, Gazprom data and Reuters calculations showed.The European Union, traditionally Russia's largest consumer for oil and gas, has for years spoken about cutting its reliance on Russian energy, but Brussels got serious after the Kremlin sent troops into Ukraine in February.State-controlled Gazprom…

Eni to Deploy FLNG Unit Offshore the Republic of Congo

Italian oil giant Eni has signed a contract with China's Wison Heavy Industry for the construction and installation of a floating liquefied natural gas (FLNG) unit with a capacity of 2.4 MTPA (million tons per annum). The FLNG will be deployed offshore the Republic of Congo.The 380-meter-long and 60-meter-wide vessel will be anchored at a water-depth of around 40 meters and will be able to store over 180,000 cubic meters of LNG and 45,000 cubic meters of LPG. Preliminary activities have already started…

ABS Opens LNG Training Center in Doha for Qatari Seafarers

Classification organization ABS will open a global liquified natural gas (LNG) training center in Doha, Qatar, as part of its support of Qatar’s National Vision 2030 and the Tawteen Program, which focuses on education and quality employment for Qatari nationals.In collaboration with local corporations, the training center will focus on LNG production and operations, ensuring that seafarers are skilled to work with this dynamic fuel and the most modern fleet of vessels, ABS said.“LNG…

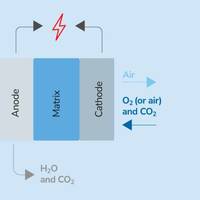

Ecospray's MCFC Tech Gets RINA Nod

Ecospray has informed that RINA has confirmed that the CO₂ reduction achieved by the new Molten Carbonate Fuel Cells (MCFC) technology for Carbon Capture (CC) in shipping, developed by Ecospray, matches the expected targets announced by the company at the beginning of the project.Ecospray chose to use bio-LNG as fuel for the MCFC technology. The MCFC can be fueled with hydrogen, methanol, ammonia, fossil LNG, but the use of a CO2 neutral - or negative- fuel represents a plus in the application of this technology…

Freeport Pushes Texas LNG Export Plant Restart to Year End

Freeport LNG on Friday again delayed the restart of the second-biggest U.S. liquefied natural gas (LNG) export facility, pushing start-up plans for its Texas plant to the end of the year, pending regulatory approval.In November, the company said it was on track to restart the plant in mid December and get most LNG production back in January with a return to full service in March.Freeport shut the plant on June 8 after an explosion that energy consultants said was the result of human error…

LNG Traders Absorb Huge Losses After Supply Outages

Major energy traders are taking hundreds of millions of dollars in losses as they scramble to plug a liquefied natural gas (LNG) supply gap after several outages hampered efforts to fill European storage ahead of the winter heating season.Unplanned disruptions at LNG plants in the United States, Nigeria and Australia have wrong-footed traders, including BP and Shell, forcing them to pay inflated costs for alternative supplies.In a market already struggling to meet global demand for natural gas after Russia sharply reduced pipeline supplies into Europe, the lost LNG cargoes which can be transported by ship, have pushed global prices sharply…

Svanehøj Develops New Fuel Pump for LNG-powered Ships

With the launch of a completely new pump design for liquefied natural gas (LNG), Svanehøj claims to be the first supplier on the marine market to offer both deepwell pumps and submerged pumps for electric fuel systems.The demand for LNG is increasing, and LNG-powered ships are being ordered like never before. Svanehøj is now building on the growth of recent years within liquefied gas solutions with an investment in a new electric submerged pump design for LNG-powered ships. The…