Great Lakes Iron Ore Trade Up 25.5% in March

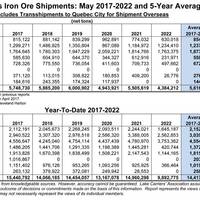

Shipments of iron ore on the Great Lakes totaled 1.6 million tons in March, an increase of 25.5% compared to 2023, according to latest figures published by trade group the Lake Carriers’ Association (LCA). Loadings also topped the month’s 5-year average by 47.5%. Year-to-date the iron ore trade stands at 4.4 million tons, an increase of 16.8% compared to a year ago. Iron ore shipments are 31.9% above their 5-year average for the first three months of the year.

Great Lakes Iron Ore Trade Up 12.4% in January

Iron ore shipments transported by U.S.-flag vessels on the Great Lakes totaled 2.8 million tons in January, an increase of 12.4% compared to 2023, according to latest data published by trade group the Lake Carriers’ Association (LCA)Loadings were also above the month’s 5-year average by 24.4%, LCA said.(Source: Lake Carriers’ Association)

Great Lakes Iron Ore Trade Up in November

Shipments of iron ore on the Great Lakes totaled 4.5 million tons in November, an increase of 1.5 percent from 2022. Shipments were below the month’s 5-year average by 1.7 percent.Year-to-date the iron ore trade stands at 46.3 million tons, an increase of 20.8 percent compared to the same point in 2022.Through November iron ore loadings are 5 percent above their 5-year average for that timeframe.

Great Lakes Iron Ore Trade Up 8.5% in October

Shipments of iron ore on the Great Lakes totaled 5.1 million tons in October, an increase of 8.5% compared to a year ago, according to latest figures from the Lake Carriers’ Association (LCA). Shipments were a near match to the month’s five-year average.Year-to-date the iron ore trade stands at 41.8 million tons, an increase of 23.3% compared to the same point in 2022, LCA said.Through October iron ore loadings are 5.7% above their five-year average for the January-October timeframe, LCA added.

Study Highlights Ammonia Bunkering Potential of Australia’s Pilbara

A feasibility study has highlighted the potential for using clean ammonia to refuel ships, particularly iron ore carriers, visiting the Pilbara region of Western Australia.The study, commissioned by Yara Clean Ammonia (Yara) and Pilbara Ports, was undertaken by Lloyd's Register, and looked at key areas including the estimated demand and likely availability of ammonia as a replacement shipping fuel. The potential risks and regulatory requirements for ammonia bunkering at the ports…

Great Lakes Iron Ore, Limestone Trades Rise in August

Shipments of iron ore and limestone on the Great Lakes for the month of August both increased compared to 2022, up 8.6% and 4.4% respectively, according to latest figures from the Lake Carriers’ Association (LCA).The 5.5 million tons or iron ore shipped in August was 3.5% above the month’s five-year average, while limestone cargos were above the month’s five-year average by 3.7%, LCA said. Limestone loadings from U.S. quarries totaled 3.3 million tons, an increase of 5% compared to 2022.

Great Lakes Iron Ore, Limestone Trades On the Rise

Shipments of iron ore and limestone on the Great Lakes rose in the month of July, according to latest figures published by trade group the Lake Carriers’ Association (LCA).Shipments of iron ore on the Great Lakes totaled 5.8 million tons in July, an increase of 8.9% compared to a year ago, while limestone shipments rose 4.7% to 4.2 million tons, LCA said. The respective trades were above the month’s five-year average by 4.8% and 6.6% respectively.Year-to-date, the iron ore trade stands at 25.6 million tons, an increase of 34.3% compared to the same point in 2022.

Great Lakes Iron Ore Trade on the Rise

Shipments of iron ore on the Great Lakes totaled 5.8 million tons in June, an increase of 47.8% from 2022, according to latest figures published by trade group the Lake Carriers’ Association (LCA). Shipments were 12.7% above the month’s five-year average.Year-to-date the iron ore trade stands at 19.9 million tons, 44% above the previous year’s total of 13.8 million tons, LCA said. Iron shipments are above their five-year average by 7.9% for the first half of the year.

Great Lakes Iron Ore Trade Down 5.6%

Shipments of iron ore from U.S. ports on the Great Lakes totaled 5.1 million tons in September, a decrease of 5.6% compared to a year ago, the Lake Carriers' Association (LCA) said on Tuesday. Shipments were below the month’s five-year average by 6.5%.Year-to-date the iron ore trade stands at 29.2 million tons, a decrease of nearly 21.8% compared to the same point in 2021, according to latest figures from LCA.Through September iron ore loadings are 20.1% below their five-year average for the first three quarters, LCA.

Great Lakes Iron Ore Trade Down in July

Shipments of iron ore on the Great Lakes totaled 5.3 million tons in July, a decrease of 6.8% compared to a year ago, according to trade group the Lake Carriers’ Association (LCA). Shipments were also 6.3% below the month’s 5-year average, LCA said.Year-to-date the iron ore trade stands at 19.1 million tons, a decrease of 27.8% compared to the same point in 2021, LCA said. Iron ore shipments are 25.5% below their 5-year average for the first seven months of the year.

Baltic Dry Index Dips to Two-week Low

The Baltic Exchange's main sea freight index fell to a nearly two-week low on Tuesday as rates across its vessel segments declined.The overall index, which factors in rates for capesize, panamax and supramax shipping vessels, shed 53 points, or 2.5%, to 2,061 points, the lowest since July 14.The capesize index fell for the second straight session, losing 141 points, or 5.4%, to 2,455 points, a near two-week low.Average daily earnings for capesizes, which typically transport 150,000-tonne cargoes such as iron ore and coal, were down $1,167 at $20,359."The biggest headache moving forward will li

Great Lakes Iron Ore Trade Down 20.4% in May

Shipments of iron ore from U.S. Great Lakes ports totaled 4.4 million tons in May, a decrease of 20.4% compared to a year ago and 21.9% below the month’s five-year average, the Lake Carriers’ Association (LCA) reported.Year-to-date the iron ore trade stands at 9.9 million tons, a decrease of 33.9% compared to the same point in 2021, LCA said. Iron ore shipments were also 31.4 % below their five-year average for five months of the year.

Great Lakes Limestone, Iron Ore Trades Dip

Shipments of limestone and iron ore on the Great Lakes were down in April, trade group the Lake Carriers’ Association (LCA) said on Friday.Great Lakes limestone shipments totaled 2 million net tons, a decrease of 16.6% compared to a year ago, though loadings were above the month’s five-year average by 5.5%.Limestone loadings at U.S. ports totaled 1.6 million tons, a decrease of 14.6%, while shipments from Canadian quarries decreased by 24.4% to 370,107 tons.Year-to-date the limestone trade stands at 2 million tons, a decrease of 19.1% from 2021. Shipments from U.S.

Baltic Dry Index Rises as Smaller Vessels Lend Support

The Baltic Exchange's dry bulk sea freight index rose on Thursday, buoyed by gains for panamax and supramax vessels that countered a dip in rates for the larger capesize segment.The overall index, which factors in rates for capesize, panamax and supramax vessels, gained 24 points, or 1%, to 2,678 points.The capesize index shed 46 points, or 1.2%, to 3,776.Average daily earnings for capesizes, which transport 150,000-tonne cargoes such as iron ore and coal, fell $390 to $24,355.Despite a decrease in Brazil-China iron ore trade volumes…

Great Lakes Iron Ore, Limestone Trades Rise in October

Iron ore and limestone shipments rose 32.4% and 8.3% respectively in October, according to the Lake Carriers' Association (LCA). Shipments of iron ore on the Great Lakes totaled 5.5 million tons in October, an increase of 32.4% compared to a year ago. Shipments were above the month’s five-year average by 7.7%.Year-to-date the iron ore trade stands at 42.9 million tons, an increase of 32.7% compared to the same point in 2020.Through October iron ore loadings are 4.4% above their…

Great Lakes Iron Ore Trade Up 38.8% in September

Shipments of iron ore from U.S. ports on the Great Lakes totaled 5.4 million tons in September, an increase of 38.8% compared to a year ago, according to trade group the Lake Carriers’ Association (LCA). Shipments were a near match to the month’s five-year average.Year-to-date the iron ore trade stands at 37.4 million tons, an increase of nearly 32.8% compared to the same point in 2020, LCA said.Through September iron ore loadings are 3.9% above their five-year average for the first three quarters.

BIMCO: Iron Ore Spot Rates Spike 163%

As the average length of the journey increases, partly due to port congestions in China, soaking up capacity and pushing up spot rates, shipowners will likely be enjoying high freight rates until the end of the year.Iron ore spot freight rates from Western Australia, to Qingdao, China have jumped 163% to USD 21.82 per tonne on 28 September 2021 compared with the same time last year. For a very large ore carrying Capesize ship transporting 200,000 tonnes of iron ore, this represents an increase in freight revenue from USD 1.66 million…

Great Lakes Iron Ore Trade Up 61.8% in July

Shipments of iron ore on the Great Lakes totaled 5.7 million tons in July, an increase of 61.8% compared to a year ago, according to the Lake Carriers’ Association (LCA). Shipments were 3.2% above the month’s five-year average.Year-to-date the iron ore trade stands at 26.4 million tons, an increase of 27.6% compared to the same point in 2020, LCA said. Iron ore shipments are 5.2% above their five-year average for the first seven months of the year.

Baltic Index Falls on Weaker Panamax, Capesize Rates

The Baltic Exchange's main sea freight index fell on Wednesday, as weaker demand for panamax and capesize vessels weighed.The index, which factors in rates for capesize, panamax, and supramax shipping vessels carrying dry bulk commodities, fell 12 points, or 0.4%, to 3,154.The capesize index lost 3 points to 3,841, its lowest since July 22.Average daily earnings for capesizes, which typically transport 150,000-tonne cargoes of iron ore, inched $24 lower to $31,856.Shanghai steel…

Great Lakes Iron Ore Trade Up Slightly in March

Iron ore shipments on the Great Lakes totaled 1.3 million tons in March, a near match to 2020. However, loadings trailed the month’s five-year average by 13.5%, according to the Lake Carriers’ Association (LCA).LCA, which represents the U.S.-flag Great Lakes fleet, said the iron ore trade stands at 3.9 million tons year-to-date, an increase of 26.3% compared to last year. Iron ore shipments are 12.2% ahead of their five-year average for the first three months of the year."We continue to rebound from the pandemic…

SSY Publishes Shipping Outlook for 2021

After a highly volatile 2020, shipbroker Simpson Spence Young (SSY) looks at the next 12 months and highlights areas of particular interest in their 2021 Outlook Report. The report looks at various drivers of the shipping markets, including how the developing emissions regulations may affect commercial fleets and shipping investments.Contributions come from a range of senior research and broking experts and cover dry bulk, tanker and gas freight markets; shipping investments, CO2 emissions, FFAs, metals and energy derivatives.

Bottlenecks and Inefficiencies Are Key Upside Risks for Dry Bulk Market -MSI

Port days and diverted voyages are having an unusually strong impact on market balances and will play a key role in the short term outlook.Summer may be drawing to close in the northern hemisphere but for dry bulk shipowners, the positive tone could continue into early autumn as port delays and diversions provide continued upside, says Maritime Strategies International.July was another positive month for the dry bulk sector, with average monthly spot rates rising to their highest level this year for all benchmark vessels…

Dalian Exchange Calls for 'Rational' Iron Ore Trade

China's Dalian Commodity Exchange on Tuesday asked members to act "rationally" in iron ore futures trade after prices for the steelmaking ingredient held above $100 per tonne."The iron ore market has been facing many uncertainties recently," the Dalian bourse said on its website, adding that it would strengthen investigations and strictly crack down on any irregularities.Dalian's most traded iron ore futures contract, for September delivery, has jumped more than 8% since May 26 on concerns of tight supply from Brazil.It closed at 757 yuan ($106.62) per tonne on Tuesday.($1 = 7.0999 Chinese yua