Inflation Hits Vessel Operating Costs -Drewry

Vessel operating cost inflation has accelerated in 2022 on mounting worldwide macroeconomic price pressures, despite some receding of Covid-19 related costs, according to the latest Ship Operating Costs Annual Review and Forecast 2022/23 report published by global shipping consultancy Drewry.Drewry estimates that average daily operating costs across the 47 different ship types and sizes covered in the report rose for the fifth consecutive year to reach $7,474 in 2022, a rise of 2.2%.

PTS to Manage Lake House Boxship Pair

Lake House, a Hong Kong and London based investment company, has appointed PT-Shipmanagement (PTS), a Hamburg based company, to manage two container ships.The two ships have a capacity of 1,300 TEU each and sail with an average crew of 15. The reason for the change to PTS was the high level of digitalisation and improved transparency on actual costs incurred.Lake House expects the ships to operate at significantly lower costs and improved yields, said a press release from the company.PT-Shipmanagement is a maritime service provider that specializes in optimizing technical ship operating costs and simplifying and digitizing administrative processes.

Ship Operating Costs Rise for Second Successive Year: Drewry

As the cost inflation is set to accelerate on higher insurance premiums, average vessel operating costs rose modestly for the second year in succession following two years of marked declines, according to the latest report published by global shipping consultancy Drewry.The report titled 'Ship Operating Costs Annual Review and Forecast 2018/19' said that typical ship operating costs accelerated moderately in 2018 as the uncertain recovery in freight markets across most cargo sectors gained momentum.Opex costs are heavily linked to developments in the wider shipping market as some costs, such as insurance, are connected to asset values…

Moore Stephens: Ship Operating Costs to Rise in 2018, 2019

International accountant and shipping consultant Moore Stephens says total vessel operating costs in the shipping industry are expected to rise by 2.7% in 2018 and by 3.1% in 2019, according to our latest survey.Responses to the firm’s latest annual Future Operating Costs Survey revealed that drydocking is the cost category likely to increase most significantly in both 2018 and 2019, accompanied in the latter case by repairs and maintenance. The cost of drydocking is expected to increase by 2.1% in 2018 and by 2.3% in 2019…

Fuels, Lubricants & Green Marine

International Maritime Organization (IMO) fuel rules entering force in 2020 mandate a drastic sulfur reduction. By 2050 the mandate is to cut greenhouse gas emissions of shipping by at least 50 percent.Marine fuels, lubricants and additives manufacturers play their part in establishing maritime’s green credentials by introducing new environmentally acceptable technologies and products.The shipping industry is more than ever portrayed in a bad light due to increasing awareness of its contribution to global climate change, according to Dirk Kronmeijer, CEO of GoodFuels Marine.

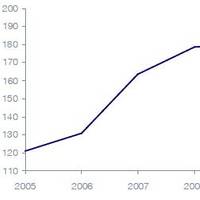

Ship Operating Costs Stabilize: Drewry

The cost of operating cargo ships rose marginally in 2017 following two consecutive years of falls, but ship owners should prepare for higher costs led by a spike in insurance premiums, according to the latest Ship Operating Costs Annual Review and Forecast 2017/18 report published by global shipping consultancy Drewry. After two years of marked decline, average vessel operating costs stabilized in 2017 as pressure on owners was lifted by a nascent recovery across most cargo shipping markets. Trends in ship operating costs are heavily linked to developments in the wider shipping market, external cost pressures notwithstanding. But the recovery has not been uniform across all sectors, and risks remain.

Ship Operating Costs to Increase for 2017 and 2018

Vessel operating costs are expected to rise in both 2017 and 2018, according to Moore Stephens' survey. Repairs & maintenance and spares are the cost categories which are likely to increase most significantly in each of the two years. The survey is based on responses from key players in the international shipping industry, predominantly shipowners and managers in Europe and Asia. Those responses revealed that vessel operating costs are likely to rise by 2.1% in 2017 and by 2.4% in 2018. The cost of repairs & maintenance is expected to increase by 2.0% in both 2017 and 2018, while expenditure on spares is predicted to rise by 2.0% in 2017 and by 1.9% in 2018. Drydocking expenditure, meanwhile, is expected to increase by 1.7% and 1.8% in 2017 and 2018 respectively.

Shipping Operating Costs Declining -Report

Total annual operating costs in the shipping industry fell by an average of 1.1 percent in 2016, says international accountant and shipping consultant Moore Stephens. This compares with the 2.4 percent average fall in costs recorded for 2015. For the second successive year, all categories of expenditure were down on those for the previous 12-month period, most notably for insurance costs and stores. The findings are set out inMoore Stephens’ ship operating costs benchmarking tool OpCost 2017…

Market Forces Down Ship Operating Costs

The cost of operating cargo ships has fallen for two successive years but is forecast to rise in 2017 and beyond, according to the latest Ship Operating Costs Annual Review and Forecast 2016/17 report published by global shipping consultancy Drewry. 2016 was another very difficult year for most shipowners and operators. Weak freight rates, declining asset values, eroded profitability and denuded cash balances have forced shipowners to reduce costs wherever possible, and vessel operating expenses have been no exception. Drewry’s assessment of 2016 operating costs across 44 different ship types and sizes shows that shipowners have trimmed costs in 2016 for the second successive year. The average decline in total ship operating costs among the vessel categories covered was 4.4%.

Ship Operating Costs Set to Rise -Survey

Vessel operating costs are expected to rise in both 2016 and 2017, according to the latest survey by international accountant and shipping consultant Moore Stephens. Repairs and maintenance and spares are the cost categories which are likely to increase most significantly in each of the two years. The survey is based on responses from key players in the international shipping industry, predominantly shipowners and managers in Europe and Asia. Those responses revealed that vessel operating costs are expected to rise by 1.9 percent in 2016 and by 2.5 percent in 2017.

Industy Supports EU's Call for Financial Incentive to Enhance Sustainable Recycling

The European Economic and Social Committee (EESC) adopted an own initiative opinion that calls on the European Commission to introduce an incentive that will “eliminate the abuses of irresponsible ship dismantling through a system which creates added value in an end-of-life ship”. SEA Europe, IndustriAll Europe and the NGO Shipbreaking Platform join the EESC in supporting an incentive that will make sure ships are recycled in a safe and environmentally sound manner. “European ship recycling companies are competitive with regards to sustainability and should be encouraged by an enabling public policy that will push ship owners towards the use of these facilities as well as enhance R&D towards more cost effective solutions in Europe,” says Christophe Tytgat, Secretary General of SEA Europe.

Moore Stephens: 4th Straight Year of Operating Costs Decline

International accountant and shipping consultant Moore Stephens says total annual operating costs in the shipping industry fell by an average of 2.4% in 2015. This compares with the 0.8% average fall in costs recorded for 2014, and is the fourth successive overall year-on-year reduction in such costs. All categories of expenditure were down on those for the previous 12-month period. This suggests continued pragmatic management of costs by ship owners and operators, as well as a reduction in active trading for some owners as a result of the prolonged worldwide economic downturn.

Thordon Wins Environmental Award

COMPAC, Thordon Bearings’ seawater lubricated propeller shaft bearing system, won the Tanker Shipping & Trade Environment Award following a verdict that the system allows shipowners to cost-effectively comply with stringent marine pollution rules. Dr. Karen Purnell, the Managing Director of the International Tanker Owners Pollution Federation (ITOPF), who sat on the award judging panel alongside representatives from INTERTANKO, IACS, UK MCA and Scorpio Tankers, said, “It is a…

Ship Operating Costs to Rise Over Next Two Years

The cost of operating cargo ships is forecast to rise over the next two years after falling in 2015, according to the latest Ship Operating Costs Annual Review and Forecast 2015/16 report published by global shipping consultancy Drewry. The average decline in ship operating costs across the sectors covered in the report in 2015 was one percent, but for ships that are big consumers of lube oils, the decline in overall costs was closer to two percent. Weak freight markets have forced ship owners to trim costs…

Ship Operating Costs to Increase

Moore Stephens’ annual survey, which indicates the direction of ship operating costs, suggests that crew wages, repairs and maintenance, along with drydocking are the costs that are most likely to increase most significantly this year and next, says a report from BIMCO. It is a survey of industry experts’ best guesses, as nobody has a crystal ball in these matters and much of the interest comes from the remarks they make as they produce their assessments. The respondents, mainly owners and managers in Europe and Asia suggest that vessel operating costs across the board will rise by 2.8% this year and 3.1% next year. It may not be what anyone wants to learn, just at present, with decent returns so hard to come by in most shipping sectors, but it may not be altogether unexpected.

Ship Operating Costs on the Rise

The survey responses, gathered primarily from key players in the international shipping industry, predominantly shipowners and managers in Europe and Asia, revealed that vessel operating costs are expected to rise by 2.8 percent in 2015 and by 3.1 percent in 2016. Crew wages are expected to increase by 2.4 percent in 2015 and by 2.3 percent in 2016, with other crew costs thought likely to go up by 2 percent and 1.9 percent, respectively, for the years under review. The cost of repairs and maintenance is expected to escalate by 2.3 percent in 2015 and by 2.4 percent in 2016…

Ship Operating Costs Down in 2014 -Moore Stephens

Total annual operating costs in the shipping industry fell by an average of 0.8 percent in 2014, said international accountant and shipping consultant Moore Stephens. This compares with the 0.3 percent average fall in costs recorded for 2013. All categories of expenditure were down on those for the previous 12-month period, confirming that ship owners and operators continued to manage costs sensibly and to watch their cash carefully in 2014. The findings are set out in OpCost 2015…

Working Toward a Low Carbon Future

Recently, Pilita Clark, the Environment Correspondent at the Financial Times, wrote a very interesting article about a new report, ‘The New Climate Economy’, which I would highly recommend reading. The New Climate Economy was commissioned in 2013 by the governments of seven countries: Colombia, Ethiopia, Indonesia, Norway, South Korea, Sweden and the United Kingdom. Its reports are completely independent, and this latest one highlights some key recommendations which can help support economic growth while reducing carbon emissions…

Report Shows Small Decline in Ship Operating Costs

International accountant and shipping consultant Moore Stephens said total annual operating costs in the shipping industry fell by an average of 0.3 percent in 2013. This compares with the 1.8 percent average fall in costs recorded for the previous year. Crew costs was the only category this time to show an increase over the 12 month period, indicating that ship owners continued to focus on managing costs and conserving cash in 2013. The findings are set out in OpCost 2014, Moore Stephens’ ship operating costs benchmarking tool…

Dry Bulk Drought: Asia Rates Fall

Rates for capesize bulk carriers on key Asian routes could continue to fall next week in the absence of major charterers although lower freight rates could tempt top iron ore miners back into the market and potentially buoy rates, brokers said. Charterers, including Vale, BHP Billiton and Fortescue Metals, kept out of the market on Thursday, shipbrokers said. "Without the likes of Vale and Rio Tinto in the market, rates are not going to rise. There are still plenty of ships available for October loading," said a Singapore-based capesize broker.

Moore Stephens Expects Vessel Operating Cost to Rise

Vessel operating costs are expected to rise by almost three per cent in both 2014 and 2015, according to a new survey by international accountant and shipping consultant Moore Stephens. The survey is based on responses from key players in the international shipping industry, predominantly shipowners and managers in Europe and Asia. Those responses revealed that vessel operating costs are expected to increase by 2.9 per cent in both 2014 and 2015, with crew wages and repairs & maintenance the cost categories likely to increase most significantly. Crew wages are expected to increase by 2.4 per cent in 2014 and by 2.6 per cent in 2015, with other crew costs thought likely to go up by 1.9 per cent and 2.1 per cent respectively for the years under review.

Asia Dry Bulk-Capesize Market 'Imploding'

Capesize rates fall to six-year lows; rates below ship operating costs, according to accountancy firm. Rates for capesize bulk carriers on key Asian routes, which crashed close to six-year lows on Wednesday, will continue their inexorable fall in the face of few fresh cargoes, brokers said. "The market is not very pretty. I've never seen it this low in my time. There is absolutely nothing happening," one Singapore-based capesize broker said on Thursday. "Capesizes are a disaster," a Hong Kong owner of dry bulk ships including capesize vessels told Reuters on Thursday. Capesize spot rates from Australia to China are down to the equivalent to $5,500 per day, below the daily cost of operating a 180,000 dwt (deadweight tonne) capesize ship, the Singapore ship broker said.

DP World: Low Bunker Prices to Fuel Economic Growth

Falling ship operating costs and low bunker prices will translate into higher profitability fueling economic growth, says Dubai-headquartered DP World. As bunker fuel prices drop, so too could shipping costs. Dubai-headquartered DP World says falling oil prices are good news for global shipping. It plans to double investments this year, local media reports. The Chairman of DP World Sultan Ahmed bin Sulayem has stated that the fall in oil price may stimulate particular economies such as India and China who are among the most energy-dependent countries, relying on overseas producers for much of their oil needs. Crude oil prices are currently about half their level six months ago. And world shipping is expected to be a key benefactor of such developments.