The ABCs and 123s of the EPA’s VGP

If you are following along and keeping a scorecard, then pay attention. Summer School is officially in session. The first iteration of the Vessel General Permit (VGP) expires on December 19, 2013. The Environmental Protection Agency (EPA) is issuing a replacement VGP permit under its authority from the Clean Water Act (CWA). The CWA and its implementing regulations contain standards that govern EPA’s imposition of National Pollution Discharge Elimination System (NPDES) permit conditions. The provisions of this permit are established under these authorities. Hereinafter the term VGP or permit shall mean the VGP replacing the permit expiring on December 19, 2013. But, what does all of that really mean to you?

Does it Apply to Me?

The VGP applies to vessels operating in a capacity as a means of transportation, that have discharges incidental to their normal operations into waters subject to this permit, except recreational vessels as defined in the CWA. Unless otherwise excluded from coverage, the waters subject to this permit means “territorial seas” of the U.S. The CWA does not require NPDES permits for vessels or other floating craft operating as a means of transportation beyond the territorial seas, such as in the contiguous zone or ocean. Therefore, the VGP does not apply to discharges in such waters.

Vessels operating in a capacity as a means of transportation are eligible for coverage under the VGP. The types of vessels covered under the VGP include commercial fishing vessels, cruise ships, ferries, barges, mobile offshore drilling units, oil tankers or petroleum tankers, bulk carriers, cargo ships, container ships, other cargo freighters, refrigerant ships, research vessels, emergency response vessels, including firefighting and police vessels and any other vessels operating in a capacity as a means of transportation. Vessels of the Armed Forces of the United States are not eligible for coverage by the VGP. While all non-recreational vessels, which are not vessels of the armed forces, may seek coverage under this permit, the permit requirements are generally targeted to vessels that are at least 79 feet in length. A separate, streamlined permit is available for vessels less than 79 feet.

How Many Vessels Impacted?

The EPA estimates that the domestic vessel population subject to the VGP is approximately 60,000 vessels. Using the Foreign Traffic Vessel Entrances and Clearances (FTVEC) database, EPA estimates approximately 12,400 foreign flagged vessels are subject to the VGP requirements.

The VGP provides effluent limits for twenty-seven specific discharge categories. This article concentrates on ballast water and leaves it to the reader to investigate the twenty-six remaining discharge categories.

Ballast Water

Ballast water discharge volumes and rates vary by vessel type, ballast tank capacity, and type of deballasting equipment. Typical cruise ships have a ballast capacity of 1,000 cubic meters or approximately 264,000 gallons of water and can discharge at 250-300 cubic meters per hour. Cargo ships carry anywhere from 2,900 cubic meters to 93,000 cubic meters or approximately 766,000 gallons to 24,568,000 gallons of water. Ballast water may contain rust inhibitors, flocculent compounds, epoxy coating materials, zinc or aluminum (from anodes), iron, nickel, copper, bronze, silver, and other material or sediment from inside the tank, pipes, or other machinery. Ballast water may also contain marine organisms that originate where the water is collected. When transported to non-native waters, these organisms may upset the environment or food web as “invasive species.” Table 1 below summarized the number of vessels subject to the ballast water requirements as calculated by the EPA and Coast Guard.

The VGP has finalized new, more stringent numeric technology-based effluent limitations to replace the non-numeric limitations in the 2008 VGP for ballast water. As part of the VGP, the EPA has also established discharge limitations for certain biocides and residuals, expressed as an instantaneous maximum.

Vessel owner/operators subject to the concentration-based numeric treatment limit may meet their obligations in one of four ways: (1) discharge treated ballast water meeting the applicable numeric limits in the VGP; (2) transfer of the ship’s ballast water to a third party—which may be onshore or on another vessel such as a treatment barge; (3) use treated municipal/potable water as ballast water; or (4) by not discharging ballast water.

VGP in Inland Applications?

The EPA believes that no existing ballast water treatment systems are widely available for inland or seagoing vessels smaller than 1600 gross registered tons. Hence, inland or seagoing vessels smaller than 1600 gross registered tons are not required to meet the numeric ballast water effluent limitation. However, these vessels must meet all other ballast water requirements of the VGP.

Separately, the Coast Guard has determined in their analysis that an estimated 1,459 domestic flagged vessels are expected to install Ballast Water Treatment Systems (BWTS) through 2018 at costs that range from $258,000 for chemical application in offshore supply vessels to more than $2.5 million to retrofit Very Large Crude Carriers (VLCCs) with ozone generating systems. The Coast Guard estimated the total annual cost for the rule at $90 million (at 3 percent discount rate, in 2007 dollars). Capital costs primarily vary with pumping capacity and technologies utilized, but are also slightly influenced by differences between the vessel categories.

The EPA has found that requiring installation of ballast water treatment will impose no incremental cost to the regulated community over meeting the Coast Guard standards. The Coast Guard rulemaking requires ballast water treatment systems be installed on the same schedule as today’s final permit. Meanwhile, the EPA believes that installation of BWTS is economically practicable and achievable even if costs are fully attributable to this permit alone. This determination considers the full installation and operation cost of BWTS on applicable vessels.

The VGP requires monitoring of the ballast water discharges from vessels employing ballast water treatment systems. Effluent samples for biological indicators (i.e., E. coli and enterococci), residual biocides and biocide derivatives must be collected during an actual ballast water discharge. The monitoring is divided into three components. The first component requires functionality monitoring to assure the system is operating as designed. Vessels conducting this monitoring also must adequately calibrate their equipment. The second component requires monitoring from all ballast water systems for selected biological indicators. The third component requires monitoring of the ballast water discharge itself for biocides and residuals to assure compliance with the effluent limitations established in the permit, as applicable.

Costs – the Bottom Line

There are three main categories of costs for complying with the ballast water treatment requirements:

- costs associated with purchase, installation, & operation of treatment system;

- costs associated with BWTS functionality monitoring and equipment calibration; and

- costs associated with discharge monitoring.

The EPA concurs with both the cost assessment developed by the USCG and their conclusion that based on the analysis of this available information, technology should be available for installation onboard vessels to meet the 2013 initial implementation date. The EPA finds that revisions in the VGP requirements could result in aggregate annual incremental costs for domestic vessels ranging between $7.2 and $23.0 million. This includes the paperwork burden costs and the sum of all practices for applicable discharge categories for all vessels estimated to be covered by the revised VGP.

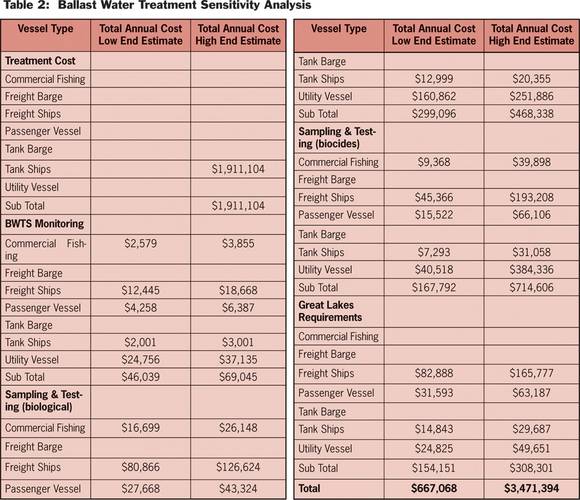

All of that said; there is considerable uncertainty in the assumptions used for several practices and discharge categories for ballast water. Tank ships have the highest average compliance costs; this is driven by potential incremental costs for oil tankers exclusively engaged in coastwise trade that may install and operate onboard ballast water treatment systems to meet the 2013 VGP requirements applicable to ballast water discharges. Therefore, annual cost estimates were calculated for a low and high end. Table 2 (on page 30) provides the low-end and high-end estimate cost by vessel type for each practice required by the VGP. It is expected to cost the industry between $667,068 and $3,471,394 to comply with the VGP.

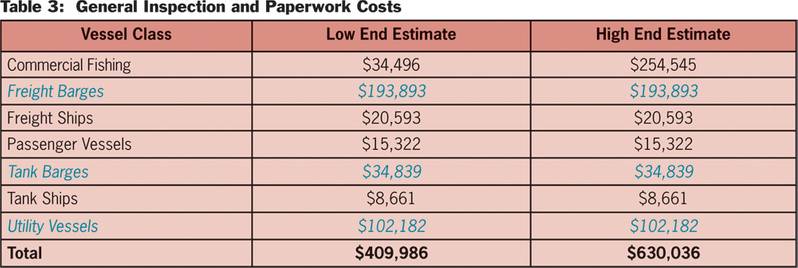

Table 3 (on page 31) provides the EPA’s projected low end and high end estimates concerning the General Inspection and Paperwork costs associated with compliance across the board for the VGP. Not all of these costs are associated with ballast water, but it is safe to assume significant portions are attributable to the VGP’s ballast water requirements.

Assumptions & Deadlines: Not always one in the same

In estimating the total cost, USCG assumed that vessels would be in full compliance with the requirement by 2018. The BWTS equipment installation requirements are phased-in for existing vessels over the 2014 through 2016 period.

All newly built vessels constructed on or after December 1, 2013 will have to comply with the discharge standards upon their delivery, while vessels constructed before December 1, 2013 will have to comply with the discharge standards as early as their first drydocking after January 1, 2014 or January 1, 2016, depending on their ballast water capacity.

Although EPA was unable to evaluate the expected benefits of the permit in dollar terms due to data limitations, the EPA collected and considered relevant information to enable qualitative consideration of ecological benefits and to assess the importance of the ecological gains from the revisions. The EPA expects that reductions in vessel discharges will benefit society in two broad categories: (1.) enhanced water quality from reduced pollutant discharges and (2.) reduced risk of invasive species introduction and dispersal.

(As published in the July 2013 edition of Marine News - www.marinelink.com)