Calculating Settlement Value of a Case

It has been said that war is politics by other means. It is probably equally true that litigation is business by other means. On the one hand, the threat of litigation – and the resulting costs, inconvenience and uncertainty – will often compel parties to resolve their differences on terms which they might otherwise consider less than ideal. And on the other hand, if an acceptable compromise cannot be reached, then litigation is the tool by which the parties can obtain a definitive resolution to the dispute.

This analogy does not apply just to “business” litigation. Resolving a personal injury claim is equally a “business” transaction in the sense that one party is seeking payment from the other, and each side has to decide how much it is willing to take or pay to avoid litigation. To the extent that litigation is just another means of conducting business, it follows that the parties to a dispute should be continually assessing the costs and benefits of that strategy just as they would assess the costs and benefits of any other business strategy they undertake. But how does one “value” a claim that may end up in litigation so that he can make a reasoned determination about what a reasonable settlement value might be?

Factors in Valuing a Claim

First, what are the factors that help determine a claim’s settlement value? Of course, every case is different. But there are some factors that apply in nearly every case. Probably the most obvious factor, and often (but not always) the most important, is the strength of the claim or defense. If a party’s claim is highly meritorious, then that will clearly suggest a high settlement value. On the flip side, if a party’s defense is strong, then that will favor a low settlement value.

In any given case, of course, there are many other factors which may greatly impact the claim’s settlement value, whether on the plaintiff’s or defendant’s side. Litigation costs often are a major factor, and both parties must consider the benefit of avoiding such costs in any settlement analysis.

Other factors may include the likely inconvenience and interruption of business that may result from litigation; the potential publicity and damage to (or enhancement of) reputation; the value of an ongoing commercial relationship with the opposing party; the impact of settlement on the deterrence of similar claims in the future; the consequences of a catastrophic adverse judgment; the time value of money – i.e. the value of payment now versus at some point in the future; and the financial stability of the counterparty – i.e. its ability to pay on a favorable judgment. And on top of those factors are often more emotional ones such as pride, ego, reputation and the personal agendas of the decision makers on each side. And this just scratches the surface.

Based on the above, one might think it impossible to meaningfully analyze a claim’s settlement value. To be sure, it is part science and part art. There are, however, ways of applying rational business-style analysis to the process which can be extremely useful.

Expected Value

The core skill required to properly assess a claim’s settlement value is the ability to identify a case’s possible outcomes and to accurately assess the probability that any particular outcome will come to pass. This process allows a party to assess a case’s “expected value.” This is a task that lawyers perform in some form or another every day, and this process of analysis underlies every reasoned recommendation that a lawyer makes to his client.

To take a simple example: in a coin toss scenario where someone would pay you $10 every time the coin landed on heads but nothing when the coin landed on tails, the expected value of a single coin toss would be $5, i.e. 50% of the $10 payout. This same analysis can be applied to a claim: where a party seeks damages of $100,000 and assesses it chances of success at 50%, the expected value of the claim is $50,000.

To take a more realistic example, say plaintiff claims for breach of a contract and seeks $100,000 in direct damages plus $50,000 in consequential damages. Defendant denies it breached the contract, and it contends that even if it did, the direct damages are only half of what plaintiff claims. It further contends that plaintiff is not entitled to consequential damages. If the matter goes to litigation, each side is likely to incur $20,000 in attorneys’ fees and costs, and the contract states that neither party can recover fees and costs from the other side.

How does one begin to analyze the settlement value of a claim like this? The answer is to break it down into all of the possible outcomes and then to ascribe a probability of occurrence to each possible outcome. Here, one possible outcome is that the defendant wins a judgment that it did not breach the contract. Let’s say the plaintiff has analyzed the claim and concludes there is a 30% chance that may happen. That means plaintiff considers there is a 70% probability that it will win. But, even if it wins, let’s say plaintiff estimates that it has only a 60% chance of recovering its full claimed direct damages (as opposed to half) and only a 50% probability of recovering consequential damage.

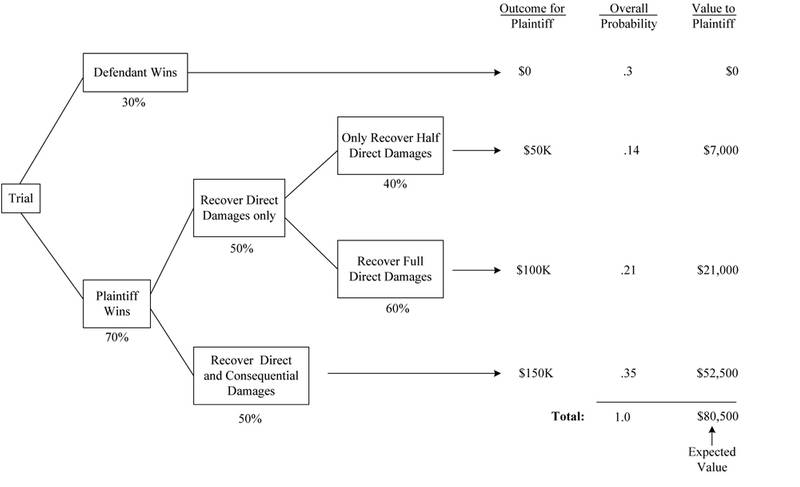

We can analyze the expected value of the claim in a chart which shows each possible outcome, the likelihood each outcome will occur, and thus each possible scenario’s contribution to the overall expected value of the case:

(See chart to the left on page 26)

You can see from the chart that there are four potential outcomes: one in which the defendant wins, and three in which the plaintiff recovers different sums depending on how the damages issues turn out. The chart allows one to calculate “compound probabilities,” that is, the likelihood of a chain of events taking place, and then fit each alternative outcome into the overall picture.

Of course, most litigations will be more complex than this, but the same technique can be expanded as necessary to account for any number of variable outcomes, such as counterclaims, dispositive motions, variable damages awards (i.e. where the potential damages are not fixed at a known dollar amount) and so forth. The analysis may be more challenging, but as the case gets more complicated the analysis becomes all the more useful.

Attorneys’ Fees, Costs

& Other Factors

There is one critical factor that the Expected Value Analysis does not account for, and that is costs. Anyone analyzing the settlement value of a case obviously has to be cognizant of what it will cost to accomplish the forecasted result. In the above example, we know that plaintiff and defendant are each estimated to spend $20,000 to get to a verdict. So, if each party is analyzing this issue at the beginning of the case (i.e. before it has spent those fees), then an economist would say that the plaintiff should be willing to settle the case for any value greater than $60,500 (i.e. $80,500 expected value less $20,000 costs), and the defendant should be willing to settle the case for any value below $100,500 (i.e. $80,500 + $20,000). This establishes a range within which both sides should rationally be willing to settle the case.

The time value of money also must be considered. A cash settlement today is more valuable to a plaintiff than an equivalent judgment two years from now, and any settlement analysis should take this factor into account.

The Importance of Critical Analysis

Of course, this kind of analysis is only as good as the data that goes into it. Most importantly, if a party is overly optimistic or pessimistic about the chances of an event occurring, then its calculation of the expected value of the case will be correspondingly skewed. In most cases, this kind of analysis is an evolving process. At the beginning of a case the parties may not have all the facts or they may not have had an opportunity to research all the critical legal issues at stake. Moreover, in a highly complex case it may not be possible at the beginning of the matter to anticipate all the developments that will unfold as parties are added, motions filed, counterclaims asserted, and so forth. As the case develops, therefore, it is critical to revisit the analysis to see how those developments impact the claim’s expected value.

The Soft Factors

Economic analysis is a very useful way to look at a claim from a “business” perspective, but in many cases there are other factors that may materially alter a party’s assessment of its “settlement value.” A claim involving serious injury or death, for instance, may be charged with emotional factors that strongly influence a plaintiff’s assessment of what it is willing to accept in settlement.

Risk acceptance or avoidance is often another significant factor. It is one thing to say that a coin toss is a 50/50 endeavor, but in any given coin toss one side wins and the other side loses, and a party may be willing to pay a premium or take a discount in exchange for the certainty of avoiding a total loss. Moreover, psychological studies have shown that a plaintiff may in some instances be willing to take an economically “irrational” risk where there is a low probability of success but a very high potential reward. (You might call this the lottery effect). And conversely, a defendant may be willing to pay an “irrationally” high amount to avoid a high value but low probability judgment, especially where such a judgment would be economically catastrophic.

Commercial considerations often significantly impact a party’s settlement threshold. For instance, a defendant may be willing to pay a premium to resolve a claim that is interfering with other business objectives, such as a merger or a public offering of shares. A plaintiff may be willing to offer a discount in order to fund its “war chest” to allow it to more vigorously pursue claims against other parties.

Personality traits and “aspirations” of the negotiating parties may also play a significant role in how a party assesses the settlement value of a case. Pride and ego are always wildcards, and if the person making settlement decisions for one party has a personal incentive (raise, bonus, promotion) to accomplish a favorable settlement, that person may be “irrationally” willing to risk an adverse outcome at trial in exchange for that prospect.

Conclusion

Analyzing the settlement value of a case is still part art and part science. Even the best analysis can never fully account for all the vagaries of litigation, such as predicting how a witness will hold up under skillful cross-examination or how a judge will rule on a motion. But as the above discussion demonstrates, a candid and thoughtful analysis of a case can help develop a solid framework from which to start a settlement negotiation. And, as new facts and information develops, the expected value of the case must be constantly reanalyzed and the assumptions and calculations adjusted as necessary.

Importantly, for this kind of analysis to lead to a settlement, both sides have to carefully and candidly analyze their respective claims and defenses. One of the great frustrations in litigation is to deal with an opposing party who is either too busy or otherwise unable to critically assess the case’s true risks and probable outcome. If everyone understands the relevant facts and legal issues and takes a candid view of the case, however, then each side’s analysis should theoretically lead to similar estimated values. When that happens, the chances for settlement greatly increase.

The Author

Thomas H. Belknap, Jr. is the Vice Practice Group Leader of the firm’s International and Maritime Litigation/ADR practice group and concentrates his practice in the areas of international commercial and insurance litigation and arbitration, with particular emphasis on the maritime industry.

t: 212.885.5270

e: [email protected]

(As published in the April 2014 edition of Maritime Reporter & Engineering News - http://magazines.marinelink.com/Magazines/MaritimeReporter)