Big Carriers Gain Market Share

Drewry’s analysis of ocean carriers’ latest financial results shows significant changes in cargo market shares, but how much of it is due to service differentiation is unclear.

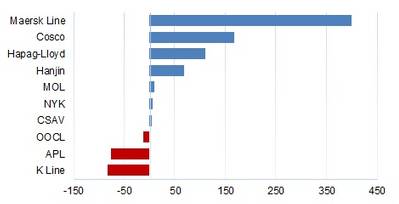

Ocean carriers’ third quarter financial results reported so far reveal that the largest are growing faster than the smallest. Maersk’s year-on-year cargo growth of 9.5% in 3Q13 was over double the global average of 4.2%, Hapag-Lloyd’s cargo increased by 8.7%, Cosco’s rose by 7.8%, and Hanjin’s was 5.8%. At the other end of the spectrum, K Line’s fell by 6.3%, APL’s declined by 5.4%, and OOCL’s reduced by 0.9% (see figure below). MOL and NYK, whose volumes only include the mighty Asia/Europe and Asia/North America tradelanes, saw increases of just 2.3% and 1.2% respectively. CMA CGM’s cargo growth, which was announced after these calculations were completed, grew by a market leading 11%.

How much of this is due to service differentiation, such as improved schedule reliability, is difficult to assess. Price cutting may have played a part on the grounds that those gaining market share usually do so by initiating freight rate reductions, but that is not obvious here as everyone suffered similarly, including Maersk (-12.2%), CMA CGM (-11.8%), Hapag-Lloyd (-10.4%), OOCL (-9.4%), MOL (-9.9%), K Line (-9.6%) and APL (-8.8%). CSAV’s market leading rate decline of 13.1% covers just July and August and could also be spurious on the grounds that a high concentration of north-south cargo is included.

Global cargo volumes and freight rate averages can also be affected by changes in tradelane cargo mix. For example, OOCL’s shares of the mighty Transpacific and Asia/Europe tradelanes, where freight rates moved differently, changed from 23% and 15.4% respectively to 24% and 17.8%, whilst APL’s changed from 30% and 15% to 29% and 16%. Those with the biggest exposure to the Asia/Europe tradelane will have suffered the most, and vice-versa. That said, many north-south trades were not a bed of roses either (see last week’s Asia-ECSA route analysis: http://ciw.drewry.co.uk/trade_route_analysis/port-throughput-asia-ecna-8/)

Comparisons between 3Q13 and 3Q12 also need to be treated with caution as the third quarter of last year was such an unusual period due to the absence of any peak season in the east-west tradelanes. For example, it could be that the fight this year was over lost market share, rather than the capturing of increased market share.

To help clarify this situation, the figure compares the first nine months of this year with the same period of 2012. Although the picture is more subdued, the message remains similar, however, with the biggest getting bigger at the expense of smaller lines. For example, Maersk’s volume increase of 3.1% was just 35% greater than the ‘global’ average of 2.3%, instead of 2.3 times greater. On the other hand, Cosco’s growth was a much higher 8.4%, whilst Hanjin’s remained a high 6.9%. CMA CGM’s cargo grew by 7%. The price paid is that Maersk’s average freight rate declined by 7.5%, Hapag-Lloyd’s by 4.3%, OOCL’s by 4.8%, APL’s by 7.3% and K Line’s by 9.4%.

The implication is that the big boys were after market share, rather than self-preservation, even though it might have meant further destabilizing freight rate market, which is curious given the parlous nature of some of their finances. Cosco and Hanjin remain in serious financial difficulties, for example, with Cosco still having to sell assets to avoid de-listing from the Shanghai Stock Exchange, and Hanjin having to borrow money to pay its bills (see http://www.drewry.co.uk/news.php?id=233).

If market share was indeed the target, it casts doubt on some of the larger lines’ expressed bewilderment over recent freight rate volatility. For example, the Chairman of Hapag-Lloyd’s Executive Board is quoted as lamenting: ‘The irrational behavior in the industry, which once again caused fright rates to drop drastically in October, is totally incomprehensible.’ Smaller lines being squeezed out of market share – for whatever reason – will of course see things very differently.

According to Drewry, the stronger cargo growth recently experienced from Asia to North America and Europe appears to have pacified the ocean carrier herd since 2Q13, but it is a fragile situation for freight rates. The sustainability of the impressive increase remains far from certain.

drewry.co.uk