Red Sea Shipping Attacks Pressure China's Exporters

For Chinese businessman Han Changming, disruptions to Red Sea freight are threatening the survival of his trading company in the eastern province of Fujian.Han, who exports Chinese-made cars to Africa and imports off-road vehicles from Europe, told Reuters the cost of shipping a container to Europe had surged to roughly $7,000 from $3,000 in December, when Yemen's Iran-aligned Houthi movement escalated attacks on shipping."The disruptions have wiped out our already thin profits…

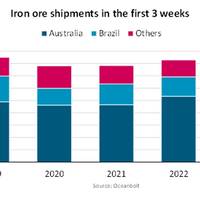

Iron Ore Shipments Drop 13.1% to Start 2023

2023 has so far been a disappointment for the dry bulk shipping sector, despite hopes that a quick economic recovery in China would boost iron ore demand,. During the first three weeks of the year, iron ore shipments fell 13.1% year on year, the lowest volume since at least 2019, worsening conditions for capesizes. In this period, the Baltic Dry Index (BDI) declined by almost 500 points to 763 on 20 January, its lowest point since June 2020.It is not unusual for the bulk market to cool during the first quarter when demand weakens during the Lunar New Year celebrations.

RIX Industries Forms Sales Partnership with Blue Deep International

RIX Industries, a developer of gas generation systems and energy technologies, announced Blue Deep International (BDI) as a new sales partner for the commercial marine and international naval defense markets. U.K.-based BDI is a representative agency servicing countries and regions across the globe including Western Europe, North America, and Australia.Effective May 1, 2022, BDI represents RIX exclusively in the United Kingdom, Germany, Italy, The Netherlands, Norway, Denmark, Sweden, and Finland acting as a sales partner.

Baltic Dry Index Rises as Smaller Vessels Lend Support

The Baltic Exchange's dry bulk sea freight index rose on Thursday, buoyed by gains for panamax and supramax vessels that countered a dip in rates for the larger capesize segment.The overall index, which factors in rates for capesize, panamax and supramax vessels, gained 24 points, or 1%, to 2,678 points.The capesize index shed 46 points, or 1.2%, to 3,776.Average daily earnings for capesizes, which transport 150,000-tonne cargoes such as iron ore and coal, fell $390 to $24,355.Despite a decrease in Brazil-China iron ore trade volumes…

Ship Blocking Suez Canal Could Be Stuck for Weeks

A containership blocking the Suez Canal like a "beached whale" may take weeks to free, the salvage company said, as officials stopped all ships entering the channel on Thursday in a new setback for global trade.The 400-meter Ever Given, almost as long as the Empire State Building is high, is blocking transit in both directions through one of the world's busiest shipping channels for oil and grain and other trade linking Asia and Europe.The Suez Canal Authority (SCA) said eight tugs were working to move the vessel…

Four New Dual-fuel Bulkers to Support U-Ming Charter Deal

U-Ming Marine Transport Corporation, Taiwan’s largest publicly listed bulk carrier company, secured a 10-year liquefied natural gas (LNG) dual-fuel dry bulk charter contract with global mining company Anglo American.A fleet of four LNG dual-fuel Tier III 190,000 DWT bulk carriers measuring 299 by 47.5 meters each will be built by Shanghai Waigaoqiao Shipbuilding (SWS) to support the charter. The new ships are expected to be delivered through 2023.The ships will be fitted with MAN Energy Solutions’ high-pressure ME-GI engines.

Three of Five Converted VLOCs Are No Longer Operating -BIMCO

Converted very large ore carriers (VLOC) are increasingly becoming a thing of the past with the long-term freight contracts coming to an end as newer and more reliable ships replace them in the market. Since June 2017, 43% of the VLOC fleet have been sent to the scrapyards, while 18% of the fleet is idled or damaged.“The tragic Stellar Daisy accident brought the safety aspect of VLOCs into question. Now, three years on, three out of five VLOCs are no longer in operation as their long-term charters have now expired.

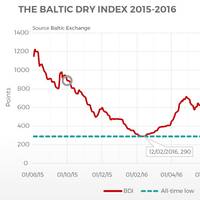

Capesize Index Turns Negative for the First Time Ever

Capesize index plummets to -133, the first time ever in negative territory – is it all up from here?The Baltic Exchange Capesize Index (BCI) dropped to -133 index points on February 4, 2020, turning negative for the first time ever on January 31, 2020. The composite BDI index (BDI), which has excluded the more stable handysize segment since March 2018, also dropped on February 4, 2020 to settle at 453 index points.The BCI has been on a freefall through the entirety of December, but the descent started to pick up more steam during the past couple of weeks.

Concern Over Trade Wars Impacts Shipping Confidence

Confidence in the shipping industry has fallen marginally over the past three months, largely as a result of ongoing concern over trade wars and increased regulation, according to the latest Shipping Confidence Survey from leading shipping adviser and accountant BDO.The average confidence level in the three months to May 2019 was 6.1 out of a possible maximum of 10.0. This is slightly down on the figure of 6.2 recorded in February 2019.Confidence was up in Asia, from 5.8 to 6.0, and in North America, from 5.6 to 6.4.

Shipping Industry Confidence Holds Firm: Moore Stephens

Shipping confidence held steady in the three months to end-May 2018 according to the latest Confidence Survey from international accountant and shipping adviser Moore Stephens. The average confidence level expressed by respondents was unchanged at the four-year high of 6.4 out of 10.0 recorded in February 2018. Confidence on the part of owners was also sustained at a four-year high, of 6.6, while managers’ confidence was up from 6.4 to 6.7. The rating for charterers was up to 6.7 from 5.0 and confidence in the broking sector was up from 6.1 to 6.3. The survey was launched in May 2008 with an overall rating for all respondents of 6.8.

Baltic Exchange Main Index to Drop Handysize T/C Average

The Baltic Exchange says from March 1, 2018, the Baltic Dry Index, its main sea freight index, which typically factors in rates for capesize, panamax, supramax and handysize shipping vessels, will no longer include the handysize time charter average. The Exchange furthmore said the index will be re-weighted to the following ratios of timecharter assessments: 40 percent capesize, 30 percent panamax and 30 percent supramax. The contribution of the various dry bulk vessel types to the dry bulk market was 40 percent capesize, 25 percent panamax, 25 percent supramax and 10 percent handysize, as per external research. "The decision to not include Handysize contributions makes no statistical difference to the calculation of the BDI…

DVB Bank Losses on Shipping

DVB, the specialist in international shipping finance, reported a consolidated net loss before taxes of EUR 506.3 million in the first six months of 2017 (previous year: net income of EUR 14.1 million). Given persistent oil price uncertainty, oil and gas companies have continued to reduce their exploration and production spending, which has further curtailed demand for offshore vessels and equipment. Shipowners remain under pressure from low charter rates and competition for employment. Against this background, owners of vessels and drilling rigs adjusted their capacities, through lay-ups, restructuring or consolidation. Excess capacity remained a major challenge on shipping markets throughout the first half of 2017.

Shipping Confidence Climbs to Three-year High

Shipping confidence reached its equal highest rating in the past three years, according to the latest Shipping Confidence Survey for the three months to end-May 2017 from international accountant and shipping adviser Moore Stephens. The average confidence level expressed by respondents to the survey was up to 6.1 out of 10 from the 5.6 recorded in the previous survey in February 2017. Increased confidence was recorded by all main categories of respondent to the survey, which launched in May 2008 with an overall confidence rating of 6.8.

Crude Oil Tanker Demolition Bucking the Trend -BIMCO

Four very large crude carriers (VLCC) have been sold for demolition since October 2016, matching the number of VLCCs sold for demolition in the preceding two years, according to BIMCO. Most recently the 1999-built double-hull VLCC with the framing name Good News returned $15.5 million to the ship owner, as demolition prices have reached levels not seen since first half of 2015 ($400 per ltd). “January struck an upbeat tone for demolition in all sectors, but the overall pace of fleet renewal, via demolition, has slowed down since then,” said BIMCO’s Chief Shipping Analyst Peter Sand.

Demolition Activity Weakens as BDI Moves Higher

After the Baltic Dry Index (BDI) had its seasonal weakness around the Chinese New Year in early February, stronger-than-expected demand came from across the board and lifted freight rates, says BIMCO market analysis of Dry Cargo. This brought earnings into profitable levels for a couple of days, as the BDI passed 1,282 on 27 March 2017. If earnings are at profitable levels now, how come BIMCO’s Road to Recovery keeps mentioning 2018 and 2019? That’s because it focuses on full year profits for all dry bulk segments. That would require a full year where the average BDI is above 1,280. Last time we had that was in 2011. Note that the BDI average for Q1-2017 was 945.

Is Dry Bulk Still on Track for Profitability in 2019?

The dry bulk industry remains well on target for profitable freight rates in 2019, according to BIMCO. This relies however, on the projected fleet supply growth rate of 0 percent in 2017 continuing. The handymax segment may even see profits in 2018 as demand may go beyond 2 percent in 2017 before reverting to 2 percent in 2018 onward. In 2016, the supply side grew by 3 percent and the demand side grew by 2.4 percent measured on a metric-ton-mile basis. This resulted in a worsening of the fundamental market balance.

BIMCO: What Shipping Market can Expect for 2017

The shipping industry has its work cut out going forward in 2017 as the International Monetary Fund (IMF) forecast the lowest level of global GDP growth since 2009. 2017 will see another year of die-hard competition, which now includes tankers. In 2016, the container shipping industry bit the bullet in terms of demolition and consolidation to help the market to recover. The dry bulk sector needs to copy that approach. The longer global economic growth remains weak and lacks investment, the lower future growth potential for shipping. For eight years, the world has struggled to cope with huge changes and challenges brought around by the crash of the financial market in 2008.

Asian Bulk Fleet Gains Value in 2016

In what has been a very difficult year for dry bulk, the values of regional fleets have changed quite a bit over 2016. Despite the down market, the Asian fleet is 7 percent more valuable at the end of the year. Since the Baltic Dry Index (BDI) low of 290 points in February this year, the index has recovered to above 1200 points. Asian owners have spent $1.6 billion on secondhand vessels, 27.5 percent of global spending throughout the year. Taking delivery of 303 of the 759 bulkers built this year means their average age has fallen by almost a year.

BIMCO: BDI Conducts the Demolition Activity

The Baltic Dry Index (BDI) ’s positive effect on capacity being removed from the fleet did not continue into Q2 2016, as capesize demolition came to a halt. The BDI went from “devastating” in February to “poor” in April with the highest total demolished DWT ever experienced in the dry bulk market. Unfortunately, BIMCO’s earlier claim was realised when demolition activity slowed down as the BDI improved. Chief Shipping Analyst Peter Sand comments, “With BDI hitting an all-time low in February 2016, the dry bulk market saw a quarterly record volume of demolished ships in the wake of it. Subsequently, demolition activity came to a halt as BDI increased from March to peak at 703 on 25 April 2016.

Capsize Scrapping: It's Complicated!

Last year saw an upswing in Capesize spot rates during the first seven months of the year, peaking in early August, rallying briefly in September and declining for the rest of the year, says ALIBRA Shipping in its Weekly Market Report. This would seem to correspond with scrapping activity – owners sold many capes for demolition during the first half of the year but stopped scrapping as rates rebounded – which ultimately killed the market again. Since 2016 began, some 64 Capesize bulk carriers have been sold for demolition, compared to 66 during the same period last year – almost identical. Does this mean we can expect to see the same trend in rates again this year? Of course, demolition is only half of the story.

Dry Bulk Insight: BDI likely to stabalise

Drewry expects the Baltic Dry Index (BDI) movements to moderate in September on the back of steady grain, minor bulk and coal trades. However, the iron ore trade is likely to lose its momentum in coming months. The BDI continued its rollercoaster ride into August first falling then rising in the second half of the month. Nevertheless, this progress failed to improve the overall picture, and the average BDI declined by 34 points to reach 673 points. Time charter rates improved in August for almost all segments except for Panamax vessels, although the demand for imported coal was high in China. On the supply side, in spite of a decline in the number of vessels delivered, the fleet expanded moderately because of a drop in demolitions.

No Reprieve for Multipurpose Shipping Until 2018: Drewry

The last three months have been some of the worst the multipurpose and project carrier sector has endured in living memory. The breakbulk and project cargo sector remain weak, with little suggestion that volumes will improve significantly until the end of 2017, according to the latest Multipurpose Shipping Market Review and Forecaster report published by global shipping consultancy Drewry. Rates have continued to slide to barely cover operating expenses, as the competing sectors of container ships and bulk carriers have weakened the MPV market ever further in their search for market share. The container lines lost billions of dollars as they filled slots no matter what…

Dry Bulk’s Biggest Spenders

In the last month, we have seen the Baltic Dry Index (BDI) recover to the same level it was 12 months ago (see circles in fig.1). Vessel values have started to firm, but not at the same rate and are still at historically low levels. In the last 12 months, contrarian owners have taken advantage of the low values and have been buying cheap tonnage. With hindsight, this looks to have paid off with many values having increased above the purchase price. This article takes a look at which dry bulk owners have been buying the most in the last year.