Seaspan's 70-ship Newbuild Program Fully Financed with $1.4 Billion Deal

Containership giant Seaspan Corporation announced on Wednesday that it now has financing lined up for its entire 70-vessel newbuild program.With the completion of the latest $1.4 billion deal in December, Seaspan said its financing proceeds are approximately $6.9 billion.Seaspan, a subsidiary of Atlas Corp, said the $1.4 billion will be used to finance ten 15,000 TEU LNG dual-fuel newbuilds, the last of its recent $7.6 billion containership ordering spree, including three ships that have already been delivered.

Deutsche Bank Set for $1 Bln Windfall from Zim Bets

Deutsche Bank is on course to make up to $1 billion on a long-shot bet on Israeli shipping firm Zim after it surged in value on the back of record-high global freight rates, Bloomberg reported on Tuesday.Citing unnamed sources familiar with the matter, the report said that Mark Spehn, a distressed debt trader at the German bank, had wagered less than $100 million over the past five years on building a position in the company through bond and bank loans as shipping rates fell. Zim recovered to float on the stock market on Jan.

Lenders Take Control of Polarcus' Ships After Default on Debt

Lenders took control of Polarcus' ships on Tuesday after the seismic surveyor defaulted on its bank loans and bonds, hit by a drop in spending by energy companies struggling with the COVID-19 pandemic and volatile oil prices.The company's Oslo-listed shares plunged as much as 47% after they resumed trading following an earlier suspension.Polarcus said lenders had taken over shares in subsidiaries that own seismic vessels and replaced directors in each subsidiary, but wanted to continue its operations."In parallel with their actions described above…

Seismic Surveyor Polarcus Sees Shares Nosedive as it Defaults on Debt Payment

Oslo-listed seismic surveyor Polarcus has defaulted on its bank loans and bonds, it said on Tuesday, sending the company's shares plunging more than 30%.Polarcus and other seismic surveyors have been hit by weak demand as oil companies slash spending on geological data amid the coronavirus pandemic and last year's crash in the price of crude."The company intends to pursue all available options with a view to ensuring the financial sustainability of the company and in the meantime will halt all payments of interest and amortization to finance providers…

Mercuria Teams Up with Envysion for Project Investment

Trading house Mercuria and Singapore-based asset manager Envysion Wealth Management have agreed to co-invest in mining and energy projects, as default-hit banks tighten their purse strings and leave commodities firms seeking other funding.The deal, signed on Wednesday, will see Mercuria present potential projects for investment to Envysion, founded and led by former Julius Baer banker Veronica Shim. Envysion will then decide whether to participate via a fund with a start-up amount…

Dutch Government Gives Shipbuilder IHC $435 Mln Lifeline

The Dutch government said on Thursday it is providing ailing shipbuilder Royal IHC with a lifeline of up to almost 400 million euros ($435 million), enabling the company's takeover by a consortium of marine companies and investors from Benelux countries.IHC had been looking for fresh capital since the summer of 2019 as it grappled with mounting debt and heavy losses on tailor-made ships.The company is to be taken over by Luxembourg-based investor HAL Trust and Belgian peer Ackermans & Van Haaren, together with Dutch dredgers Van Oord and equipment maker Huisman.Together these companies will pr

Ezion Sells Offshore Vessel to Astro

Singapore’s troubled liftboat operator Ezion Holdings has signed a memorandum of agreement to sell its offshore vessel Teras Genesis to the offshore and maritime chartering and brokerage company Astro Offshore.Ezion, in an attempt to reduce cash burn and shift focus to liftboats, has agreed to sell the vessel for cash consideration of US$2.25 million.The sale is expected to generate a gain of US$858,000 for Ezion, based on the vessel's US$1.39 million carrying value as at end-September.Ezion will use the sale proceeds to repay its secured bank loans. The mortgage over the vessel will be discharged after the sale.The debt-stricken offshore…

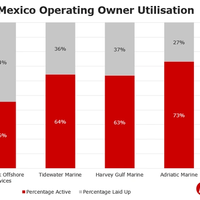

BY THE NUMBERS: the OSV Markets

US Offshore Support Vessel Analysis 2018 and 2019. The US GOM Offshore Support Vessel (OSV) market is suffering, utilization remains poor, and many owners are still squeezed financially. However, a poor market forces people to adapt and for those willing to take risks, the upside can be extremely large.US Owners 2018 vs. 2019: Within the US GOM, 2018 saw a period of strategic thinking and tactical business decisions. Tidewater Marine completed their merger with GulfMark Offshore to create the world’s largest OSV player.

Rosatom: Northern Sea Route to Cost 735 bln Roubles

Russia's ambitious Northern Sea Route (NSR) requires 735 billion roubles ($11.7 billion) in investments, with the state budget to provide a third and the rest to come from companies and banks, the head of state nuclear firm Rosatom, Alexey Likhachyov, said.Rosatom, the world's top nuclear company in terms of foreign orders, was selected by the Russian government to operate the NSR - the Arctic route Moscow wants to turn into a new Suez - coordinating development of the project among its users.This month…

WFW Advises CCBL on Sale, Leaseback of Two VLCCs

The international law firm based in London Watson Farley & Williams (WFW) has advised CCB Financial Leasing Co., Ltd. (CCBL) on a US$132.8m sale and leaseback transaction of two tanker vessels (VLCC) acquired from and chartered back to two subsidiaries of Globe Shipholding S.A.Globe Shipholding is maintaining a fleet of crude carrier tankers managed by Almi Tankers S.A..CCBL’s transaction with Globe represents the first completed sale and leaseback of VLCCs in the Chinese leasing community. US$132.8m was drawn by Globe under the sale and eight-year capital lease back transaction which was put to various uses including the refinancing of certain bank loans secured on the two tankers.Founded in 2007…

Chinese Eye Philippines Hanjin Shipyard

Two Chinese shipbuilding companies have expressed intent to invest in the largest Philippine shipyard, debt-riddled Hanjin Heavy Industries and Construction Philippines, the Department of Trade Industry (DTI) said.Drowning in debt, the Philippine business of the Hanjin Group of South Korea, has asked the government for help in search of an investor who would take over the business and save the troubled shipbuilder.Philippines Rodrigo Duterte administration has stepped in to help save the troubled investor in Subic.According to local media reports, which quoted Trade Undersecretary and Board of Investments (BOI) Managing Head Ceferino Rodolfo, two Chinese firms contacted the Board.“They’re interested in the shipbuilding industry in general ...

Ørsted Completes Divestment in Hornsea 1 Offshore Wind Farm

Danish offshore wind farm developer Orsted A/S has completed the divestment of 50% of the Hornsea 1 Offshore Wind Farm to Global Infrastructure Partners (GIP).Three months ago, Ørsted signed an agreement to sell 50% of the 1,218MW offshore wind farm Hornsea 1 to Global Infrastructure Partners (GIP). Hornsea 1 is under construction and will be the world’s largest offshore wind farm when commissioned in 2020.As part of the agreement, Ørsted will construct the wind farm under a full-scope EPC contract. Ørsted will also provide long-term operations and maintenance services from its O&M base in Grimsby and provide a route to market for the power generated by Hornsea 1.Ole Kjems Sørensen…

Fredriksen's Flex Raises $300 Mln for LNG Newbuilds

Flex LNG, controlled by Norwegian-born billionaire John Fredriksen, has raised $300 million in a private placement of shares to help pay for five new vessels costing $918 million, it said on Thursday.Fredriksen's companies typically add high-yield bond issues and bank loans at a later time to pay the cost not covered by share sales.When the vessels are delivered from the yards of South Korea's Daewoo (DSME) and Hyundai (HHI) in 2020 and 2021, Flex LNG will have a fleet of 13 ships, Flex said.Fredriksen himself bought shares for $100 million, cutting his overall stake in the firm to 44.6 percent following the placement from 49.9 percent.The new shares of Oslo-listed Flex were sold at 14.25 Norwegian crowns each, a five percent discount to Wednesday's closing price of 15 crowns, and the plac

US Court Approves Seadrill's Bankruptcy Exit Plan

A U.S. judge said on Tuesday he would approve Seadrill Ltd's plan to exit its Chapter 11 bankruptcy, in which the global offshore oil and gas drilling company would shed billions of dollars of debt and raise $1 billion in new investment. U.S. Bankruptcy Judge David Jones in Houston overruled two minor objections to the reorganization plan during a 90-minute hearing. The plan extends maturities on more than $5 billion of bank loans and converts about $2.3 billion in bond debt into equity in a reorganized Seadrill.

Seadrill, Creditors Reach Joint Restructuring Deal

Shipping tycoon John Fredriksen has reached an agreement with a majority of creditors over a restructuring plan for oil rig firm Seadrill, according to U.S. court documents on Monday. The company, once the world's largest offshore driller by market value, filed for Chapter 11 bankruptcy protection with debt and liabilities of over $10 billion last September after a sharp drop in oil prices in 2014 cut demand for rigs. "It's good for all parties that Seadrill comes out of an expensive and time-consuming process," said Frederik Lunde, head of research at brokerage Carnegie.

Noble Group Sells Four Vessels to Cut Debt

Hong Kong-based struggling commodity trader Noble Group will sell four dry bulk carrier vessels for about $95 million, as it looks to cut debt to keep its business running, reports Reuters. According to company statement, net proceeds from the disposal, following repayment of bank loans associated with the ships and other costs, will amount to about $30 million. Noble said the sale of the vessels was expected to close next year between March 10 and May 31 and would not significantly impact the operations of the freight business. Once Asia’s largest commodity trader, Noble Group’s decline since 2015 has been marked by losses, concern it won’t be able to pay its debt, and accusations from Iceberg it inflated the value of some contracts, said a Bloomberg report.

Mitsui OSK Targets 26% Stake in Swan's Indian LNG Unit

Japan's leading shipper Mitsui OSK Lines aims to buy at least a 26 percent stake in a floating storage regassification unit (FSRU) in India, a company official said, to boost its exposure in the west coast project of Swan Energy. Swan Energy is building a 5 million tonnes a year FSRU and floating storage unit (FSU) at Jafrabad in western Gujarat state, with Mitsui awarded a long-term contract for operation and maintenance services. "We have until end-2019, by when the project will be completed, to buy at least 26 percent in Triumph Offshore," Senior Managing Executive Officer Takeshi told Reuters on Monday, referring to the Swan subsidiary that will control the $260 million FSRU. Swan aims to commission the project in the first quarter of 2020, he added.

Dynagas LNG Posts Q2 Loss

Greece-based Dynagas LNG Partners has reported a second-quarter loss of USD 5.2 million, after reporting a profit in the same quarter a year before. "We are satisfied that the class surveys, including dry dockings, were completed in a quick and efficient manner with an average of approximately 15 days per vessel from arrival to departure at the shipyard. The vessels are on a 5-year special survey cycle, therefore we expect the next special class survey and related dry docking to occur in about 5 years," he added. "Our reported earnings for the second quarter of 2017 were, as expected, below those of the second quarter of 2016 and were impacted by the following: (i) the class surveys and related dry dockings of three of our vessels…

Rickmers Maritime is Latest Singapore Casualty

Company struggled with debt in wake of shipping downturn. Debt includes over $270 mln in secured loans. Rickmers Maritime, a Singapore-listed trust that operates container ships, said it would be wound up as it has been unable to reach an agreement with its lenders to restructure debt or raise new equity. Struggling in the wake of a global shipping downturn, Rickmers joins other Singapore-listed companies from the offshore and marine sectors that have been grappling with debt in the last year. Singapore banks, which were caught off-guard by the collapse of oilfield services company Swiber Holdings last year, have taken a hit as the firms restructure their loans.

Korea Bank Puts 10 Hanjin Vessels Up for Sale

Korea Development Bank, the main creditor of the dissolved Hanjin Shipping Co. and state-owned entity, has put 10 Hanjin vessels up for sale in order to source back elements of its extended loans, reports Yonhap. According to the sources, potential buyers are required to submit their bids for the ships — two container ships and eight bulk carriers — by Feb. 21. Previously a South Korean court agreed to formally end Hanjin Shipping Co Ltd’s court receivership process after a two week appeal period, ending the business. Therefore any method of rehabilitation for the South Korean shipping company is now over, thus heralding liquidation.

Ex-Daewoo Shipyard Head Gets 10 Years in Prison

Ko Jae-ho, the former head of the ailing South Korean shipbuilder Daewoo Shipbuilding and Marine Engineering (DSME), has been sentenced to 10 years in prison by a lower court in Seoul over accounting fraud, Yonhap News Agency reports. The Seoul Central District Court found Ko Jae-Ho guilty of manipulating the company's books in 2013 and 2014, when he was the CEO, and using them to raise bank loans. Ko Jae-Ho's punishment epitomises the decline of Daewoo, which was once one of the country's biggest conglomerates, or chaebol. "It seems that Ko was aware that there was extensive accounting fraud to make up for operating losses and achieve the operating profit target," the court said in its ruling.

Euronav Gets Credit Line of $ 410mln

Euronav NV announces has signed a new USD 410 million senior secured amortizing revolving credit facility. The facility has been made available on 16 December 2016 for the purpose of refinancing 11 vessels as well as Euronav’s general corporate and working capital purposes. The credit facility was used to refinance the USD 500 million senior secured credit facility dated 25 March 2014 and will mature on 31 January 2023 carrying a rate of LIBOR plus a margin of 2.25%. Hugo De Stoop, CFO of Euronav said: “This new facility will provide a lot of flexibility for Euronav. It is a full revolving credit facility replacing a term loan, it has a lower margin (50 bps lower) than the facility it is refinancing, and it has a much longer maturity.

Euronav Secures Loan for VLCC Refinancing

Tanker shipping company Euronav NV announced it has signed a new $410 million senior secured amortizing revolving credit facility. The facility has been made available on December 16, 2016 for the purpose of refinancing 11 vessels as well as Euronav’s general corporate and working capital purposes. The credit facility was used to refinance the $500 million senior secured credit facility dated March 25, 2014 and will mature on January 31, 2023 carrying a rate of LIBOR plus a margin of 2.25 percent. Hugo De Stoop, CFO of Euronav said, “This new facility will provide a lot of flexibility for Euronav. It is a full revolving credit facility replacing a term loan, it has a lower margin (50 bps lower) than the facility it is refinancing, and it has a much longer maturity.