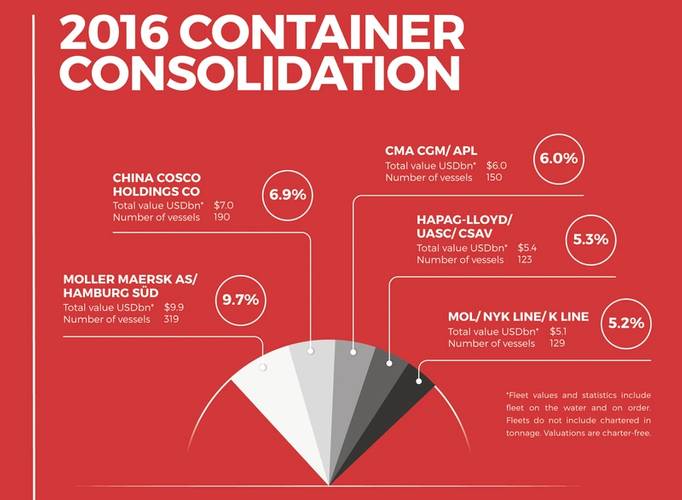

Following the sale of Hamburg Süd to Maerskfor $4 billion, VesslesValue senior analyst William Bennett has compiled a report on the top consolidated container fleets. Currently these top five fleets are worth $33.4 billion and account for 33 percent of the entire container fleet.

Moller Maersk AS/Hamburg Süd

Maersk have confirmed rumors that they will acquire German container shipping line Hamburg Süd. Hamburg Süd’s strong position in north-south trades will complement Maersk's current business. Maersk is thought to have paid roughly $4 billion for Hamburg Süd whose fleet is worth $1.5 billion. The deal is expected to complete end 2017. Entry of Hamburg Süd into the 2M alliance will put the alliance into the lead with 15 percent of global capacity.

China COSCO Holdings Co

The Chinese state cabinet approved the merger of COSCO and China Shipping back in December of 2015. The merger is a part of plans to create stronger, larger national entities that have greater competitive advantage and prevents the two lines from competing against one another. China COSCO Holdings have the largest fleet on order with 29 ULCVs and four post-panamax containerships. The Chinese owned container fleet is the most valuable at $17.6 billion and accounts for around 17 percent of the market.

CMA CGM/APL

The largest acquisition in the French giant's history, CMA CGM acquired Singaporean company, NOL, best known for its APL brand. Recently it was also confirmed that APL would join CMA CGM in the Ocean Alliance which will subsequently represent 14 percent of global container capacity, second only to the 2M alliance. The acquisition will make the combined fleet the third most valuable in the industry.

Hapag-Lloyd/UASC/CSAV

Hapag-Lloyd completed their integration of Chilean line CSAV earlier this year. In July, they continued their growth by signing a merger agreement with UASC. The new merger will bring Hapag-Lloyd’s average age down to 7.8 years from 8.7 years. Hapag-Lloyd and UASC will be the fourth most valuable fleet up from 10th and eighth, respectively.

MOL/NYK Line/K Line

One of the more recent mergers to be announced is that of MOL, NYK and K Line. Only the container businesses of these companies will merge and the consolidation is expected to be complete by 2018. The most valuable Japanese container fleet is Shoei Kisen valued at $3 billion and ranked eighth. In comparison, none of the other Japanese entities feature in the top 10 most valuable container fleets. The merger shows that consolidation can be used very effectively in the container industry to create a large footprint with only mid-size lines. The new arrangement makes the merged entity the fifth most valuable at $5.1 billion.