Yet More Consolidation Proposed in Russia

The prospect of Russia’s two largest container terminal operators joining forces has raised concerns over the dominant position that the combined enterprise would enjoy were the deal to be agreed.

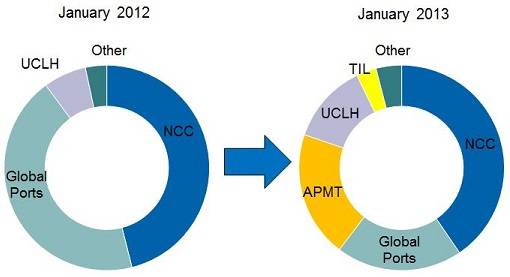

Global Ports Investments (GPI), one of the two largest players in the Russian container port market, is investigating the acquisition of a controlling stake in National Container Company (NCC), the other dominant player in the Russian market.

The prospect of Russia’s two largest container terminal operators joining forces has raised concerns over the dominant position that the combined enterprise would enjoy were the deal to be agreed.

Global Ports Investments (GPI), one of the two largest players in the Russian container port market, is investigating the acquisition of a controlling stake in National Container Company (NCC), the other dominant player in the Russian market.

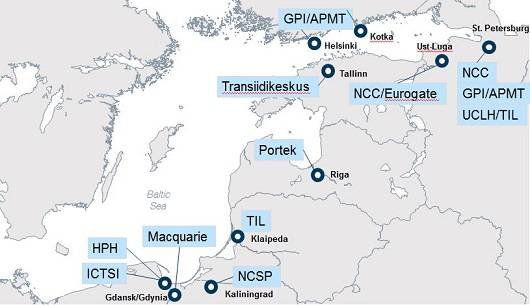

Ownership of selected container terminals in the Eastern Baltic

Given their powerful market shares in St Petersburg, it seems highly improbable that the deal would be acceptable to the Federal Antimonopoly Service of Russia, yet it is unlikely that the proposal would have got this far without at least a few words of comfort from someone in power. It could be that some parts of GPI and NCC would have to be sold.

GPI is the largest terminal operator in Russia, with a 2012 market share of almost 30%, followed by NCC with just over 21%. Within St. Petersburg port the story is even more concentrated, with GPI and NCC each having a share of around 43% in 2012.

However, as the Russian Government has repeatedly said that it wants to make cross border transport easier again, including the simplification of customs procedures, it could be that a bigger port player at home is felt to be a safer way of ensuring that Russian ports remain competitive. The Russian container port market totaled just over five million teu in 2012 (excluding cross border traffic), with around half of this handled at St. Petersburg, so its access to both Moscow and Western Europe, is critical for Russia.

Although both GPI and NCC have strong market positions, and are highly profitable as a result, with EBITDA margins in excess of 60% in the 2012 financial year, they are not immune to competition from ports outside of the country, such as Klaipeda, Riga and Tallinn, which are currently busy improving their facilities and intermodal links into Russia.

Moreover, if NCC is indeed available for acquisition, GPI may not have a clear run at it (leaving aside the views of the competition authority). Reports suggest that there are several interested parties including Summa Capital which recently acquired Russian shipping line FESCO (which also has a container terminal in Vladivostok in the Russian Far East). It may take Summa some time to digest this acquisition and the leverage it created, though.

Another interested party could be UCL Port. Part of a large conglomerate with interests in ports, shipping, logistics and metals in Russia and Europe, UCL is the other significant (and fast growing) container terminal operator in St. Petersburg through its aptly named Container Terminal St. Petersburg (CTSP), formerly 4th Stevedoring Company. In May 2012, UCL sold a 20% stake in CTSP to Terminal Investment Limited (TIL), the global terminal operator affiliated with MSC. CTSP has been the fastest growing terminal in St. Petersburg over the last year, and the connection with TIL and MSC is no coincidence in this respect.