According to a weekly update from the U.S. Energy Information Administration (EIA), an oversupply of European distillates is raising the amount of product being held in floating storage, and also causing changes to shipping routes to slow delivery to the continent.

Europe is experiencing a relatively warm winter resulting in weaker demand, and also high refinery runs in Europe and increased imports have kept distillate inventories in the Amsterdam, Rotterdam, and Antwerp (ARA) area far above normal.

Higher inventories have pushed distillate futures prices in the ARA into a steep contango (meaning prices for delivery dates further in the future are higher than for near-month delivery). As a result, inventories are being held in floating storage and imported cargos are being diverted to longer voyages.

Moving Product Internally

Distillate produced at ARA refineries is typically moved via barges on the Rhine River and a pipeline that runs near the river into western Germany and eastern France. Low water levels on the Rhine River, which disrupted barge shipments earlier in the season, contributed to high inventories in the ARA area in late 2015. Rhine River water levels have risen in recent months, allowing normal barge traffic to resume, but reduced heating oil demand kept ARA distillate inventory at elevated levels. Increased European refinery runs are another factor contributing to high distillate inventories in the ARA region, according to EIA.

Supply & Demand

At the same time, new and traditional sources of distillate have expanded capacity to supply ultra-low sulfur distillate (ULSD) to Europe. In Russia, which is a longtime supplier of distillate to Europe, refineries have been upgraded to produce lower-sulfur distillate fuels that are widely used in Western Europe, and have increased exports to Europe. Elsewhere, several new refineries, including those in Saudi Arabia and India, which are geared toward maximizing ULSD output, have come online in the past few years, further adding to the supply of distillate.

These factors — reduced heating demand, increased European refining runs, and increased imports — have pushed independently held distillate inventory levels in the ARA to more than 26 million barrels in recent months, more than 7 million barrels higher than the five-year average.

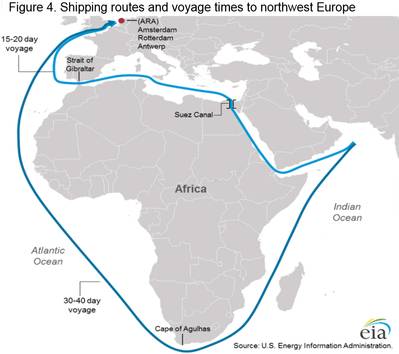

Floating Storage & Changing Shipping Routes

Trade press reports indicate that a lack of storage space and a large contango have pushed distillate supplies into floating storage and encouraged import cargoes to take longer shipping routes. When contango in the futures contracts become sufficiently large, market participants can lock in a profit by purchasing distillate supplies on the spot market, chartering a vessel, and selling a longer-dated futures contract. Trade press report that several vessels in European waters, such as off the coast of Gibraltar in southern Spain and outside of the ARA ports, have been booked specifically for distillate floating storage. Another tactic employed by market participants is to have inbound cargoes take longer voyages, which allows more time to find a buyer, or onshore storage space, and also provides a return from the higher priced later delivery date. According to the trade press, many cargoes from the Middle East and India have diverted around the Cape of Agulhas, at the southernmost point of Africa, on their way to Europe rather than passing through the Suez Canal in Egypt. The longer trip takes 30-40 days instead of the 15-20 day journey through the Suez Canal (Figure 1).