Eimskip Gets Finance Deal for New Container Vessels

Eimskip has secured 80% financing of the contract price of the vessels with a 15 year tenor in Euros taken upon delivery. The lender is the German bank KfW IPEX-Bank GmbH. The loan is secured by China Export & Credit Insurance Corporation (Sinosure). On 25 January, Eimskip signed a contract with China Shipbuilding Trading Company Limited and Guangzhou Wenchong Shipyard Co. Ltd. to build two 2,150 TEU container vessels. The contract price of each vessel is approximately USD 32 million and the vessels are expected to be delivered in 2019. The payment profile of the vessels is that 40% of the contract price is paid during the building period and 60% upon delivery. The contract was subject to financing and that has now been lifted.

New Maritime Bank Opens Its Doors

A new niche bank for the shipping and offshore sector opened its doors for business on December 20, 2016. Serving the global maritime markets from its main office in Oslo, Maritime & Merchant Bank ASA (M&M) will provide secured lending in the form of first priority terms loans. “The sustained tight credit market for the maritime sector has left many companies owners seeking financing with few alternatives,” said M&M CEO, Halvor Sveen. “We believe M&M can fill a need for a specialized bank with experience in shipping and offshore that is able to contribute to good solutions for our customers.”

Russian Firms Face Huge Insurance Costs as Foreign Providers Flee

Russian companies face billions of dollars in extra insurance costs as Western sanctions prompt foreign insurance firms to start pulling out, worried that any business they undertake is at risk from future measures and an increasingly sick economy. Russian President Vladimir Putin came under heavy criticism at a G20 summit last weekend, where Western leaders accused him of continuing to destabilise Ukraine in violation of a September peace agreement. Existing sanctions, along with an oil price tumble, have brought Russia to the brink of recession. The rouble is down some 30 percent over the year and lending costs are soaring for all companies, be they on sanctions lists or not.

Maritime & Merchant AS Granted Banking License

Maritime & Merchant AS (M&M) (TBR Maritime & Merchant Bank ASA) has received regulatory approval to operate a private bank in Norway, underpinning the firm’s strategy to become a niche financial institution dedicated to meeting the funding needs of owners active in the shipping and offshore industries, worldwide. “We are currently preparing for a capital issue with a target of $300-350 million (USD) in equity to fund operations. We have selected Pareto Securities AS and DNB Markets as Joint Lead Managers and Bookrunners, with Cleaves Securities to act as Financial Advisor.

New Maritime Bank Targets 2Q 2014 Operations

An experienced team of shipping, offshore and finance professionals are pleased to announce the intention to establish Maritime & Merchant Bank (M&M) a niche financial institution dedicated to meeting the funding needs of owners active in the shipping and offshore industries, worldwide. The newly formed project company, Maritime & Merchant AS (M&M AS), will file a banking license application on behalf of M&M during the autumn of 2013. The main sponsoring shareholders of M&M AS are currently Arne Blystad…

New Maritime Bank Plans to Bridge Funding Gap

A team of Norway-based shipping, offshore and finance professionals intend to establish Maritime & Merchant Bank (“M&M’’) a niche financial institution dedicated to meeting the funding needs of owners active in the shipping and offshore industries, worldwide. The newly formed project company, Maritime & Merchant AS (M&M AS), will file a banking license application on behalf of M&M during the autumn of 2013. The main sponsoring shareholders of M&M AS are currently Arne Blystad…

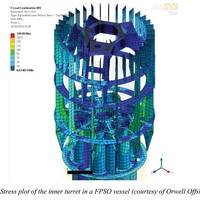

Finite Element Solutions

The international marine industry faces unprecedented challenges today. Energy costs are rising, as are concerns about reduced pollutant emissions, water ballast treatment and other environmental impacts. A tight credit market and cash-strapped operators mean that engineers must deliver designs with a high degree of fidelity and reliability while reducing the development cycle. Extreme weather, hazardous cargoes and other challenging operating conditions present the need to continually innovate, implement new materials and deliver analyses confidently.

August 31st Deadline for ARRA Engine Loan Program

The (California) Air Resources Board is reminding and encouraging small business owners of off-road diesel vehicles, portable diesel equipment, or diesel marine vessels and engines to take advantage of this loan assistance opportunity. The loan must be completed and executed by August 31, 2012. The American Recovery and Reinvestment Act award provided $5 million to the loan assistance program to reduce harmful diesel emissions by helping owners upgrade or replace their older vehicles, equipment, or engines. This joint program between the ARB and the California Pollution Control Financing Authority (CPCFA) provides competitive-rate loan opportunities in the current tight credit market to small businesses.

Power & Automation Group ABB Close $2.5-billion Bond Offer

The bonds, which are registered with the U.S. This constitutes the largest-ever bond offering completed by ABB. The net proceeds of the issue will be used for general corporate purposes, including the previously-announced acquisition of Thomas & Betts Corporation. As a result of this offering, ABB has cancelled the $4 billion credit agreement it had entered into in connection with the Thomas & Betts acquisition. ”We’re extremely pleased with the positive response to our offering,” said Michel Demaré, ABB’s Chief Financial Officer. “This transaction further extends the maturity of our long-term debt and gives us additional financial strength and flexibility at some of the lowest rates ever achieved in the U.S.

Omega Navigation Q3 2009 Results

For the quarter ended September 30, 2009, Omega Navigation reported total revenues of $14.3 million and Net Income of $1.9 million, or $0.12 per basic share, excluding losses on interest rate derivative instruments and incentive compensation grants expense. Including these items the Company reported Net Income of $ 0.1 million or $0.01 per basic share. Adjusted EBITDA for the third quarter of 2009 was $8.0 million. Please see below for a reconciliation of Adjusted EBITDA to Cash from Operating Activities. Operating Income included revenue of $0.8 million attributable to profit sharing. The company owned and operated an average of eight product carriers during the third quarter of 2009, the same number as in the third quarter of 2008.

Tight Credit Squeezes Maritime Industry

“Liquidity has come back to some extent,” said Oliver Ebner, Senior Manager, Project and Structured Finance for the National Bank of Abu Dhabi. Ebner is one of a panel of speakers lined up to address a special session on financing the industry in the global economic slowdown at Middle East Money & Ships, the region’s premier networking event for senior executives from the maritime and finance sectors. The conference from 7-8 October 2009 at the Grand Hyatt Hotel, Dubai, will also assess the continued appetite for investment in shipping, the likely pattern for recovery, where the money will come from as well as providing a realistic assessment of the current order book.

Omega Navigation Q2 2009 Results

Omega Navigation Enterprises, Inc. (NASDAQ: ONAV) (SGX: ONAV50), a provider of global marine transportation services focusing on product tankers, announced its financial and operational results for the quarter ended June 30, 2009. For the quarter ended June 30, 2009, Omega Navigation reported total revenues of $16.7 million and Net Income of $3.4 million, or $0.23 per basic share, excluding a loss related to the termination of a purchase agreement, a loss on interest rate derivative instruments and incentive compensation grants expense. Including these items the Company reported Net Loss of $1 million or $0.06 per basic share. EBITDA for the second quarter of 2009 was $6.6 million. Please see below for a reconciliation of EBITDA to Cash from Operating Activities.

Omega Navigation 1Q 2009 Results

Omega Navigation Enterprises, Inc. (NASDAQ: ONAV) (SES: ONAV50), a provider of global marine transportation services focusing on product tankers, announced its financial and operational results for the first quarter ended March 31, 2009. For the quarter ended March 31, 2009, Omega Navigation reported total revenues of $18.7 million and Net Income of $6.3 million, or $0.41 per basic share, excluding a loss on its interest rate derivative instruments, a gain on warrants revaluation and incentive compensation grants expense. Including these items the Company reported Net Income of $5.7 million or $0.37 per basic share. EBITDA for the first quarter of 2009 was $13.2 million.

DryShips Reduces Capital Expenditures

DryShips Inc. (NASDAQ:DRYS), a global provider of marine transportation services for drybulk cargoes and off-shore contract drilling oil services, announced two transactions to reduce its future financial commitments and improve its financial strength. These transactions include: the disposal of three Capesize newbuildings, and the cancellation of the acquisition of nine Capesize vessels (including five newbuildings) previously agreed to by the company. These two transactions will reduce the company's capital expenditure commitments by over $1.5b in initial transaction value. In addition, during this period of lower freight rates and an impaired credit market, the company will suspend dividend payments on its common stock.

Title XI Financing for Vessel and Shipyard Improvement Projects

Anyone planning to build a vessel in a U.S. shipyard, and any U.S. shipyard planning a shipyard improvement project, should consider using the Title XI program to finance the project. In a nutshell, the Title XI program is a loan guarantee program under which the U.S. Government guarantees bonds issued or a bank loan extended to finance the construction of a vessel in a U.S. shipyard or a U.S. shipyard improvement project. At first glance, the Title XI program looks very attractive. It enables the borrower to borrow more money at a significantly lower interest rate over a much longer period of time. There are, however, significant costs associated with using the Title XI program. So how does one determine whether it makes sense to use Title XI financing for a particular project?

What Goes Up …

Global credit woes have largely had little affect on the historic shipbuilding orderbook … yet. According to a Bloomburg report, there are signs that shipbuilding’s bull run may be coming to an end, fueled by the largest credit-market losses ever, which is starting to make attaining credit more difficult and putting in peril a number of shipbuilding orders. According to the Bloomburg report, as much as $14 billion in ship orders is threatened by cancellations and delays. With the potential for cancellation comes a silver lining…

Doosan Drops out of Daewoo Bid

Doosan Group pulled out of the bidding for Daewoo Shipbuilding, while steel firm POSCO said it was seeking partners to make a bid. POSCO, the world's No.4 steelmaker and a strong candidate for the Daewoo deal, wants to partner with a financial firm and 's National Pension Service (NPS) to bid for Daewoo Shipbuilding, reports said. The developments reflect expectations that a hefty premium for Daewoo Shipbuilding could double the value of a deal to $7.8-$9.6m and that tight credit market conditions are squeezing potential buyers. Source: Reuters