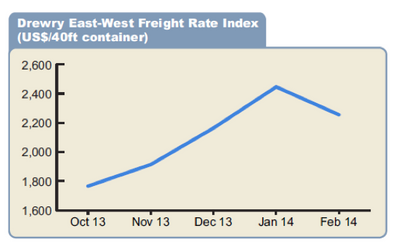

East-West Freight Rates Remain Down After Chinese New Year

Following three consecutive months of price rises, freight rates on the East-West trades declined in February, according to Drewry’s online Container Freight Rate Insight.

Rates came under most pressure on the Asia-Europe trade, which weakened following a meteoric rise in the run-up to the Chinese New Year. Drewry’s Asia-Europe Westbound Freight Rate Index dropped 12% in February to $2,992 per 40ft container, while weekly data from the World Container Index assessed by Drewry indicates that the pricing erosion has continued into March.

Spot rates on the transpacific shed some gains as well with Drewry’s Transpacific Eastbound Freight Rate Index easing 3% over January to $2,669 per 40ft unit.

As a consequence, Drewry’s East-West Freight Rate Index, a weighted average of spot rates across the transpacific, transatlantic and Asia-Europe/Med trades, shed 8% in February to average $2,255 per 40ft.

“The GRIs lined up on both the Asia-Europe and the transpacific trades will struggle to lift rates to sustainable levels unless carriers take drastic measures to tighten capacity while accommodating the ultra-large vessels scheduled to join these trades this year,” said Simon Heaney, senior manager of supply chain research at Drewry.

“Deliveries of new ultra-large ships will only add to the existing overcapacity and lead to more cascading, putting rates under further pressure. The policy of skipped sailings and frequent GRIs can be expected to continue, but any gains from these tactics will only bring temporary relief to carriers,” added Heaney.

Source: Drewry’s Container Freight Rate Insight

www.drewry.co.uk/cfri