Oil Loadings from Black Sea Ports Remain Suspended

Oil loadings from the Black Sea port of Novorossiysk and the Caspian Pipeline Consortium (CPC) terminal have not resumed due to an ongoing storm forcing exporters to look for alternative routes, three sources familiar with exports told Reuters on Wednesday.Novorossiysk and the CPC terminal account for about 2 million barrels of oil per day (bpd) from Russia and Kazakhstan."A storm warning is in effect in Novorossiysk. It is raining, and the wave height is from two to four meters…

Mexico Plans $4-$5 Billion LNG Hub at Gulf Port

Mexico plans to build a liquefied natural gas (LNG) export hub worth between $4 billion and $5 billion in the Gulf of Mexico that will help serve European demand, President Andres Manuel Lopez Obrador said on Tuesday.The planned LNG facility in the port of Coatzacoalcos, in the eastern state of Veracruz, would transport gas by boat to Europe, Lopez Obrador said."We're about to promote private sector involvement, it's going to be an investment of $4-5 billion this plant," he told a regular news conference.Lopez Obrador had previously floated the idea of an LNG plant in Coatzacoalcos, alongside

BIMCO on Tanker Shipping; The Worst is Not Over

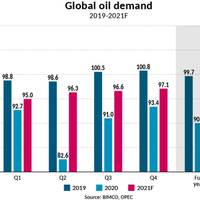

While the tanker market had a strong run at the outset of the COVID-19 pandemic, according to a report released this morning by BIMCO, tanker shipping will not benefit this year from the usual strong winter seasonal effect. Though the new lockdowns being introduced in many countries are less strict than in the spring, the effect on tanker shipping will be worse, given the supply glut of Q2. The news of an effective vaccine offers some hope of a global oil demand recovery but, however it comes about…

Indonesia Revokes Rule Requiring Domestic Ships for Some Exports

Indonesia's government will revoke rules requiring exporters of coal and palm oil to use domestic shipping companies for shipments, Coordinating Minister for Maritime and Investment Affairs Luhut Pandjaitan told reporters on Wednesday.Indonesia, the world's biggest thermal coal exporter, issued regulations in 2018 requiring its coal and palm oil exporters to use domestic shipping companies, which were due to come into force this May.The government has since concluded that the rule would be disruptive for exports and President Joko Widodo has ordered it to be revoked…

Guyana's First-Ever Oil Cargo Sets Sail for the U.S

A vessel carrying about 1 million barrels crude oil from Guyana set sail on Monday for the United States, according to vessel tracking service TankerTrackers.com, ushering the tiny South American nation into ranks of the world's oil exporters.The first cargo of Liza crude departed from the floating platform Liza Destiny off Guyana, operated by U.S. companies Exxon Mobil, Hess Corp, and China's CNOOC . (Reporting by Marianna Parraga; editing by Diane Craft)

U.S. Sanctions Deal Blow to LSFO for 'IMO 2020'

Highly sought after types of oil best suited to making cleaner shipping fuel are suddenly finding they are a tougher sell for thirsty East Asian markets, traders say, in an unintended consequence of U.S. sanctions on a Chinese shipping fleet.With just over two months until environmental rules are set to mandate the biggest changes to ship power in over a century, certain rare types of West African oil have soared in value but have had to be marked down due to the higher costs of transport.The United States imposed sanctions on units of China's COSCO on Sept.

Saudis Call on Buyers to Secure Hormuz Passage

Saudi Arabia, one of the world's top oil exporters, called on global oil buyers to secure their energy shipments passing through the Strait of Hormuz, Energy Minister Khalid al-Falih said on Thursday."We, of course, call on the international community and have discussions with my counterpart Minister Pradhan today that India also needs to do its part of securing free navigation of sea links transporting energy to the rest of the world," al-Falih told Reuters after meeting with India's Petroleum Minister Dharmendra Pradhan.Concerns of disruptions in the Strait of Hormuz, where about 20% of global supply is transported daily, have increased after the Iranian Revolutionary Guards seized the British-flagged oil tanker Stena Impero in the waterway on Friday in apparent retaliation for the Briti

Sanctions spell the end of OPEC output deal

President Donald Trump’s decision to withdraw from the nuclear agreement with Iran marks the end of the current output agreement between OPEC and its allies.OPEC is likely to insist the current agreement remains in effect, at least for now, but the prospective removal of several hundred thousand barrels per day of Iranian exports from the market will require a major adjustment.Saudi Arabia has already promised to "mitigate" the impact of any potential supply shortages, in conjunction with other suppliers and consumer countries…

Indonesia Delays New Rules to Limit Coal, Palm Oil Shipments

Indonesia has postponed indefinitely the application of new rules that would limit shipments of coal and palm oil exports to only national shipping companies, a Coordinating Economic Ministry official said on Tuesday. The rule will only be applied once vessel requirements have been calculated and satisfied by the trade ministry, shipping industry and coal and palm oil exporters, Elen Setiadi, acting chief of trade and industry at the Coordinating Economic Ministry, told Reuters by phone.

Oil Rises on Record Indian Imports, Hopes of Output Caps

Oil prices edged up on Wednesday, supported by record Indian crude imports and talks between OPEC producers and other oil exporters on curbing output to end a glut in the global market. Global benchmark oil futures, the Brent and U.S. West Texas Intermediate (WTI) contracts, have both risen more than 10 percent since the end of September on prospects major crude producers would freeze or cut production to stem an oversupply in the market. However, doubts remain as to the intentions of major suppliers such as Saudi Arabia and Iran and the effectiveness of any agreement in reining in output from record highs. Brent crude futures were up 26 cents at $52.67 a barrel by 1115 GMT. U.S. West Texas Intermediate (WTI) crude futures rose 23 cents to $51.02 a barrel.

Argentina Crude Exports Poised to Hit Record

Argentina's oil producers have shipped record volumes of crude this month, spurred by a new government subsidy that has also prompted state-owned oil company YPF to return to the export market for the first time in years. The surge in shipments abroad comes just a month after Argentina's new president, Mauricio Macri, introduced measures to help oil exporters as part of sweeping policy changes aimed at boosting investment and opening the South American nation's economy after years of heavy controls on trade. Exports are expected to reach a record 91,000 barrels per day (bpd) of crude in April, including two cargoes sold by YPF to China and barrels shipped by private producers, according to a source.

Saudi's Rule Out Production Cuts, Oil Drops 4%

Oil prices fell 4 percent on Tuesday after Saudi Oil Minister Ali Al-Naimi ruled out any production cuts, restating the kingdom's rationale for maintaining output was that demand would pick up excess crude that has crushed prices over the past 20 months. Big oil exporters Saudi Arabia and Russia have proposed to freeze output at January levels, which were near record highs, only if other producers also do the same. More meetings on the potential freezes will be held in March, al-Naimi told the IHS CERAweek conference in Houston, adding that he expects most of the countries that count to freeze crude production levels. Analysts remain skeptical that the cuts will be effective in rebalancing the market.

‘Business as Unusual’ for Oil in the Medium Term

The recent crash in oil prices will cause the oil market to rebalance in ways that challenge traditional thinking about the responsiveness of supply and demand, the International Energy Agency (IEA) said in its annual Medium-Term Oil Market Report (MTOMR). The U.S. light, tight oil (LTO) revolution has made non-OPEC production more responsive to price swings than during previous market selloffs, the report said, adding that this would likely set the stage for a relatively swift recovery.

Sohar Port Challenges Gulf Rivals

Gulf of Oman port bids to become transhipment centre for region; to more than double container capacity by 2017. Part of Oman's drive is to industrialise, diversify beyond oil. An advertisement by the highway outside Dubai's massive Jebel Ali Port tells firms they don't need to ship goods through the Strait of Hormuz, the traditional gateway to the Gulf. Instead they can have goods delivered to a port in Oman, outside the Gulf, and bring them into the region by road. "Why go through the Strait when you can go straight to the Gulf," the billboard reads, in a challenge to Jebel Ali, which has become one of the biggest ports in the world by handling many of the region's imports via Hormuz.

Russia And China Ready For Deal On Energy

"China is our reliable friend," Russian President Vladimir Putin said on Monday in an interview ahead of a conference in Shanghai. Most evaluations of the bilateral relationship begin by reciting the historical border disputes, rift between Mao Zedong and Nikita Khrushchev, opening to China by Richard Nixon, and the perennial problem of reaching an agreement on gas pricing. But these are all essentially backward looking and ignore the growing community of interests between the two countries. The case for a closer bilateral relationship on energy, trade, security and diplomatic issues is compelling. In the energy sphere, the two countries are an almost perfect match: the world's largest net energy exporter and its second-largest net energy importer (2011) with a long land border.

Vanishing Volatility Signals Oil Market Shift

The oil market has rarely been so quiet. Benchmark Brent has traded in a narrow range of $5 either side of $110 per barrel since the summer of 2012. Price volatility has fallen to some of the lowest levels since crude futures markets were established in the early 1980s. Oil prices have rarely been so stable for so long since the 1973 oil shock ended the long period of calm in the 1950s and 1960s and ushered in the era of OPEC dominance. Measured volatility in front-month Brent futures prices has been below average continuously for almost two years.

Singapore at Heart of Counter Piracy Worldwide

For the third time in nearly five years, the Republic of Singapore Navy (RSN) has stepped down from a three-month command of the multi-national Combined Task Force (CTF) 151, after coordinating operations to deter and disrupt maritime organized crime in the Gulf of Aden as part of international counter-piracy efforts. The fact that there were no successful hijacking incidents in the CTF 151's area of responsibility during Singapore’s naval leadership is only part of the story of its success.

Iran Refrains from Oil Delivery to Greece

TEHRAN (FNA) - A Greek tanker returned home unloaded after Iran refrained from supplying crude oil to the crisis hit European state, FNA learned on Sunday. According to FNA dispatches, Iran refrained from supplying the 500,000-barrel cargo to the Greek tanker which was due to deliver it to Hellenic Petroleum refinery. The development came days after Iranian Oil Minister Rostam Qassemi called on the European countries to make a final decision on oil imports from Iran, warning that they will be sanctioned by Tehran otherwise.

Environmental breakthrough in Abu Dhabi

The Norwegian companies SAAS System and Aker Technology have received an order for the delivery of a system to prevent pollution from gas flaring on an oil field in Abu Dhabi. in different types of environmental technology. The delivery includes a system which removes the demand for flaring at an oil plant in Abu Dhabi in the United Arabian Emirates UAE. Unnecessary flaring is still in use at oil and gas facilities all over the world. achieved without the pollution. Arab Emirates, which is one of the world's largest oil exporters. Under the turnkey contract the two companies will use a local company for installation work. since 1997 on marketing systems which avoid the use of pollutive flaring at oil and gas facilities. company of the United Arab Emirates.

Analysts See Oil Glut Over By End Of September

OPEC oil exporters are reportedly on course to wipe out surplus inventories of crude oil and petroleum products by the end of September, even before the start of peak winter demand.

Chantal's Forces Leave Two Fishermen Missing Off Yucatan Peninsula

Tropical Storm Chantal slowed to a stop and dumped torrential rain on Mexico's Yucatan Peninsula on Tuesday after leaving two fishermen missing at sea and forcing 2,500 evacuations from the low-lying coastline. "At 5 a.m. EDT, Chantal was in a near stationary position 15 miles south of Chetumal," said Stacy Stewart of the U.S. National Hurricane Center. "The storm is carrying torrential rains, up to 15 to 20 in.," Stewart, a hurricane specialist, said. Winds remained at 65 miles per hour (104 kph). Chantal made landfall with winds of 70 miles per hour, around 8 p.m. High winds churned up Caribbean waters and left two fishermen missing. The men ignored warnings to avoid open seas during the storm, said Jose Nemesio Medina, director of the state's civil protection services.

Oil Price Drops As Speculators Jump

Euphoria surrounding the soaring price per barrel of oil soured a bit last week, as world oil markets took a nosedive as speculators apparently decided the rally which doubled prices since March had gone far enough. London benchmark Brent blend futures dipped $0.61 cents to $20.02 a barrel in late trading after overnight U.S. data indicated slower than expected demand growth for gasoline in the world's biggest oil consuming nation. Weekly government data showed U.S. gasoline inventories rose in the week to August 20 when dealers were expecting a large decline. "Gasoline supplies appear plentiful," said Prudential Bache broker Nauman Barakat. Traders said the investment hedge funds which have led this year's price rise, in the wake of OPEC supply cuts, sold heavily on Thursday.