Tankship Market Analysts Say Timing Essential for Success

Marine transport advisors McQuilling Services explain in a tanker industry note that timing is everything in a volatile tanker market.

McQuilling explain that on the outset, one might not directly see a similarity between Valentine’s Day and the tanker market; however, both can sometimes require serendipitous timing in order for desired outcomes to transpire. Furthermore, just like the dating world, the tanker market is full of volatility. Industry participants have been reminded of these market swings thus far in 2014 as the market witnessed its biggest spike in the last five years before losing steam at the beginning of this month. This volatility has been particularly prevalent in the VLCC and Suezmax tanker classes, but also visible in the Aframax and Panamax segments (Figure 1, below).

The upward momentum was supported by the usual combination of elevated regional demand against a tighter supply of vessels. Some additional support might have come from vetting restrictions imposed by certain charterers as well as weather related delays in several ports around the globe, that limited tonnage supply.

Regardless of the factors that helped tighten tonnage availability, the timing that an owner fixed their vessel in the trajectory of the uptick will have a significant impact on their bottom line. While this might seem relatively obvious, it sets the stage for some owners to feel a long awaited respite from the pressured market of previous years, while missing the upturn could even force some players to throw in the towel.

In an effort to highlight these market conditions, we examined three different Suezmax tankers and their timing related to the recently ended market cycle. Naturally, the breakdown of the voyages varied for each vessel but ultimately they all sailed from the Atlantic Basin to a discharge port in the East. All vessels eventually repositioned to Diego Garcia in the Indian Ocean. This is a common destination for Suezmax owners to reposition following voyages to the East, as it provides for a relatively centralized point to assess rates in both West Africa and the Middle East. In each of the three examples we examined their return over a period of 90 days which entailed ballast and laden legs, port time, waiting time and weather delays.

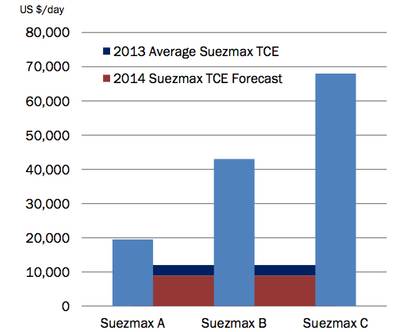

The three scenarios are as follows. Vessel A entered the market at the start of the cycle earning US $19,500/day, Vessel B entered it halfway bringing in US $43,000/day and Vessel C was fixed at the peak at US $68,000/day (see Figure 2 to the right).

Although there were significant earnings variations for each of these Suezmax owners, they were all able to outperform the market actuals of 2013, which averaged about US $12,000/day (Figure 2). In addition to the upswing in spot rates, owners were able to further maximize earnings through optimal vessel utilization that minimized ballast legs. To illustrate how these voyages might impact the annual earnings of these vessels, we assume that for the balance of the year, earnings will be around US $8,900/day (see Figure 2 on the right). This is based on the weighted average of Suezmax (WAF/USAC & BSea/Med) earnings in our 2014-2018 Tanker Market Outlook. This figure is based on round trip voyages, with a sailing speed of 13.5 knots, and has been adjusted to reflect current bunker prices.

Based on these assumptions, Vessels A, B and C will outperform the market forecast by US $10,500/day, $34,000/day and $59,000/day, respectively. This provides an example of how timing can have such a positive impact on earnings, and illustrates how savvy (or lucky) owners can capitalize on unbalanced market fundamentals.

Although McQuilling Services anticipates that 2014 is unlikely to see a drastic improvement in rates due to the continued abundance of tonnage, several factors point to increased volatility in the markets. A recovering world economy should result in more demand to transport oil. The North American shale story is still developing, meaning that traditional trading patterns are far from certain. Segmented supply due to charterers vetting requirements/age restrictions may also introduce short-term tonnage supply disruptions.

At present, the potential for another super spike seems unlikely, but admittedly it is hard to accurately predict weather delays, end of year inventory clear-outs and supply disruptions all transpiring in unison. However, we could still see spikes that will drastically improve the results of a few owners throughout the year.

Furthermore, given the recent uptick in VLCC rates compared to the downward spiral in Suezmax earnings, substitutions will likely to be the order of the day in the near future, especially on large vessels, and that will keep earnings in check.

The take-away from these observations is for both owners and charterers alike to keep a weathered eye on the market, perhaps more so than last year as rate volatility may be returning. In closing, on this Valentine’s Day, remember that in shipping, as in matters of the heart, timing can be everything.

In addition, video from McQuilling

McQuilling TV, Senior Shipping/Energy Advisor, Chris Neumiller, discusses some of the highlights from the tanker market in 2013 as well as McQuilling Services' view of tanker market fundamentals for 2014-2018.

Watch here:

http://www.youtube.com/watch?v=88_SwXppf1A

https://www.mcquilling.com/blog/tv/latest.html

Source: McQuilling Services LLC