Floating Production Expenditure set to Double

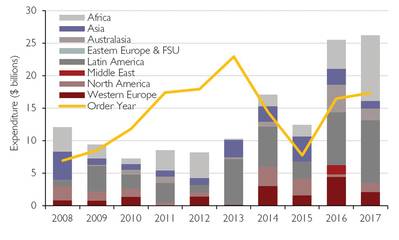

Douglas-Westwood forecast that between 2013 and 2017, $91bn will be spent on floating production systems (FPS) – an increase of 100% over the preceding five-year period. A total of 121 floating production units are forecast to be installed – a 37% increase.

This growth is driven by multiple factors, such as a larger proportion of newbuilds and conversions compared to redeployments, a greater degree of local content which often results in a higher cost base and general offshore industry cost inflation.

Market Forecast

FPSOs represent by far the largest segment of the market both in terms of numbers (94 installations) and forecast Capex (80%) over the five-year period. FPSSs account for the second largest segment of Capex (10%) with TLPs third (7%).

Latin America accounts for 29% of the 121 installations forecast and 37% of the projected Capex, with the majority of these being FPSOs. The difference between the two figures is due to Latin America having higher than average capital costs compared to some other regions, due to a higher proportion of expensive deepwater projects.

Africa is the second largest region, with forecast Capex of $18.2bn (20%). Like Latin America, a large proportion of the African installations will take place in deepwater.

Although Asia, has more installations (24) forecast than Africa (18), it is due to account for only $12.5bn, a smaller proportion of global Capex (nearly 14%). This is due to the majority being located in relatively shallow water and benign environments, requiring more straightforward FPS designs, sourced from converted vessels which are usually cheaper than newbuilds.

Although a predominantly shallow water region where fixed platforms are utilised, Western Europe is expected to see a respectable number (20) of FPS installations over the next five years. Some of these projects revolve around the rejuvenation of mature producing areas.

Key Demand Drivers

Three main factors are driving the sustained growth of the FPS sector:

• Move to deepwater

• Development of complimentary production technologies

• Marginal field development and early production systems

As shallow-water opportunities become increasingly scarce, the development of deepwater reserves will accelerate rapidly. For a field in deepwater, FPS is the development method of choice, since fixed platforms are often ruled out on technical and/or economic grounds.

Floating production expenditure in deepwater is expected to total $58bn over the 2013-2017 forecast period, equating to 63% of the value of the global FPS market. The deepwater market distribution for the next five years shows the continued dominance of Latin America and Africa, with Latin America expected to increase its share of forecast Capex from 30%.to 50%,

The subsea sector has developed at a remarkable pace in recent years enabling the economic development of fields in deeper waters further offshore. Furthermore, subsea processing technology is maturing and is now enabling production to FPSOs from challenging reservoirs including heavy oil.

Considerable versatility enables FPSs to be used for a variety of different applications besides conventional life-of-field production. These include Extended Well Testing (EWT), Early Production Systems (EPSs) and Rejuvenation Projects.

FPSOs are also an attractive solution for marginal field developments, particularly where an existing unit can be renovated, modified and redeployed at a significantly lower cost than a newbuild.

Supply-side Considerations

Three main factors will affect the supply of units in the FPS sector:

• Financing

• Local content

• Leasing

Financing remains a challenge for leasing contractors and smaller E&P companies as a result of the debt crisis in Europe. At the same time local content requirements are pushing up prices and extending lead times, particularly in Brazil.

For the oil company field operator, FPS ownership becomes the more cost-effective option where production extends over a long period. Alternatively, the decision to lease an FPS can be seen as a trade-off between the lower up-front Capex and the increased Opex as a result of the leasing charges. However, leasing also brings advantages in terms of the cost of field abandonment (Abex).

The top three leasing contractors are BW Offshore, MODEC and SBM Offshore, which collectively account for 34% of the leased fleet. The FPSO leasing sector remains weak with 85% utilisation at present compared to 89% at the time of the 2011 edition of this report. Contractors are reporting poor returns on existing projects and write-downs on new projects due to cost over-runs.

Conclusions

The FPS sector recovery, following the 2008/2009 downturn, continues steadily. A total of 25 units were ordered in 2011 vs. 24 in 2010. We note that orders in 2012 are 13 units as of September, suggesting that this year is unlikely to show spectacular improvement without a surge of orders in Q4. Analysis of the order book shows 51 FPSs in-build at present – a slight increase compared to last year’s edition of the Douglas-Westwood report. However, over the entire forecast period, the outlook is considered positive with the value of annual installations is projected to grow from $10.2bn in 2013 to $26.2bn in 2017.

The E&P industry is mature and needs to access offshore and deepwater reserves. Energy demand is growing as a function of population and economic growth. The upstream E&P business is increasingly reliant on offshore reserves to achieve incremental production as most of the easy-to-access reserves onshore have already been exploited.

Floating production systems are a key enabler for offshore production in deepwaters and for economically-marginal fields.

The lingering European sovereign debt crisis presents two significant risks to the sector. First, that projects do not go ahead due to lack of available finance for either the FPS contractor or the operator. Second, that the crisis will bring further economic downturns and depress oil demand and prices – in turn impacting new E&P activity.

The technological complexity of field developments is increasing and this will benefit oilfield equipment suppliers. Deeper waters, challenging reservoirs (e.g. very high or low pressure, sour hydrocarbons, high water content), and ageing fields will all present problems for operators of FPSs and opportunities for OEMs and engineering firms.

Local content requirements are causing delays in project execution and cost overruns. The ambition of creating value and employment locally will need to be balanced with the need to have an efficient, competitive and competent supply chain. These ambitions may continue to prove to be mutually exclusive.

The FPS leasing sector needs a sustainable business model. Poor financial performance from leasing contractors is being blamed on taking similar downside risk to operators (e.g. reservoir performance, construction risk, political risk) but without any of the upside that operators are exposed to (e.g. high oil & gas prices and total production being greater than forecast). Lease contractors need to work with operators to find sustainable contractual arrangements for mutual long-term benefit.

Political risk has always been present in the E&P business and this is unlikely to change. Boundary disputes, threats of civil unrest and war and changes in taxation regimes are all ever-present challenges that the oil and gas industry is well-used to encountering. A ‘portfolio approach’, avoiding excessive exposure to a single risk area is likely to continue to be the approach for E&P and oilfield services companies.

The medium and long-term outlook is however very positive. Douglas-Westwood are confident that the underlying long-term growth drivers will overcome the near-term issues. We are tracking over 200 potential future FPS deployment opportunities and over the period to 2017 we forecast that 121 installations will occur, with associated Capex spend doubling compared with the previous five year period.

This is a complex, dynamic industry that is exiting a period of weakness and is now entering a new up-cycle. DW’s five-year outlook vs. the 2011 edition of our report shows an improvement in market size of some $23.6 billion – a 35% uplift. In terms of timing, the next 12 months could present a superb entry opportunity to FPS-related business sectors.

About the Author

Hannah Lewendon joined DW as a researcher after graduating from the University of Southampton with a first-class degree in Economics and Finance. She has carried out extensive research on the floating production sector and Hannah is the lead author of the ‘The World Floating Production Market Forecast 2013-2017’.

Report details: Now in its 11th edition, Douglas-Westwood’s World Floating Production Market Forecast 2013-2017 has been tracking and analysing the industry for over a decade.

http://www.douglas-westwood.com/shop/shop infopage.php?longref=1048~0#.UH0aOW_A-kM

As Published in the November 2012 edition of Maritime Reporter & Engineering News (www.marinelink.com)