DREWRY: U.S. Exports Miss Target

US exports have been relatively robust in a backdrop of a moribund global economy, but slowing growth means that President Obama’s ambitious plan to double outbound trade in five years will fall short.

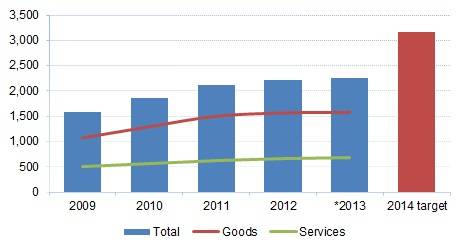

In his first State of the Union speech in January 2010, President Barack Obama set out an ambitious goal to double exports over the next five years to support 2 million new jobs.

Following an initial burst that made that target look a realistic possibility, a slowdown in 2012 means that at just past the half-way stage Obama will have to settle for considerably less than he was hoping for.

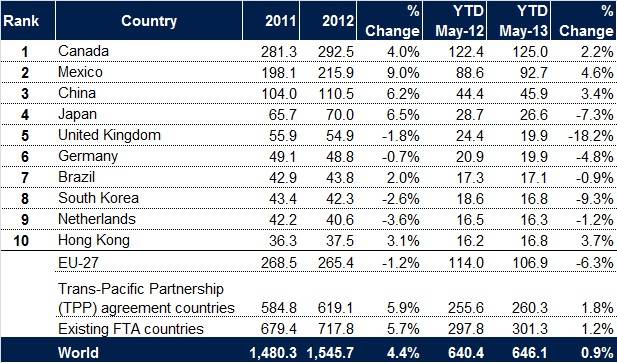

US exports of goods and services increased by 17% in 2010, but that rate fell to 14.5% in 2011 and dropped even further to 4.6% in 2012. The most recent trade data shows that after five months of 2013 the speed of growth is slowing further at just 1.9% with falling exports to the ailing EU27 the major sore point. The US exports reviewed here include all types of goods and services (including oil and energy products) and all types of transport modes (including surface transport, liquid bulk shipping, container shipping and air freight).

At the current pace, President Obama’s target of $3.15 trillion exports by the end of 2014 will not be reached until 2032, an overshoot of nearly two decades.

Despite its commonly held image as the world’s great consumer of other countries’ products, America is no slouch in shifting its own stuff to the world. It is ranked by the World Trade Organisation (WTO) as the world’s second largest exporter behind China, overtaking Germany in 2010.

Between 2009 and 2012 exports of US goods increased by 46% with the biggest gains coming from the automotive (79%) and industrial supplies (69%) sectors, the latter including petroleum and related products. During this time, the fastest growing markets for US goods were Brazil and Mexico (both 68%) while China (now America’s third-largest market after Canada and Mexico) grew by 59%. In contrast, export growth to Europe floundered at below 20%.

The National Export Initiative (NEI), the agency tasked with facilitating Obama’s target, was set up to assist the small- and medium-sized enterprises who make up the vast majority of all US exporters by offering advocacy, improving access to credit and upholding international trade laws.

There has been some success on that front with the Census Bureau reporting that number of US firms exporting goods in 2011 reached a new record of 302,260 (98% of which being SMEs), an increase of 9% since 2009. While the big companies such as Boeing and Caterpillar continue to dominate in dollar terms, SMEs were responsible for a third of all US goods exports with revenues in 2011 of $440.1 billion, some 42% up on 2009.

While the overall trend for US export sales is certainly not to be sniffed at and suggests that Obama’s export initiative has spurred some additional growth, America’s 2009-12 export growth of 46% was only on par with the global trend and was way down on China, which at the same time grew its exports by 70.5%.

The real success story of US exports over the last few years has been in services, which make up around 30% of total US exports. Between 2009 and 2012 the growth rate has been much higher than for goods at 78%, boosted by so-called private services such as in the science, digital technology and engineering sectors. It seems therefore that what the rest of the world, and in particular emerging economies, really craves is American knowledge rather than its goods.

Of course, services do not need to be moved in containers and US container export traffic to its main trading bloc partners in Asia and Europe has not set the pulse racing, growing considerably slower than imports.

According to Drewry research, exports to Asia between 2009 and 2012 rose by 12%, compared with 19% for the opposite direction, while exports to North Europe gained 13.5% as opposed to westbound growth of 36%. In container terms, therefore, the National Export Initiative has done nothing to rebalance trade.

When President Obama delivered his 2010 State of the Union address, US politicians were listening to the grievances of US exporters who felt they were being short changed by container lines in terms of equipment and ship availability.

The issue highlighted the fact that US exporters have always had to play second fiddle to importers due to the enormous trade imbalance, but also raised the question of what obligation non-US carriers have to US exporters. There are no major US-based shipping lines for domestic manufacturers to call upon.

So what are the short-to-medium term prospects for US exports? Obama is looking to boost trade with Asia and Europe with new free trade agreements, but even if these deals come off (the spying row is threatening to scupper the transatlantic talks at an early stage) it will be years before the impact is registered in significantly higher exports and container moves.

In the immediate term, a strengthening dollar will also put a break on US exports, while more generally the weak global economy will dilute the purchasing power of its trading partners.