Jack-up Rig Deal Agreed by NADL & Ship Finance

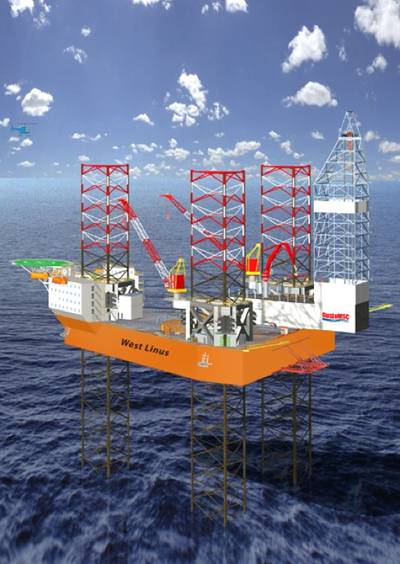

North Atlantic Drilling ("NADL") and Ship Finance International Limited ("Ship Finance") agree a combined a combined sale & leaseback arrangement for the harsh environment jack-up rig 'West Linus'.

Ship Finance will acquire the harsh environment jack-up drilling rig West Linus from a subsidiary of NADL. The West Linus is currently under construction at Jurong Shipyard in Singapore with scheduled delivery in December 2013.

The total acquisition cost will be US$600 million and the drilling rig will be chartered back to NADL on a bareboat contract for a period in excess of 15 years. NADL has been granted four purchase options, the first of which will occur after five years and the last at the end of the charter period. Ship Finance will also have an option to sell the rig back to NADL at the end of the charter period.

NADL has sub-chartered the rig to ConocoPhillips Skandinavia AS ("ConocoPhillips") for a period of five years with 2, two-year extension options. Expected delivery to ConocoPhillips is April 2014 and the rig will be at a mobilization rate from the delivery from the shipyard until commencement of the sub-charter.

US$195 million of the purchase price was received by NADL in June 2013, and the remaining US$405 million will be received on delivery from the shipyard in December 2013. The debt financed portion of the total price will be US$475 million in total, of which US$70 million will be funded now, and US$405 million at delivery from the shipyard.

The bareboat charter rate paid over the first five years (excluding the four-month mobilization period) will be approximately US$220,000 per day and the average rate for the remaining 10-year lease period will be approximately US$115,000 per day. The purchase option price after five years is around US$ 380 million.

NADL is an offshore harsh environment drilling company with focus on the North Atlantic basin. The company has nine drilling units in the fleet, including five semi-submersible, a drillship, and three jack-up rigs. Seadrill Limited currently owns 74% of the outstanding shares and the company is listed on the Oslo OTC exchange with a market capitalization of approximately USD 2 billion.