Tanker Market 2014 Foundations Shaky Say Analysts

Marine transport advisors McQuilling Services have published 'Tanker Market Highlights', a note touching on the foundation upon which the 2014 tanker market rests, as follows:

Looking at the global economy, although markets seemingly having a hard time digesting recent moves by the US Fed to scale back its bond purchasing program, a recovery appears to be on the horizon. One notable difference when compared to recent years has been that OECD economies, in particular the US, comprises a larger contribution to this development. This has been spurred by reduced energy costs on the back of the US oil boom which has been helping to reign in the unemployment level. However, despite this, non-OECD economies are projected to post the most robust growth levels through 2014 and 2015.

Our trade data showed that between 2012 and 2013, global ton-mile demand (CPP & DPP) increased by roughly 2% (Figure 1 below). This development was primarily supported by clean product trade, which saw overall ton-mile demand rise by 3%.

Looking at tankers that transport crude and residual fuels, total ton-mile demand rose by just over 1% year-on-year. In addition to global economic concerns, a primary pressure on crude and residual tankers throughout 2013 was heavy refinery maintenance, especially at the start of the year, which reduced feedstock demand. This seasonal market factor was further exacerbated as European refiners continued to struggle from reduced margins while problems with the Motiva refinery in the US pressured AG import volumes. Although the oil production boom in the US oil has all but eroded its imports of light sweet crude oils, longer sailing distances to markets east of Suez provided support to ton-mile demand originating in West Africa. In terms of the ton-mile demand, lower freight rates, which were spurred by over tonnage in the sector, supported a 6% rise in Suezmax ton-mile demand.

As we move into the current forecast period, we expect that ton-mile demand for crude and residual product tankers will rise by a relatively low 0.75% on an annual average.

Turning to clean product tankers, trades originating in the US continued to post higher outflows particularly to Europe, the Caribbean, South America and increasingly, Africa. While the MR2 fleet transported the majority of clean trade volumes, we continued to see a migration towards the larger LR fleet. Ton-mile demand on both LR2 and LR1 vessels increased by 7% while MR2 demand climbed by a lower 3%. At present, we expect ton-mile demand for clean petroleum tankers will rise by a relatively higher annual average of 1% during the forecast period.

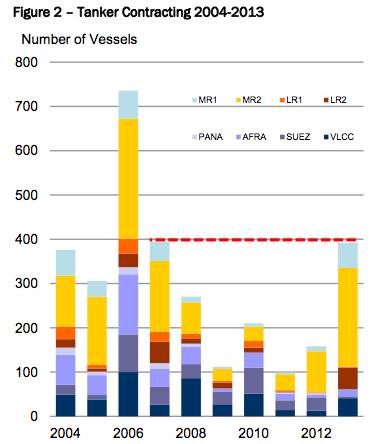

Contracting activity was robust in 2013. Throughout the year, orders were placed for 392 tankers above 27,500 dwt. This was the highest level since 2007 when 394 were ordered (Figure 2). Roughly 55% of these orders were for MR2 vessels bringing orders for this class to a total of 350 since 2011. Orders for other clean tonnage were also healthy, a testament of where market participants’ optimism rests (see diagram on the right).

This activity continues to cement our belief that starting in 2015 and 2016, clean tonnage will come under pressure. Turning to dirty tankers, a strong 41 VLCCs were ordered, with about 30% of these in 4Q 2013. While some of these vessels are unlikely to exit yards, the ordering activity highlights how sentiment can quickly trump history.

In the process of preparing for this year’s tanker market outlook, we continued to boost collaboration with our clients and other market participants. This provided us with greater insight to trade flows, in particular for clean products, and further product movements. This information was incorporated into our demand engine, providing broader criteria for analysis.

Conclusion

As we begin the forecast period we realize that the global fleet is unbalanced, as observed by the recent swings in the market. However, despite strong performances in some sectors, the quick correction has reminded us of the abundance of tonnage.

Throughout recent years, this excess tonnage capacity has been mitigated by owners opting to slow steam in the face of rising bunker costs, but an improvement in earnings could cause some owners to push the throttle forward and exacerbate the situation. Until owners opt to dispose of older tonnage, or stricter age limits are imposed through charterers, port restrictions or vetting procedures, fleet levels will remain a concern and improvements in spot rates are likely to be limited.

https://www.mcquilling.com/