South Korea's Container Squeeze Throws Exporters into Costly Gridlock

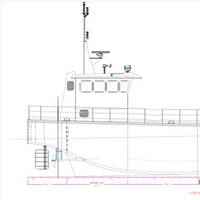

Unable to get a slot on a container vessel, Lee Sang-hoon is considering using fishing trawlers docked for repair in the South Korean port of Busan to meet surging export orders for the car engine oil he sells to Russia."China is the black hole in this shipping crisis, all the carriers are headed there," said Lee, owner of Dongkwang International Co. in Busan which makes about 20 billion won ($17.60 million) in annual revenue."Those fishing boats out there could be an answer for us because we're already one month behind schedule.

Fuel, Propulsion, Emissions & the Decision to Scrap or Refit

When the maritime history books are written, 2020 will be viewed as a year of pivots, re-invention and new paradigms. By February 2020, concerns about marine fuel’s sulfur content quickly shifted to near-term disruptions induced by the COVID-19 pandemic. By mid-year, with demand recovering, the conversation turned to longer term questions surrounding the moves towards reduced maritime carbon emissions and alternative fuels. How will this all impact the current fleet?Perhaps the most extreme reaction to the shifting landscape is the ongoing “pivot” of Scorpio Bulk (NYSE: SALT)…

Odfjell Sells Stake in Dalian Termnial

Odfjell announced Monday that Odfjell Terminals (China) Pte. Ltd. (OTC) has today completed a sale of its 50% shareholding of Odfjell Terminals (Dalian) Co Ltd. (OTD) to VTTI Terminals I B.V., a subsidiary of VTTI group, for a total cash consideration of $59 million.Kristian Mørch, CEO of Odfjell said, “The sale of OTD represents another step in the restructuring of our terminal portfolio and is in line with our strategy to focus on chemical terminals where we can harvest synergies with Odfjell Tankers or have another angle for further value creation by Odfjell.”OTC is indirectly owned 51% by Odfjell and 49% by Lindsay Goldberg (LG).

Odfjell Sells Stake in Chinese Terminal

Norwegian shipping and tank terminal company Odfjell SE has finalized the sale of its indirect 55% equity stake in Odfjell Terminals Jiangyin (OTJ), China.Reference is made to the stock exchange announcement of May 8th, 2018, in which Odfjell SE (Odfjell) announced that Lindsay Goldberg (LG) is considering a sale of its 49% shareholding in Odfjell Terminals BV.After LG completed the sales of its shareholdings in the US and European terminals, LG is now in the process of selling its shareholding in the Asian terminals. Connected with this, Odfjell has decided to tag along on LG’s sale of its indirect shareholding in Odfjell Terminals (Jiangyin).Odfjell is pleased to announce that Odfjell Terminals Asia Holding Pte. Ltd.

HMM Names Jae-hoon Bae As New CEO

South Korean container line Hyundai Merchant Marine (HMM) has announced that its board of directors had approved the hiring of Jae-hoon Bae as president and chief executive officer (CEO).The CEO recommendation committee led by Korea Development Bank, selected Bae as the final candidate for the next HMM CEO following a comprehensive candidate examination.Before his formal appointment, Bae came to the office to meet HMM’s senior executives and thoroughly checked current and future business conditions for the company.HMM official said in a press statement, “Bae, an expert in logistics who successfully served as CEO of Pantos Logistics for six years…

Sale of Rotterdam Terminal Impacts Odfjell

Tank terminal transactions will further strengthen Odfjell SE but the company experienced another challenging quarter in the chemical tanker markets.The second quarter 2018 results reflect the impact of the sale of the Rotterdam terminal, while underlying results from Odfjell Terminals improved compared to the previous quarter. The chemical tanker market remains challenging, but Odfjell’s TCE performance remains stable.“The sale of our Rotterdam terminal will further strengthen Odfjell SE as a company. The planned increase in our shareholding in our j/v terminal in Antwerp will ensure a foothold in Europe, with Antwerp being the most important port for chemicals in the EU.

HII to Pay $9.2 Mln in False Billing Settlement

Huntington Ingalls Industries Inc. (HII) has agreed to a $9.2 million settlement of allegations that it violated the False Claims Act by knowingly overbilling the government for labor on U.S. Navy and Coast Guard ships at its shipyards in Pascagoula, Miss. Under the settlement, HII will make a payment of $7.9 million which, combined with earlier repayments, will result in the settlement recovery of approximately $9.2 million. “Contractors that knowingly bill the government in violation of contract terms will face serious consequences,” said Acting Assistant Attorney General Chad A.

Hyundai Eyes Samsung, LG Cargo

South Korea’s second-largest container line Hyundai Merchant Marine Co Ltd is in talks with South Korean firms such as home appliance makers Samsung and LG to carry their cargo, Reuters reported quoting the chairman of South Korea's Financial Services Commission. Hanjin Shipping Co Ltd was handling cargo of Samsung Electronics Co Ltd and LG Electronics. Hyundai plans to deploy 13 more vessels to the U.S. and Europe to help ease cargo disruptions after its bigger rival Hanjin's collapse, according to a report in Bloomberg. HMM could acquire some of the distressed assets from Hanjin, including vessels and protecting some jobs, Bloomberg has reported. HMM said it would work with authorities to come up with possible measures, but elaborated no further.

More Hanjin Ships Seized, Box Rates Surge & Shippers Fret

About 10 Hanjin vessels effectively seized at China ports; Court says plans to start rehabilitations proceedings soon. Hanjin Shipping Co Ltd vessels have been seized at Chinese ports in the wake of the South Korean firm's collapse, further roiling the industry as freight rates jump and manufacturers scramble for alternatives. Seeking to contain the fallout, a South Korean court said it would soon begin proceedings to rehabilitate the carrier - which would allow Hanjin to take legal action in other countries to keep its ships and other assets from being seized. Rival Hyundai Merchant Marine will also deploy at least 13 of its ships to two routes exclusively serviced by Hanjin, while the South Korean government also plans to reach out to overseas carriers for help.

Global Fallout from Hanjin Collapse

When Hanjin Shipping, Korea's largest and one of the world’s top ten container carriers, filed filed for court receivership after losing the support of its banks, its assets left frozen as ports from China to Spain denied access to its vessels. The long-term fallout from Hanjin collapse will have far-reaching effects, but the impact is already being felt in ports around the world. Shipping is one of the sectors in which South Korea is a global leader, so what does this recent collapse tell us about world trade? The collapse of Hanjin Shipping sent ripples though global trade on Thursday, as the country's largest port turned away its ships and as some manufacturers scrambled for freight alternatives, says a report in the Reuters.

Klüber to Present New EALs at SMM

“Closer to you” is the motto, under which Klüber Lubrication will be presenting its latest environmentally acceptable lubricants (EALs) for ships and offshore installations at the SMM 2016. According to the manufacturer, all the EALs offer high-performance capacity and reliability under extreme conditions and comply with the requirements defined by the Environmental Protection Agency (EPA) for the 2013 Vessel General Permit and by current environmental standards. “Klüber Lubrication offers a complete range of EALs for all relevant applications on board a ship,” said Dirk Fabry, Business Development Manager for Marine at Klüber Lubrication.

MN100: Klüber Lubrication NA LP

Klüber Lubrication is one of the world’s leading manufacturers of specialty lubricants, offering high-end tribological solutions to virtually all industries and markets worldwide. Most products are developed and made to specific customer requirements. During its more than 80 years of existence, Klüber Lubrication has provided high-quality lubricants, thorough consultation and extensive services, which has earned it an excellent reputation in the market. The company holds all common industrial certifications and operates a test bay hardly rivaled in the lubricants industry.

Klüber Debuts Eco-compatible Open Gear Lubricant

Manufacturer of specialty lubricants Klüber Lubrication has introduced Klüberbio LG 39-701 N, an eco-compatible operating lubricant for open gear drives used in marine applications. Klüberbio LG 39-701 N is specifically designed for manufacturers and operators of open gear drives, jack-up lifting systems or other onboard equipment that is frequently in contact with sea water. Klüber said its new lubricant offers excellent adhesion to surfaces, has good low-temperature behavior and enables operation of open drives in areas with very low ambient temperatures, down to minus 30°C.

Blount to Build Bunkering Tanker for NY-NJ Harbor

Blount Boats signed a contract with American Petroleum & Transport, Inc. to construct a 79x23 foot, double hull, steel, fuel bunkering tanker for service in New York Harbor and New Jersey. The vessel, designed by Farrell & Norton Naval Architects, will be built to USCG Subchapter “D” specifications and admeasure to less than 100 GRT. The new tanker will be named Chandra B, and will replace the Capt. Log. Blount noted that the vessel will be powered by two, Tier III Cummins Model QSL9…

Banking on US Shale Gas Boom, Asia Petrochemical Firms Switch to LPG

Asia petrochemicals firms are building tanks and retooling plants to store and process liquefied petroleum gas imported from the United States, counting on a flood of supply from the shale boom to replace costlier naphtha as a raw material. Samsung Total Petrochemical, LG Chem and Royal Vopak are among a number of companies in Asia expanding import terminals or retrofitting plants over the next one to two years as they buy more LPG. The gas is used by petrochemicals firms to make a broad range of consumer and industrial plastics. Asian petrochemicals firms have traditionally used naphtha as a raw material. They are now switching to LPG because rising U.S. supplies have pushed prices below those of both naphtha and LPG from their main supplier, the Middle East.

Klüber Lubrication

Whether their job is in the international transport of goods, the extraction of oil or gas, or in the cruise business – ships operating at sea or on inland waterways are exposed to high stresses. Many factors work simultaneously toward the degradation of vessel and systems, factors such as extreme cold or heat, high mechanical loads, corrosion, rising and falling temperatures, micro-movement, and the contact with salty air and sea water, all make maintenance and repair a perpetual task.

Seoul Shares End Flat, Shipyards Gains

According to a report from Reuters, Seoul shares ended flat on June 3 due to caution ahead of key U.S. data and a holiday here, with falls in technology stocks like LG Electronics weighing, but modest foreign buying and firm gains in shipyards giving the market support. Source: Reuters

Corporate Investigation Service Launched

London-based law firm Lawrence Graham has launched LG Corporate Investigations - a multi-disciplinary team of experts who advise clients on the potential for corporate risk, and implement solutions to contain and minimize it, while also offering a full investigation service for those faced with possible fraud or regulatory breach. The team is also ideally positioned to advise businesses or directors who may require independent advice - both independent of the company and its existing advisers. Led by partner Andrew Witts, a specialist in corporate fraud and international asset tracing, the team brings together the firm's wide-ranging expertise in areas including: corporate governance…

Good Fuel = Good Profits

More than ever, emphasis on fuel quality — what goes in and what comes out — is a top agenda item of lawmakers and vessel owners alike. With ever tightening pressure on vessel owners to lower consumption and emission numbers, similar pressure has been applied to the maritime supply market to make engines, systems and products that help achieve this end. Algae-X offers a line of fuel conditioning products that it touts as helping owners, both large and small, to meet and exceed the rigors of running profitable, environmentally compliant vessel. "The Port of Everglades Pilots have been using the Algae-X unit for almost two years, and we can honestly say it works," said a letter from the Pilot Association's Boat Maintenance Department, distributed by Algae-X.

Oil Majors, Shipowners Merge Online Tanker Exchange

A U.S. oil majors' Internet tanker venture is merging with a shipping dot-com in a bid to become the first live online chartering exchange for the industry. SeaLogistics, which is backed by five oil groups, is merging with OneSea Direct, which has several major shipowner investors, to combine their efforts in web-based tanker chartering, the two companies said. SeaLogistics currently involves U.S. oil companies Texaco, Chevron, Koch Industries, L.G. Caltex and Coastal Corp. OneSea includes support from leading shipping companies such as A.P. Moeller, Bergesen, Teekay, I.M. Skaugen, OMI Corp., Osprey, Leif Hoegh, Worldwide, Acomarit, and V.Ships.

VLCC Market Skyrockets In Middle East

The VLCC market has taken off in the Middle East Gulf, following the announcement of the December loading program, but rates remain steady, brokers said on Tuesday. Four VLCC cargoes were fixed by SK Corp for discharge in South Korea between the 19th and 26th of December. At $2.30 per barrel, the fixtures were cheaper than LG's fixture of the Front Tobago at W170 ($0.14) or Hyundai's fixture of the Sylt at W175 ($0.15). Seven VLCCs from the Tankers International pool were also fixed for Middle East cargoes to South Korea by unknown charterers. Tankers International is the world's biggest VLCC operator, controlling an estimated quarter of the modern fleet.

Freight Rates Are Falling

A lack of enquiry from Far Eastern charterers has caused VLCC freight to fall almost to the same level as the longer haul westbound routes, which usually trade much lower, brokers said Tuesday. "When the East comes back in that will change," said a London tanker analyst, adding "but it's difficult to say when that will be." London's Baltic Exchange closed on Tuesday with its assessment of VLCC freight from the Mideast Gulf to Singapore at W88.4, less than one point higher than its assessment of freight to the U.S.Gulf. This compares to a 50-point spread between the two routes in mid-November. Brokers disregarded LG's fixture on Tuesday of the New Vanguard from the Mideast Gulf to Korea at W82.5 as below market rate. - (Reuters)

Seoul Shares Rise; STX Shipbuilding Surges

Seoul shares closed 2.3 percent up earlier this week, their biggest daily percentage gain in three weeks, as STX Shipbuilding surged after buying a stake in a Norwegian ship builder, while Apple's strong results boosted tech stocks, according to a Reuters report. STX Shipbuilding Co (067250.KS) surged by the daily limit of 15 percent to $74.17 after it announced the purchase of a 39.2 percent stake in Norway's Aker Yards (AKY.OL) for $800m, a move analysts said underlined its commitment to fast expansion and would bolster networks in Europe. The benchmark Korea Composite Stock Price Index (KOSPI) (.KS11) gained 2.3 percent to 1,947.98, staging a strong rebound a day after slumping 3.4 percent to its lowest close in more than a month.