Tanker Freight Rates Could Weaken in 2016

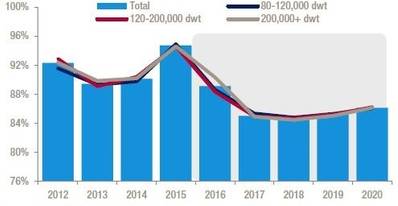

Four major factors led to the big leap in tanker earnings in 2015: strong growth in oil trade, sluggish expansion of the fleet, a sharp increase in floating storage and lower bunker prices. Tonnage supply, which has increased at a slow pace in recent years, is expected to accelerate in the next two years with deliveries of products as well as crude tankers. At the same time, a gradual decline in floating storage towards normal levels will increase the available tonnage for seaborne trade. Tonnage demand is only expected to increase at a modest pace in the next two years as the growth in oil trade will be sluggish. As a result, tonnage utilisation in the tanker market is expected to decline from the highs seen in 2015 with stronger growth in vessel supply than in demand.

“Low crude prices resulted in high refinery runs and stocking activity, which in turn caused a surge in both crude and products inventories. Soaring inventory is expected to curb trade growth in 2016, as it will reduce the needs for imports,” said Rajesh Verma, Drewry’s lead analyst for tanker shipping.

“Looking further ahead and with the resultant decline in tonnage utilisation, freight rates are expected to fall in the next two years. However, despite the decline in spot freight rates, tanker earnings will still be attractive thanks to the continued weakness in bunker prices”, added Verma.