Transocean Defeats Shareholder Appeal over Gulf Spill

Transocean Ltd on Thursday won the dismissal of an appeal by shareholders accusing the owner of the doomed Deepwater Horizon drilling rig of deceiving them about its safety practices prior to the 2010 Gulf of Mexico oil spill. The 2nd U.S. Circuit Court of Appeals in Manhattan said the lead plaintiff waited two months too long to sue over alleged misstatements in an Oct. 2, 2007, proxy statement for the offshore drilling company's merger with GlobalSantaFe Corp. Shares of Transocean rose 3 percent after the decision was issued. Geoffrey Johnson, a lawyer for the plaintiffs, declined to comment. Transocean and its lawyers did not immediately respond to requests for comment.

Energy Sector Volatility Affects Middle Market M&A Activity

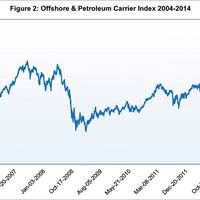

Market volatility for the petroleum sector provides a backdrop to an evolving Merger & Acquisitions environment for the Offshore Sector. In the 3Q edition of Maritime Professional, this series of articles examined the overall evolution of maritime and offshore M&A activity since 2010, tracing the flow of deals in the post-financial crisis era. In this edition, we take a closer look at relevant U.S. offshore energy industry deal flow and market movements as they relate to oil prices over time, and highlight some recent middle market transactions.

Rob Shaw Named Vice President, Controller and Principal Accounting Officer

Transocean Ltd. (NYSE: RIG) (SIX: RIGN) announced today that Rob Shaw has been appointed to serve as Vice President, Controller and Principal Accounting Officer, effective December 1, 2011. Until Mr. Shaw assumes this position, Robert L. Herrin, Jr. will serve as interim Vice President and Controller and Ricardo H. Rosa, the company’s Senior Vice President and Chief Financial Officer, will serve as interim Principal Accounting Officer. Mr. Herrin has served as the company’s Vice President of Internal Audit since 2007, but will not act in that capacity during the period that he serves as interim Vice President and Controller. Mr. Shaw, age 48, has served as Vice President and Treasurer since joining the company in July 2010. Previously, Mr.

Transocean Ltd. Q4 & Full-Year 2009 Results

Transocean Ltd. (NYSE:RIG) reported net income attributable to controlling interest for the three months ended December 31, 2009 of $723 million, or $2.24 per diluted share, on revenues of $2.733 billion. The results compare to net income attributable to controlling interest of $754 million, or $2.35 per diluted share, on revenues of $3.270 billion, for the three months ended December 31, 2008. -- Partially offset by $48 million of net charges primarily related to discrete tax items, the retirement of debt and adjustments associated with the GlobalSantaFe merger. For the year ended December 31, 2009, net income attributable to controlling interest totaled $3.181 billion, or $9.84 per diluted share, on revenues of $11.556 billion.

Transocean Reports Q3 2009 Results

Transocean Ltd. (NYSE:RIG) reported net income attributable to controlling interest for the three months ended September 30, 2009 of $710 million, or $2.19 per diluted share, compared to net income attributable to controlling interest of $1.063 billion, or $3.30 per diluted share for the three months ended September 30, 2008. Revenues for the third quarter of 2009 were $2.823 billion compared to $3.192 billion for the third quarter 2008. • partially offset by $40 million of income related to discrete tax items and gains on settlements of certain tax matters. Revenues for the three months ended September 30, 2009 decreased slightly to $2.823 billion, compared to revenues of $2.882 billion during the three months ended June 30, 2009.

Transocean Reports 4Q & 2008 Results

Transocean Ltd. (NYSE:RIG) reported net income for the three months ended December 31, 2008 of $800m, or $2.50 per diluted share. Revenues for the fourth quarter 2008 totaled a record $3.3b. The results compare to net income of $1.05b, or $4.17 per diluted share, for the three months ended December 31, 2007. For the three months ended December 31, 2007, revenues were $2.1b. • $17m of write-offs for uncollectible accounts receivable associated with the Sedco 712 rig contract after the operator announced it had been placed into administration (a form of bankruptcy protection under U.K. • Partially offset by $21m of income related to the sales contract termination fee on the Transocean Nordic and income from the TODCO tax sharing agreement.

Rowan - Ralls CEO, Lentz COB

Rowan Companies, Inc. (NYSE: RDC) announced that, effective January 1, 2009, its Board of Directors has named W. Matt Ralls as the company's new President, Chief Executive Officer and member of the Board of Directors, succeeding D.F. McNease, who announced his retirement in late October 2008. Mr. Ralls, 59, most recently served as Executive Vice President and Chief Operating Officer of GlobalSantaFe Corporation, an international contract drilling company, from June 2005 until the completion of the merger of GlobalSantaFe with Transocean, Inc. in November 2007. Prior to that time Mr. Ralls served as Senior Vice President and CFO of GlobalSantaFe. He joined Global Marine, Inc.

GlobalSantaFe SCORE Down for July

GlobalSantaFe Corporation reported that the company's worldwide SCORE, or Summary of Current Offshore Rig Economics, for July 2003 was down 0.2% from the previous month's SCORE. GlobalSantaFe's SCORE compares the profitability of current mobile offshore drilling rig dayrates to the profitability of dayrates at the 1980-1981 peak of the offshore drilling cycle. In the 1980-1981 period, when SCORE averaged 100 percent, new contract dayrates equaled the sum of daily cash operating costs plus approximately $700 per day per million dollars invested. In addition to a worldwide SCORE covering key types of competitive offshore drilling rigs in key drilling markets, a separate SCORE is calculated for certain types of rigs and certain regions to indicate the relative condition of rig markets.

Global Marine and Santa Fe International Corporation Complete Merger Of Equals

Houston-based GlobalSantaFe Corporation announced that Global Marine Inc. and Santa Fe International Corporation completed their merger of equals. The ordinary shares of GlobalSantaFe will begin trading on the New York Stock Exchange on November 21, 2001, under the symbol "GSF". Global Marine and Santa Fe International shareholders approved the merger during separate shareholder meetings held earlier today. into 0.665 of an ordinary share of GlobalSantaFe. ordinary shares will trade as GlobalSantaFe ordinary shares. The combined company will have approximately 233 million shares outstanding. "This merger of two great companies creates the world's premier drilling contractor," GlobalSantaFe chairman, Robert E. "Bob" Rose, said.

GlobalSantaFe Assists Crew From Offshore Rig in Mediterranean

Houston-based offshore drilling contractor GlobalSantaFe Corporation reported that an 84-person crew was evacuated from one of its offshore drilling rigs that encountered a severe storm in the Mediterranean Sea offshore Israel. The Italian Navy and U.S. evacuation efforts. The offshore drilling rig remains afloat approximately 50 miles offshore Israel. At the time of the storm, the rig, named Key Singapore, was in the process of moving to a new location offshore Egypt. storm caused two of the three tugboats moving the rig to lose their towline connections. Four tugboats are currently on location, with one still attached to the rig. At this time, GlobalSantaFe said that it does not know of any significant damage to the rig. Previous media coverage erroneously reported the rig had sunk.

GlobalSantaFe to Present at CEO Energy/Power Conference

GlobalSantaFe Corporation Chief Executive Officer Jon Marshall will present at 8:40 a.m. CDT in New York on Thursday, September 4, 2003, at the Lehman Brothers Seventeenth Annual CEO Energy/Power Conference. Interested parties may listen to the presentation live over the Internet at http://www.lehman.com/conferences/200309ceo-energy-power/presenters.htm# . To listen to the live presentation, please go to the Web site at least 15 minutes early to register and to download and install any necessary audio software. A replay of the presentation will be available shortly after the conclusion of the presentation through GlobalSantaFe's Web site (http://www.gsfdrill.com/ ) until 5 p.m. CDT September 15, 2003.

GlobalSantaFe New-build Rigs Provide Model for Requirements

Technical advances in the offshore industry and regulatory developments have spurred an update of the ABS Guide for Certification of Drilling Systems. First published in 1985 and last updated in 1990, the Guide references current standards and the recommendations of American Petroleum Institute (API). Importantly, the new Guide provides industry with an option for a “Safety Case” or risk-based analysis approach to certification, rather than applying the more traditional prescriptive rules reflected in the 1990 version of the Guide, says Merih Unuvar, ABS project leader and principal surveyor. “We’re offering drilling unit owners and builders a more streamlined approach to ABS classification, with the option of certifying the drilling system,” said Unuvar.

GlobalSantaFe Announces 3Q Earnings

Worldwide oil and gas drilling contractor GlobalSantaFe Corp. reported net income for the third quarter ended September 30, 2003, of $15.1 million, or $0.06 per diluted share, on revenues of $458.1 million, as compared to net income of $75.0 million, or $0.32 per diluted share, on revenues of $514.4 million for the same quarter in 2002. For the nine months ended September 30, 2003, GlobalSantaFe reported net income of $104.9 million, or $0.45 per diluted share, on revenues of $1,408.5 million, as compared to net income of $225.5 million, or $0.95 per diluted share, on revenues of $1,504.8 million for the corresponding period in 2002.

GlobalSantaFe to Present at Global Energy Conference

GlobalSantaFe Corporation Chief Executive Officer Jon Marshall will present at 8:25 a.m. EST in New York on Wednesday, November 5, 2003, at the Merrill Lynch 2003 Global Energy Conference.

GlobalSantaFe Worldwide SCORE Slightly Down

October 2003 was down 0.2% from the previous month's SCORE. 1981 peak of the offshore drilling cycle. invested. relative condition of rig markets. calculations for the U.S. Southeast Asia.

GlobalSantaFe Board Approves Quarterly Cash Dividend

GlobalSantaFe Corporation announced that its board of directors has approved a regular cash dividend of $0.05 per ordinary share. This dividend is payable on January 15, 2004, to shareholders of record as of the close of business on December 31, 2003.

GlobalSantaFe Receives ISM Certification

Houston-based GlobalSantaFe Corporation announced it has become one of the first offshore drilling contractors to receive the full International Safety Management (ISM) certification for its shore-based facilities and self-propelled offshore rigs. flags. The American Bureau of Shipping (ABS) audited GlobalSantaFe for compliance to the code. Robert Kremek, president of ABS Americas, presented the company's first ISM Document of Compliance certificate to GlobalSantaFe executives in a ceremony held on December 18 in Houston. "We have always been absolutely committed to the safety of our people and the marine environments where we operate," Bob Rose, GlobalSantaFe chairman, said. "The ISM certification is further evidence of our commitment.

GlobalSantaFe Board Approves Cash Dividend

Houston-based offshore drilling contractor GlobalSantaFe Corporation announced that its board of directors has approved a regular quarterly cash dividend of $0.0325 per ordinary share. The dividend is payable on January 15, 2002, to shareholders of record as of the close of business on December 31, 2001. In connection with a recent merger, former Global Marine Inc. shareholders were mailed a transmittal form for the surrender of their common stock in exchange for GlobalSantaFe ordinary shares. Those shareholders who have not surrendered their common stock certificates and transmittal form for exchange by the payment date, will receive their dividend from the exchange agent when the shares are exchanged.

MarAd Approves Six Transfers

The Maritime Administration approved six applications under section 9 of the Shipping Act, 1916, as amended. · GlobalSantaFe Drilling Company has received approval to transfer four mobile offshore drilling units to Vanuatu registry and flag without change in the ownership of said Vessels. The 4,976-gross-ton GLOMAR MAIN PASS I was built in 1982 in Pascagoula, MS. The 4,976-gross-ton GLOMAR MAIN PASS IV was built in 1982 in Pascagoula, MS. The 4,473-gross-ton GLOMAR HIGH ISLAND IV was built in 1980 in Quebec, Canada. The 4,473-gross-ton GLOMAR HIGH ISLAND VIII was built in 1981 in Quebec, Canada. · General Metals of Tacoma, Inc., Tacoma, WA has received approval to sell the 4,562-gross-ton barge TWIN HARBOR II to B.

Offshore SCORE Continues Decline

GlobalSantaFe Corporation reported that the company's worldwide SCORE, or Summary of Current Offshore Rig Economics, for April 2004 was down 4.5% from the previous month's SCORE. GlobalSantaFe's SCORE compares the profitability of current mobile offshore drilling rig dayrates to the profitability of dayrates at the 1980- 1981 peak of the offshore drilling cycle. In the 1980-1981 period, when SCORE averaged 100 percent, new contract dayrates equaled the sum of daily cash operating costs plus approximately $700 per day per million dollars invested. In addition to a worldwide SCORE covering key types of competitive offshore drilling rigs in key drilling markets, a separate SCORE is calculated for certain types of rigs and certain regions to indicate the relative condition of rig markets.

GlobalSantaFe Announces First Quarter Results

Worldwide oil and gas drilling contractor GlobalSantaFe Corporation reported net income for the first quarter ended March 31, 2004, of $8.7 million, or $0.04 per diluted share, on revenues of $380.0 million, as compared to net income of $45.9 million, or $0.20 per diluted share, on revenues of $424.4 million for the same quarter in 2003. Net income for the first quarter 2003 included $22.1 million, or $0.10 per diluted share, from the settlement of a claim filed in 1993 with the United Nations Compensation Commission. Revenues for the first quarter of 2004, and 2003, exclude $26.9 million and $28.6 million, respectively, related to revenues from land rig drilling operations, which are reflected as discontinued operations.

GlobalSantaFe to Hold 4Q Conference Call and Webcast

GlobalSantaFe Corporation has scheduled a conference call to discuss its fourth-quarter and year-end financial results at 11:00 a.m. CST (12:00 p.m. EST) Wednesday, January 28, 2004. The results are scheduled to be released publicly prior to market opening on the New York Stock Exchange that same day.

GlobalSantaFe Worldwide SCORE Continues to Show Decline in Semi Market

GlobalSantaFe Corporation reported that the company's worldwide SCORE, or Summary of Current Offshore Rig Economics, for November 2003 was down 3.5% from the previous month's SCORE. 1980-1981 peak of the offshore drilling cycle. dollars invested. relative condition of rig markets. calculations for the U.S. Southeast Asia.