Leadership Changes at Huntington Ingalls Industries

U.S. shipbuilder Huntington Ingalls Industries (HII) announced today a number of changes across its leadership team. HII’s Board of Directors has elected Christopher D. Kastner to succeed Barbara A. Niland as the company’s chief financial officer and corporate vice president, business management, effective with Niland’s retirement on March 1, 2016. Furthermore Philip Luna, corporate vice president and president, UniversalPegasus International (UPI), a subsidiary of HII, has been promoted to the HII senior executive team, effective immediately.

Smith Joins HII Corporate Team

Huntington Ingalls Industries appoints Michael S. Huntington Ingalls Industries (HII) announced today that Michael S. Smith has joined the company as corporate vice president, business growth. He will work closely with the HII's senior leadership team in support of corporate development and strategic endeavors and will serve as the company interface with business associations in Washington, D.C. Smith will work in HII's Washington, D.C., office and report to Mitchell B. Waldman, corporate vice president, government and customer relations.

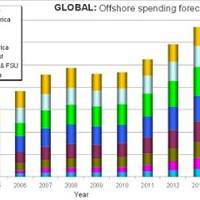

Offshore Spend to Rebound after 2009-10 Lows

Despite the global recession, offshore spend is expected to grow strongly – from $578b Capex and $379b Opex over the last five years to $807b Capex and $549b Opex over the period to 2013. Exploration for fresh oil & gas supplies and development of existing and newly found accumulations from ever more demanding reservoirs in new extremes of environment, are expected to drive offshore industry spends. These headline forecasts appear in the new, fully updated edition of the “World Offshore Oil & Gas Production and Spend Forecast 2009-2013” published by Douglas-Westwood and Energyfiles.

FLIR Systems Elects Wood to Board

FLIR Systems, Inc (NASDAQ: FLIR) announced that John W. Wood, Jr. has been elected to the Board of Directors for a term expiring at the Company's 2010 Annual Meeting of Shareholders. Mr. Wood has also been appointed to serve on the Corporate Governance Committee of the Board of Directors. Mr. Wood served as chief executive officer of Analogic Corporation, a leading designer and manufacturer of medical imaging and security systems, from 2003 to 2006, and is currently a consultant. Prior to joining Analogic, he held senior executive positions over a 22-year career at Thermo Electron Corporation. He served as president of Peek Ltd., a division of Thermo Electron Corporation, and as a senior vice president of the parent company.

Offshore Drilling Spends Surges

High oil prices will drive oil & gas industry spends on offshore drilling to a total of $380b over the five year period to 2012; a rise of nearly 60% in comparison to the $240b spent in the previous five years. The latest edition of the ‘World Offshore Drilling Spend Forecast 2008-2012’ published by Douglas-Westwood and Energyfiles forecasts that by 2012 the global drilling market will be worth an estimated $80b, more than doubling since 2003. The data derived from the Energyfiles Global Database shows that nearly 18,000 offshore wells were drilled over the last five years. “The forecast for the next five years is generally stable but with a peak in 2010 and a slight dip in 2011, ultimately equalling a little over 20,000 for the period, and representing a rise of 13%.

Oil Prices: Heading Up?

“Due to increasing demand and reducing reserves, oil prices currently at $40 are likely to soon enter a period of sustained rises resulting in a need to massively develop natural gas and renewable energy resources” according to John Westwood of energy analysts Douglas-Westwood. “Oil reserves are depleting and demand growing. Recent increases in oil demand from China, for example, are likely to accelerate. The average American consumes 25 times as much oil as the average Chinese yet China has 5 times the population and is industrialising rapidly. Vehicle growth in China is rising rapidly and this will cause global demand for oil to continue its increase.

Will Oil Continue Heading Up?

"Due to increasing demand and reducing reserves, oil prices currently at $40 are likely to soon enter a period of sustained rises resulting in a need to massively develop natural gas and renewable energy resources" according to John Westwood of energy analysts Douglas-Westwood. "Oil reserves are depleting and demand growing. Recent increases in oil demand from China, for example, are likely to accelerate. The average American consumes 25 times as much oil as the average Chinese yet China has five times the population and is industrializing rapidly. Vehicle growth in China is rising rapidly and this will cause global demand for oil to continue its increase.

ConocoPhillips Finalizes Agreement with Freeport LNG

ConocoPhillips announced the finalization of its transaction with Freeport LNG Development, L.P. to participate in a proposed liquefied natural gas (LNG) receiving terminal in Quintana, Brazoria County, Texas. ConocoPhillips has acquired 1 billion cubic feet (BCF) per day of regasification capacity in the terminal, has obtained a 50 percent interest in the general partner managing the venture and will provide substantial construction funding to the venture. The terminal is designed with storage capacity of nearly 7 BCF and send-out capacity of 1.5 BCF per day. Natural gas will be transported through a 9.4-mile pipeline to Stratton Ridge, Texas, which is a major point of interconnection with the Texas intrastate gas pipeline system.

Feature: Offshore Drilling: 5-Year Projection is $189B

"Over the next five years it is expected that 15,000 offshore wells will be drilled worldwide, at a total cost of some $189 billion. Of these wells nearly 4,500 will be exploratory costing $75 billion, and around 10,500 will be development, costing $114bn. It is estimated that drilling and completion expenditure in 2003 was $36 billion. Spending levels are expected to grow somewhat over the next two years and then decline slightly, stabilising at about $37 billion per year." These are among the findings of the second edition of The World Offshore Drilling Report, published by Douglas-Westwood. The largest change that is forecast by the energy analysts is continuing growth in deepwater drilling (over 500 m water depth) which contrasts with a long-term decline in shallow water activity.

Lockheed Martin Awarded Contract

Lockheed Martin will provide the Arab Republic of Egypt with a fully integrated maritime search and rescue (SAR) system for the Gulf of Suez (GOS) under a $50 million contract signed today in Cairo. The SAR system will complement the Gulf of Suez Vessel Traffic Information Management System (VTIMS) provided by Lockheed Martin under a 1998 contract and provide the Egyptian Ministry of Transport with all the necessary capabilities to manage and respond to any maritime distress in the Gulf of Suez. The SAR contract was signed in the presence of the Prime Minister of Egypt, His Excellency Dr. Atef Ebaid; the Minister of Transportation, His Excellency Dr. Ibrahim El-Demairi; U.S. Ambassador C.

Station 12 Strives To Corner Satcom Market

The competitive satellite communications market has taken an additional step toward consolidation, with Station 12 — an independent operating business owned 65 percent by KPN (Royal Dutch Telecom) and 35 percent by Telstra — leading the way having the intention of cornering the market. Station 12 recently outlined its strategy to double its size in the next three years, both through organic growth and acquisitions. Station 12 already claims to have 24 percent of the competitive Inmarsat maritime and mobile satellite communications sector, with current annual sales of $215 million. This is expected to rise to $500 million by 2003. The company is the largest customer and shareholder in Inmarsat, the leading provider of wholesale satellite airtime.

Feature: World Offshore Drilling Activity: A 5-Year Outlook

The following is an outline of some of the key conclusions of the "The World Offshore Drilling Report 2003-2007" recently published by energy analysts Douglas-Westwood. Offshore drilling has, for the last 30 years, been the driving force behind growth in oil and gas industry activity and production. Beginning in the 1960s, after global opportunities on land had begun to decline, offshore drilling levels grew rapidly, peaking in 1981 following two decades of technology improvements and a decade of energy price rises. Since then, offshore drilling levels have broadly stabilized on a flat trend, albeit moving up or down in response to fluctuations in energy demand and oil price.