OSG Buys Laid Up Jones Act Tanker from BP

U.S. shipping company Overseas Shipholding Group, Inc. (OSG) on Thursday announced it has reached an agreement with BP Oil Shipping Company to purchase the Jones Act compliant crude oil tanker Alaskan Frontier.Built by General Dynamics NASSCO in 2004, the 1.3-million-barrel capacity tanker is a sister to three other Alaskan Class vessels operated by OSG’s wholly owned subsidiary, Alaskan Tanker Company. It was part of Alaska Tanker Company's active fleet until 2019 when the vessel was placed in cold lay-up in Labuan, Malaysia.OSG said it expects the transaction will be completed in early November. Afterward, the company intends to reactivate the tanker…

Big Money Needed to Develop US Offshore Wind Ports

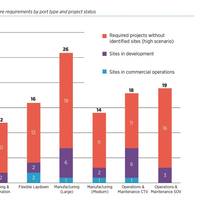

Much has been written about potential bottlenecks in store for various parts of the U.S. offshore wind industry, from vessels to monopiles. A new report published by the Business Network for Offshore Wind (BNOW) outlines the need for significant investment in and development of port infrastructure to support the industry in its goal of 30 gigawatts (GW) of offshore wind power by 2030 and 110 GW by 2050.The good news is that more than 35 new offshore wind port projects have gone into development or began commercial operations in the U.S.

Sempra Reaches FID on Port Arthur LNG Plant's Phase 1

U.S. power and gas utility Sempra Energy said on Monday the first phase of its proposed Port Arthur liquefied natural gas (LNG) export terminal received the financial greenlight to move ahead with investment firm KKR & Co agreeing to a minority stake in the project.Though KKR's investment was not disclosed, an infrastructure fund managed by it will buy a 25% to 49% indirect, non-controlling interest in the project. Sempra Infrastructure Partners, the 70%-owned unit of Sempra, would target 20% to 30% of indirect ownership interest in the project…

U-Ming’s New Post Panamax Bulk Carrier Christened

A christening ceremony at Oshima Shipbuilding yard in Japan was recently held by U-Ming Marine Transport Corporation (TSEC code: 2606 – one of nine public-listed companies of the Far Eastern Group) for its new built 99,990 DWT Post Panamax Bulk Carrier M.V. Cemtex Dominance.The event was hosted by Mr. Douglas Hsu, Chairman of the Far Eastern Group on July 12, 2022, with attendance of Mrs. Tracy Tsai Wang, who christened the vessel and also many business associates and distinguished guests.Measuring 235m in length and 40m in width, M.V.

DOF Subsea to Help VAALCO with FPSO/FSO Swap Offshore Gabon

Oil and gas company VAALCO Energy has hired DOF Subsea to perform subsea construction and installation services offshore Gabon, where the company operates the Etame field.The contract is for the support of the subsea reconfiguration associated with the replacement of the existing Floating Production, Storage and Offloading unit (“FPSO”) with a Floating Storage and Offloading vessel (“FSO”) at the offshore field.VAALCO in 2021 said it had struck a charter deal with the FSO owner World Carrier Offshore Services Corp for the Cap Diamant, a double-hull crude tanker built in 2001, which will be converted to an FSO for operations at the Etame field.By deploying the FSO at the field…

OpEd: Time To Shine for US Offshore Wind

It is clear only a few weeks into 2022 that this year can be a watershed moment for American offshore wind. The Department of the Interior has positioned 2022 to be a record year in terms of offshore wind lease offerings and project greenlights.At the end of 2021, the Bureau of Ocean Energy Management (BOEM), the regulatory agency responsible for offshore wind lease sales, released the document, Offshore Wind Leasing Path Forward 2021–2025. The document maps out potential new wind lease sales.

Piraeus Bank to Sell Bad Shipping Loans to Davidson Kempner Unit

Piraeus Bank, one of Greece’s four largest lenders, said on Tuesday it had reached a deal to sell a portfolio of non-performing shipping loans to an entity affiliated with Davidson Kempner Capital Management.The agreed price will be about 53% of the portfolio’s gross book value of 400 million euros ($452 million), the bank said.The sale of the portfolio, dubbed project Dory, is subject to approval by the Hellenic Financial Stability Fund, a shareholder in Piraeus Bank, the lender said.The transaction will reduce Piraeus Bank’s ratio of non-performing exposures to about 15% from 16% at the end

Japan's JFE to Invest $363,3M in New Offshore Wind Monopile Plants

Japan's JFE Engineering Corporation is set to build a factory for the construction of monopile foundations and transition pieces for the offshore wind industry. The company also has plans to build jacket-type foundations in the future."The monopile foundation consists of a transition piece for connecting the monopile as a support and the wind turbine tower and is an extremely thick, large-diameter, long super-heavy object, which is difficult to manufacture at existing factories in Japan.

Aker Horizons, Statkraft, Yara Working on Europe's First Industrial-scale Green Ammonia Project

Aker Horizons has signed a Letter of Intent with Statkraft and Yara with the aim to establish "Europe's first industrial-scale green ammonia project in Norway, enable the hydrogen economy, and accelerate the energy transition." The company said the first project in the partnership will be to electrify Yara's existing ammonia facility in Porsgrunn, "which has the potential to be one of the largest climate initiatives in Norwegian industrial history."The partners will further target green hydrogen and green ammonia opportunities within shipping…

Booming Offshore Wind Market Faces Shortage of Installation Vessels

Offshore wind is expanding rapidly, and as turbine and project sizes grow, demand for specialized installation vessels will soar, Rystad Energy said Thursday, however, warning that the boom might lead to a shortage of offshore wind installation vessels."The market for vessels capable of installing large offshore wind components is quickly being outpaced by growing demand from the global development pipeline, a Rystad Energy analysis shows. The global fleet will be insufficient to meet demand after 2025…

'Largest Ever' Offshore Wind Financial Close Reached for World's Largest Offshore Wind Farm

Equinor and SSE have announced a financial close on the first two phases of the world's largest offshore wind farm project - the Dogger Bank in the UK North Sea.Dogger Bank wind farm is a joint venture between SSE Renewables, who are leading the construction of the offshore wind farm, and Equinor, who will operate the 3.6GW project during its lifetime of at least 25-years. When completed, Dogger Bank will be the world’s largest offshore wind farm.The overall wind farm is being built in three 1.2GW phases; Dogger Bank A, Dogger Bank B, and Dogger Bank C.

FEED Completed for Delfin FLNG Vessel

Delfin Midstream (“Delfin”) has informed that the FEED has been completed for the Newbuild FLNG Vessel for the Delfin LNG project offshore Louisiana, in cooperation with Samsung Heavy Industries and Black & Veatch.Delfin LNG project has been described as a brownfield Deepwater Port "requiring minimal additional infrastructure investment to support up to four FLNG Vessels producing up to 13 million tonnes of LNG per annum."Commenting on the completion of the FLNG FEED Delfin said: "The tripartite cooperation has been successful in developing a robust…

Zvezda Shipbuilding Gets USD3.09bln

Over 202 billion rubles ($3.09 billion) will be allocated for the construction of the Zvezda shipbuilding complex in Russia's Far Eastern Primorsky Region, of which 66 billion rubles have already been given.According to Sputnik, the Zvezda shipyard, once completed, will comprise production facilities and workshops for that will be used to build marine equipment, including gas carriers, tankers and nuclear icebreakers.The report quoted Russian Deputy Prime Minister Yury Borisov saying that Zvezda had already signed deals with major Russian companies to build 37 vessels.Under the capital investment plan, the total capital investment in the Zvezda shipbuilding complex is estimated at 202.2 billion rubles, the report said.The project is currently being financed from investors' funds.

Maritime Autonomy: Sea Machines Gets a $10M Investment

While there remains much debate as to what an autonomous future looks like in the maritime sector, one company, Sea Machines, is helping to pace the field with product development, partnerships and investment.Sea Machines Robotics announced today that it had closed a $10 million Series A investment led by Accomplice VC, with participation from several corporate titans including Toyota AI Ventures; Brunswick Corp., through investment partner TechNexus Venture Collaborative; Eniac Ventures…

Top Five Trends in Offshore Wind

As technologies mature and dramatic cost-cutting continues, the future is looking bright for offshore wind. Below are five trends to keep an eye on.Follow the LeaderOffshore wind’s established leader, Europe, will continue to show the way forward and build capacity. At the end of 2016, nearly 88 percent of the world’s offshore wind installations were located in European waters. In 2017, Europe saw a record 3,148 MW of net additional offshore wind capacity installed, with 560 new offshore wind turbines across 17 wind farms, according to WindEurope.

Total CEO Not Worried over Possible Norway Fund Capital Exit

The possible exit of Norway's sovereign wealth fund from the capital of French oil and gas major Total will take place over time and is thus unlikely to hurt Total's stock price, Chief Executive Officer Patrick Pouyanne said on Friday. "I can tell you that, obviously, the managers of the fund who we know very well...are not going to sell in a manner that would lead to a stock-price collapse," Pouyanne told shareholders during an annual gathering in Paris. Acccording to Thomson Reuters data, Norges Bank Investment Management - owns around 1.6 perent of Total's capital.

Simulation: The Centre for Marine Simulation

St. CMS operates a range of marine simulation equipment that covers a broad range of marine and offshore activities. Much of the equipment is highly specialized and unique including fully motion capable simulators. The center also provides technical management and support of simulation equipment that is used by other parts of the Marine Institute. CMS simulation activities can be divided into three main areas; Training, Industrial Response, and Applied Research. To support these…

Ophir, OneLNG JV to develop Fortuna FLNG Project

Ophir Holdings & Ventures LTD ("Ophir"), a wholly owned subsidiary of Ophir Energy plc, and OneLNGSM, a joint venture between subsidiaries of Golar LNG Limited and Schlumberger, announce that they have signed a binding Shareholders' Agreement to establish a Joint Operating Company ("JOC") to develop the Fortuna project, in Block R, offshore Equatorial Guinea utilising Golar's FLNG technology. OneLNG and Ophir will have 66.2% and 33.8% ownership of the JOC respectively (with economic entitlements materially consistent with the equity interest in the JOC). The JOC will facilitate the financing, construction, development and operation of the integrated Fortuna project and, from Final Investment Decision ("FID"), will own Ophir's share of the Block R licence and the Gandria FLNG vessel.

Seaspan Declares Q3 Results

Seaspan Corporation announced its financial results for the three and nine months ended September 30, 2016. Revenue edged up thanks to new additions to its fleet, including the delivery of one newbuild vessel during the quarter. GAAP earnings plunged into the red with the company reporting a loss of $184 million, or $1.86 per share, as a result of $202.9 million in non-cash impairment charges it took after writing down the value of some of its smaller vessels. It has raised over $1.5 billion from capital markets, sale-leaseback, and other financing transactions during the first nine months of 2016. The company has achieved 8.9% reduction in ship operating expense per ownership day during the quarter ended September 30…

Texas LNG’s Brownsville Project Progressing

Texas LNG appoints BNP Paribas as financial adviser for Brownsville LNG project, progresses FERC pre-filing process and completes over 60 percent of front end engineering and Design for facility. Texas LNG Brownsville LLC announced that BNP Paribas has been appointed as financial adviser for the Brownsville project. BNP Paribas will assist Texas LNG in the raising of equity and debt financing for the total capital requirements of the Project, including the execution of definitive transaction documents for achieving final investment decision (FID) and project construction.

Mitsubishi, Seamax JV Closes Debut Shipping Fund

A joint venture between Mitsubishi Corp subsidiary MC Asset Management and Seamax Partners has held a $300m final close for its debut fund, which will target container shipping. Seamax Partners is the manager of MC-Seamax Management Limited. The Fund has closed with total capital commitments of USD 300 million from institutional investors in North America, Europe and Japan, including MC's commitment of USD 50 million. MC-Seamax Management picked up the capital from unnamed institutional investors in North America, Asia and Europe. The fund will focus on investing in container shipping to provide outsourcing alternatives to vessel ownership, offering term leases on large, modern vessels. The container shipping market experienced an oversupply of orders prior to the global financial crisis.

StealthGas Announces Newbuilds, New Vessel Contracts

StealthGas Inc., a ship-owning company primarily serving the liquefied petroleum gas (LPG) sector of the international shipping industry, announced today as part of its fleet expansion program the acquisition of two newbuilding LPG vessels. The company exercised the acquisition options with a Korean yard and the additions to the fleet consist of two 22,000 cbm semi refrigerated eco LPG carriers scheduled to be delivered in the second and third quarter of 2017, respectively. The company expects that the acquisition of these larger semi refrigerated eco LPG carriers that can load LPG with high ethane content, will complement well its already leading position in pressurized vessels.

Yara to Acquire Majority Position in Galvani

Yara International ASA has entered into an agreement to acquire a 60% stake in Galvani Indústria, Comércio e Serviços S/A ("Galvani"), for an enterprise value of USD 318 million. Galvani is an independent, privately held fertilizer company, controlled by Mr. Rodolfo Galvani Jr., a Brazilian entrepreneur. The company is engaged in phosphate mining, Single Super Phosphate (SSP) production and distribution of fertilizers in the center and northeast of Brazil. Galvani also owns licenses for two new greenfield phosphate mine projects in Brazil. The acquisition is in line with Yara's strategy for growth in Latin America, seeking to develop a production footprint in Brazil to complement its established position, following the recent acquisition of the Bunge fertilizer business in Brazil.