DP World Launches $9 Billion Financing

UAE global port operator DP World has launched a $9 billion financing into a targeted syndication process involving less than 10 banks, according to banking sources.The financing, which backs the borrower's privatization, was expected to sell down in a general syndication, but instead DP World decided to offer the deal to a select group of relationship banks.“(The deal is) going out to less than ten relationship banks that have already showed interest in the deal but were unable to join in the senior phase…

Reduced Appetite Expected for DP World’s $9bn Loan

Appetite for UAE global port operator DP World's $9bn loan financing is expected to weaken due to market turmoil caused by the coronavirus, bankers said.The loan was fully underwritten by Citigroup and Deutsche Bank, and went out to a wider group of DP World’s relationship banks in senior syndication, which closed at the end of last week, one of the bankers said.These banks included Abu Dhabi Commercial Bank, MUFG, Emirates NBD, First Abu Dhabi Bank and HSBC, a second banker said.“Senior…

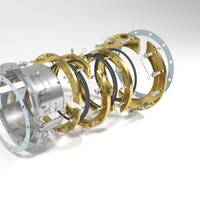

Royal IHC sells Subsidiary IHC Sealing Solutions

Royal IHC (IHC) has reached an agreement to sell 100% of its shares in its subsidiary IHC Sealing Solutions to new owners Willem Steenge, who as CEO is partly responsible for the strong growth of IHC Sealing Solutions in recent years, and Rabo Participaties (RaPar). The sale enables IHC to strengthen its focus on its core business: offering integrated innovative vessels, advanced equipment and life-cycle support to the dredging, wet mining and offshore construction industries.

Navios Acquisition Proposes Private Offering

Navios Maritime Acquisition Corporation announced that the company and Navios Acquisition Finance (U.S.) Inc., its wholly owned finance subsidiary, intend to offer through a private placement, subject to market and other conditions, approximately $600 million of first priority ship mortgage notes due 2021. The notes will be offered and sold in the United States only to qualified institutional buyers pursuant to Rule 144A under the Securities Act of 1933, as amended, and in offshore transactions to non-United States persons in reliance on Regulation S under the Securities Act. The notes will be secured by first priority ship mortgages on 12 vessels aggregating approximately 2.6 million deadweight tons owned by certain subsidiary guarantors.

Lawrence Graham Completes LATCO Loans

London law firm, Lawrence Graham has advised the Latvian Shipping Company on a complex multi-bank loan scheme to finance its recently completed purchase of three 68,000 dwt product tankers. The $125 million deal, together with $90 million of associated acquisition finance, involved separate loan agreements with banks in Hamburg, Stockholm, Riga and Rotterdam. number of banks through separate loans rather than obtain one syndicated loan. Latvian Shipping Company agreed to pay $41.6 million for each of the sister vessels and Lawrence Graham advised them on three separate purchases and loan facilities of $30 million each. The purchases and financings involved coordinating legal advice from many jurisdictions around the world…