Bulk Carriers Orders Down 30%

The number of Bulker orders were down 30% for 2020 YTD compared to the same period last year. From the 1st of January 2020 when the Chinese market and shipyards closed due to the pandemic, until today, we have only seen USD 1,037 mil spend in the Bulker NB market, down 35% for the same period in 2019. The Chinese government have now started up the economy again and most of the orders placed are by companies like China Development bank and Bank of Communications all being built…

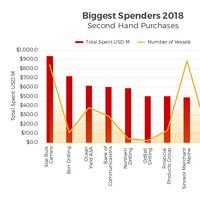

Biggest Spenders of 2018

With less than a week until Christmas and most of our presents bought, we're feeling the pinch. However, that's nothing compared to the amount that some have been spending this year. VesselsValue's Senior Analyst Court Smith gives a rundown on which countries have splashed the most cash on second hand vessel purchases over 2018.USAJP Morgan Global Maritime is the US company who has spent the most on second hand vessels: 308 million USD so far in 2018. However, they have changed their purchasing strategy half way through the year.

WFW Advises HSBC $123m Three Vessel Sinosure-backed Financing

Watson Farley & Williams advised HSBC Bank, HSBC Bank Middle East Limited HSBC Corporate Trustee Company and a syndicate of banks including Mashreqbank, HSBC Bank Middle East Limited and Bank of Communications Ltd in connection with three Sinosure-backed loan facilities totalling approximately US$123m to UAE-based Zakher Marine International Inc (ZMI), to finance the construction and acquisition of three new high-spec jack-up barges.The delivery of the final two barges in September 2018 completed a structured financing and delivery process which saw Mashreqbank joining the project in 2017. Abu Dhabi-based ZMI was established in 1984 and now operates a fleet of 45 support…

Scorpio Tankers Signs Sale-Leaseback with Bocomm

Scorpio Tankers has agreed to sell and leaseback five 2012 built MR product tankers (STI Amber, STI Topaz, STI Ruby, STI Garnet, and STI Onyx) to Bank of Communications Financial Leasing (Bocomm Leasing). As of today, three of the five transactions have been completed, which has increased the Company’s liquidity by approximately $21 million in aggregate after the repayment of the outstanding debt. The sales price for each vessel is $27.5 million, and the Company will bareboat charter-in the vessels for a period of seven years at $9,025 per day per vessel. The Company also has three one-year options to extend the bareboat charter agreements beyond the initial term. In addition, Scorpio Tankers has purchase options beginning at the end of the fifth year and until the end of the agreements.

Scorpio Tankers Updates on Fleet Status

Scorpio Tankers sold and leased back, on a bareboat basis, three 2013 built MR product tankers, STI Beryl, STI Le Rocher and STI Larvotto to Bank of Communications Financial Leasing in April 2017. The sales price was $29 million per vessel and the company bareboat chartered-in the vessels for a period of up to eight years at $8,800 per day per vessel. The international provider in the transportation for refined petroleum products has the option to purchase these vessels beginning at the end of the fifth year of the agreements through the end of the eighth year of the agreements. Additionally, a deposit of $4.35 million per vessel was retained by the buyers and will either be applied to the purchase price of the vessel if a purchase option is exercised…

Trafigura Backs Out of Tanker Foray

Trafigura has sold five oil vessels to a unit of China's Bank of Communications , ending the trading house's move into owning tankers, the company said on Friday. Under the deal, the five medium-range tankers, ordered by Trafigura in 2013 from a shipyard in China, were sold to Bank of Communications Financial Leasing Company Ltd and subsequently leased back to the Swiss trading house. Financial terms were not disclosed. "The ships were bought at low entry levels and we saw an opportunity to sell now. While we have a significantly growing cargo programme it is not a must for us also to own the steel," Trafigura global head of wet freight Rasmus Bach Nielsen said in a statement.

Navig8 Leaseback Pact with with Chinese Financer

Navig8 Chemical Tankers has signed sale and leaseback agreements with China's Bank of Communications Financial Leasing (BCFL) for a quartet of medium range tankers. The for four 49,000 DWT Interline coated medium range tankers being built at STX Offshore & Shipbuilding Co., Ltd, Korea (STX). The four vessels from STX have contractual delivery dates ranging from end March 2017 to end June 2017. Under the sale and leaseback agreements, BCFL will provide funding for pre-delivery as well as the delivery instalments for the STX Vessels. The net proceeds from the transaction (after a 12% sellers' credit) will be USD 140,025,600. The STX Vessels will be delivered to BCFL on their respective deliveries from STX.

Evergas Acquires 4th multigas LNG vessel

Evergas’ latest addition to its fleet, the 4 th ‘dragon class’ 27.500 cbm multigas LNG carrier in a series of eight was successfully named today the 28th of January, at a ceremony at the Sinopacific Offshore & Engineering (SOE) shipyard in Qidong, China. The state-of-the-art carrier was named JS INEOS INSPIRATION. The vessel bear a distinct dragon symbolizing its Chinese and Western heritage. The dragon chosen to sail and protect JS INEOS INSPIRATION is the King of Earth, reflecting patience, thoughtfulness and stability for the future ahead. The ‘Dragon’ class vessels are the largest, most flexible and advanced multigas carriers built to date.

DSME Rolls Out World's Largest Containership

Korean shipbuilder Daewoo Shipbuilding and Marine Engineering (DSME) has named the MSC Oscar, which has claimed the title of the world’s biggest containership. After the christening ceremony the MSC Oscar departed for Busan. The vessel has a capacity of 19,224 containers, and is the equivalent of four football stadiums in length with the nominal capacity of 19,224 TEU. The prestigious title has been taken over from China Shipping’s CSCL Globe, boasting 19,100 teu, which is currently on its maiden voyage in Europe. A report in Korea Times says that it was the first vessel of the three that China's Bank of Communications has ordered to charter to Swiss container shipping line Mediterranean Shipping Company (MSC).

Deadbeat Chinese Shipyards Stick Banks with Default Bill

Chinese banks are stuck in a lose-lose legal battle between domestic shipyards and foreign buyers over billions of dollars in refund guarantees that are supposed to be paid out if shipbuilders fail to deliver on time. One in three ships ordered from Chinese builders was behind schedule in 2013, according to data from Clarksons Research, a UK-based shipping intelligence firm. Although that was an improvement from 36 percent a year earlier, it was well behind rival South Korea, where shipyards routinely delivered ahead of schedule the same year. That means Chinese banks may be on the hook to pay large sums to buyers if the yards can't come through per contract, with little hope of recouping the cash from the yards.

China Arbitration Court Orders Korea's STX to Pay Debt

Troubled South Korea shipbuilder STX Heavy Industries Co. issued a guarantee on a loan defaulted on by its Chinese heavy machinery manufacturer, STX Dalian Heavy Industries Co., from China's Bank of Communications and has been ordered to repay the loan, reports Yonhap. Unlisted STX Dalian Heavy Industries is a wholly owned subsidiary of STX Heavy Industries and has been ordered to repay the 60.9 billion won (US$56.8 million) loan by the China International Economic and Trade Arbitration Commission after the Chinese unit failed to service the principle and interest.

Big Ship Newbuildings: Global Order Update

Container ship newbuildings figure most active in the latest weekly news from Clarkson Hellas, with the majority of orders placed with China and Korea shipbuilders. Clients of Diana Shipping reports Clarkson Hellas in its Weekly Bulletin have announced a further order for one 82,000 DWT Kamsarmax at Sinopacific’s Dayang facility. Based on the Sinopacific MHI 82 design, the vessel is planned for delivery in the second quarter of 2016. Jinling Shipyard took an order for four firm 64…

Global Vessel Newbuildings: Latest News

The past week has been another active one, reports Clarkson Hellas S+P Weekly Report, with notable levels of ordering across all sectors. In Dry and whilst understood to have been contracted earlier this year, Clients of Polaris Shipping are reported to have signed three firm 250,000 DWT VLOCs as well as a single 207,000 DWT Newcastlemax at Hyundai Heavy Industries. These will be built at their Samho facility and whilst final pricing is yet to be disclosed, delivery is expected from the third quarter of 2014 and will continue through to early 2015. Parakou Shipping were reported to have contracted four firm SDARI designed 64,000 DWT Ultramax with a further four plus four options attached at Chengxi Shipyard.