Diamond Offshore Posts Smaller-than-expected Loss

Diamond Offshore Drilling Inc posted a smaller-than-expected loss on Monday, as a fall in revenue was offset by a 15 percent drop in costs.The Houston-based company's total operating expenses fell to $321.2 million from $378.5 million, a year earlier.As oil prices stay above $70 a barrel, oil and gas producers are again showing an interest in expensive offshore projects that can take up to a decade to develop.The rig contractor recorded a loss of $69.27 million, or 50 cents per share, in the second quarter ended June 30, compared to a profit of $15.95 million, or 12 cents per share, a year earlier.Excluding items, the company posted a loss of 33 cents per share.

Idled St. Croix Refinery to Restart, Produce Fuels by 2020

Owners of an idled oil refinery in St. Croix, U.S. Virgin Islands, which was once one of the world's largest refineries, plan to invest $1.4 billion to refurbish and restart a portion of the plant, they said on Monday. ArcLight Capital Partners, a private equity firm that owns 80 percent of Limetree Bay Terminals LLC, expects the former Hovensa plant to be able to process 200,000 barrels per day of crude and deliver fuels to market by January 2020, officials told a news conference in St. Croix. The Boston-based company spent two years studying the market and developed "a refinery profile we see thriving in the current marketplace," said John Erhard, an ArcLight partner. The refinery would supply low-sulfur fuels under an International Maritime Organization mandate that begins in 2020.

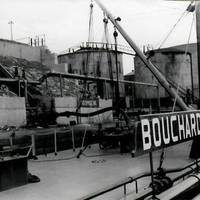

#BTC100 History

In 1951, under the leadership of Capt. Fred’s son, Morton S. Bouchard Sr., (A.K.A. “Buster” Bouchard), the company builds three 20,000 barrel oil barges and three accompanying tugboats, which ran the New York State Barge Canal. The construction of these vessels would then, in the years that followed, lead to Buster’s position as a prominent figure within the oil transportation industry. The July 2018 edition of Maritime Reporter & Engineering News will feature a special “Bouchard Transportation Co. Celebrates 100 Years” magazine.

Offshore Oil Service Firms Dominate Energy Bankruptcies

Offshore oil drilling and service companies, hurt by the energy industry's shift to lower-cost shale and away from deepwater projects, are dominating the year's energy bankruptcies in North America, according to law firm Haynes and Boone. There were fewer oilfield service companies seeking protection this year than last but those that did have had larger debts. Through October, 44 oilfield services companies filed for bankruptcy in the United States and Canada owing creditors $24.8 billion, compared with 72 companies and $13.48 billion for all of 2016.

Caribbean Oil Terminals Prepare for Hurricane Maria

Several Caribbean oil storage terminals that temporarily closed ahead of Hurricane Irma earlier this month have started making preparations in case they have to shut again due to Hurricane Maria, which was a rare Category 5 storm on Tuesday. Shippers and traders in the Atlantic basin are struggling amid this year's very active storm season, which has seen seven hurricanes so far, four of them major hurricanes, defined as at least a Category 3 on the five-step Saffir-Simpson scale. Hurricane Harvey hit the U.S.

Wells Fargo Calls $100 Oil a 'Pipe Dream'

USD 100 per barrel oil is but a “pipe dream,” Wells Fargo said in a new investor note, reports MarketWatch. The report quoted Wells Fargo’s John LaForge saying that he’s doesn’t expect oil prices to climb anywhere near $100 a barrel over the next few years. Barrels price will bounce between $30 and $60 in the coming years, according to top bank’s diagnosis. “We continue to hear that big cutbacks are on the cusp of happening,” he said. “The evidence, however, implies otherwise. Shale production has caused American output to stand higher than it did in 2014, before the oil price crisis began. Wells Fargo data shows current production at 15.5 million barrels per day, compared to 14 million bpd three years ago.

PIRA Expects $50-60/barrel Oil from OPEC Deal

The Organization of Oil Exporting Countries' decision to embrace production cuts will help move crude prices toward a target of $50 to $60 per barrel, Gary Ross, chairman of consultancy PIRA Energy Group, told reporters on Wednesday. OPEC's policy has shifted as Saudi Arabia is targeting that price range and Iran has become more willing to accept an agreement. Ross said at a news conference that U.S. shale producers were likely to hedge future output more selectively after OPEC decided to limit output. Shale producers and oil-consuming companies were under-hedged, he said, adding that industrial and airline buying would support prices. The surplus in oil supply has been eroding since the second quarter and will be "gone" by the second half of 2017, Ross said.

Kirby to Pay $4.9 Mln Penalty over Oil Spill

Kirby Inland Marine LP has agreed to pay $4.9 million in civil penalties to settle claims stemming from a 4,000-barrel oil spill in the Houston Ship Channel in March 2014, the U.S. Justice Department said on Tuesday. The company, a subsidiary of Kirby Corp, also agreed to implement operating improvements across its hundreds of vessels operating in U.S. inland waters, the department said in a statement. (Reporting by Tim Ahmann; Writing by Eric Walsh; Editing by Susan Heavey)

Vigor Delivers ATB Tug to Harley Marine

Vigor’s Seattle shipyard recently delivered a 95’ x 38’ x 16’, 3,000 hp ATB Twin Screw Tug, Dale R Lindsey, to Harley Marine Services Inc. Designed by Elliot Bay Design Group for primary operation in Alaska, the ATB tug utilizes an Articouple FRM-43M coupler system to pair with the 20,000 barrel oil barge, Petro Mariner. It features a raised aluminum pilothouse for optimal visibility built by Kvichak. Dale R Lindsey is the 11th vessel built by Vigor for its long-time customer, Harley Marine.

US Oil Drillers Cut Rigs for 6th Week

U.S. energy firms cut oil rigs for the sixth straight week, data showed on Friday, and were expected to shed more in coming weeks with three major U.S. shale oil companies slashing their spending plans after crude prices hit 12-year lows. Drillers removed 12 oil rigs in the week ended Jan. 29, bringing the rig count down to 498, the least since March 2010, oil services company Baker Hughes Inc said in its closely followed report. That compares with 1,223 oil rigs in same week a year ago. In 2015, drillers cut on average 18 rigs per week for a total of 963 oil rigs for the year, the biggest annual decline since at least 1988. U.S. crude futures were trading around $33 a barrel on Friday…

Shell Moves Ahead in Arctic with Exploratory Well

Shell Oil's icebreaker MSV Fennica weaved through nine remaining protesters hanging from the St. Johns Bridge and made its way toward the Pacific Ocean. Authorities have removed protesters dangling from a bridge and in kayaks in Oregon, allowing an icebreaker to get through and head toward the Arctic, The Associated Press reported. Demonstrators had been trying to stop the Fennica from leaving Portland, Oregon, and heading for an oil drilling operation, the AP reported. The ship had tried to leave earlier Thursday, but was forced to turn around by the protesters dangling from the bridge. "The Fennica is now safely on its way to Alaska…

Oil Majors Push Offshore Players for 30% Cuts

30%That’s the minimum level of capital expenditure cuts facing owners and operators of offshore rigs, vessels and various support services, as they scramble to keep equipment working and their heads above water during one of the worst oil downturns in 30 years. From a high of $108 per barrel in June of last year, prices plummeted roughly 60% as supply surpassed weakening demand, crashing in November to around $44 a barrel. The pricing collapse caught all sectors of the industry and financial markets by surprise, pulling down with it market valuations, quarterly earnings and day rates.

Shell to Get Permission to Drill in the Arctic

The US government is expected this week to give the go-ahead to a controversial plan by Shell Oil Company, one of the largest oil companies in the world to restart drilling for oil in the Arctic. The UPI reports that the decision rests on the U.S. Department of Interior Secretary Sally Jewell, who is expected to announce the decision on Wednesday. The green light from Sally Jewell, the interior secretary, will spark protests from environmentalists who have campaigned against proposed exploration by Shell. Environmentalists are concerned with the issue, since technology has not been prepared to deal with an oil spill in that region. The Environmental Impact Statement claims there is a 75 percent chance of a large spill occurring.

Oil Price Crash Claims First US LNG Project Casualty

Excelerate Energy's Texan liquefied natural gas terminal plan has become the first victim of an oil price slump threatening the economics of U.S. LNG export projects. A halving in the oil price since June has upended assumptions by developers that cheap U.S. LNG would muscle into high-value Asian energy markets, which relied on oil prices staying high to make the U.S. supply affordable. The floating 8 million tonne per annum (mtpa) export plant moored at Lavaca Bay, Texas advanced by Houston-based Excelerate has been put on hold, according to regulatory filings obtained by Reuters. The project was initially due to begin exports in 2018. Excelerate's move bodes ill for thirteen other U.S.

Weak Oil Threatens US Export of LNG

Plunging global oil prices may turn hopes for cheap liquefied natural gas supplies from the United States into a costly disappointment for Asian buyers who have already invested billions of dollars in long-term contracts. The 26 percent price slide since June to $85 a barrel exposes cracks in the assumption by utilities and industrial companies from Japan to India that cheap U.S. LNG would muscle into high-value Asian energy markets from 2016. Oil prices form the backbone of LNG trade to Asia, because exporters outside the United States typically tie 25-year supply deals to crude oil prices. If prices continue to fall, these suppliers from Qatar to Australia will regain their edge over upstart U.S. producers. "From the buyer's view, $80 oil makes oil-linked supplies less expensive ...

Shell's US Arctic Policy an 'Ongoing Gamble': Greenpeace Analysis

The analysis considers that the US Arctic Ocean presents almost a perfect storm of risks: a requirement for a long-term capital-intensive investment for uncertain return; a remote and uniquely challenging operating environment; ongoing court challenges; a lack of extraction and spill response infrastructure; and the spotlight of the world’s environmental organisations, the US political community and international media. Royal Dutch Shell stands at a strategic crossroads. Its response…

Iraq Returns as World's Fastest-Growing Oil Exporter

Iraq is reclaiming its rank as the world's fastest-growing oil exporter, cushioning consumers from Libyan supply outages for now and, perhaps, reviving OPEC market share rivalries down the road. Despite worsening violence due to spillover from the war in Syria, Iraq - already OPEC's second-largest producer - is likely to post one of the biggest annual output jumps in its history as BP, Exxon Mobil and other companies tap its southern fields, which are untouched by the unrest. With many export bottlenecks now cleared at the southern Basra terminals - from which almost all of Iraq's crude is shipped - Baghdad is expected to keep up, or even exceed, the rapid pace of oil sales reached in February - at 2.8 million barrels per day (bpd), a 500,000 bpd rise on the previous month.

Popular Boat: Popular Engine

On the Mississippi and throughout the U.S. inland waterways, pushboats of about 70 feet and with around 2000 hp are ubiquitous. They can be seen in barge fleeting operations along the riverbanks for pushing one or two 30,000-barrel oil barges. In recent years, the standard power package has been a pair of Cummins’ popular KV38-M engines. These V-12-clylinder 2300-cubic-inch displacement engines have evolved over the years to take advantage of new technologies and, more recently, to meet new environmental standards. Gary Eymard has been around the inland towboat world for some time also.

United Purchases Riverhead Deepdraft Products Terminal

United Completes Purchase Of Phillips 66 Riverhead Long Island 5 Million Barrel Oil And Petroleum Products Terminal; Deepwater Location Accommodates Any Ocean Going Vessel In The World. United Riverhead Terminal, Inc., announced today that it has closed on the purchase agreement with Phillips 66 to acquire the Riverhead bulk storage terminal. The facility, located on a 286 acre site in Suffolk County, New York, consists of 20 storage tanks, a truck transfer rack, and an off-shore barge/ship platform which is the only deepwater loading/unloading platform on the U.S. East Coast. With an operating draft of 64 feet, the terminal's offshore platform routinely receives Suezmax vessels and is capable of handling VLCC tankers.

Build And Repair Work Accelerates

All U.S. Coasts enjoying upswing in business. For many U.S. builders, last year closed on a happier note than 2010 – when the BP spill, offshore drilling ban and weak U.S. and global economies hurt business. In 2011, new orders for vessels for the oil industry and for the U.S. and foreign governments promised to keep a number of builders busy in 2012. A need to comply with new federal regulations created work, and repair activity grew. The upshot is that coastal economies are getting a needed boost. But some companies find themselves with more customers than they can immediately handle.

Irene SL Release by Somali Pirates

INTERTANKO is delighted that the Irene SL has been released by the Somali pirates who hijacked this tanker and her 2m barrel oil cargo in February, and that Master, officers and crew are in good health after 58 days in captivity – especially after 12 days being used as a pirate mothership. At the time INTERTANKO’s Managing Director Joe Angelo remarked that the Irene SL hijacking marked a significant shift in Somali piracy, taking the crisis into the middle of the main sea lanes coming from the Middle East Gulf. Her crude oil cargo represented 20% of total U.S.

Report: Ship Delivery Underperformance in 2010

Industry concerns over the glut of newbuilding deliveries last year may have been overplayed as the three major shipping market segments - dry bulk, container and tanker - avoided significant oversupply, according to figures released by Braemar Seascope. The London-listed shipbroker compared the orderbook at the end of 2009 with the full-year delivery statistics for 2010. The gap between what was anticipated to deliver and what actually delivered offers an insight into the development of the shipbuilding and freight markets. The difference between the orderbook schedule and actuality in 2010 was a function of technical underperformance at certain shipyards and the fall-out of the credit crunch. Some orders were cancelled while, in many cases, ship owners renegotiated delivery dates.

Offshore: Which Way in ’09?

In mid July of 2008, oil prices shattered all-time records and hovered around $140 per barrel. Analysts had dire warnings of $200 per barrel oil. Gone are the days of “cheap” oil, cable newscasts screamed. Exactly a decade ago, oil prices slumped below $10 per barrel in December of 1998. Analysts then decried prices would never again rise to $40 per barrel, markets were saturated. Sound familiar? It seems commodity analysts’ predictions change as much as the nightly weatherman’s.