What Goes Around Comes Around - Sale of Ex-Sanko Energy Firming AHTS Values

Those who are old enough (or young enough) to remember Justin Timberlake’s poignant lyrics, ‘What goes around, goes around, goes around, comes all the way back around’, will appreciate their significance and relatability to the offshore oil and gas market. On that theme, it appears a vessel very close to my heart, the AHTS previously known as Sanko Energy (now Ena Shogun), has come 'all the way back around.'News is filtering through the market that Eastern Navigation (Singapore) has sold the vessel five years after purchasing it from Sanko Steamship in early 2017.So why does this vessel resonate with me? Well, from a professional perspective, it was my first analyst experience of a sale that went against everything established market experts thought about values and sale prices.

UOS Completes Acquisition of UOS Support and Hartmann Offshore

German offshore industry service provider United Offshore Support (UOS) announced that it has completed its acquisition of the commercial and technical-nautical management businesses of both UOS United Offshore Support and Hartmann Offshore.Since the acquisition was announced in July 2018, the management and staff of both companies have been working to bring the two organisations under the UOS brand, which is based in Leer, Germany.UOS is led by Chief Executive Howard Woodcock, who joined the company in August 2018. Howard has over 35 years’ experience in the shipping, marine, and offshore oil & gas sectors, and prior to joining UOS spent 13 years as Chief Executive of Bibby Offshore…

AHTS Fleet Secures Long-Term Investment

Hartmann Group, the independent family-owned shipping company, announces the recapitalisation of an 11-strong fleet of Anchor Handling Tug Supply (AHTS) vessels through a partnership with, and long-term investment from, Breakwater Capital and Hayfin Capital Management. Agreed with the financing banks on October 12 2017, the deal provides the fleet with immediate stability and the potential for growth. Following the deal, full ship management of the fleet remains with the former owners, Hartmann Group, with Hartmann Offshore continuing the technical-nautical operations and UOS (United Offshore Support) managing the commercial side. The fleet will operate under their current expedition names such as "Challenger" and "Columbia", with the prefix changed from UOS to GH.

Dry Bulk’s Biggest Spenders

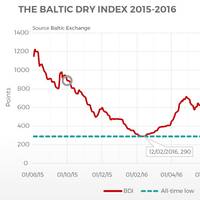

In the last month, we have seen the Baltic Dry Index (BDI) recover to the same level it was 12 months ago (see circles in fig.1). Vessel values have started to firm, but not at the same rate and are still at historically low levels. In the last 12 months, contrarian owners have taken advantage of the low values and have been buying cheap tonnage. With hindsight, this looks to have paid off with many values having increased above the purchase price. This article takes a look at which dry bulk owners have been buying the most in the last year.

Odfjell Finalizes LPG/Ethylene Joint Venture Deal

Following Odfjell SE’s May 16, 2014 announcement declaring the signing of a definitive agreement to form a LPG/E shipping joint venture, Odfjell today announced that the transaction with Breakwater Capital and Oak Hill Advisors, L.P. has been closed. In accordance with the joint venture agreement, Breakwater Capital and Oak Hill Advisors, L.P. (acting through certain of its funds and accounts) have jointly agreed to invest approximately $50 million as consideration for the 50% equity interest in Odfjell's LPG/Ethylene business.

Latest Global Deep-Sea Shipbuilding Orders

Sinotrans Shipping have signed contracts for two firm 78,000 DWT Panamax at Jiangnan Shipyard. This order is understood by Clarkson Hellas to have been under discussion for some time, and commits two remaining slots within end 2015 basis the yard’s existing Panamax design. It has also been reported that the same owner has ordered four firm 64,000 DWT Ultramax at Chengxi Shipyard for delivery within 2016, with the deal having been concluded just prior to the Lunar New Year. At Qingshan Shipyard…

China Shipyards Haul in Latest Ocean-going Newbuildings

Increased activity in the dry bulk carrier shipbuilding market is reported in the latest Clarkson Hellas Weekly S+P Bulletin, and in all sectors the shipbuilders are in China. Grieg Shipping have added to their existing orders at Dayang, with two further units of Ultramaxes, due for delivery within September and December 2015, this takes their order at that yard to four ships. Wah Kwong Shipping have now also placed order at Chengxi Shipyard for four 64,000dwt Ultramaxes scheduled for delivery within 2016.