Drewry Cuts Global Port Throughput Forecast

Drewry Shipping Consultants has revealed that it now expects global port throughput to rise by 2.6% in 2019, down from the previous 3.0% expectation.The mood-music surrounding the container market has deteriorated further in the last three months, resulting in Drewry downgrading its outlook for world container port throughput for the current year and the rest of the five-year horizon in the Container Market Annual Review and Forecast.The weight of risks pressing down on the container market seems to be getting heavier by the day,” said Simon Heaney, senior manager, container research at Drewry and editor of the Container Forecaster.

Container Market Challenges Likely as Uncertainty Mounts

Today’s container market is confronting more than its fair share of headwinds.The recently published Container Forecaster from global shipping consultancy, Drewry, highlights concerns of a slowing global economy stoked by the ongoing US-China trade war (albeit paused for the moment), escalating geo-political tension in many regions of the world and an industry grappling with challenging new emission regulations. Beyond these, however, a series of existential fears are also beginning to present themselves that could dent demand for shipping in the future…

Drewry Cautiously Optimistic on Container Shipping

The container Shipping industry is facing an exceptionally high level of uncertainty, ranging from the extra cost associated with IMO 2020 and how much carriers will recover from shippers, to the possibility of a trade recession and unknown future engagement by shipowners in large vessel building programmes.According to the recently published Container Forecaster from global Shipping consultancy Drewry, every region is expected to see container port handling growth in each and every year of the five-year forecast, albeit at a slightly slower pace than Drewry was previously anticipating.Moreover, supply growth is expected to be below that of demand through 2023…

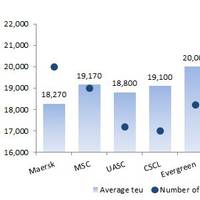

Drewry Sees Balanced Supply-Demand in ULCVs

Maritime research consultancy Drewry believes that the industry’s supply-demand balance will benefit from a reduced appetite for Ultra Large Container Vessels (ULCVs) among the major carriers, some of which now have their eyes fixed on a bigger prize of becoming global logistics integrators."Aside from feeder ship replenishment, there has been no reaction from other lines to HMM’s mega-ship order and as such we have greatly reduced our projected new orders for 2020 onwards,” said Simon Heaney, senior manager, container research at Drewry and editor of the Container Forecaster."This subsequently feeds into a much brighter supply-demand index forecast for carriers through 2022…

Drewry Predicts Better Freight Rates and Profits

The shipping industry’s supply-demand balance will benefit from a reduced appetite for Ultra Large Container Vessels (ULCVs) among the major carriers, some of which now have their eyes fixed on a bigger prize of becoming global logistics integrators, said Drewry.Simon Heaney, senior manager, container research at Drewry and editor of the Container Forecaster said: "Aside from feeder ship replenishment, there has been no reaction from other lines to Hyundai Merchant Marine (HMM)’s mega-ship order and as such we have greatly reduced our projected new orders for 2020 onwards."“This subsequently feeds into a much brighter supply-demand index forecast for carriers through 2022…

Drewry Downgrades Forecast for Container Demand

A gloomier world economic outlook and rising trade tensions have forced Drewry to downgrade its forecast for container demand over the next five years, according to the global shipping consultancy’s latest edition of the Container Forecaster.Drewry’s long-term supply and demand prognosis for carriers has deteriorated since the last report. Previously, the company’s global supply-demand index was expected to take incremental steps upwards through 2022, by which time the industry would at long last be close to equilibrium.However, the new forecasts suggest that the industry now faces being stuck with the current over-supplied situation for several more years.“The anticipated re-balancing of the container market looks to have been postponed.

Trade Wars Threaten to Derail Container Revival: Drewry

The risk to container shipping from US-led trade wars is currently low, but potentially very damaging, according to the latest edition of the Container Forecaster published by global shipping consultancy Drewry. “In the March report we said that we were hopeful of a peaceful resolution, but at this point in time we must accept that tariffs are going to become a reality. The only question now is: how severe will they be?” said Simon Heaney, senior manager, container research at Drewry and editor of the Container Forecaster. Additional tariffs of 25% on the first list of 818 Chinese products, worth approximately $34 billion, are scheduled to be collected by US Customs from Friday 6 July.

Drewry Predicts Modest Growth for Container Shipping

The outlook for the container shipping market in 2018 and 2019 is a combination of healthy demand growth that will outpace the fleet; resulting in a better supply-demand balance and slightly higher freight rates and profits for carriers, according to the latest edition of the Container Forecaster published by global shipping consultancy Drewry. “The bad news for carriers is that they are unlikely to see the very strong demand growth rates of early 2017 for the foreseeable future. The good news is that while port handling growth may have peaked, they can still expect more than adequate volumes for at least the next two years,” said Simon Heaney, senior manager, container research at Drewry and editor of the Container Forecaster.

Container Shipping Market has Bottomed Out

Hanjin’s receivership represents the trough of the container shipping market and despite continuing concerns of weak trade growth and fleet oversupply a gradual market recovery is now expected, according to the latest annual Container Forecaster and Review 2016/17 report published by global shipping consultancy Drewry. Worse than expected second quarter financial results will be followed by a better second half-year. But Drewry still expects container carriers to record a collective operating loss of $5 billion this year. We forecast industry profitability to recover next year, thanks to improving freight rates and slightly higher cargo volumes, and so record a modest operating profit of $2.5 billion in 2017. However, this anticipated recovery needs to be put into perspective.

Wave goodbye to $50 bln - Drewry

Container industry revenues are contracting faster than carriers can cut costs. First-half results so far suggest sales are down by around 18%, increasing the pressure to reduce costs. The container shipping industry is currently enduring a severe revenue contraction that is placing carriers under enormous pressure to squeeze more savings wherever they can and is driving the latest round of M&A activity. The first-half 2016 financial results that have been published so far from a handful of major carriers paint a very depressing picture for the industry. First-half revenue from the sample companies listed in Table 1 was down by 18% on average, which if it holds true for the industry across the full year would mean that carrier income will shrink by approximately $29 billion against 2015.

Shipping Industry Slumps, but Ship Scrapping Looks Up

While the shipping industry struggles through a historic downturn, ship scrapping business is seeing accelerating demand, reports WSJ. The global economic slowdown is putting shipping through its most bruising period since the 2008 financial crisis. With the capacity running some 30% ahead of shipping demand, orders for new vessels have fallen to a record low this year and companies can’t get rid of ships fast enough. In the five years to last year, owners ordered an average of 1450 ships annually. This year orders to last month fell to 293 vessels, according to British marine data provider Vessels Value. About 1000 ships that have the combined capacity to haul 52 million tonnes of cargo will be dragged on to beaches, cut into pieces and sold for scrap metal this year.

A Painful Shipping Record – Vessel Scrapping

More containership capacity is being demolished than ever before, including old-design ships made redundant by the new Panama Canal. Drewry checks if this end the current capacity surplus? Now is not a good time to own an old containership. Drewry’s Container Forecaster (June 2016) found that, for the first time, 450,000teu of containership capacity is expected to be scrapped in just one year, as the containership sector recognises that there are far too many ships chasing too little cargo. Based on an average size of 3,000teu for ships which are being scrapped, this means that about 150 mainly old and medium-sized containerships will be pulled out of the market or out of temporary idle positions and sent to the scrapyard in 2016. In 2015, demolitions were less than half this level.

Drewry: Container Shipping Rates Have Bottomed Out, Forecast to Rise

Container freight rates are forecast to rise modestly over the next 18 months from the all-time lows reached recently, but this will not be sufficient to rescue the industry from substantial losses in 2016, according to the latest Container Forecaster report published by global shipping consultancy Drewry. Liner shipping has had a torrid time so far in 2016 with spot freight rate volatility reaching unprecedented levels, while unit industry income has fallen to record lows. There are distinct parallels between what is happening now and the depths of the 2008/09 global financial crisis.

Containership Scrapping Gathers Momentum

After a slow start scrapping of containerships gathered momentum towards the end of 2015 and has continued into 2016, says Drewry Maritime Research. A record intake of newbuild containershps (1.7 million teu) in 2015 coincided with an unusually low scrapping total, serving to widen the supply and demand gap that is assisting the erosion of carrier profits. The amount of scrapping halved in 2015 with only about 195,000 teu worth of capacity removed from the world’s cellular fleet, well down on the previous three years from 2012 to 2014 when the annual scrapping totals averaged nearly twice as much. Last year, owners of older scrapping…

Container Shipping Approaching Crucial Trigger Point - Drewry

Further expected container shipping liner losses throughout the first half of 2016, exacerbated by the awful prevailing spot and contract freight rates will lead to a major trigger point at some stage later this year. This will happen either through radical capacity management at the trade route level and/or a much more sensible and logical approach to commercial pricing, according to the latest Container Forecaster report published by global shipping consultancy Drewry. Global rate levels are no longer sustainable and with the lines’ GRI mechanism soon to be defunct on European trades due to new EU regulations that are about to be implemented, carriers will need to find new tools.

Drewry: Deeper Capacity Cuts Required

What should have been acceptable ship utilisation figures last year didn’t prevent spot rates from falling to historic lows. Carriers will need to intensify their capacity management tactics in 2016 if they are to reverse the trend. The immediate answer is that they were actually pretty close to full with ship utilisation on headhaul East-West services averaging 87% over the course of the year. This was down on 93% ship utilisation for 2014 as reported in our most recent Container Forecaster report, but nonetheless the decrease was not of the magnitude that can fully explain the rates blood-bath that ensued. Considering the seasonal peaks in volumes, carriers did a reasonable job of matching supply with demand on a monthly basis.

Dark Days Ahead for Container Ships

Further widening of the supply-demand imbalance at the trade route level and insufficient measures to reduce ship capacity will lead to an acceleration of freight rate reductions and industry-wide losses in 2016, according to the latest Container Forecaster report published by global shipping consultancy Drewry. The decline in global container shipping freight rates is anticipated to have been as great as 9% last year and Drewry is forecasting that carrier unit revenues will decline further in 2016, albeit at a slightly slower pace. Excluding 2009, the past 12 months has seen the lowest spot rates in most major trade lanes and all at the same time. This is not solely due to fundamental supply/demand imbalances caused by weak volumes and over supply.

Box Shipping Eyes More Overcapacity, Financial Pain

Slowing global trade and a bloated orderbook of large vessel capacity mean that container shipping is set for another three years of overcapacity and financial pain, according to the latest Container Forecaster report published by global shipping consultancy Drewry. The recent slowdown in world trade has forced Drewry to halve its forecast for container shipping growth for this year to just 2.2 percent and revise down estimates for future years. Meanwhile, an additional 1.6 million teu of new capacity is being added to the fleet this year, equating to a growth rate of 7.7 percent.

Container Shipping Lucky to Break Even in 2015

A toxic mixture of overcapacity, weak demand and aggressive commercial pricing is threatening liner shipping industry profitability for the rest of 2015, according to the Container Forecaster report published by global shipping consultancy Drewry. Earlier this year Drewry forecast that container shipping carriers would collectively generate profits of up to $8 billion in 2015, but our revised view is that it will be lucky to break even this year. This means that some lines will be back in the red by the end of 2015.

Box Ship Oversupply Stoking Trouble

Despite positive growth momentum, the container shipping industry continues to suffer new, big ship deliveries with no let-up to the ordering frenzy according to the Container Forecaster, published by Drewry Maritime Research. Drewry forecasts another year of excess growth in relation to demand in 2015. This will make it harder for carriers to repeat the estimated 92% load factors across the main headhaul East-West trade lanes achieved in 2014. New orders for Ultra Large Container vessels of at least 18…

Drewry: Global Number of Container Ships Peaks

The number of container ships transporting goods around the world has fallen in the first half of 2014 but the total capacity of the global fleet continues to increase, consulting firm Drewry Maritime Research said in a note on Monday. Drewry Maritime Research foresees a fall in the number of container ships on an annual basis this year for the first time in at least 20 years. The container shipping industry has been struggling with over capacity because of there are too few goods to transport on too many vessels as a result of the economic downturn. Despite fewer ships, nominal capacity of the global fleet continues to increase by about 6 percent a year, Drewry said.

Cost-Cutting Container Carriers Forge Ahead: Analysis

As freight rates keep declining, cost reductions are the top priority for box carriers, according to Drewry's 2Q14 'Container Forecaster', highlighting that there is a widening gap between the positive financials of the few carriers really focused on cutting costs and the rest of the top 20 lines, as they battle with the pressure of falling freight rates. Drewry forecasts that once again, average freight rates will be lower than in the previous year. Drewry estimates that on the headhaul transpacific trade alone, carriers have given away in the region of $1.25 billion in annual revenue via the lower annual contracts they signed with Beneficial Cargo Owner clients in May.

Container Shippers Battle Falling Rates

As freight rates keep declining, cost reductions are the top priority for box carriers. Drewry’s 2Q14 Container Forecaster highlights that there is a widening gap between the positive financials of the few carriers really focused on cutting costs and the rest of the top 20 lines, as they battle with the pressure of falling freight rates. Drewry forecasts that once again, average freight rates will be lower than in the previous year. Drewry estimates that on the headhaul transpacific trade alone…