Royston Completes Engine Overhaul Work on Tanker

Royston completed work to overhaul a high-speed diesel engine on a Pritchard Gordon Tanker.Engineers undertook the 51,000 running hour service on the No.2 generator onboard the 127m length Henrietta PG in Trinidad as part of a planned refurbishment and maintenance program. The Henrietta PG is one of 10 purpose built shallow draft, double hull tankers from 6,200 dwt to 10,600 dwt in the Pritchard Gordon Tankers’ fleet. The company specializes in the transportation of crude oil…

OSG Orders Tank Barge from Gunderson Marine

Portland, Ore. shipbuilder Gunderson Marine announced today that it has secured an order from Tampa. Fla. based energy transportation firm Overseas Shipholding Group, Inc. (OSG) for the construction of a 204,000 barrel capacity tank barge for delivery in the second quarter of 2020. The agreement also includes an option to build a second sister barge which would have a scheduled delivery date during the fourth quarter of 2020.The state-of-the-art 581' oil and chemical tank barge will be constructed to pair with existing tugs within OSG's current fleet for operation as an articulated tug barge (ATB) unit. OSG intends to register the barge under the U.S. Flag with a coastwise endorsement, allowing it to be employed in Jones Act trades.The tank barge for dual mode ITB service pursuant to U.S.

Share Holders Okay Macquarie, Goldman Sachs to Acquire HES International

Riverstone Holdings and The Carlyle Group jointly announce that they intend to sell HES International to a consortium of Macquarie Infrastructure and Real Assets (MIRA) & Goldman Sachs. Macquarie European Infrastructure Fund 5, which is managed by MIRA, and West Street Infrastructure Partners III (WSIP), which is managed by the Merchant Banking Division of Goldman Sachs, have reached an agreement in principle with Riverstone Holdings and The Carlyle Group to acquire HES International. Capital for the original investment by Riverstone and Carlyle came from two funds: (i) Riverstone/Carlyle Global Energy & Power Fund IV, L.P. and (ii) Carlyle International Energy Partners, L.P. (CIEP). HES will now initiate consultations where appropriate with the relevant works councils.

OSG Reports $284m Profit In 2015

Overseas Shipholding Group, a provider of oceangoing energy transportation services, reported results for the fourth quarter and full year 2015. The company reported net income of $9.3 million in its fourth quarter. The crude oil and petroleum transportation company posted revenue of $243.7 million in the period. For the year, the company reported profit of $284 million, or 49 cents per share. Revenue was reported as $964.5 million. The Board has declared a dividend of $0.08 per share. “We are pleased to report strong results for the 4th quarter and full year 2015,” said Captain Ian T. Blackley, OSG’s president and CEO. “The positive supply and demand fundamentals in the international tanker market…

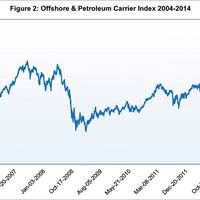

Energy Sector Volatility Affects Middle Market M&A Activity

Market volatility for the petroleum sector provides a backdrop to an evolving Merger & Acquisitions environment for the Offshore Sector. In the 3Q edition of Maritime Professional, this series of articles examined the overall evolution of maritime and offshore M&A activity since 2010, tracing the flow of deals in the post-financial crisis era. In this edition, we take a closer look at relevant U.S. offshore energy industry deal flow and market movements as they relate to oil prices over time, and highlight some recent middle market transactions.

Sovcomflot Reports “Strong Start” for Q1 2014

Russian shipping company Sovcomflot, a global top-five tanker company, reported its financial results for the first quarter of 2014. The company, which offers crude oil, refined petroleum products and liquefied gas transportation services, recorded a “strong start” with highlights as listed below. •Successful completion by SCF Group’s company, Novoship, of modernization at the Port of Sochi for 2014 Winter Olympic Games. Sergey Frank, President and CEO of OAO Sovcomflot, said, “Following five years of recession, the tanker market is showing the early signs of a long overdue recovery.

Oiltanking Partners Report Q1 Distribution Increase

Oiltanking Partners, L.P. announced that the board of directors of its general partner declared a cash distribution of $0.495 per unit, or $1.98 per unit on an annualized basis, for the first quarter of 2014. The first quarter distribution represents a 5.3% increase over the prior quarter distribution of $0.47 per unit and a 22.2% increase over the prior year distribution of $0.405 per unit. The distribution will be paid on May 14, 2014, to unitholders of record on May 2, 2014. Oiltanking Partners, L.P.

Commercial Barge Line Company Announces Results

Company announces offering of $650 million senior secured term loan. Commercial Barge Line Company announced results for the quarter and year ended December 31, 2012. For the year, the Company reported total revenues of $811.6 million and Adjusted EBITDAR of $232.1 million. Compared to 2011 results, revenues declined $41.4 million, or 4.9%, while Adjusted EBITDAR improved by $57.8 million, or 33.2%. For the quarter, total revenues were $207.9 million compared to $244.5 million in 2011 and Adjusted EBITDAR was $62.8 million compared to $60.3 million in 2011. Commenting on the results, Mark Knoy, President and Chief Executive Officer…

Wooldridge CCO, Navios Maritime Acquisition

Navios Maritime Acquisition Corporation (NYSE: NNA) announced that Adrian Wooldridge will serve as the Company's Chief Commercial Officer, responsible for all chartering and related commercial activities. Before joining the company, Wooldridge worked for eight years at various divisions of Shell Oil where he most recently served as Freight Trading Manager for Shell Western Supply & Trading Ltd. in Barbados with overall responsibility for crude and refined petroleum products' trading. Wooldridge holds a Master's in Business Administration from Warwick Business School in the UK and a degree from the Royal College of Music in London. He also is a Fellow of the Institute of Chartered Shipbrokers.