BIMCO: Tanker Market Hangover Continues

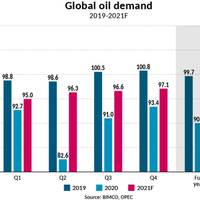

Tanker shipping was in many ways the odd one out of the shipping sectors in 2020; at the start of the pandemic, the market was strong, only to finish off the year in the doldrums, while the other sectors stayed profitable. Even a demand boost in December only managed to lift earnings slightly, raising the question, what will it take for tankers to return to profitability?In the immediate aftermath of the pandemic being declared, tanker shipping appeared immune, but it too has suffered from lockdowns and travel restrictions.

BIMCO on Tanker Shipping; The Worst is Not Over

While the tanker market had a strong run at the outset of the COVID-19 pandemic, according to a report released this morning by BIMCO, tanker shipping will not benefit this year from the usual strong winter seasonal effect. Though the new lockdowns being introduced in many countries are less strict than in the spring, the effect on tanker shipping will be worse, given the supply glut of Q2. The news of an effective vaccine offers some hope of a global oil demand recovery but, however it comes about…

Crude Oil Tanker Earnings Drop 68% in Nine Days -BIMCO

Crude oil tanker earnings have come down sharply in recent weeks with very large crude carrier (VLCC) earnings from the Middle East Gulf to China dropping 68% in just nine days (from $222,591 per day on April 22 to $71,885 per day on May 4), according to BIMCO. In the same period, daily VLCC earnings from the Middle East Gulf to the U.S. Gulf have plunged nearly 80% (from $162,433 per day to $36,249).The window of extraordinary earnings closed at the end of April with the OPEC+ oil production cuts of 9.7 million barrels per day (bpd) on May 1, reducing the flood of oil in the market.

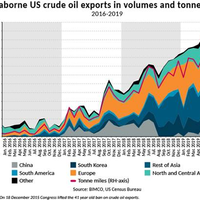

BIMCO: US Crude Exports Soar in June 2019

The highest US crude oil exports to China in 11 months lifted total seaborne US crude oil exports to a record high at 11.9 million (m) tonnes in June 2019. Also contributing to the June record was South Korea, as exports to the other main Far Eastern buyer reached an all-time high volume of 2.3m tonnes.1.2m tonnes were shipped to China between June 1, and June 30, , up from 1m tonnes in May and worlds apart from no exports at all in the months of August through October in 2018…

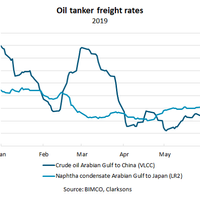

BIMCO: VLCC Freight Rates from Gulf to China Doubles

VLCC spot freight rates between the Arabian Gulf and China rose 101% in the days between June 13, 2019 and June 20, 2019, in the aftermath of attacks on two tankers in the Strait of Hormuz. Spot freight rates for a VLCC, carrying 2 million barrels of oil, between the Arabian Gulf and China reached USD 25,994 per day on June 20, their highest level since March and significantly above the May average of USD 9,979 per day.Despite this increase, freight rates on this route only narrowly exceeds the daily break-even costs of a VLCC…

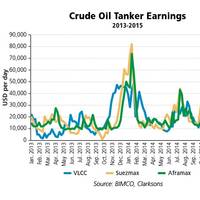

Strong Tanker Market Extends Peak Season High Earnings

Tanker earnings for crude oil tankers have climbed to new strong levels in the first quarter of 2015, with averages not seen since 2008, the Baltic and International Maritime Council (BIMCO) reported. The demand for crude oil tankers remains high even though the winter months are far behind us. Following the winter peak season of 2013/14, crude oil tanker earnings collapsed and remained low during spring, before rebounding over the summer. In the winter peak of 2014/15, this has not been the case.

Mideast Crude Tanker Rates Near 3-month Low

Crude oil tanker earnings on the major Middle East route fell to their lowest in nearly three months as a slowdown in business in recent days battered rate sentiment. The world's benchmark VLCC export route from the Middle East Gulf (MEG) to Japan <DFRT-ME-JAP> on Monday reached W37.93 in the worldscale measure of freight rates, or $8,142 a day when translated into average earnings - its lowest since June 23. That compared with W38.25 or $8,827 a day on Friday and W42.68 or $15,142 a day last Monday. "Activity was very low last week leaving freight rates under pressure," Arctic Securities analyst Erik Nikolai Stavseth said on Monday. In January, average earnings reached just over $61,000 a day - their highest since February 2010, before the rally loststeam.

Mideast Crude Tanker Rates Struggle in Ship Glut

Crude oil tanker earnings on the major Middle East route were steady this week, helped by light bookings although rates have yet to rebound after a recent surge late last month. The world's benchmark VLCC export route from the Middle East Gulf (MEG) to Japan <DFRT-ME-JAP> on Thursday reached W42.57 in the worldscale measure of freight rates, or $14,080 a day when translated into average earnings, the latest Baltic Exchange data showed. That compared with W41.21 or $11,142 a day on Wednesday and W46.90 or $20,727 a day last Thursday. "Activity has ... revived but the tempo is firmly in the control of the charterers. Again, firm business is being overwhelmed with offers and the competition among owners remain fierce," broker Fearnleys said.

Ship Glut Pressures Mideast Crude Tanker Rates

Crude oil tanker earnings on the major Middle East route remained under pressure on Tuesday as the market struggled to absorb a glut of tankers due to slower business. The world's benchmark VLCC export route from the Middle East Gulf (MEG) to Japan reached W36.71 in the Worldscale measure of freight rates, or $5,550 a day when translated into average earnings. That compared with W36.85 or $5,430 a day on Monday and W38.42 or $8,273 a day last Tuesday. "(VLCC) rates remain at a relatively weak level due to high vessel availability," Pareto Securities said. In January, average earnings reached just over $61,000 a day - their highest since February 2010, before the rally lost steam.

Mideast Crude Tanker Earnings Slip, Ukraine Watched

Crude oil tanker earnings on the major Middle East route fell on Tuesday as a build up of vessels available for hire weighed on rate sentiment. Shipping markets continued to monitor developments in Ukraine after Russia sent military forces into the Crimea region of southern Ukraine. Russian President Vladimir Putin said Moscow would only use military force in Ukraine as a last resort. A U.S. official said it was ready to impose economic sanctions on Russia. The world's benchmark VLCC export route from the Middle East Gulf (MEG) to Japan reached W50.73 in the Worldscale measure of freight rates, or $25,765 a day when translated into average earnings. That compared with W51.33 or $27,219 a day on Monday and W55.05 or $32,176 a day last Tuesday.