Performance Shipping Adds Secondhand Aframax Tanker

Greek tanker owner Performance Shipping announced it has taken delivery of the a 2009-built 105,071 dwt Aframax tanker that it agreed to purchase in June 2022.The vessel, formerly known as Maran Sagitta, has been renamed P. Sophia. It was built in 2009 by Hyundai Heavy Industries Co., Ltd. in Ulsan, South Korea. Performance Shipping acquired the vessel for a gross purchase price of $27,577,320.Andreas Michalopoulos, Performance Shipping’s chief executive officer, said the delivery increases the company’s fleet to a total of six Aframax tankers, all currently operating in the firm spot charter market. “The addition of this high specification vessel…

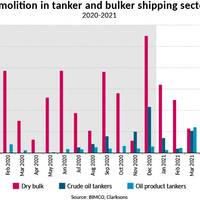

BIMCO: Ship Demolition Prices Spike, Tankers Lead the Way

In the first four months of 2021, the amount of oil product tanker capacity that has been sent for demolition has already reached the total amount of demolished capacity in each of 2019 and 2020 due to unfavourable freight rates. If that pace continues for the rest of the year, an 11-year record is set to be broken.This according to a report out today from BIMCO, which shows that so far this year, 10 crude oil and 38 oil product tankers have left the active trading fleet and the…

BIMCO: US Seaborne Crude Oil Exports Hit Record High

US exports of crude oil have, since August 2018, continued to rise every month, with a new record high in January of 9.6 million tonnes. Exports rose in January on the back of increased sales to Europe, which rose from 2.7 million tonnes in December to 4.8 million tonnes in January.A strong end to 2018 meant that volumes for the full year totalled 87.4 million tonnes, 96.7% higher than the 44.4 million tonnes exported in 2017. This is good news for the crude oil tanker sector…

Tanker Market Grappling with More Uncertainty

Tanker shipping: Added uncertainty is not helpful to the struggling tankersDemandJust when you thought it could not get any worse for the tanker shipping industry, the U.S. is reimposing sanctions on Iran coming into force after a six months wind-down period ending on November 4, 2018. The immediate effects are less tangible but sure to add more uncertainty to the whole shipping industry that has plenty of uncertainty to deal with already.At the same time, freight rates for both crude oil tankers and oil product tankers are mostly in loss making territory.

Six New VLCCs Marks the Start of a Busy Delivery Year

2016 is off to a flying start when it comes to delivering brand new VLCCs from shipyards in South Korea and China to owners and investor across the globe, says a report BIMCO. The six new VLCCs were delivered in a strong winter market. Having reduced slightly, since the turn of the year, VLCC average earnings currently sit at USD 50,000 per day, in early February. For the full year, an additional 58 VLCCs are scheduled for delivery, but delays and postponements usually decrease that number to a certain degree. Taking that into consideration, BIMCO expects 37 VLCCs to be delivered during the final 11 months of 2016. South Korean shipyards will provide the lion’s share of these newbuilds.

2016 a Busy Year for VLCC Deliveries - BIMCO

When it comes to delivering brand new VLCCs from shipyards in South Korea and China to owners and investor across the globe, 2016 is off to a flying start. Six new VLCCs were delivered in a strong winter market. Having reduced slightly, since the turn of the year, VLCC average earnings currently sit at $50,000 per day, in early February, reports BIMCO. For the full year, an additional 58 VLCCs are scheduled for delivery, but delays and postponements usually decrease that number to a certain degree.

Euronav: USD 350m Capital Increase to Support Maersk VLCC Acquisition

On 5 January 2014, Euronav announced the acquisition of fifteen (15) Very Large Crude Carriers (VLCC) from Maersk Tankers Singapore Pte Ltd. for a total acquisition price of USD 980 million. Euronav follows that announcement by advising its intent to raise USD 50,000,000 by way of a capital increase under the authorized capital and that 5,473,571 new shares will be issued upon full payment of the subscription price, which is expected to be at or around 10 January 2014. The subscription…

Teekay Acquires Spanish LNG and Oil Shipping Company

Teekay Shipping Corporation has entered into a definitive agreement to acquire Naviera F. Tapias S.A. Teekay has also entered into an agreement with the shareholders of Tapias to establish a 50/50 joint venture that will pursue new business in the oil and gas shipping sectors, focusing specifically on the Spanish market. The Tapias acquisition will establish Teekay's presence in LNG shipping, one of the fastest growing sectors of sea-borne energy transportation. It will position the Company as a key supplier of LNG shipping to Spain, the world's third largest importer of LNG, and provide a strategic growth platform for Teekay. As a major provider of crude oil transportation to Spain, the acquisition of Tapias will also extend Teekay's leading position in the crude oil tanker sector.

Gas Ships: Teekay Enters LNG With Tapias Acquisition

Teekay Shipping Corporation has entered into a definitive agreement to acquire Naviera F. Tapias S.A., a leading independent owner and operator of LNG carriers and crude oil tankers in Spain. Teekay has also entered into an agreement with the shareholders of Tapias to establish a 50/50 joint venture that will pursue new business in the oil and gas shipping sectors, focusing specifically on the Spanish market. The Tapias acquisition will establish Teekay's presence in LNG shipping, one of the fastest growing sectors of sea-borne energy transportation. It will position the company as a key supplier of LNG shipping to Spain, the world's third largest importer of LNG, and provide a strategic growth platform for Teekay.

Moody's affirms General Maritime's Ratings

Moody's Investors Service has confirmed the debt ratings of General Maritime Corporation ("General Maritime"), completing a review for possible downgrade that was initiated on March 29, 2004. The confirmed ratings include: $250 million senior unsecured notes due 2013, rated B1 Senior Implied rating of Ba3 Senior Unsecured Issuer rating of B1 The rating outlook is stable. General Maritime's ratings had been placed on review for possible downgrade following the announcement by the company of its proposed purchase of Soponata SA for approximately $415 million. At the time of the announcement, Moody's was concerned about the increased levels of debt associated with this acquisition and its effect on near term liquidity…

Moody’s Confirms General Maritime Rating

Moody's Investors Service has confirmed the debt ratings of General Maritime Corporation, completing a review for possible downgrade that was initiated on March 29, 2004. The confirmed ratings include: $250 million senior unsecured notes due 2013, rated B1 Senior Implied rating of Ba3 Senior Unsecured Issuer rating of B1 The rating outlook is stable. General Maritime's ratings had been placed on review for possible downgrade following the announcement by the company of its proposed purchase of Soponata SA for approximately $415 million. At the time of the announcement, Moody's was concerned about the increased levels of debt associated with this acquisition and its effect on near term liquidity…