Six New VLCCs Marks the Start of a Busy Delivery Year

2016 is off to a flying start when it comes to delivering brand new VLCCs from shipyards in South Korea and China to owners and investor across the globe, says a report BIMCO. The six new VLCCs were delivered in a strong winter market. Having reduced slightly, since the turn of the year, VLCC average earnings currently sit at USD 50,000 per day, in early February. For the full year, an additional 58 VLCCs are scheduled for delivery, but delays and postponements usually decrease that number to a certain degree. Taking that into consideration, BIMCO expects 37 VLCCs to be delivered during the final 11 months of 2016. South Korean shipyards will provide the lion’s share of these newbuilds.

2016 a Busy Year for VLCC Deliveries - BIMCO

When it comes to delivering brand new VLCCs from shipyards in South Korea and China to owners and investor across the globe, 2016 is off to a flying start. Six new VLCCs were delivered in a strong winter market. Having reduced slightly, since the turn of the year, VLCC average earnings currently sit at $50,000 per day, in early February, reports BIMCO. For the full year, an additional 58 VLCCs are scheduled for delivery, but delays and postponements usually decrease that number to a certain degree.

Strong Tanker Market Extends Peak Season High Earnings

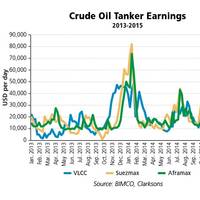

Tanker earnings for crude oil tankers have climbed to new strong levels in the first quarter of 2015, with averages not seen since 2008, the Baltic and International Maritime Council (BIMCO) reported. The demand for crude oil tankers remains high even though the winter months are far behind us. Following the winter peak season of 2013/14, crude oil tanker earnings collapsed and remained low during spring, before rebounding over the summer. In the winter peak of 2014/15, this has not been the case.

BIMCO: Tanker Market is Full of Surprises

Some time ago, BIMCO expected the first signs of a solid recovery in the oil tanker industry to appear in the product tanker market. However, like other soon-to-arrive recoveries, the waiting time tends to increase as we approach the expected tipping point. This time around, global refinery throughput started the year strongly but entered a still running soft patch in May, high volumes but shorter hauls out of the U.S. Gulf, and the steady inflow of new ships were part of the cocktail that prevented freight rates from taking off big time.