Dalian Coking Coal Slumps as Traders Eye Australian Supply

Chinese coking coal futures extended losses to hit their lowest in four weeks on Wednesday, as traders kept an eye on a batch of Australian coal cargoes expected to arrive soon in top steel producer China.Rising Chinese steel inventories also weighed on overall market sentiment, analysts said.China is seen gradually resuming Australian coal imports, having eased an unofficial trade ban imposed in 2020, as signs of warming ties between the two countries have emerged.Prices of the steelmaking ingredient have dropped nearly 5% since the start of the year.The most-traded coking coal…

Shipbuilding Drives Rise in Japanese Steel Output

Japan's crude steel output is expected to rise 1.9% in the January-March quarter from a year earlier, helped by a recovery in manufacturing including shipbuilding and machinery, its Ministry of Economy, Trade and Industry (METI) said last week.This would mark the fourth straight quarterly increase and bring annual output for the financial year to March 31 to 97.07 million tonnes, up 17% from a year earlier when the COVID-19 pandemic pushed production to the lowest in about 50 years.METI estimated crude steel output at 24.15 million tonnes for the three-month period…

Iron Ore: China Demand Powers Fortescue Shipments to Record

Australia's Fortescue Metals Group Ltd on Thursday narrowly beat its full-year estimate for iron ore shipments after a record fourth quarter, as strong demand from top consumer China offset the impact of bad weather.The world's fourth-largest iron ore miner fared better than rivals Rio Tinto and BHP, whose June quarter output dropped because of weather disruptions in Western Australia.Despite those disruptions, surging prices of the steelmaking ingredient and robust demand from China are expected to drive bumper earnings at miners…

Baltic Index Ticks Up on Capesize Gains

The Baltic Exchange's main sea freight index, which tracks rates for ships carrying dry bulk commodities, ticked up on Wednesday on gains in the capesize segment.The index, which factors in rates for capesize, panamax and supramax shipping vessels, added 5 points, or 0.2%, to 3,058.The capesize index rose 8 points, or 0.2%, to 3,513.Average daily earnings for capesizes, which typically transport 150,000-tonne cargoes of iron ore, were up $64 at $29,135.The gains came even as benchmark…

Baltic Index Gains as Capesize Vessel Rates Rise

The Baltic Exchange's main sea freight index rose for a second consecutive session on Tuesday, buoyed by stronger rates for capesize vessels.The Baltic dry index, which tracks rates for ships ferrying dry bulk commodities and reflects rates for capesize, panamax and supramax vessels, was up seven points, or 0.5%, at 1,289 points.The capesize index gained 24 points, or 1.3%, at 1,922 points, hitting its highest since Sept.

Chinese Demand Keeping the Dry Bulk Market Going -BIMCO

An impressive recovery in Chinese dry bulk imports has protected the industry from the effects of falling demand in the rest of the world. High deliveries and low contracting have left the orderbook at multi-year lows, but – with the poor outlook – the current influx of new dry bulk ships orders is not what is needed.Demand drivers and freight ratesThe biggest story in the dry bulk industry in recent months has been the strength of the recovery in major Chinese imports. These are up across the board…

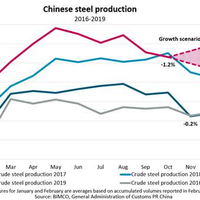

BIMCO: Chinese Steel Production Declines

Chinese steel production dropped by one million (1m) tons, a decline of 1.2%, compared to October last year. China produced 81m tonnes of crude steel in October 2019. This is the first decline in steel production year-on-year (y-o-y) since December 2017.The story unfolds quite differently when looking at the accumulated volumes of crude steel production. In total, China has produced 829m tonnes of crude steel through the first 10 months of 2019, an increase of 6% when compared to the same period last year.In fact…

“It’s the steel production, stupid!”

BIMCO's Peter Sand, in a new report, weighs in on the implications for the Dry Bulk sectors.Chinese imports of iron ore keep falling, while its crude steel production keeps growing. China’s increased use of scrap metal for its production of crude steel is fundamentally critical to the dry bulk shipping industry. Mostly Capesize ships are impacted by this, way beyond the temporary iron ore export disruptions in Brazil and Australia.Chinese steel production grew by a massive 12.6 million tonnes (+9.2%) in the first two months on 2019 as estimated by China Iron and Steel Association (CISA).

Multipurpose Shipping Looks Bullish

Many key drivers for dry cargo demand have reported a significant uptick in 2017, resulting in improving conditions for all vessels in the multipurpose shipping sector, according to the latest Multipurpose Shipping Market Review and Forecast report published by global shipping consultancy Drewry. This year started out well with most demand drivers for the breakbulk sector strengthening from the lowest levels seen in 2016 with the trend forecast to continue in the medium term at least. The exception is the price of oil for which forecasts suggest is unlikely to rise over $55 a barrel for the next few years. Whether that is sufficient to rekindle investors’ interests or not remains a moot point. The demand for breakbulk commodities and project cargo comes from a wide variety of sources.

Dry Bulk Shipping: Improved Frieght Rates Despite Continues Fleet Growth

On 10 February 2016, the Baltic Dry Index (BDI) hit 290. At that point, a bulk carrier regardless of its size, age and fuel-efficient qualities earned a time charter average of USD 2,417-2,776 per day. Whereas the three smaller segments have seen higher earnings since then, capesize earnings lost ground up until the end of March. By mid-April, the gap closed and capesizes are back on par with the pack. Despite the fact that earnings have doubled in those two months, they remain below OPEX levels for the largest part of the fleet. Despite the many attempts by steel mills around the world to fend off Chinese steel from their home market, China’s steel export volumes did not fall significantly in January and February. Export dropped by just 1.6% to 17.85 million tonnes.

Can Chinese Steel Support Freight Markets?

Is China’s steel exports enough to support the freight market? No, it’s not enough, you will need lower Chinese iron ore production too in order to keep growing imports of iron ore into China that will support the dry bulk freight market, says international shipping association BIMCO. World Crude steel production for the first seven months of 2015 was 945.8 million tons, down 2.1 percent on same period last year, according to World Steel Association. As China accounts for 50 percent of the world’s crude steel production, it’s fair to highlight the specific development in China as well as in the rest of the world separately. In dry bulk shipping, all eyes are on China as 960 million tons (MT) out of a total 1,425 MT of seaborne iron ore exports is expected to be landed there in 2015.

China Aug Power Output Falls First Time in 4 yrs

China's power output, a bellwether for economic activity, posted its first annual decline in more than four years in August, adding to evidence that the world's second-largest economy is losing momentum after a brief rebound in the second quarter. Power output in the world's top consumer fell 2.2 percent to 495.9 billion kilowatt hours (kWh) in August from a year earlier, data showed on Saturday. While the annual fall was in part due to the high reading last summer, when many cities were struck by a record heat wave, overall electricity production also posted its first fall in three months - a sign of slackening demand from major industrial users.

Drewry's Analysis Raises Questions for the Dry Bulk market

London, UK, September 15 2003: Drewry Shipping Consultants, the world's leading maritime consultants, today announced that its latest report, “Annual Dry Bulk Market Review and Forecast 2003/04”, is now available to purchase. This in-depth review of the market addresses the question: how long will the current high freight rates and even higher levels of optimism continue? The market is currently buoyed by high freight rates and even higher levels of optimism but with the market hitting an all time peak in May 2003 and recording consistently firm levels ever since, the question now is how long will this last? “The forecasts for the global economy over the short term are steady…

Steel Prices Stay Firm

With global steel demand running at an unprecedented level, rapidly rising prices have been a constant headache for ship repairers, as well as ship builders, in recent months. And despite sharply higher steel output, there is little sign of any softening as the New Year dawns. According to the International Iron and Steel Institute (IISI), crude steel production for the 62 countries reporting their figures was 945m tonnes by the end of November, up 9% on the corresponding period one year earlier. Analysts were expecting total production to break through the billion tonne mark easily by the end of the year for the first time ever. IISI figures show that China accounted for the largest increase in output.

Drewry Report Expects Sustained Recovery by End of Year

Drewry’s latest “Annual Dry Bulk Market Review and Forecast –2002” explains the reasons behind the expected recovery in 4Q02. Although 2002 is unlikely to see a sustained recovery in freight rates before the last quarter of the year this report predicts that 2003 shows great promise. The projected level of new building deliveries around 14m dwt, shows a decrease compared to 2002 and 2001. Meanwhile the number of vessels heading for the demolition beaches will continue to rise to the 6 m dwt mark by the same year. Trade forecasts are also good with most commodities showing a healthy rise as the global economy picks up and confidence returns to the sector. This is generally led by crude steel production, which is widely expected to pick up by the end of this year, as the U.S.