Drewry Benchmarking Club Reaches Milestone

Drewry has welcome one of the world’s leading automotive and energy companies to its exclusive, online ocean freight cost comparison service, Benchmarking Club.With this latest addition, Drewry Benchmarking Club now counts more than 10% of its members in the S&P 100 and Nasdaq 100.Launched in 2014, Drewry Benchmarking Club is a closed user group designed exclusively for shippers and is one of a number of ocean freight procurement support services from Drewry’s logistics consultancy arm, Drewry Supply Chain Advisors.These services give logistics and procurement teams within global manufacturers and retailers the visibility they need…

Drewry: Ocean Freight Shipping Rates Fall in Q4

Ocean freight rates for cargoes moving under contracts on major East-West routes decreased by 7% in the fourth quarter, according to the results of Drewry’s Benchmarking Club Contract Index.The cost reduction, based on contract freight rate data provided confidentially by Asian, American and European retailers and manufacturers to the Benchmarking Club, shows that shippers who negotiate well with carriers can continue to reduce their multi-million freight spend on most East-West routes, despite the increases in bunker prices during the past year. A moderate fall in the Asia-Europe rates drove this decline.“The latest reduction in average East-West contract rates is the largest quarterly fall since the end of 2016…

Drewry Rolls-out ‘Cost Impact Calculator’ for Shippers

Responding to the concerns and needs of Beneficial Cargo Owners (BCOs) ahead of the IMO 2020 global emission regulation, global shipping consultancy Drewry announces the addition of a new BAF formula and fuel cost benchmarking service to complement its existing range of ocean freight procurement support services.In cooperation with both shipper members of the Drewry Benchmarking Club and other parties, Drewry has developed an IMO low-sulphur rule, “Cost Impact Calculator” based on robust market data, benchmarked BAF charges and fuel cost differentials between loops and carriers.“With the compliance window to the IMO’s low-sulphur rule change in January 2020 rapidly closing…

Unease Over IMO 2020 Low-Sulphur Rule: Drewry Survey

There is considerable unease among global shippers/BCOs (Beneficial Cargo Owners) and freight forwarders ahead of the IMO’s 2020 global emissions regulations, due to come into force on 1 January 2020, according to a survey conducted by global shipping consultancy Drewry.Particular uncertainty and concern was expressed by respondents in both the survey and follow-up interviews about carriers’ methods of fuel cost recovery with more than half of all respondents (56%) stating that they did not consider their service providers’ existing approaches as either fair or transparent.Further to this, 4 in every 5 of the shippers/BCOs participating in the survey stated that they had yet to receive clarity from their providers as to how the widely anticipated future fuel cost increases…

Drewry’s Global Reefer Freight Rate Index Up for Consecutive 4Q

Reefer trades have something of a reputation for volatility both in terms of volumes and freight rates, yet Drewry’s Global Reefer Freight Rate Index has recorded only increases over the last 12 months, even during off-peak seasons. “The recent wave of carrier consolidation, which will continue well into 2018, is having a direct impact on global market structure,” said Stijn Rubens, senior consultant at Drewry Supply Chain Advisors. “As shipping lines gradually regain control of prevailing freight rates, the markets are becoming increasingly tight with behaviours one would more commonly associate with oligopoly conditions. The recent drop in investment in reefer containers only lends further weight to our expectations of further rate increases during 2018,” Stijn added.

Drewry Warns BCOs to Adapt Their Contract Strategy

International transport and logistics executives using container shipping are facing the biggest shift in their ocean provider base for 20 years and must adapt their procurement and contract strategy, according to ocean freight procurement consultancy Drewry Supply Chain Advisors. In the last five years, beneficial cargo owners have been able to secure large reductions in freight costs by running traditional competitive bids with numerous providers in an over-supplied, fragmented market. “Today’s business environment is starkly different, so we are now pro-actively advising our BCO customers that last year’s contract strategy will simply not work as a blueprint for the forthcoming annual ocean tender,” said Philip Damas, Head of Drewry’s logistics practice.

Quality of Ocean Carriers “Poor to Average”

The service provided by container shipping lines is rated as poor to average and has deteriorated in the past year, according to a survey of exporters, importers and freight forwarders conducted jointly by Drewry and the European Shippers’ Council (ESC). The ESC and Drewry contacted several hundred shippers and forwarders from all over the world in March 2017 and asked them how satisfied they were with 16 price and non-price related attributes of the services provided by ocean carriers. The survey also looked into areas most in need of improvement and how quality varies by type of carrier. On a scale of 1 (very dissatisfied) to 5 (very satisfied), customers on average did not rate carriers higher than 3.3 for any of the 16 service attributes, the survey showed (see chart).

Spot Freight Rates Soar from North Europe to Asia

Spot container freight rates from North Europe to China increased by 45 percent this week, reaching a four-year high. The “World Container Index assessed by Drewry” market reading on the route from Rotterdam to Shanghai jumped to $1,076 per 40ft dry container today, from $740 last week. “Our sources reported that ships are currently full and that carriers have demanded much higher rates – only some prior rate agreements remain in place,” said Philip Damas, head of Drewry’s logistics practice. It is highly unusual for the “backhaul” route from Europe to Asia – where vessels normally have load factors of less than 70 percent - to see such spikes in rate levels and capacity shortages.

Benchmarking Against Peers Upheld Among BCOs

International transport and logistics executives are increasingly benchmarking their companies’ costs and supplier terms in ocean transport contracts, according to data gathered by Drewry Supply Chain Advisors. In the past 6 months, the ocean transport spend under carrier contracts benchmarked by Beneficial Cargo Owners via the Drewry Benchmarking Club global initiative increased by 50%, to $2.2 billion; the number of benchmarked routes rose by 81% and the volume of benchmarked dry container teu jumped by 67%. FMCG companies and retailers are generally ahead of industrial manufacturers when it comes to using benchmarking to negotiate contracts.

OOCL Tops the Chart in Reliability

According to the latest Carrier Performance Insight, produced by Drewry Supply Chain Advisors, the most reliable carrier in May was Orient Overseas Container Line (OOCL), which had an on-time reliability average of 81.1%, closely followed by niche carrier Wan Hai at 81.01%. Taiwanese container line Evergreen ranked third with a score of 80.3%. The report shows that ocean carriers achieved a six-month high for liner service reliability in May. The on-time average of 76.0 per cent for the 10 trades covered was a 4.1 point improvement on April, representing the third straight month-on-month rise, the American Journal of Transportation reported.

Six-Month High for Service Reliability

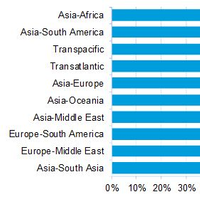

Ocean carriers achieved a six-month high for liner service reliability in May, according to Carrier Performance Insight, the online schedule reliability tool provided by Drewry Supply Chain Advisors. The on-time average of 76.0% for the 10 trades covered was a 4.1 point improvement on April, representing the third straight month-on-month rise. Along with the better on-time performance so to there was an improvement for the average deviation from the expected arrival at port, which came down from 0.9 days in April to 0.8 days in May, the lowest it has been since December 2015. Eight of the 10 routes covered recorded month-on-month increases in May, the exceptions being Asia-Africa, down by 11.9 points to 772.5%, and Asia-South America that dropped by 1.5 points to 75.7%.

Liner Reliability Bucks Downward Trend

Ocean carriers bucked a five-month downwards trend by improving container service reliability in March, according to Carrier Performance Insight, the online schedule reliability tool provided by Drewry Supply Chain Advisors. The average on-time performance in March gained 5.5 points against February to reach 68% with an average deviation from the expected arrival at port of 1.0 days. The improvement seen in March was expected as services returned to closer to operational normality after Chinese New Year in February when carriers tinkered with ever more void sailings to mitigate weaker demand. Indeed, eight of the 10 trades covered reported monthly improvements in reliability with the biggest seen in the Asia-Oceania and Europe-Middle East trades…

Liner Reliability Bucks Downward Trend - Drewry

Ocean carriers bucked a five-month downwards trend by improving container service reliability in March, according to Carrier Performance Insight, the online schedule reliability tool provided by Drewry Supply Chain Advisors. The average on-time performance in March gained 5.5 points against February to reach 68% with an average deviation from the expected arrival at port of 1.0 days. The improvement seen in March was expected as services returned to closer to operational normality after Chinese New Year in February when carriers tinkered with ever more void sailings to mitigate weaker demand. Indeed, eight of the 10 trades covered reported monthly improvements in reliability with the biggest seen in the Asia-Oceania and Europe-Middle East trades…

Which way to Munich?

Drewry Supply Chain Advisors’ whitepaper finds that the traditional gateway ports in North-West Europe no longer hold all of the trump cards. A recently published whitepaper from Drewry’s Supply Chain Advisors looking at the ‘Best Routes’ for containerised imports into South Germany from China found that for some shippers using Mediterranean gateway ports is a viable alternative to the traditional North-West Europe gateways. To establish shippers’ best-route Drewry examined a variety of routes to find the best mix of cost, transit time and the number of service options. Firstly, the whitepaper looked at the number of maritime services from Shanghai to South Germany’s so-called Northern and Southern gates that were available to the market as of March 2016 (see Table).

Drewry Launches e-Sourcing Solution

Drewry, an independent research and consulting firm to the shipping sector, has launched a new e-Sourcing solution for global ocean transport exporters and importers. The new e-Sourcing Ocean Freight Solution (eSOFS) combines Drewry’s freight rate benchmarking intelligence, industry expertise with new technology to bring speed and efficiency to ocean freight sourcing events, the firm explained. Faced with increasingly complex, data-intensive product flows and budgetary constraints, ocean transport logistics managers within multinational retailers and manufacturers have been seeking a more efficient and cost effective process to handle procurement activities. Drewry said its eSOFS solution provides the flexibility and analytical capabilities to ensure well informed procurement decisions.

East-West Shippers See Contract Rates Slide

Ocean freight rates for cargo moving under contracts on the major East-West trade routes saw another reduction in the last quarter of 2015, according to Drewry’s Benchmarking Club, a closed user group of multinational retailers and manufacturers who closely monitor their contract freight rates. The Drewry Benchmarking Club Contract Rate Index, based on Trans Pacific and Asia-Europe contract freight rate data provided confidentially by shippers, declined by 5 percent between August and November last year, another fall on top of the sharp decline we saw during the third quarter of 2015. The reduction in contract rates was driven by a combination of lower fuel costs, excess vessel capacity and intensive competition between shipping lines.

Drewry: Container Reliability Stable in November

Containership reliability was broadly unchanged in November as the average on-time performance across all trades slipped by just 0.8 percentage points against October to 77.2%, according to Carrier Performance Insight, the online schedule reliability tool provided by Drewry Supply Chain Advisors. Six of the 10 trades covered recorded month-on-month on-time improvements in November, but worse performances in each of the three East-West trades and in the Asia-South America route – the only North-South trade to decline – dragged down the overall reliability performance. The average deviation from the sailing schedule was 0.8 days. Eight of the 19 “Top 20” carriers measured scored an average on-time performance of 80% or higher in November.

Drewry: Container Reliability Stable in November

Containership reliability was broadly unchanged in November as the average on-time performance across all trades slipped by just 0.8 percentage points against October to 77.2 percent, according to Carrier Performance Insight, the online schedule reliability tool provided by Drewry Supply Chain Advisors. Six of the 10 trades covered recorded month-on-month on-time improvements in November, but worse performances in each of the three East-West trades and in the Asia-South America route – the only North-South trade to decline – dragged down the overall reliability performance.

Drewry: Container Service Reliability Falls

Containership reliability took a small step backwards in October as the average on-time performance across all trades reached 77.9%, according to Carrier Performance Insight, the online schedule reliability tool provided by Drewry Supply Chain Advisors. The latest result is based on reliability across 10 deep-sea container trades, instead of the three East-West trades as was previously measured up to and including September 2015, when the aggregate on-time result was 79.9%. The expanded coverage is part of an upgrade to Drewry’s Carrier Performance Insight, which now covers 69 ports and 809 port pairs, and also includes new functionality to download data from the monthly release in both Excel and PDF formats.

East-West Shippers' Contract Rates Falling -Drewry

Ocean freight rates for cargo moving under contracts on the major East-West routes have seen a sharp reduction since the beginning of the year, according to Drewry’s Benchmarking Club, a closed user group of multinational retailers and manufacturers who closely monitor their contract freight rates. The Drewry Benchmarking Club contract rate index, based on Trans Pacific and Asia-Europe contract freight rate data provided confidentially by shippers, declined by 7% between May and August this year, the steepest fall since the Benchmarking Club was established in March 2014. The fall in contract rates has been driven by a combination of lower fuel costs, excess vessel capacity and intensive competition between shipping lines.

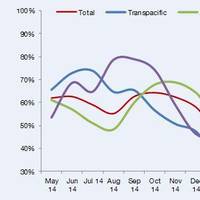

Liner Reliability Slips for First Time in 6 Months

Breaking a run of six consecutive months of improvement, container service reliability across the three main East-West trades declined in July, falling by 4.0 percentage points from June to 73.3%, according to Carrier Performance Insight, the online schedule reliability tool provided by Drewry Supply Chain Advisors. The latest overall monthly performance was the result of lower reliability scores in the Asia-Europe and Transpacific trades, although service punctuality for the far smaller Transatlantic route was raised to a new data series high.

Containership Reliability Reaches New High

Container service reliability reached a data-series high in April with the aggregate on-time performance for the three key East-West trades rising to 67.6%, up by 4.1 percentage points on March, according to Carrier Performance Insight , the online schedule reliability tool provided by Drewry Supply Chain Advisors. The previous best since Drewry’s new data series started in May 2014 was achieved in October last year (64.3%) after which the industry struggled to cope with heavy port congestion on the US West Coast and the implementation of new alliance partnerships and services.

Liner Service Reliability Jumps to 64%

According to Drewry Supply Chain Advisors, liner shipping service reliability on the three East-West trades showed an aggregate on-time performance of 64% in March - a five-month high. According to Carrier Performance Insight, the online schedule reliability tool provided by Drewry, this was 8.5% up on the February figure - and the second best aggregate since the new data series begun last May. The latest result represents an 8.5 percentage point gain over February and is the second best average (after October 2014) since the start of the new data series in May 2014. Drewry attributed the improvement to better services on the Asia-Europe trade and slowly improving congestion conditions after the labour go-slow on the US West Coast was settled.