Port of Corpus Christi Gets $157.3 Million for Channel Improvement Project

The Consolidated Appropriations Act of 2023, approved by Congress in December 2022, includes project closeout funding of $157.3 million for the Port of Corpus Christi Ship Channel Improvement Project (CIP) for the U.S. Army Corps of Engineers (USACE). This funding will advance the last phase of the CIP, a national critical infrastructure project that will render the Corpus Christi Ship Channel the most improved in the entire U.S. Gulf Coast from Texas to Florida. The Port of Corpus Christi is the nation’s largest U.S.

Russian Coal, Crude, LNG Exports Slipping as Self-sanctioning Starts

The voluntary shunning of Russian commodities by Western buyers, or self-sanctioning, was expected to start hitting exports of crude oil, liquefied natural gas (LNG) and coal from April, but there are already signs that flows are weakening.Russia's invasion of neighbouring Ukraine has prompted numerous Western companies to withdraw from their investments in Russia and scale back or halt their purchases of energy commodities, the mainstay of Russia's economy.While Western governments haven't directly sanctioned energy commodities…

Japan's Power Plan to Rattle Australian Coal, LNG exporters

Japan has been largely forgotten as a source of demand for energy commodities, overshadowed by the rapid rise of China, but the country's new electricity generation targets will shake the market up.For many years Japan has been viewed as a largely steady source of demand for liquefied natural gas (LNG) and thermal coal used in power generation, with small variations in the volumes imported on a year-by-year basis.But this comfortable situation for commodity producers supplying…

Vitol, ENH Form LNG Trading JV

Commodity trading company Vitol and the Mozambican state-owned oil and gas company ENH have formed ENH Energy Trading, a partnership focused on trading oil products.The Dutch energy and commodity trading company said in a press note that ENH Energy Trading will initially be owned 51% by ENH and 49% by Vitol. It is anticipated ENH’s share will increase over time.ENH Energy Trading will focus on energy commodities, in particular LNG, LPG and condensate, enabling ENH to create additional value and develop expertise in trading energy commodities.Mozambique has an estimated 125 TCF of technically recoverable gas resources. In addition to using these resources to fuel domestic energy demand…

Suez Canal Accounts for 8% of LNG Trade

Total oil flows through the Suez Canal and the SUMED pipeline accounted for about 9% of total seaborne traded petroleum in 2017, and LNG flows through the Suez Canal and the SUMED pipeline accounted for about 8% of global LNG trade."The Suez Canal and the SUMED Pipeline are strategic routes for Persian Gulf crude oil, petroleum products, and LNG shipments to Europe and North America," U.S. Energy Information Administration (EIA) said.Located in Egypt, the Suez Canal connects the Red Sea with the Mediterranean Sea, and is considered as a key choke-point due to the large volumes of energy commodities that flow through it.Choke-points are narrow channels along widely used global sea routes that are critical to global energy security…

"A Maritime Disaster Waiting to Happen"

Since the founding in 2016, cyber defence company Naval Dome has won awards for its Endpoint cyber defense system and achieved the highest level of security certification from classification society DNV GL, helping to protect merchant ships, cruise ships and yachts from cyber-attack.In 2019, Naval Dome optimized Endpoint with a “Dashboard” App, providing maritime users with a clear picture of the cyber status of all critical systems on board the ship, designed to allow users…

TMS Cardiff Gas Charter Pact with Vitol

Greece-based TMS Cardiff Gas, an operator and manager of 16 liquefied natural gas (LNG) Carriers, announced that it has entered into a ten year time charter contract with Vitol, a energy & commodities company, for one of its X Carrier Series vessels.The 174,000 cubic meter vessel with efficient XDF propulsion is being constructed at Hyundai Heavy Industries (HHI). The LNG carrier company has now secured term employment for ten of its eleven X Carrier Series vessels and maintains options for further growth.The vessel will be built to the highest industry specifications, as per TMS Cardiff Gas standards.The Company maintains its appetite for further growth in the sector…

DNV GL Publishes 2050 Maritime Forecast Report

A transitioning energy industry will change the shape of shipping, but not its importance to the global economy, says DNV GL. In its recently published Maritime Forecast to 2050, DNV GL analyzes a changing global energy system’s impact on the shipping industry through to 2050, exploring how factors such as expected shifts in energy production and demand, GDP growth, industrial production and regional manufacturing might affect the maritime industry and individual ship segments.

Maiden Bakken oil cargo to Asia ships out, with more to come

The first ever reported export of North Dakota's crude oil to Asia left port last month, according to a shipping document seen by Reuters on Wednesday, in what is expected to be the first of numerous cargoes once the key Dakota Access pipeline starts moving oil in May. Swiss-based Mercuria Energy Trading S.A. loaded more than 600,000 barrels of Bakken crude, as well as some Mars Sour crude, in late March off the coast of Louisiana onto the very large crude carrier (VLCC) Maran Canopus, destined for Singapore, according to the bill of loading and ship tracking data. The burgeoning appetite for U.S. crude among Asian refiners could be a boon for Bakken crude, especially when the Dakota pipeline starts up.

South Korean Yards Eyed for $3.8 Bln LNG Shipbuilding Deal

A little-known investment company said it intends to order up to 20 liquefied natural gas (LNG) carriers, probably from South Korean shipbuilders. The contracts would be worth as much as $3.8 billion, two people with direct knowledge of the matter told Reuters. CBI Energy and Chemical, which is controlled by Australian and Canadian investors and has offices in Hong Kong, also said in a statement to Reuters that it would be seeking to buy floating LNG production and import facilities as part of an ambitious plan for Africa and Asia. The orders would be a major shot in the arm for South Korea's ailing shipbuilding industry, which has been hit by a collapse in new orders as global trade growth slows and after the slump in commodities prices in recent years.

U.S. Energy Security: Maritime Infrastructure Investment is a Key, says Moniz

The maritime industry was front and center yesterday in Washington, D.C., as “getting more oil on the water” was touted as one piece of the puzzle in ensuring future U.S. energy security, said U.S. Secretary of Energy Ernest Moniz. Sec. Moniz spoke yesterday at the U.S. Energy Information Administration (EIA) 2015 EIA Energy Conference at the Renaissance Downtown Hotel in Washington, DC. Building U.S. energy security via a strategic evaluation of the U.S. Strategic Petroleum Reserve (SPR) was central to his comments…

MOL JV Ink Deal for 2 LNG Vessels

Mitsui O.S.K. Lines, Ltd. announced today that through a joint venture ship-owning company with Itochu Corporation charter agreements have been signed with E.ON Global Commodities SE, a wholly owned subsidiary of E.ON SE. The joint venture also signed a deal with Daewoo Shipbuilding & Marine Engineering Co., Ltd.’s shipyard in Korea to build maximum of two new 179,900m3 liquefied natural gas (LNG) carriers to be able to fulfil the contractual requirements to EGC. MOL will manage the two new vessels, which will transport LNG from a shale gas liquefying plant in North America to Europe and other destinations around the world. EGC is the energy trading arm of E.ON SE, one of the world’s largest investor-owned power and gas companies.

Leading Shipping Equity Analyst Joins Clarkson Capital Markets

Clarkson Capital Markets, the investment banking arm of shipping services group Clarkson PLC, says it has enhanced its equity research coverage with the appointment of Omar Nokta as Managing Director of Shipping Research. Omar will be based in CCM's New York office. Omar brings significant sector experience and expertise to Clarkson Capital Markets. He joins CCM from Global Hunter Securities LLC where he was Senior Shipping Analyst. Prior to this he was Senior Research Analyst at Dahlman Rose, where he helped build the company into one of the leading shipping focussed investment banks, advancing its energy, commodities and metals and mining product offering.

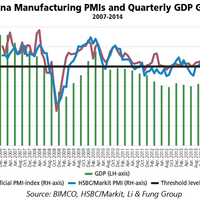

China’s Growth Plans are Positive for Global Shipping

China’s aim of 7.5% GDP growth for 2014 is positive news for the shipping market – in particular, dry bulk, the Baltic and International Maritime Council (BIMCO) said in a report published today. Despite being a little down on the 2013 GDP growth of 7.7%, BIMCO said the growth target of 7.5% set by China’s Premier Li Keqiang at his first appearance at China’s annual parliamentary session bodes well for shipping, trade and commodity demand in 2014. In 2013, Chinese seaborne imports surpassed the 2 billion metric tons, mark according to CRSL.

OCEANFREIGHT INC. Announces Fleet Expansion

March 29, 2011 - Athens, Greece - OceanFreight Inc., (NASDAQ:OCNF) a global provider of seaborne transportation services for both drybulk and energy commodities, announced today that it has entered into an agreement to purchase two resale newbuilding 206,000 DWT capesize vessels at a well-known Chinese yard. The vessels are scheduled to be delivered in the second and fourth quarter of 2013. The vessels will be purchased from a Company ultimately controlled by our Founder and Chief Executive Officer, Mr. Anthony Kandylidis.

CRUDE CARRIERS CORP. APPOINTS DIMITRIS P. CHRISTACOPOULOS TO ITS BOARD OF DIRECTORS

ATHENS, Greece, March 14, 2011 – Crude Carriers Corp. (NYSE: CRU) today announced that its Board of Directors has elected Dimitris P. Christacopoulos to serve as a Director on the Company’s Board. He will be an independent Board member and will serve on the Board's Audit and Independent Directors’ committees. Mr. Christacopoulos, 40, joined the Company’s Board on March 11th, 2011. Mr. Christacopoulos currently serves as a Partner at Octane Management Consultants. He started his…

Bulk Carrier Fleet Poised for Growth

A new report, released by Lloyd’s Register - Fairplay Research, predicts that the world’s dry bulk carrier fleet will continue to show strong growth over the next five years, spurred largely by surging demand for iron ore and metallurgical coal to feed China’s undiminished appetite for steel production. The monthly Shipbuilding Market Forecast for September examines the dry bulk and general cargo ship sectors. It provides a review of the global business environment demand for seagoing transport, market conditions and capacity utilization for these classes of vessels, and gives a detailed five-year shipbuilding forecast, including new orders, deliveries and demolitions.

OceanFreight Inc. New Charter

OceanFreight Inc. (NASDAQ: OCNF), a global provider of seaborne transportation services for both drybulk and energy commodities, announced a new charter for the recently acquired 180,000DWT, 2005 built capesize vessel. Upon delivery, the vessel will be renamed M/V Montecristo and will commence employment on a time charter for a minimum period of four years at a gross rate of $23,500 per day and a maximum of eight years at an average gross rate of $24,125 per day for the optional period. Anthony Kandylidis, Chief Executive Officer of the Company, commented: "Being consistent with our strategy of modern vessel acquisitions and of secured revenues…

Oceanfreight Inc. Acquires Capesize Vessel

OceanFreight Inc., (NASDAQ:OCNF) a global provider of seaborne transportation services for both drybulk and energy commodities, announced it has agreed to acquire a 2006 built 173,949 dwt Capesize bulk carrier for a purchase price of $61.25m. The vessel is scheduled for delivery before November 30, 2009. Upon delivery to the company the vessel will commence employment on a time charter for a minimum period of five years and a maximum period of 8 years at a rate of $26,000 per day. Anthony Kandylidis, Chief Executive Officer of the Company commented “We are very pleased to have acquired another high quality modern Capesize vessel. We continue to put to good use the equity proceeds recently raised.