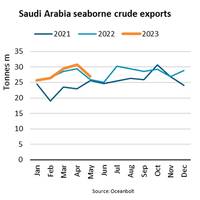

Saudi Arabian Crude Oil Exports Fall 12%

“By agreeing to an additional voluntary production cut within OPEC (Organization of the Petroleum Exporting Countries) of 500,000 barrels per day in May and announcing a further independent production cut of 1,000,000 barrels per day in July, Saudi Arabia is aiming to reduce excess supply and support prices,” says Niels Rasmussen, Chief Shipping Analyst at BIMCO.According to the EIA (U.S. Energy Information Administration), Saudi Arabian oil production fell to 9.9 mbpd (million barrels per day) in May…

Shell to Install Kongsberg's JAWS Software on 45 LNG Carriers

Shell has signed a five-year contract for the installation of Kongsberg's JAWS (Just Add Water System) software on board 45 of the LNG carriers chartered by Shell.These are LNG carriers that already utilize the Kongsberg Maritime K-IMS Information Management System application suite. K-IMS is a web-based solution that gives both ship crews and shore teams continual access to crucial voyage and vessel data. The provision of JAWS as an application within the K-IMS suite renders it instantly available to all K-IMS users.The contract signing follows a successful year-long trial…

Offshore Energy Outlook for 2020

The “new normal” is a phrase tossed around often in offshore energy circles today as those servicing and operating in the sector grapple with the harsh realities of the prolonged industry downturn. Operators, service companies and equipment suppliers have been forced to adjust to oil selling at prices well below the $100+ per barrel mark seen in years past. As of this writing, Brent oil was hovering around $62 per barrel, and analysts expect prices will remain in this range for some time into the future.On top of this…

UK to Account for 35% Offshore Wind in Europe

The UK will account for 35% of the growth in offshore wind over the next five years, followed by the Netherlands and Germany, said , according to WindEurope’s new ‘Wind Energy Outlook to 2023’.In the next five years 22 GW of wind energy capacity will reach the end of its normal operational life (20 years). Most of this will get a lifetime extension. Around 2 GW will be repowered.And another 2 GW will be fully decommissioned. Government policy and regulation is still not as supportive of repowering as it should be, it said."If Governments end up producing clear and ambitious National Energy & Climate Plans (NECPs) and they improve the permitting arrangements for wind farms and they keep investing in new grid capacity, then Europe’s wind energy capacity would grow by 88 GW to 277 GW by 2023.

LNG Spot Shipping Rates Increase, Says Awilco

In spite of low gas prices due to ample LNG supply growth and muted demand so far in 2019 spot shipping rates have gradually increased over the last few months and are currently about USD 70,000 per day on average, said Awilco LNG Group.According to Norwegian LNG transportation provider, European gas storage nearing full capacity coupled with a consistent contango across the LNG price curves for contracts delivering over the rest of the year supports sending US LNG to Asia.A handful of vessels have already been employed on storage plays over the next few months. Consolidation discussions with other ship owners are still ongoing, however…

IEA to Push for Offshore Wind Energy

The International Energy Agency (IEA) held a high-level workshop on the outlook for offshore wind energy yesterday (May 13), bringing together 80 senior representatives from government, the private sector, research groups, academia and international organisations.Participants joined from countries around the world, including many from Europe, the United States, Japan and China, said a press release from the Paris-based autonomous intergovernmental organization which works to ensure reliable, affordable and clean energy.Altogether, the countries represented at the workshop account for 97% of current and planned offshore wind development.Technological improvements for offshore wind are improving performance and lowering the costs of the electricity it produces…

BIMCO: US Seaborne Crude Oil Exports Hit Record High

US exports of crude oil have, since August 2018, continued to rise every month, with a new record high in January of 9.6 million tonnes. Exports rose in January on the back of increased sales to Europe, which rose from 2.7 million tonnes in December to 4.8 million tonnes in January.A strong end to 2018 meant that volumes for the full year totalled 87.4 million tonnes, 96.7% higher than the 44.4 million tonnes exported in 2017. This is good news for the crude oil tanker sector…

India, China to Lead Rapid Growth in Energy

The major chunk of global energy supply growth is expected to come from renewables and natural gas over the next two decades, but steep investment in oil exploration and production will be needed to meet crude demand in 2040.The global energy demand is set to rise by around a third by 2040, driven by improvement in living standards, particularly in India, China and across Asia.- These are the key highlights of BP Energy Outlook 2019.It shows how rising prosperity drives an increase in global energy demand and how that demand will be met over the coming decades through a diverse range of supplies including oil, gas, coal and renewables.The UK-based oil company said wind…

Offshore Wind: Good Supply, Growing Demand

In its 2019 “Annual Energy Outlook” the US Energy Information Administration (EIA) projects that electric generation from renewables (wind, solar, hydro) will go from 500 billion KWh in 2018 to 1500 billion KWh in 2050, just 30 years from now.“The AEO highlights the increasing role of renewable energy in the US generation mix,” said EIA Administrator Linda Capuano. “Solar and wind generation are driving much of the growth. In fact, our reference case projects that renewables will grow to become a larger share of U.S.

Wind to be EU's Largest Power Source in Ten Years

Wind power is set overtake coal, nuclear and gas to become the EU’s largest power source well before 2030. This is according to the International Energy Agency’s (IEA) 2018 World Energy Outlook.According to the IEA’s projections, wind energy will become the EU’s largest power source in 2027, overtaking coal, nuclear and then gas in the process. This is compared to the IEA’s last projection made in its 2017 World Energy Outlook, where it said this would happen “soon after 2030”.According to the IEA, wind electricity generation in the EU will more than triple to 1,100 TWh by 2040, pointed out WindEurope, association based in Brussels,…

Cautious Consolidation for OSV Companies Brings Market Change

Will a rising tide in the offshore oil markets float all the boats? In the U.S. Gulf of Mexico, that remains to be seen.Offshore services, exploration and production are on a roll. In early October, yet another business combination of big drillers was announced. In a sign of optimism, Ensco announced its plan for an all-stock acquisition of Rowan Offshore, worth around $2.4 billion. The new company will be domiciled in the United Kingdom, but will have a large presence in Houston.

Optimism in Multipurpose Shipping: Drewry

Surging growth in renewable energy generation around the world and a construction boom in South East Asia that is expected to run for the next 10 years bode well for the once ailing multipurpose shipping fleet.In the latest edition of Drewry’s Multipurpose Shipping Forecaster report we declare that we remain cautiously optimistic on the outlook for the sector. There are some caveats to this optimism as global general cargo demand is forecast to grow at a rate of just 2% per year to 2022, while the multipurpose and heavylift fleet is expected to contract at less than 1% per year over the same period.Meanwhile, the threat of a trade war…

EIA: Oil Barrel Price Steady Around $70

EIA expects Brent prices will average $71 per barrel in 2018 before declining to $68 per barrel in 2019. In the June 2018 update of its Short-Term Energy Outlook (STEO), the U.S. Energy Information Administration (EIA) forecasts Brent crude oil prices will average $71 per barrel (b) in 2018 and $68/b in 2019. The new 2019 forecast price is $2/b higher than in the May STEO. The increase reflects global oil markets balances that EIA expects to be tighter than previously forecast because of lowered expected production growth from both the Organization of the Petroleum Exporting Countries (OPEC) and the United States. Brent crude oil spot prices averaged $77/b in May, an increase of $5/b from April and the highest monthly average price since November 2014.

China Surpasses US as Largest Crude Oil Importer

China took the crown as the world’s largest crude oil importer in 2017, according to U.S. Energy Information Administration press release. China imported 8.4 million barrels per day, and the United States imported 7.9 million barrels per day. China had become the world’s largest net importer (imports minus exports) of total petroleum and other liquid fuels in 2013. New refinery capacity and strategic inventory stockpiling combined with declining domestic oil production were the major factors contributing to the recent increase in China’s crude oil imports. In 2017, 56 percent of China’s crude oil imports came from countries within the Organization of the Petroleum Exporting Countries (OPEC), a decline from the peak of 67 percent in 2012.

BP Says Gas will Overtake Oil as Main Energy Source by 2040

BP expects gas to overtake oil as the world's primary energy source in around 2040 as demand for the least polluting fossil fuel grows, its vice president for strategic planning said on Wednesday. "We see it (gas) take over from coal in the early 2030s... We think there is a very good case for gas actually overtaking oil post 2040 or just before 2040," Dominic Emery told a gas conference in Vienna. Emery highlighted estimates for demand growth for gas in China of around 15 percent year-on-year last year and said BP expects overall gas demand to grow around 1.6 percent a year for years to come…

8 Energy Firms Commit to Reduce Methane Emissions

BP, Eni, ExxonMobil, Repsol, Shell, Statoil, Total and Wintershall have committed to further reduce methane emissions from the natural gas assets they operate around the world. The energy companies also agreed to encourage others across the natural gas value chain – from production to the final consumer – to do the same. The commitment was made as part of wider efforts by the global energy industry to ensure that natural gas continues to play a critical role in helping meet future energy demand while addressing climate change. Since natural gas consists mainly of methane, a potent greenhouse gas, its role in the transition to a low-carbon future will be influenced by the extent to which methane emissions are reduced.

BP’s LNG Carrier Fleet is Growing

BP said it will take delivery of six new, state-of-the-art liquefied natural gas (LNG) tankers in 2018 and 2019 to support its expanding global LNG portfolio. BP’s finance partners KMarin and ICBC Leasing are investing more than $1 billion in the tankers. The vessels will join BP’s exixting fleet to help service a 20-year liquefaction contract with the Freeport LNG facility in Texas, as well as other international LNG projects in BP’s global portfolio. “These vessels will significantly increase BP’s ability to safely transport LNG to anywhere in the world, directly supporting BP’s global natural gas strategy,” said BP Shipping CEO Susan Dio. The new ships are designed to be about 25 percent more fuel efficient than their predecessors, BP said.

US LNG Exports to Increase: EIA

U.S. Energy Information Administration (EIA)'s latest Short-Term Energy Outlook projects that the United States will export more natural gas than it imports in 2017. The U.S. has been a net exporter for three of the past four months and is expected to continue to export more natural gas than it imports for the rest of 2017 and throughout 2018. The nation’ status as a net exporter is expected to continue past 2018 because of growing U.S. natural gas exports to Mexico, declining pipeline imports from Canada, and increasing exports of liquefied natural gas (LNG). The U.S. is currently the world's largest natural gas producer, having surpassed Russia in 2009. Natural gas production in the U.S. increased from 55 billion cubic feet per day (Bcf/d) in 2008 to 72.5 Bcf/d in 2016.

Global Oil Demand to Grow into 2040s

Global oil demand will keep growing into the 2040s due to higher consumption of plastic goods even as the electric vehicle fleet expands rapidly and technology revolutionises transport, BP said in its annual Energy Outlook on Wednesday. The forecast of sustained demand growth for the fossil fuel comes as other oil companies such as Royal Dutch Shell brace for demand to plateau by the early 2030s while countries gradually shift to less-polluting energy. In its industry benchmark report, BP forecasts a significant slowing of carbon emissions, which remain well in excess of goals set by governments to fight global warming. The British oil and gas company also said current recoverable global oil supplies of around 2.6 trillion barrels are sufficient to meet demand out to 2050 twice over.

US Authorizes Non-FTA LNG Export from Golden Pass

The U.S. Department of Energy announced that it has signed an order authorizing Golden Pass Products LLC to export domestically produced liquefied natural gas (LNG) to countries that do not have a free trade agreement (FTA) with the United States. Golden Pass is authorized to export LNG up to the equivalent of 2.21 billion cubic feet per day (Bcf/d) of natural gas to any non-FTA country not prohibited by U.S. law or policy from the Golden Pass Terminal near Sabine Pass, in Jefferson County, Texas. With the dramatic increase in domestic natural gas production, the U.S.

EIA Release Short-Term Energy Outlook

The U.S. Energy Information Administration released its Short-Term Energy Outlook. • North Sea Brent crude oil spot prices averaged $52 per barrel (b) in April, $1/b higher than the March average and the fifth consecutive month that Brent crude oil spot prices averaged between $50/b and $55/b. EIA forecasts Brent prices to average $53/b in 2017 and $57/b in 2018. West Texas Intermediate (WTI) crude oil prices are forecast to average $2/b less than Brent prices in both 2017 and 2018.

U.S. Freight Recovery Spurs Diesel Demand

U.S. freight movements have started increasing again, which should help boost consumption of distillate fuel oil in 2017 and 2018. The tonnage of freight moved by road, rail, barge, pipeline and air cargo has been increasing year on year since October, after stagnating for much of 2015/16 (http://tmsnrt.rs/2qSDLAJ). Freight movements hit a new record in February, before slipping slightly in March, according to the U.S. Bureau of Transportation Statistics (http://tmsnrt.rs/2rTVx58). Most freight is hauled by equipment that uses diesel engines, or jet turbines in the case of air cargo. Freight is therefore the main driver for consumption of fuels refined from the middle of the crude oil barrel, including distillate fuel oil and jet fuel. The U.S.

Delfin Project Gains US Approval to Export LNG

The U.S. Department of Energy (DOE) has approved a long-term application to export liquefied natural gas (LNG) from the first offshore project, Delfin LNG, LLC. Exports in the amount of 1.8 billion cubic feet per day (Bcf/d) of natural gas are approved from Delfin’s proposed offshore Louisiana floating LNG terminal in the Gulf of Mexico. Development of the Delfin project offshore of Cameron Parish, La. will include the construction of floating liquefaction and storage vessels.