BOEM Approves COP for Equinor's Empire Wind Project

The United States’ Bureau of Ocean Energy Management (BOEM) approved the Construction and Operations Plan (COP) for Equinor’s Empire Wind project, marking another milestone in advancing the New York offshore wind project.With this permitting action by BOEM secured, Empire Wind is on track to begin construction in its federal lease area off the southern coast of Long Island later this year. Already well advanced in planning and development, Empire Wind 1 could deliver first power to New Yorkers by 2026.

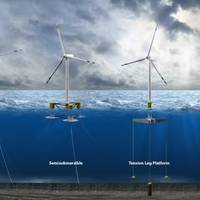

How Do Floating Wind Turbines Work?

Northern California has some of the strongest offshore winds in the U.S., with immense potential to produce clean energy. But it also has a problem. Its continental shelf drops off quickly, making building traditional wind turbines directly on the seafloor costly if not impossible.Once water gets more than about 200 feet deep – roughly the height of an 18-story building – these “monopile” structures are pretty much out of the question.A solution has emerged that’s being tested in several locations around the world: wind turbines that float.In California…

Crowley, Humboldt Bay to Develop and Operate California Wind Terminal

Crowley signed an agreement on Thursday with the Port of Humboldt Bay to exclusively negotiate to be the developer and operator of a terminal to serve as California’s first hub for offshore wind energy installations. Through Crowley’s Wind Services group, the company will enter into negotiations with the port to lease and serve as the port’s developer of the Humboldt Bay Offshore Wind Heavy Lift Marine Terminal. The services provided will support tenants in the manufacturing, installation and operation of offshore wind floating platforms…

Chevron, Exxon Among Top Spenders at Biden Offshore Auction

U.S. oil majors Exxon Mobil Corp and Chevron Corp were among the top buyers at a federal auction of oil leases in the U.S. Gulf of Mexico on Wednesday that generated more than $190 million - the highest since 2019.The auction was a boon for federal coffers, but a potential setback for the climate policies of U.S. President Joe Biden, whose administration tried to suspend federal lease sales to fight global warming before a court forced them to proceed.The United States was also…

Maryland Act Boosts Offshore Wind Market

Maryland state lawmakers have passed the Clean Energy Jobs Act (CEJA) of 2019, which would incentivize the development of 1.2 GW of additional offshore wind energy off the coast of Maryland.US Wind Country Manager Salvo Vitale testified last month before the Senate Finance Committee and House Economic Matters Committee urging passage of the legislation while citing the significant economic benefits that the legislation would make possible by incentivizing the development of 1,200 MegaWatts of additional offshore wind energy off the coast of Maryland."The benefits are many and will prove transformational to Maryland's economy: 5,000-7…

NOIA Response : Cancellation of Alaska OCS Lease Sales

“The cancellation of scheduled federal lease sales offshore Alaska and the denial of lease suspension requests from Statoil and Shell are extremely disappointing and short-sighted. It is clear that this Administration used Shell's recent dry-hole experience as an excuse for a political exit from the Alaska offshore area. The Shell outcome should not have resulted in the cancellation of these two sales, which have been scheduled since 2012. Shell proved that exploration and drilling can be done safely in the Arctic, but the real challenge was navigating under the regulatory thumb of the Federal government. “The overall potential oil and gas outlook of offshore Alaska remains enormous.

W&T Offshore Acquires Interest in Federal Lease

W&T Offshore Inc. announced it has entered into an agreement with Apache Corp. to acquire Apache’s interest in Ship Shoal 349, a federal offshore lease off the coast of Louisiana, for $116m. “We are excited about acquiring Apache’s interest in the Ship Shoal 349 field,†said Tracy Krohn, W&T’s chairman and CEO. “Better known as Mahogany, (the field) was the first economic subsalt field drilled in the Gulf of Mexico. When consummated, W&T will own 100 percent working interest in the field.†W&T is an independent oil and natural gas company focused primarily in the Gulf of Mexico, including exploration in the deepwater and deep shelf regions.

W&T Offshore Acquires interest in Federal Lease

W&T Offshore Inc. announced it has entered into an agreement with Apache Corp. to acquire Apache’s interest in Ship Shoal 349, a federal offshore lease off the coast of Louisiana, for $116 million. “We are excited about acquiring Apache’s interest in the Ship Shoal 349 field,” said Tracy Krohn, W&T’s chairman and CEO. “Better known as Mahogany, (the field) was the first economic subsalt field drilled in the Gulf of Mexico. When consummated, W&T will own 100 percent working interest in the field.” W&T is an independent oil and natural gas company focused primarily in the Gulf of Mexico, including exploration in the deepwater and deep shelf regions.

Federal Lease Sale Draws Second Highest Bid Totals

The U.S. Department of the Interior’s Minerals Management Service recent central Gulf of Mexico lease sale received 1,428 bids on 723 tracts, attracting $2.9 billion in high bids – the second highest total in U.S. leasing history. Secretary of the Interior Dirk Kempthorne, who officially opened the sale, said the bids made a statement concerning the future of the Gulf of Mexico. “This historic sale emphasizes the Gulf’s strategic value for America’s energy security and the significant economic benefits of environmentally safe oil and gas production for the nation and the Gulf states,” Kempthorne said. The Gulf accounts for about a quarter of domestically produced oil and 15 percent of domestically produced natural gas in the nation.

GOM Lease Sales Up 38%

Near record oil and gas prices led to robust bidding in an offshore federal lease sale today. The Central Gulf of Mexico Lease Sale 198, garnered $588,309,791 in high bids from 82 companies for oil and natural gas leases in the Federal waters of the Gulf of Mexico. The total of all bids was $978,310,887. This represents a 38% increase over last years Central Gulf Sale. The sale, held March 15 in New Orleans, was conducted by the Minerals Management Service. In Sale 198 the agency received 707 bids on 405 tracts. Johnnie Burton, Director of the Minerals Management Service, spoke briefly at the sale. “The Department is committed to working with all interested parties to enhance energy development in an environmentally responsible manner in available areas of the Gulf,” she said.

Gov: No Offshore Signoffs Without Royalty Share

Louisiana’s governor warned that the state would not support future offshore lease sales in the Gulf of Mexico unless Louisiana gets a share of the federal royalties generated by oil production there. Under a federal law that governs offshore drilling, governors in adjacent states are required to agree that federal lease sales are consistent with their states' coastal management plans. Louisiana governors have traditionally signed off on such lease sales, and the current governor’s letter will not stop a March 15 lease sale of 4,000 blocks in the Gulf of Mexico for oil and gas exploration. However, the August lease sale could be held up. This is the latest push for a share of federal royalties from oil and gas production off Louisiana's coast.

Chevron Reports 1998 Net Income of $1.98 Billion

Chevron Corporation reported 1998 preliminary net income of $1.98 billion, down 39 percent from 1997 net income of $3.3 billion. Net income for 1998 and 1997 included net benefits of $31 million and $76 million, respectively, from special items. For the fourth quarter 1998, net income of $431 million included net charges of $72 million from special items. Charges associated with asset write-downs; reserves for environmental remediation and a litigation issue; and last-in, first-out (LIFO) inventory adjustments were partially offset by favorable prior-year tax adjustments and a gain from an asset sale. Fourth quarter 1997 net income included net benefits from special items totaling $68 million.