IMO2020: Market Uncertainty Brings More Fuel Oil Price Volatility

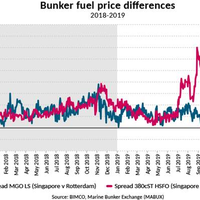

The oil market has recently been shaken up by geopolitical events, but volatility in the price difference between low and high sulphur fuel cannot be explained by that alone – the uncertainty is the chaos factor.The uncertainty of the upcoming IMO 2020 Sulphur cap regulation (IMO2020) is having a big impact on the bunker market. Whereas, the price for Marine Gas Oil Low Sulphur (MGO LS) has largely remained stable, the price for High Sulphur Fuel oil (HSFO) has been become increasingly more volatile in recent months.

Big Oil Set to Cash in on IMO 2020 Rules

The world's biggest oil traders are gearing up to cash in on big disruptions that could hit the shipping fuel market in just over a year due to new U.N.-mandated environmental rules.International Maritime Organization (IMO) regulations will cut the limit for sulphur in marine fuels globally from 3.5 percent to 0.5 percent from the start of 2020."We're going to hopefully facilitate the new rules in 2020 by helping out the industry and the participants in general to have a reasonably smooth transition…

IMO Low-Sulfur Requirements to Disrupt Industries

The International Maritime Organization (IMO) recently confirmed that global refiners and shippers must comply with new regulations to reduce the sulfur content in marine bunker fuels by January 2020—five years earlier than many expected. As a result, both the global refining and shipping industries will experience rapid change and significant cost and operational impacts, according to new analysis from IHS Markit, the leading global source of critical information and insight. “While the IMO is taking positive action to address the environmental impacts of air pollution from ships, the rapid change creates significant disruption for both the refining and shipping industries,” said Kurt Barrow, vice president of downstream research at IHS Markit.

LNG-fueled Newcastlemax Bulk Carrier Design Unveiled

Project partners BHP, Fortescue, Mitsui O.S.K. Lines (MOL), Rio Tinto, SDARI, U-Ming, Woodside, and DNV GL presented the results from stage one of their “Green Corridor” joint industry project (JIP), which demonstrated the commercial potential and technical feasibility of bulkers fueled by liquefied natural gas (LNG) in the iron ore and coal trade between Australia and China. The result is an LNG-fueled Newcastlemax design which is in the process of receiving Approval in Principle (AiP) from DNV GL. The idea of developing LNG-fueling infrastructure for the vessels operating on the Australia–China iron ore and coal trade route has been contemplated by major charterers, ship owners and operators for many years.

MAN B&W Launches Engines, Targets LNG

MAN B&W Diesel A/S launched the ME-GI engine, a range designed for the highly specialized LNG carrier market. The design builds on experience gained from the earlier MC-GI engines combined with the developments in the latest electronically controlled ME engines. The manufacturer is touting the combination of low installation and running costs for this highly specialised type of vessel makes the adoption of the dual fuel ME-GI engine from MAN B&W very attractive for owners and operators. An additional reliquefaction plant allows sale of more gas when the gas price is higher than the fuel oil price. “The LNG carrier market, like all sectors of the transportation industry, needs to control and, where possible, reduce operational expenses, while securing sound profit.