Sea States: Documentary on the Shipping Industry to debut in Spring 2019

Sea States, a new documentary film on the importance of the shipping industry is currently under production by Third Wave Films. Endorsed by the Connecticut Maritime Association, and the Marine Industry Foundation, the film is being funded by key stakeholders in the maritime community.Sea States will show how shipping is the life blood of our global economy. Despite the fact 90% of all consumables arrive by ship, the public remains unaware of the value of this hidden, yet massive industry.

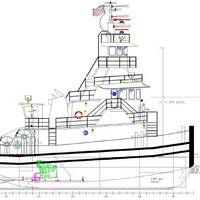

Rodriguez Shipbuilding Delivers Powerful Shallow-Draft Tugboat

The yard recently delivered a Cummins powered 75 by 28-foot model bow tug to Morgan City-based Garber Bros. Inc. and Sea Cypress LLC for Gulf of Mexico operations, inform Cummins Hotips. Cummins explain that over the years, Rodriguez Shipbuilding Inc, of Bayou LaBatre Alabama has probably delivered more shallow-draft tugs than any other US-yard. Their signature lugger-type tug design, with its distinctive aft cabin and wheelhouse, has a strong following amongst US Gulf Coast operators servicing near shore petro-operations.

New Tugs: Big Power, Shallow Draft

Bayou LaBatre Alabama has long been recognized for the production of its many shipyards. Currently the Rodriguez Shipyard is in the process of adding several more tugs to the dozens that they have launched over the decades. From the computer assisted design work of owner Joey Rodriguez, the latest creation is a shallow draft triple screw tug for Roy Garber’s Sea Cypress LLC in Berwick Louisiana. At 78 by 28 feet Rodriguez Hull #307 has a ten-foot molded depth. Three Cummins QSK19-M diesels…

Greene's Energy Promote Jaret Garber

Jaret Garber has been promoted to the position of Financial Manager of Testing and Services. Based in Lafayette, La., Garber will manage financial reporting and analysis of testing and services. This includes management of invoices, financial planning, analysis and division financial performance and monthly closing. Additionally, Garber will be responsible for cost control management; bonus plans and earn-outs; mergers and acquisitions; and balance sheets. Prior to promotion, Garber was the Financial Analyst and Fleet Administrator.

GEG Names Garber as CIO

Greene’s Energy Group (GEG), a provider of integrated testing, rentals and specialty services, has named Gene Garber as Chief Integration Officer, announced Chief Executive Officer (CEO) Bob Vilyus. Based in Lafayette, La., Garber, who also maintains his position as Senior Vice President, will now also be responsible for the development and integration of operational programs, strategies and associated projects to achieve strategic business goals and operational objectives. Additionally…

Global Marine and Santa Fe International Corporation Complete Merger Of Equals

Houston-based GlobalSantaFe Corporation announced that Global Marine Inc. and Santa Fe International Corporation completed their merger of equals. The ordinary shares of GlobalSantaFe will begin trading on the New York Stock Exchange on November 21, 2001, under the symbol "GSF". Global Marine and Santa Fe International shareholders approved the merger during separate shareholder meetings held earlier today. into 0.665 of an ordinary share of GlobalSantaFe. ordinary shares will trade as GlobalSantaFe ordinary shares. The combined company will have approximately 233 million shares outstanding. "This merger of two great companies creates the world's premier drilling contractor," GlobalSantaFe chairman, Robert E. "Bob" Rose, said.

GlobalSantaFe's Worldwide SCORE Supported By International Areas

Houston-based offshore drilling contractor GlobalSantaFe today reported that the company's worldwide SCORE, or Summary of Current Offshore Rig Economics, for November 2001 was essentially level with the previous month's SCORE. GlobalSantaFe President and CEO Sted Garber said, "The worldwide SCORE remained stable in November, in spite of oil price uncertainties and continued weakness in the Gulf of Mexico. GlobalSantaFe's SCORE compares the profitability of current mobile offshore drilling rig dayrates to the profitability of dayrates at the 1980-1981 peak of the offshore drilling cycle. In the 1980-1981 period, when SCORE averaged 100 percent, new contract dayrates equaled the sum of daily cash operating costs plus approximately $700 per day per million dollars invested.

GlobalSantaFe's Worldwide SCORE

Houston-based international offshore drilling contractor GlobalSantaFe reported that the company's worldwide SCORE, or Summary of Current Offshore Rig Economics, for December 2001 was down from the previous month's SCORE by 1.7 percent. Looking back at 2001, GlobalSantaFe President and CEO Sted Garber said, "SCORE clearly reflects some of the key trends in the major offshore drilling markets over the year. GlobalSantaFe's SCORE compares the profitability of current mobile offshore drilling rig dayrates to the profitability of dayrates at the 1980-1981 peak of the offshore drilling cycle. In the 1980-1981 period, when SCORE averaged 100 percent, new contract dayrates equaled the sum of daily cash operating costs plus approximately $700 per day per million dollars invested.

GlobalSantaFe's SCORE Declines

Houston-based international drilling contractor GlobalSantaFe reported that the company's worldwide SCORE, or Summary of Current Offshore Rig Economics, for February 2002 was down from the previous month's SCORE by 1.1 percent. GlobalSantaFe President and CEO Sted Garber said, "Declines in the Gulf of Mexico SCORE have slowed considerably and the international SCORE remains near its highest level since early 1999. The improving U.S. economy, which has strengthened U.S. GlobalSantaFe's SCORE compares the profitability of current mobile offshore drilling rig dayrates to the profitability of dayrates at the 1980- 1981 peak of the offshore drilling cycle.

GlobalSantaFe Reports 1Q Results

GlobalSantaFe Corporation reported net income for the quarter ended March 31, 2002, of $77.1 million, or $0.33 per diluted share, on revenues of $464.0 million. This compares to net income of $40.7 million, or $0.34 per diluted share, on revenues of $274.8 million for the quarter ended March 31, 2001. The 2001 financial results reflect only historical Global Marine, prior to the merger that formed GlobaSantaFe, so some comparisons to these results may not be meaningful. Santa Fe International into an industry leader," GlobalSantaFe President and CEO Sted Garber said. recording operating income of $97.5 million. largely insulated from the comparatively weak U.S. Gulf of Mexico drilling market.

SCORE Up for First Time in 10 Months

0.5 percent. classes. erosion in jackup dayrates. 1980-1981 peak of the offshore drilling cycle. million dollars invested. regions to indicate the relative condition of rig markets. month, includes separate SCORE calculations for the U.S. Mexico, the North Sea, West Africa and Southeast Asia. include jackup and semisubmersible rigs.

Offshore Market Begins To Rumble

U.S. oil drillers expect weaker or flat first quarter earnings but see revenues picking up later in the year as recent high oil prices trickle down to the service sector. According to sector company executives, the recovery is set to begin in the second half of this year for most, and improve markedly in 2001 as major, independent and national oil firms ramp up oil and gas exploration and production spending. "The year 2000 will be a transition year, the later we get into the year the better things will become...We troughed in the third quarter (1999)," Robert Rose, Chairman, President and CEO of offshore driller Global Marine. "But we have to wait to 2001 before we start having the kind of earnings we had in 1997…

GlobalSantaFe SCORE Shows Improvement

Houston-based worldwide drilling contractor GlobalSantaFe reported that the company's worldwide SCORE, or Summary of Current Offshore Rig Economics, for May 2002 was up from the previous month's SCORE by one percent. GlobalSantaFe President and CEO Sted Garber said, "This month's SCORE shows continued improvement in the Gulf of Mexico jackup market, as the cash-flow sensitive independents ramp up their 2002 Gulf-based drilling programs following several months of stable U.S. natural gas prices. With heightened Gulf drilling activity reducing excess jackup capacity, the concern subsides that Gulf-based rigs will move internationally and upset the balance of rigs in those markets.

GlobalSantaFe Reports 2Q Earnings

GlobalSantaFe reported net income for the quarter ended June 30, 2002, of $73.4 million, or $0.31 per diluted share, on revenues of $501.7 million, versus $84.3 million and $0.69 per diluted share for the corresponding 2001 quarter. For the six months ended June 30, 2002, GlobalSantaFe reported net income of $150.5 million, or $0.63 per diluted share, on revenues of $990.4 million. This compares to net income of $125.0 million, or $1.03 per diluted share, for the six months ended June 30, 2001. Comparisons to the 2001 financial results may not be meaningful as they reflect only the performance of Global Marine prior to the November 2001 merger that formed GlobalSantaFe.

GlobalSantaFe SCORE Shows Improvement

Houston-based worldwide oil and gas drilling contractor GlobalSantaFe Corporation reported that the company's worldwide SCORE, or Summary of Current Offshore Rig Economics, for July 2002 was up from the previous month's SCORE by 1.7 percent. GlobalSantaFe President and CEO Sted Garber said, "This month's SCORE showed real improvement in the Gulf of Mexico offshore rig market during July, as the supply for certain classes of jackup rigs in this region tightened and drove dayrates higher. GlobalSantaFe's SCORE compares the profitability of current mobile offshore drilling rig dayrates to the profitability of dayrates at the 1980-1981 peak of the offshore drilling cycle.

GlobalSantaFe Announces Senior Management Change

GlobalSantaFe Corporation reported that executive vice president of finance and Administration Seals McCarty has elected to take early retirement from the company and will pursue other interests after a long and successful tenure with the organization. Effective immediately, chief financial wfficer Matt Ralls will report directly to President and Chief Executive Officer Sted Garber. McCarty's position will not be filled. McCarty, 56, was named to his current position, which included oversight of the company's finance, human resources, procurement and information technology departments, following the merger that formed GlobalSantaFe in November 2001. Prior to his recent position, McCarty was chief financial officer of Santa Fe International Corporation.

GlobalSantaFe SCORE Shows Continued Worldwide Market Weakness

GlobalSantaFe Corporation reported that the company's worldwide SCORE, or Summary of Current Offshore Rig Economics, for August 2002 was down from the previous month's SCORE by 4.5 percent. GlobalSantaFe President and CEO Sted Garber said, Worldwide SCORE showed continued weakness in August for the semisubmersible rig market.This was especially true in the North Sea, where overall softness continued to put downward pressure on semisubmersible dayrates. GlobalSantaFe's SCORE compares the profitability of current mobile offshore drilling rig dayrates to the profitability of dayrates at the 1980-1981 peak of the offshore drilling cycle.In the 1980-1981 period…

GlobalSantaFe's Worldwide Semisubmersible SCORE Reaches 18-Month Low

Worldwide oil and gas drilling contractor GlobalSantaFe Corporation has reported that the company's worldwide SCORE, or Summary of Current Offshore Rig Economics, for September 2002 was down from the previous month's SCORE by 1.4 percent. GlobalSantaFe President and CEO Sted Garber said, "The Gulf of Mexico SCORE reversed from last month's dip. New, higher semisubmersible dayrates contributed to the area's improvement in September. GlobalSantaFe's SCORE compares the profitability of current mobile offshore drilling rig dayrates to the profitability of dayrates at the 1980- 1981 peak of the offshore drilling cycle. In the 1980-1981 period…

Offshore Sector SCORE Remains Flat

GlobalSantaFe reported that the company's worldwide SCORE, or Summary of Current Offshore Rig Economics, for January 2002 was down from the previous month's SCORE by 0.2 percent. previous month. dayrates show signs of leveling out in the Gulf of Mexico. to the profitability of dayrates at the 1980-1981 peak of the offshore drilling cycle. cash operating costs plus approximately $700 per day per million dollars invested. relative condition of rig markets. third Monday of each month, includes separate SCORE calculations for the U.S. Gulf of Mexico, the North Sea, West Africa, and Southeast Asia. Rig types include jackup and semisubmersible rigs.

Offshore Market 2000: In like a lamb, out like a lion?

Though fraught with traditional starts and stops, peaks and valleys, it appears now the much-anticipated Gulf of Mexico offshore business rebound is imminent. Maybe. Much of the uncertainty surrounding the upswing of offshore activity in the Gulf of Mexico region closely parallels the unpredictable dips and turns of the price per barrel of oil itself. While those in the industry and the financial community are hardly prepared to declare the oil market free from its cyclical shackles, there has been mounting evidence that those who most directly control the market - i.e. OPEC leaders - are more determined than ever to ensure stability is the hallmark of the new millennium's oil market.

GLM, Santa Fe International Announce $6 Billion Merger

The course of corporate consolidation within the already tight offshore business took a dramatic turn over the holiday weekend, as Global Marine Inc. and Santa Fe International Corporation entered into a definitive agreement to merge in a stock-for-stock transaction that will create the world's second largest offshore drilling contractor. The new company, which will be named GlobalSantaFe Corporation, will be headquartered in Houston and will trade on the New York Stock Exchange under the ticker symbol "GSF". Based on Santa Fe's closing stock price on Friday, August 31, GlobalSantaFe would have a market value of approximately $6 billion.

Offshore SCORE Drops in November

GlobalSantaFe Corporation reported that the company's worldwide SCORE, or Summary of Current Offshore Rig Economics, for November 2002 was down from the previous month's SCORE by 1.0 percent. GlobalSantaFe President and CEO Sted Garber said, "Worldwide SCORE was essentially flat in November. SCORE in the various international markets continues to fluctuate. GlobalSantaFe's SCORE compares the profitability of current mobile offshore drilling rig dayrates to the profitability of dayrates at the 1980-1981 peak of the offshore drilling cycle. In the 1980-1981 period, when SCORE averaged 100 percent, new contract dayrates equaled the sum of daily cash operating costs plus approximately $700 per day per million dollars invested.

Offshore:Offshore SCORE Drops in November

GlobalSantaFe Corp. reported that the company's worldwide SCORE, or Summary of Current Offshore Rig Economics, for November 2002 was down from the previous month's SCORE by 1.0 percent. GlobalSantaFe President and CEO Sted Garber said, "Worldwide SCORE was essentially flat in November. SCORE in the various international markets continues to fluctuate. The offshore drilling rig market will likely be in a holding pattern until operators' 2003 exploration and production budgets provide some direction." GlobalSantaFe's SCORE compares the profitability of current mobile offshore drilling rig dayrates to the profitability of dayrates at the 1980-1981 peak of the offshore drilling cycle.