OHT Gets $135M Loan for 'Alfa Lift'

Oslo-listed offshore heavy transport and wind installation company OHT has received and accepted a firm offer for a USD 135 million Senior Secured Green ECA Credit Facility.The loan was accepted by OHT's ship owing company OHT Alfa Lift AS, which is building the offshore wind foundation installation vessel Alfa Lift in China. OHT ordered the Alfa Lift on speculation in 2018, and has since secured contracts to install foundations at the world's largest wind farm - the Dogger Bank in the UK.Sharing further details on the loan…

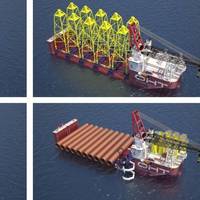

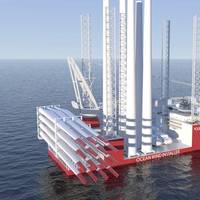

Ocean Installer, Vard Working on 'Most Advanced' Offshore Wind Installation Vessel

Ocean Installer, a Norwegian company mostly known for its offshore oil and gas services provider, is increasingly turning towards the offshore wind industry.Following a recent establishment of an offshore wind branch, and the naming of a director to lead it, Ocean Installer on Monday announced it would enter into a partnership with shipbuilder Vard - a Fincantieri company - "to develop one of the world's most advanced turbine installation vessels for offshore wind." Erik Haakonsholm…

Teekay Gets Norway's 'Green' Funding for Tankers

The marine energy transportation company Teekay Offshore has secured long-term financing from the Norwegian Government for four new shuttle tankers being built at Samsung Heavy Industries (SHI) in South Korea.The shuttle tankers are all equipped with a new innovative technology developed by the maritime supplier Wärtsilä in cooperation with Teekay, resulting in zero volatile organic compounds (VOC) emissions from the tankers.On behalf of the Norwegian Government, Export Credit Norway and GIEK have provided loan and guarantee of USD 165.5 million. The financing is part of a larger syndicate involving several commercial banks and a foreign export credit agency.

Partnership Creates spill Response 'One-Stop-Shop'

Norwegian suppliers Framo, Maritime Partner, Norbit Aptomar, and NorLense have come together to create the OSRV (Oil Spill Recovery Vessel) Group to offer a complete oil spill response solution. “Our aim is to be a one-stop-shop where we pool our efforts and act as a total systems supplier of safe, highly functional, and well-tested technology. The emergency response equipment has undergone thorough testing and quality assurance drawing on 40 years of oil spill response experience,” says Jørgen Brandt Theodorsen, Area Manager, Oil & Gas Pumping Systems, at Framo.

Investors Give Kleven a Boost

A group of investors has pumped nearly $40 million into Norwegian shipbuilder Kleven. Norwegian cruise, ferry and cargo operator Hurtigruten and its owners, Petter A. Stordalen and TDR, will be the largest partner in the newly established company, with a 40 percent share. Current owners, John Kleven AS and H-Invest AS are bringing new funds to the company. Additional investors include Åge Remøy and Magnus Roth's InYard Invest, Lürssen-Group, and Per Lillebø. "It has been important for us to bring in new investors with an industrial…

Höegh LNG Secures Financing for FSRU Unit

Höegh LNG Holdings has announced that it has received commitment letters for a US$230 million debt financing for its eighth floating storage and regasification unit (FSRU). The Facility comprises a 12 year export credit agency (ECA) term loan of up to USD 150 million backed by Garantiinstituttet for Eksportkreditt (GIEK) and Eksportkreditt of Norway, and a 5 year non-amortising commercial bank loan of up to USD 80 million funded by ABN AMRO Bank, Danske Bank, Nordea and Swedbank. The Facility is available to fund 65% of the delivered cost of the FSRU with no employment requirement, increasing to 75% upon securing long-term employment. The interest rate will be swapped from floating to fixed, and at the current market conditions the fixed interest rate is expected to come in at around 4.1%.

Norwegians to Finance Vessel Retrofits

Following the International Maritime Organization (IMO) ratifications of the ballast water and exhaust gas treaties, government-owned Export Credit Norway offers financing to international vessel owners who purchase retrofit equipment from Norwegian suppliers. The Norwegian export credit agency Export Credit Norway has assembled a specialized team and tailor-made financing solution to support vessel owners who need to retrofit equipment such as gas exhaust cleaning systems, ballast water treatment systems and new coating systems.

Scorpio lines up $172m in loans for newbuilds

Scorpio Tankers Inc. announced today that the Company has received commitments for a loan facility of up to $172 million from a group of financial institutions including Macquarie Bank Limited (London Branch), DekaBank Deutsche Girozentrale ("DekaBank"), The Export-Import Bank of Korea ("KEXIM") and Garanti-Instituttet for Eksportkreditt ("GIEK"). The loan facility, which is composed of multiple tranches, will be used to finance up to 60% of the market value of eight MR product tankers under construction at Hyundai Mipo Dockyard Co., Ltd. which are scheduled for delivery in 2017 and 2018. The maturity date of each tranche is between six and 12 years from each drawdown date, and the facility bears interest at LIBOR plus a blended margin of 2.02% per annum.

Scorpio Tankers Secures $172m for Eight Vessels

Tanker carrier Scorpio Tankers has landed a loan deal for USD 172 million. The money will finance 60 percent of eight new MR product tankers which are currently under construction in South Korea. The company said in a press release that it has received commitments for a loan facility of up to $172 million from a group of financial institutions including Macquarie Bank Limited (London Branch), DekaBank Deutsche Girozentrale (DekaBank), The Export-Import Bank of Korea (KEXIM) and Garanti-Instituttet for Eksportkreditt (GIEK). The loan facility, which is composed of multiple tranches, will be used to finance up to 60% of the market value of eight MR product tankers under construction at Hyundai Mipo Dockyard Co., Ltd. which are scheduled for delivery in 2017 and 2018.

PLSV Delivered to TechDof Brasil

DOF Subsea and Technip, through 50/50 owned affiliate TechDof Brasil AS, have taken final delivery of the pipe-lay support vessel (PLSV) Skandi Açu. The vessel commenced as per commitment on August 13, 2016 its eight-year charter contract with Petrobras. It is the first of four PLSVs fixed on long-term charters with Petrobras which were awarded to the joint venture between DOF Subsea and Technip in August 2013. The vessel is designed to achieve a 650-ton laying tension capacity…

Construction Vessel Delivered to Eidesvik Offshore

Eidesvik Offshore has taken delivery of Viking Neptun, an offshore construction vessel from Kleven Verft AS. According to Eidesvik Offshore, TBN Viking Neptun is represents its largest ever investment in the subsea segment. A long-term loan facility of $124 million has been drawn with Nordea and Eksportkreditt Norway/GIEK to finance the vessel. The vessel, equipped with Reach ROVs and manned by Eidesvik marine personnel and Reach ROV personnel and engineers, will begin a contract with Technip in March 2015.

Norwegian Seminar to Focus on Financing, Procurement

The challenges of managing efficient procurement processes and getting the right funding in the shipping and offshore sectors is the topic for a major half day conference in Singapore later this month. Coinciding with the Asia Pacific Maritime (APM) event on March 20, the Norwegian Procurement and Finance seminar is aimed at operators seeking to build vessels, capital goods or services within the shipping and offshore industries, or Norwegian exporters in these fields. The session will also see the release of a major report into procurement processes in Asia which was commissioned by the Norwegian Oil and Gas Partners (INTSOK) organization. The main findings will be revealed at the event.

Petrobas CEO to Deliver Keynote Address at Nor-Shipping 2013

Petrobras CEO, Maria das Graças Silva Foster – named one of the world’s 100 most influential people by Time magazine in 2012 – will be a keynote speaker for the New Frontiers roundtable at Nor-Shipping’s Agenda Offshore conference on June 5. Foster will be joined by top executives from two other world-leading oil and gas companies. Statoil CEO Helge Lund and Royal Dutch Shell Upstream International Director Andy Brown will speak at the event, the second time Nor-Shipping hosts a conference connecting the offshore industry and the maritime industry.

Deepwater Driller Ocean Rig 2012 Financial Reports

Ocean Rig UDW Inc international contractor of offshore deepwater drilling services reports unaudited losses in Q4 & year-end 2912 financial results. For the year ended 2012, the Company reported a net loss of $132.3 million, or $1.00 basic and diluted loss per share. ◦ Costs associated with the 10-year class survey for the Eirik Raude of $65.5 million, or $0.50 per share. Excluding the above items, the Company's net results would have amounted to a net loss of $66.8 million, or $0.50 per share. • The Company reported Adjusted EBITDA of $354.4 million for the year ended 2012, as compared to $387.9 million for the year ended 2011.

Pacific Drilling Gets Funding for Two Drillships

Pacific Drilling S.A. sign a $1 billion senior secured credit facility agreement to finance construction of the Pacific Sharav & Pacific Meltem. The term loan made pursuant to the credit facility will have a maturity of 5 years from the delivery date of the Pacific Meltem. A portion of the funding will be provided before delivery of the vessels, with all drawdowns from the facility subject to satisfaction of customary conditions precedent. The transaction was led and structured by Citibank and DNB, and supported by the Norwegian export credit agencies Garanti-Instituttet for Eksportkreditt (GIEK) and Eksportkreditt Norge AS. Also acting as Mandated Lead Arrangers were ABN AMRO, ING, SEB and Standard Chartered Bank.

Ocean Rig Announces Financing, Contract Developments

The Company announced that it has received firm commitments from lenders for a $1.35 billion syndicated secured term loan to partially finance the construction costs of the Ocean Rig Mylos, the Ocean Rig Skyros and the Ocean Rig Athena. This facility has a 5 year term, and approximately an 11 year repayment profile. The facility bears interest at LIBOR plus a margin. Lead banks are DNB Bank and Nordea Bank supported by several other commercial lenders. Also participating in this financing are export credit agencies Garanti-Instituttet for Eksportkreditt (GIEK), Export Credit Norway and the Import-Export Bank of Korea (KEXIM). This agreement is subject to definitive documentation which the Company expects to complete in the first quarter of 2013.

Farstad Takes Delivery of New PSV

Platform Supply Vessel (PSV) 'Far Scotsman' delivered from STX OSV Langsten shipyard to Farstad Shipping Ltd. The vessel is of PSV 08 CD design, developed in close co-operation between STX Europe and Farstad Shipping. Far Scotsman will trade the spot market in the North Sea. Eksportkreditt Norge AS financed the vessel in cooperation with DNB Bank ASA, GIEK and SpareBank 1 SMN. Farstad Shipping's fleet currently consists of 54 vessels (29 AHTS, 22 PSV and 3 SUBSEA) with 7 PSV and 4 AHTS under construction.

Ocean Installer, Solstad Order Subsea Vessel

Ocean Installer and Solstad Offshore ordered a large, advanced construction support vessel (CSV). The vessel will be delivered in Q2 2014 and is to be operated by Ocean Installer. The contract is subject to GIEK (“Garanti-instituttet for eksportkreditt”) board approval (June 20th 2012). The vessel, of type OSCV 06L, has been designed by shipbuilder STX OSV and Solstad, in close cooperation with Ocean Installer. This combination has resulted in one of the most advanced CSVs built to date. The vessel is equipped with a 3000t carousel, a 400t active heave compensated (AHC) crane and launching systems for Remotely Operated Vehicles (ROVs) (LARS). The vessel will be delivered with a 150t Vertical Lay Spread System (VLS) priced at 200 million NOK.

Dryships Announces Signing Of $800 Million Loan Facility

ATHENS, GREECE – April 18, 2011 - DryShips Inc. (NASDAQ: DRYS) (the “Company” or “DryShips”), a global provider of marine transportation services for drybulk and petroleum cargoes and off-shore contract drilling oil services, announced the signing, by its majority-owned subsidiary Ocean Rig UDW Inc. (“Ocean Rig”), of the $800 million syndicated secured term loan facility to partially finance the construction costs of the Ocean Rig Corcovado and Olympia. This facility has a 5 year term and 12 year repayment profile, and bears interest at LIBOR plus a margin.

Normand Ranger Delivered

Normand Ranger for Solstad Offshore is delivered from Ulstein Verft May 5. Completion of the anchor handling vessel has been a challenging task but the shipyard delivers the project to the agreed terms within time. Ulstein Verft won the contract with GIEK and Sparebank 1 SR-Bank for completion of the anchor handling vessel last spring. The ship came to Ulstein Verft from the bankrupt shipyard Karmsund Maritime Service in August 2009. Normand Ranger type VS 490 AHTS from Wärtsilä Ship Design.