Stonepeak to Buy Teekay LNG in $6.2 Billion Deal

Investment firm Stonepeak said on Monday it would buy Teekay LNG Partners in a deal worth $6.2 billion, as it looks to take advantage of rising global demand for LNG amid a push towards cleaner sources of energy.Prices of the benchmark U.S. natural gas contract have been on the rise, hitting seven-year highs recently. On Monday, the front-month gas futures contract was up 6.3% at $5.97 per million British thermal units (mmBtu).Stonepeak is offering $17 per unit, which represents a premium of 8.3% to the closing price of Teekay LNG's common units on Oct.

BP Issues Force Majeure Notice for Golar FLNG Unit

Golar LNG Ltd said on Tuesday that it received a force majeure notice from a BP Plc unit seeking to delay taking delivery of a floating liquefied natural gas facility by a year.The notice is the latest force majeure claim issued in the LNG sector that is struggling with a seasonal plunge in demand as well as the spread of the coronavirus outbreak, which has further hammered the consumption of the super-chilled fuel globally.BP is expecting a one-year delay due to the pandemic and currently sees no possibility in reducing the duration of the new timing…

GasLog Withdraws from Golar 'Cool Pool'

The owner and operator of liquefied natural gas (LNG) carriers GasLog and spin-off GasLog Partners are withdrawing their LNG carriers from their pooling joint venture with Golar LNG.The Cool Pool was launched in September 2015 with 14 tri-fuel diesel engine (TFDE) LNG carriers contributed by three owners: three ships from Dynagas Ltd, three from GasLog Ltd and eight from Golar LNG Ltd.Golar LNG Limited announced in a press release that due to the potential spin-off of its TFDE fleet into a new pure-play LNG shipping entity, GasLog has decided to withdraw its six vessels from the Cool Pool. Golar, or, subject to interim market conditions, the spin-off entity, will assume ownership of the Cool Pool following GasLog's departure in June.

Stolt-Nielsen LNG, Golar LNG and Höegh LNG in Joint $182 Million Investment

Stolt-Nielsen Limited (Oslo Børs: SNI), Golar LNG Ltd and Höegh LNG Holdings Ltd. announced a combined investment commitment of $182 million in Avenir LNG Ltd. to pursue opportunities to deliver LNG to areas of stranded demand, as well as the development of LNG bunkering capabilities.The investment will be contributed as cash and equity-in-kind and will fund the construction of six small-scale LNG carriers, a small-scale storage terminal and regasification facilities.Avenir LNG was formed by Stolt-Nielsen in 2017 to provide LNG to markets lacking access to natural gas pipelines.

Golar LNG Appoints Iain Ross as CEO

Shipping company Golar LNG Ltd said it has appointed Iain Ross as its new chief executive. Ross succeeds Oscar Spieler, who was appointed as CEO last year after having previously led the company between July 2009 and June 2011. Spieler was in charge of the company's FLNG Hilli Episeyo project and is leaving after its delivery, but would remain with the group as executive adviser, the company said in a statement. Ross has joined Golar from project delivery company WorleyParsons Ltd, Golar LNG said. Reporting by Kanishka Singh

Keppel to Deliver World's First Converted FLNGV

Keppel Offshore & Marine's (Keppel O&M) wholly-owned subsidiary, Keppel Shipyard Ltd (Keppel Shipyard), will soon deliver the world's first converted Floating Liquefaction Vessel (FLNGV) owned by Golar Hilli Corporation (Golar), a subsidiary of Golar LNG Ltd. The vessel was named Hilli Episeyo at a ceremony in Keppel Shipyard today. Upon its completion, the FLNGV will be put in operation offshore Kribi, Cameroon for Société Nationale des Hydrocarbures and Perenco Cameroon SA, and will be the first FLNGV project in Africa. Chris Ong, CEO of Keppel O&M said, "We are proud to be able to deliver the world's first FLNGV conversion in partnership with Golar LNG within three years and with a commendable safety record.

Golar LNG Hit by Weak Market

Oscar Spieler-led LNG shipowner Golar LNG Ltd. (GLNG) on Tuesday reported a loss of $80.1 million in its first quarter. The results did not meet Wall Street expectations. The average estimate of seven analysts surveyed by Zacks Investment Research was for a loss of 41 cents per share. The operator of carriers for natural gas shipping posted revenue of $18.6 million in the period, also falling short of Street forecasts. Four analysts surveyed by Zacks expected $23.1 million. The early part of 2016 has witnessed a continuation of the weak LNG freight market, says a company statement. The majority of fixtures have been in the Pacific basin, however they have tended to be for relatively short periods, and this is also where the largest number of idle vessels are located.

FLNG Birth of a Market

FLNG deal-making has been sporadic since Woodside Petroleum at the end of 2013 delayed a final investment decision for the giant Browse FLNG project off Northwest Australia. The previous year had seen go-aheads for most of the floating liquefied natural gas projects (FLNG) underway today, including Shell’s Prelude FLNG — Woodside’s choice, it seems, of a liquefaction solution for fields 200 kilometers offshore. Yet Prelude, “the first project out”, might not be first to produce.

Dynagas, GasLog, Golar LNG Team up to Operate LNG Carrier Pool

Dynagas Ltd., GasLog Ltd. and Golar LNG Ltd today jointly announced having entered into an LNG carrier pooling agreement to market their vessels, which are currently operating in the LNG shipping spot market. The LNG Carrier Pool allows the participating owners to optimise the operation of the pool vessels through improved scheduling ability, cost efficiencies and common marketing. The objective of the LNG Carrier Pool is to serve the transportation requirements of a rapidly growing LNG shipping market by providing customers with reliable, more flexible, and innovative solutions to meet their increasingly complex shipping requirements.

Tanker Converted to LNG-electric Propulsion

Bergen Tankers’ 95-meter-long chemical and product tanker Bergen Viking has returned to service following its conversion from diesel-electric to liquefied natural gas (LNG)-electric propulsion. Delivered in 2007, the Rolls-Royce powered vessel supplies diesel and petrol along the Norwegian coastline in trade for Statoil as part of a fleet of six vessels owned by Bergen Tankers AS. Bergen Viking’s retrofit saw four of the ship’s original six diesel generating sets replaced with two Rolls-Royce Bergen C6 generating sets.

Rolls-Royce Gas Engines for FLNG Power Generation

Rolls-Royce has secured a contract with Keppel Shipyard in Singapore to supply two all-gas engines for power generation on-board a Floating Liquefaction Vessel (FLNGV) owned by Golar LNG Ltd. The vessel Hilli was a former LNG carrier and is being converted to a FLNGV carrier. Bergen B35:40V20AG is a compact and powerful gas engine with environmental performance in terms of low emissions of NOx, CO2, SOx and particulates. The energy consumption is also low, helping Rolls-Royce to win the bid by offering a more efficient all-gas solution compared to dual-fuel options.

Golar LNG sells Golar Viking

Golar LNG Ltd has completed the sale and delivery of the LNG carrier Golar Viking to PT Perusahaan Pelayaran Equinox (Equinox) for US$135 million. The 140,205-cbm Golar Viking (built 2005) has been renamed Salju under Indonesian flag and registry. Under Indonesian Cabotage regulations, LNG cargoes produced and sold within Indonesia must be transported on an Indonesian flagged vessel. Equinox decided to acquire the Golar Viking and transfer the vessel to Indonesian flag due to an anticipated increase in domestic allocation for Indonesian produced LNG cargoes this year. The technical specification of Golar Viking, now renamed Salju, is well suited for the short haul nature of the domestic Indonesian trade.

Golar LNG Posts Q4 Results

According to a report from RTT News, on March 1, Golar LNG Ltd. (GOL) posted consolidated net income of $4.7m and consolidated operating income of $15m for the fourth quarter of 2010. (Source: RTT News)

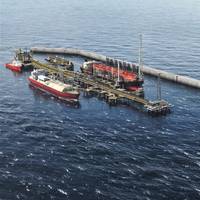

Ince Advises on Jordan FSRU

International law firm Ince & Co. LLP advised Golar LNG Ltd. on the successful completion of a Floating Storage and Regasification Unit (FSRU) time charter with the Ministry of Energy and Mineral Resources of Jordan. Ince advised Golar on all aspects of the charter and related documentation, from the initial expression of interest, throughout the tender stage, to final completion of the deal on July 31. The FSRU Golar Eskimo will be moored at a purpose built structure that is to be constructed by the Aqaba Development Corporation off the Red Sea port of Aqaba. Capable of storing 160,000 cubic meters of LNG and delivering up to 500 MMSCFD with a peaking capacity of 750 MMSCFD…

Betting Big LNG Rates Will Rise

Gas is big and growing, as rates for LNG hauling tanker rise for a third year, fueled in part by demand from Japan. According to a Bloomberg report, rising Japanese demand means that Golar LNG Ltd., which operates nine LNG tankers and is controlled by John Fredriksen, will report a threefold gain in 2012 net income, according to the mean of 11 analyst estimates in a Bloomberg survey. Golar is reactivating four-decade-old mothballed ships after rates doubled in 2011 and are forecast by analysts to advance another 58 percent in 2012. Traders redirected 13 ships to Asia from Europe or the U.S. in the past month, data compiled by Bloomberg show. LNG from Nigeria, the largest exporter in the Atlantic, sold for 93 percent more in Japan than in the U.K.

ABB Wins Electrical Contract for Drillships, LNG Carriers

ABB's order, worth $80 million from Samsung Heavy Industries, is to supply energy efficient drives, motors and electrical power systems for five drilling vessels and two liquefied natural gas (LNG) carriers to be built at Samsung’s shipyard in Korea. The vessels will be used to extract, process and transport oil and gas. Samsung is building five drill ships (three for Seadrill Ltd. in Norway, one for Pacific Drilling S.A in Brazil and one for Ensco Plc in the UK) and two LNG carrier vessels for Golar LNG Ltd in the UK. The vessels will be used for oil and gas exploration and the transportation of liquefied natural gas. ABB will deliver the complete electrical system for the seven vessels…

ABB Wins $80 million Order From Samsung Heavy Industries

ABB recently won an order worth $80 million from Samsung Heavy Industries to supply energy efficient drives, motors and electrical power systems for five drilling vessels and two liquefied natural gas (LNG) carriers to be built at Samsung’s shipyard in Korea. The vessels will be used to extract, process and transport oil and gas. The order was booked in the second quarter of 2012. Samsung Heavy Industries, a branch of the giant South-Korean holding, focuses its shipyard business on a wide range of large vessel types, including LNG carriers, drill ships and semi-submersible drilling rigs.

Golar LNG Wins Chile FSRU Contract

Golar LNG Ltd. Golar LNG Limited has been awarded the Gas Atacama Mejillones Seaport's FSRU Project ("Gas Atacama"). The FSRU will be moored approximately 1.6 km offshore and in approximately 50 metres water depth in the Bay of Mejillones. The newbuild FSRU will be capable of storing 170,000 m3 of LNG and delivering approximately 180 MMcfd per day of regasified LNG and will be delivered to the project in the fourth quarter of 2015. The initial term of the contract, in Gas Atacama's option, is for 15 or 20 years and is expected to generate an average annual EBITDA of approximately US$48 million for the 15 year charter or US$47 million for the 20 year charter. Gas Atacama has three, five-year contract extension options, representing a potential 15 additional years of commitments.

Africa to Roll out Three Floating LNG Projects

Africa has planned three floating LNG export projects - Cameroon, Equatorial Guinea and Mozambique. According to local media reports, the African nations are launching LNG projects - three such planned projects in Nigeria; two planned LNG projects in Equatorial Guinea; two in Mozambique and one in Tanzania, none of which is sanctioned. Cameroon is the latest African country to signal a planned LNG project. Of the planned LNG projects one is a Floating LNG each in Equatorial Guinea, Mozambique and Cameroon. The Daily News says that Cameroonian Floating LNG project, announced on Christmas Day 2014 as a three way Heads of Agreement (the HOA) between Golar LNG Ltd (Golar) Societe Nationale de Hydrocarbures (SNH) and Perenco Cameroon…

Keppel to Sign Golar LNG Conversion Contract

Keppel Shipyard enters into a term sheet agreement with Golar LNG regarding the conversion of three LNG vessels. Keppel Shipyard Ltd (Keppel Shipyard) has entered into a term sheet agreement with Golar LNG Ltd (Golar LNG), to work together on the conversion of up to three LNG vessels into Floating LNG (FLNG) vessels. This term sheet agreement requires Keppel Shipyard to start with a Front-End Engineering and Design (FEED) study to confirm the engineering and work scope. Upon completion of the FEED study, Keppel Shipyard will then proceed to work with Golar LNG on the conversion and engineering of the first of the three FLNG vessels. There will be an option to convert the other two FLNG vessels at a later date.

Smith Named CEO of Golar LNG

Gary Smith will take over as CEO of Golar LNG limited, taking over for Doug Arnell, who will step down on February 1, 2015. Smith brings a track record of leadership and operational management in the mid-stream oil and gas, shipping and LNG businesses. His career spans 35 years, including 25 years with Shell and Caltex Australia (a Chevron affiliate) in roles including General Manager LNG Shipping for Shell (STASCO) and General Manager Refining, Supply and Distribution for Caltex Australia.

Change in CEO at Golar LNG

Golar LNG Limited today announced that Doug Arnell has decided to step down as CEO of Golar on February 1, 2015. Mr. Arnell's decision is driven by a personal wish to return with his family to his home country of Canada. Mr. Arnell will be succeeded by Gary Smith, who is well known to Golar and who brings with him a track record of leadership and operational management success in the mid-stream oil and gas, shipping and LNG businesses. Mr. Smith's career spans 35 years, including 25 years with Shell and Caltex Australia (a Chevron affiliate) in roles including General Manager LNG Shipping for Shell (STASCO) and General Manager Refining, Supply and Distribution for Caltex Australia.

GasAtacama has US LNG Providers Lined Up

GasAtacama, energy provider to metal producers in Chile's Atacama desert, has lined up eight potential U.S. natural gas suppliers for a proposed import terminal on its Pacific Coast, but uncertainty about energy demand has delayed deals, CEO Rudolf Araneda told Reuters on Thursday. GasAtacama plans to build a $350 million offshore liquefied natural gas (LNG) import terminal that would take shipments of the fuel to help create 500 megawatts of electricity for power-hungry miners in the mineral-rich north.