INSIGHTS: John Rynd / President , CEO and Director, Tidewater Inc.

Mr. John Rynd graduated from Texas A&M University with a Bachelor of Arts degree in Economics. He previously served as Chief Executive Officer and President, and as a director of Hercules Offshore from 2008 through 2016. Prior to his time with Hercules, Mr. Rynd spent 11 years with Noble Drilling Services, Inc., where he served in a variety of management roles. Earlier in his career, he served in various roles of increasing levels of responsibility with Chiles Offshore and Rowan Companies. Beyond this, Mr. Rynd served as Chairman of the National Ocean Industries Association (NOIA) from 2014-15 and currently holds an Ex-Officio position on the Executive Committee. He serves on the Board of Directors of Fieldwood Holdings LLC, and was on the Board of Directors of Hornbeck Offshore, Inc.

Qatari Coastguard Orders 9 More Newbuilds

Turkey’s ARES Shipyard and partner BMT have secured a new order from the Qatari Coastguard to produce nine additional patrol boats on top of the 17 vessels already ordered. The new order, which was officially signed during DIMDEX (Doha International Maritime Defense Exhibition and Conference) last week, includes three 48-meter ARES 150 HERCULES Offshore Patrol Vessels (OPVs) and six 24-meter ARES 80 SAT Special Operations Support and Fast Attack Craft, all of which are expected to be delivered by the end of 2020.

Tidewater Names Rynd President, CEO

Tidewater Inc. (NYSE: TDW) appointed John T. Rynd as the company's new President and CEO and a member of the Board of Directors effective March 5. He replaces Larry T. Rigdon who has served as interim President and Chief Executive Officer since October of 2017. Tom Bates, Chairman of the Board of Directors, said "After completing a comprehensive search, the Board is very pleased to welcome John to the team. He brings with him considerable experience in the offshore drilling services sector and the global oil and gas industry as a whole. Rynd previously served as Chief Executive Officer and President, and as a director of Hercules Offshore from 2008 through 2016.

The New Offshore Reality

Swedbank’s chief economist, Harald Andreassen, isn’t “too hopeful” about the long-term prospects for the oil price, but then again, “I’m less certain of this than I’ve ever been as an economist,” he told a floating production conference in Oslo. After two-and-half years of oil-price collapse followed by layoffs in the thousands; stacked oil rigs and order freezes for offshore shipping, price insecurity itself is a partial expression of confidence. Beneath some palpable yet halting movements toward recovery in 2017…

Ocean RIG Files for Bankruptcy Protection in US

Rig contractor Ocean RIG UDW Inc filed for Chapter 15 bankruptcy protection in a U.S. court amid a deep and prolonged downturn in the industry. Shares of the company plunged 36.4 percent to 46 cents in early trading on Tuesday. The Cyprus-based company, which had $3.25 billion in debt as of Dec. 31, filed for bankruptcy in the United States Bankruptcy Court for Southern District of New York on Monday. Under U.S. bankruptcy laws, Chapter 15 grants a foreign company protection from creditors looking to seize its assets in the country.

Offshore Vessel Contractors Re-shaping for a Rebound

The announcement on the February 28 of EMAS Chiyoda’s bankruptcy is the latest in a long line of vessel contractors to fall victim to the downturn since January 2015. Multiple companies such as Cal Dive, Ceona, Cecon, Hercules Offshore, Harkand and Swiber have entered into administration, taking a significant number of vessels out of the active fleet. In other cases, internal restructuring measures (e.g. Siem Offshore, Boa Offshore, Deepocean etc.) were/have been in order. While current indicators of subsea activity (e.g.

Ship Operator Toisa Files for Bankruptcy

Shipping company Toisa Ltd filed for U.S. Chapter 11 bankruptcy as falling demand for the Bermuda-chartered company's oil-and-gas supply vessels left it running short of cash, according to court documents. Toisa, owned by Greek shipping magnate Gregory Callimanopulos, has a global fleet of 26 offshore oil service vessels, 13 tankers and seven bulk ships, according to documents filed with the U.S. Bankruptcy Court in Manhattan. The ship operator said it had more than $1 billion in debt in court documents.

Hercules Offshore Filing for Bankruptcy Again

Hercules Offshore Inc said it planned to file for prepackaged Chapter 11 bankruptcy, just six months after the rig contractor emerged from bankruptcy protection. The company said it had entered into a restructuring support agreement with some lenders, which will eventually allow it to place all its unsold assets into a wind-down vehicle until they can be sold. Hercules Offshore said its international units would not be included in the bankruptcy filing, but would be a part of the sale process. The company said in February that it was considering strategic options, including selling itself. Hercules filed for Chapter 11 bankruptcy protection in August 2015 and emerged from bankruptcy in November. "Since this time, the ongoing decline in oil prices, the consolidation of its U.S.

Hercules Offshore Expects to Emerge from Bankruptcy in Q4

Rig provider Hercules Offshore Inc said on Thursday that it expects to file for Chapter 11 protection next month and emerge with a restructured balance sheet in the fourth quarter. The company said last month that it had entered into a restructuring agreement with a majority of its debtors and would file for Chapter 11 protection by July 8. Hercules shares were down 5.8 percent at 15.35 cents on Thursday afternoon. (Reporting by Sneha Banerjee and Narottam Medhora; Editing by Savio D'Souza)

Hercules Offshore to Begin Restructuring

The Houston-based NASDAQ-listed drilling contractor Hercules Offshore Inc. (HERO) has entered a restructuring agreement with a noteholder group, and expects a prepackaged reorganization plan. HERO says the agreement will convert $1.2B of debt to new common equity, and noteholders will backstop $450M of new debt financing to fully fund the remaining construction cost of the Hercules Highlander and provide additional liquidity to fund the company's operations. HERO's existing equity holders will see their stake reduced to 3.1%. John T. "The Agreement we reached contemplates a value maximizing transaction for the Company, which we expect will impact our balance sheet only, while our operations will continue as usual.

Hercules Offshore: Challenges Ahead in 2015

Drilling contractor Hercules Offshore Inc forecast a challenging year ahead as demand for its rigs remains weak with producers scaling backing drilling due to a slump in global oil prices. Shares of the company, which reported a smaller-than-expected loss, rose 21 percent to 84 cents in light trading before the bell. Demand for jackup rigs remains weak in every region of the world, Chief Executive John Rynd said, adding that a "significant" number of new rigs were expected to be delivered over the next several years, burdening an already weak market. Hercules operates 33 jackup rigs, used in shallow-water drilling. Utilization rates for the company's U.S. offshore rig division, its biggest business, fell to 60.1 percent from 83 percent, a year earlier.

Taylor to Chair NOIA Board

The National Ocean Industries Association (NOIA) Board of Directors has elected Cindy B. Taylor as Chair and Kevin McEvoy as Vice Chairman for the upcoming 2015-2016 term. Taylor and McEvoy assumed their positions at the NOIA Annual Meeting today in Washington, DC. Since 2007, Cindy has served as President and Chief Executive Officer of Oil States International, Inc., a publicly traded diversified oilfield services company headquartered in Houston. She also serves on the company’s board of directors, and has been NOIA’s Vice Chair for the 2014 -2015 term. “The oil and natural gas industry is tough and resilient. Since I first joined NOIA…

Hercules Offshore Shares Fall 33%

Drilling contractor Hercules Offshore Inc's shares fell as much as 33 percent to a record low on Friday, a day after Deutsche Bank cut its price target on the company's stock to $0. State-owned oil company Saudi Aramco terminated its contract for one of Hercules Offshore rigs on Thursday, prompting the brokerage to downgrade the stock to 'sell' from 'buy'. Rig operators are struggling to find work as oil producers scale back spending and drilling activity in response to a near 50 percent fall in crude prices since June. "With demand nearly non-existent and a steady stream of new capacity entering the market, the prospect for recovery in the short to intermediate term is bleak," Deutsche Bank analysts wrote in a note to its clients.

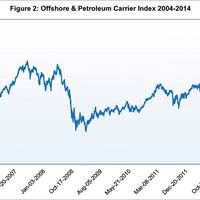

Energy Sector Volatility Affects Middle Market M&A Activity

Market volatility for the petroleum sector provides a backdrop to an evolving Merger & Acquisitions environment for the Offshore Sector. In the 3Q edition of Maritime Professional, this series of articles examined the overall evolution of maritime and offshore M&A activity since 2010, tracing the flow of deals in the post-financial crisis era. In this edition, we take a closer look at relevant U.S. offshore energy industry deal flow and market movements as they relate to oil prices over time, and highlight some recent middle market transactions.

Rowan Appoints Butz CFO

Rowan Companies (NYSE: RDC) appointed Stephen M. Butz as Executive Vice President, Chief Financial Officer and Treasurer, effective December 1, 2014. Butz joins the company from Hercules Offshore, Inc., where for the past nine years he has served in various corporate development, treasury and finance functions, most recently as Executive Vice President and Chief Financial Officer. Butz also has more than 10 years' experience in commercial and investment banking. Butz will take over from Kevin Bartol, whose resignation was previously announced and is effective as of November 30, 2014.

Sembcorp Wins US$236-Million Jack-up Rig Contract

Singapore's Sembcorp Marine says that its subsidiary Jurong Shipyard has secured a US$236 million (about S$296 million) contract to build a high specification, tailor-made jack-up rig for new customer Hercules North Sea Ltd. Scheduled for delivery in the second quarter of 2016, the jack-up rig will be built based on the Friede & Goldman JU 2000E design which has enhanced features suitable for UK operations. The new rig is designed to operate in waters of 400 feet and drill to depths of 30,000 feet. Itwill be equipped with 2,000,000 lbs drilling capacity, 6,000 barrels mud capacity, 28,000 kips preload capacity for the legs and 150-man accommodation capacity. Upon delivery, it will be chartered out to Maersk Oil and Gas for deployment in the UK sector of the North Sea. Mr. John T.

Hercules Offshore December Fleet Status Report

Hercules Offshore, Inc. announced that it has published the November Fleet Status Report. The report includes the Hercules Offshore Rig Fleet Status (as of December 18, 2013), which contains detailed contract information for each of the company's drilling rigs. The report also includes the Hercules Offshore Liftboat Fleet Status Report, which contains information by liftboat class for November 2013, including revenue per day and operating days. The report can be found on the company's website at herculesoffshore.com, under the "Investor Information" section of the website.

Keppel FELS Deliver Second Hercules Offshore Rig

Hercules Offshore, have received a second harsh environment KFELS Super A Class jackup rig, named ‘Hercules Resilience’ from Keppel FELLS, Singapore. Developed by Keppel FELS’ R&D arm, Offshore Technology Development (OTD), the KFELS Super A Class is an enhancement of the successful and proven KFELS A Class design. The Hercules rigs have been customised to meet the requirements of Houston-based Hercules Offshore, and are capable of operating in water depths of 400 feet and drilling depths of 35,000 feet.

Hercules Offshore Provides November Fleet Status Report

Hercules Offshore, Inc. published the November Fleet Status Report. The report includes the Hercules Offshore Rig Fleet Status (as of November 21, 2013), which contains detailed contract information for each of the company's drilling rigs. The report also includes the Hercules Offshore Liftboat Fleet Status Report, which contains information by liftboat class for October 2013, including revenue per day and operating days. The report can be found on the company's website at herculesoffshore.com, under the "Investor Information" section.

GAC Moves Rig from Sri Lanka to India

GAC Sri Lanka has completed the movement of offshore drilling rig Hercules Triumph from the port of Trincomalee to India. The rig, owned by Hercules Offshore, Inc., is now safely anchored at Kakinada, ready to start drilling operations for CAIRN Energy at the RAVVA offshore oil field. GAC Sri Lanka, part of global shipping, logistics and marine services provider GAC Group, chartered three anchor-handling tug boats - SCI URJA, SCI Ahimsa and Mahaweli - to off-land the Hercules Triumph from heavy-lift vessel Target at Trincomalee Anchorage and worked in close liaison with the Harbor Master and port officials throughout the complex operation.

Offshore Drill-Rig 'Hercules Triumph' Arrives India

Logistics and marine services provider, GAC Sri Lanka, chartered three anchor-handling tug boats to off-land the 'Hercules Triumph' from heavy-lift vessel 'Target' at Trincomalee Anchorage, Sri Lanka, then arranged further towage over 700 NM miles to Kakinada, Indai arriving 8 days later. The rig is ready to start drilling operations for CAIRN Energy at the RAVVA offshore oil field. As part of its task to oversee the entire project, GAC Sri Lanka was also responsible for domestic air transfers of Hercules Offshore officials to and from the site.

All Coast Acquires Hercules Liftboats

All Coast, LLC, a newly formed company for the marine services industry founded by John Powers and John Nesser III, has completed the acquisition of Hercules Offshore’s domestic liftboat assets. This $57.5 million acquisition includes 29 actively marketed liftboats ranging from class 105 to class 229, 10 inactive liftboats and additional related assets. Powers and Nesser, All Coast managers and co-chief executive officers, each have more than 40 years of experience in the oil and gas, engineering and maritime industries.

New Firm Acquires Hercules Offshore Domestic Liftboats

All Coast, LLC, a newly formed company for the marine services industry founded by John Powers and John Nesser III, has completed the acquisition of Hercules Offshore’s domestic liftboat assets. This $57.5 million acquisition includes 29 actively marketed liftboats ranging from class 105 to class 229, 10 inactive liftboats and additional related assets. Powers and Nesser, All Coast managers and co-chief executive officers, each have more than 40 years of experience in the oil and gas, engineering and maritime industries. Throughout his career, Powers has owned and operated numerous energy and marine services companies including Power Offshore Services, LLC; Reeled Tubing, LLC; Seatrax, LLC; and Coastal Drilling Co.