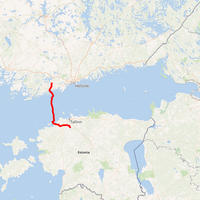

Finland-Estonia Gas Pipeline System to Get Bigger Capacity after Repair

The Balticconnector gas pipeline between Finland and Estonia, which was damaged last month, will get a bigger northbound transmission capacity next year following repairs, Finnish operator Gasgrid said in a statement on Wednesday.The increase will come from an enhancement of the Latvia-Lithuania interconnection, which allows for higher gas volumes to be transported around the Finnish-Baltic region, it added.The pipeline will in the future get a base capacity of 70.5 gigawatt hours of gas per day in the direction from Estonia to Finland…

Panama Canal Sees Dip in LNG Carrier Transits

Warmer temperatures this winter in Asia and higher gas demand in Europe are cutting demand for transit of vessels carrying liquefied natural gas (LNG) through the Panama Canal, the waterway's authority told Reuters on Wednesday.The canal overall is facing higher seasonal demand for vessel passage with an average of 39 ships per day, and it is working to accommodate vessels arriving without reservation for passage, the Panama Canal Authority added.(Reuters - Reporting by Elida Moreno, writing by Marianna Parraga)

LNG Demand to Rise 25-50% By 2030 - Morgan Stanley

Demand for liquefied natural gas (LNG) is expected to rise by 25 to 50% by 2030, making it the fastest growing hydrocarbon over the next decade, analysts from Morgan Stanley Research said in a note on Monday.Morgan Stanley has raised its long-term LNG price outlook to $10 per million British thermal units (mmBtu), expecting spot prices of the super-chilled fuel to average 40% higher over the next decade, versus the past five years.Asian spot LNG prices hit a record above $56 mmBtu…

Europe Looks for Gas as Groningen Folds

Europe’s energy landscape will be completely changed once the Dutch shut down the largest gas field on the continent years ahead of schedule, according to Rystad Energy.The Netherland recently announced that production at Groningen – Europe’s largest gas field – will be halted in 2022, eight years earlier than initially planned. However, despite the ambitious target of decommissioning the field by 2022, Rystad Energy expects that there could be some residual production from Groningen up to 2030 as it is technically challenging to completely shut down production in such a short timeframe.The drastic drop in output from Groningen will redefine the European energy landscape.

U.S. Natural Gas Prices Tumble as Coal Surges

U.S. natural gas prices have tumbled by more than 10 percent since late May as hedge funds start to liquidate a near-record bullish position accumulated in the expectation of a tighter market that failed to materialise. Hedge funds and other money managers reduced their combined net long position in the two main futures and options contracts linked to Henry Hub prices by 584 billion cubic feet in the week to May 30. Fund managers reduced their net long position by the largest amount in any one week since November 2016, after raising it by a cumulative 1,721 bcf during the previous 12 weeks. Prior to the selloff, hedge fund managers held a record ratio of 5 long positions for every 1 short position, a warning sign that their position had become overstretched and was at risk from a reversal.

Hitachi Gas Supply System Order for MHI

Mitsubishi Heavy Industries, Ltd. (MHI) has received an order from Hitachi Zosen Corporation for a high-pressure gas supply system enabling use of natural gas as fuel in marine engines. In lieu of conventional heavy oil, the system supplies liquefied natural gas (LNG), injected under high pressure, to the engine. This configuration curbs emissions of sulfur oxides (SOx), nitrogen oxides (NOx) and carbon dioxide (CO2), thus contributing to reduction of environmental loads. Delivery of the system is scheduled for the second half of 2016, for installation at Hitachi Zosen's Ariake Works in Nagasu-machi, Kumamoto Prefecture. After use in gas fuelled demonstration testing of a marine diesel test engine…

NOIA Applauds Senate Passage of OPENS Act

NOIA President Randall Luthi issued the following statement on the Senate Energy and Natural Resources Committee’s passage of the OPENS Act, which will open new areas of the OCS to energy exploration and development, extend revenue sharing to participating coastal states, and lift the outdated ban on U.S. “The National Ocean Industries Association applauds the Senate Energy and Natural Resources Committee for passing the OPENS Act, which will strengthen America’s energy and national security, improve our national economy, and benefit consumers across the country. Over 85 percent of our federal offshore acreage is off limits to oil and natural gas development.

Statoil 2Q 2015 Earnings Slip

Statoil delivered Adjusted earnings of NOK 22.4 billion and adjusted earnings after tax of NOK 7.2 billion in the second quarter. Statoil reported Net income in accordance with IFRS of NOK 10.1 billion, including gains from divestments. "In the second quarter, Statoil delivered encouraging operational performance with good production growth and high regularity, whilst continuing to reduce cost. Our financial results were characterised by gains from divestments and lower prices. Also in the second quarter, we report a close to neutral free cash flow after dividend and proceeds", says president and CEO of Statoil ASA, Eldar Sætre. Adjusted earnings were NOK 22.4 billion in the second quarter compared to NOK 32.3 billion in the same period in 2014.

Oil’s Downward Spiral Stalls LNG’s Ascent

As industry embraces gas, emissions regulations loom large and bunker logistics options develop, LNG’s fortunes nevertheless get a boost. For every gleeful consumer at the pump, and stockpiling tanker anchored offshore, there’s a corresponding trail of businesses that are struggling to ride out the worst price drop in crude since the mid-1980s. As oil giants slash CapEx, Halliburton and other industry players layoff thousands and record numbers of oil rigs go offline, less obvious is the impact of the latest oil market blow out on the growth of liquefied natural gas (LNG).

Statoil to Cut Expenditure by $5 Billion

Statoil's fourth quarter 2013 net operating income was NOK 43.9 billion. In 2013, net operating income was NOK 155.5 billion. At today's Capital Markets Update, Statoil presents its plan for reduced capital expenditure by more than $5 billion (USD) from 2014-16 compared to previous plans. This will enable positive organic free cash flow after dividend from 2016. Statoil expects to deliver around 3 % average rebased organic production growth from 2013-16. Adjusted earnings for the fourth quarter of 2013 were NOK 42.3 billion, compared to NOK 48.3 billion in the fourth quarter of 2012.

Statoil: Long-Term Outlook Bright

Today, Statoil (OSE: STL, NYSE: STO) presented its long term growth outlook. The company expects to raise production from around 1,9 million barrels in 2010 to above 2.5 million barrels of oil equivalents per day in 2020. With premium positions on a revitalised Norwegian Continental Shelf (NCS) and a world class project portfolio, Statoil is positioned to deliver strong shareholder returns. Celebrating its ten years anniversary as a publicly listed company, Statoil expands on its outlook for the coming years at the Capital Markets Day at the New York Stock Exchange.

StatoilHydro's 3Q Results

StatoilHydro ASA (OSE: STL, NYSE:STO) StatoilHydro's net income in the third quarter in 2008 amounted to NOK 6.3 billion compared to NOK 14.6 billion in the third quarter of 2007 and was negatively affected by the significant strengthening of the US dollar compared to NOK on net financial items and consequently an unusually high tax rate. Net income in the first nine months of 2008 amounted to NOK 41.2 billion, compared to NOK 38.4 billion in the first nine months of 2007. In the third quarter of 2008 the net operating income was NOK 47.0 billion, compared to NOK 35.8 billion in the third quarter of 2007. For the first nine months of 2008, net operating income amounted to NOK 161.1 billion, compared to NOK 106.4 billion in the first nine months of 2007.

Natural Gas Boom Causes Soft Offshore Rig Demand

Demand for offshore rigs in the U.S. Gulf of Mexico has softened after a natural gas drilling boom in the first half of 2001, but forces that could support a recovery may already be at work, analysts said on Monday. Drilling has slowed down in the waters off the Texas and Louisiana coasts in response to a steep drop in U.S. natural gas prices from record highs of around $10 per thousand cubic feet at the end of last year to levels of around $3 in recent weeks. The number of rigs working in the U.S. Gulf fell to 165 last week from 168 the previous week, bringing the utilization rate for the U.S. Gulf drilling fleet down to 77.8 percent from 90.5 percent in late April, according to Offshore Data Services.