Container Shipping a 'Mixed Bag' - Drewry

South Asia container trade with Europe continues to outpace the Middle East, says Drewry in its Container Insight Weekly report.Container shipments in the combined eastbound Europe to the Middle East and South Asia trade performed well in the first quarter, rising by 5.2 percent year-on-year according to Container Trade Statistics. However, that aggregate rate hides two very different performances by the two destinations. CTS reports that inbound traffic to South Asia soared by 18 percent in 1Q18 to reach approximately 410…

Top 5 Carriers to Dominate Container Shipping, Says Drewry

If both APL and UASC are included within their new parents, the top five ocean carriers now control approximately 54 percent of the world’s containership fleet, says Drewry. In 2015, the top 10 carriers were close to controlling 90 percent of the market. It is conceivable that at some point in the future further concentration will see 90 percent of the Asia-North Europe market being controlled by just five competitors, at which time the carriers will have much greater pricing power than they did in the past. Drewry said in its Container Insight Weekly that in addition to Hanjin Shipping, whose global presence was over, other brands that have effectively disappeared from the upper echelons of carrier rankings this summer included China Shipping Container Lines after its merger with Cosco…

Steady as She Goes

Ahead of the Panama Canal expansion two alliances have announced they will upsize some of their ships on the Asia-US East Coast route. How quickly will the others follow? The 9,400-teu Cosco containership Andronikos will make the first transit of the expanded Panama Canal on Sunday 26 June, and ahead of that two shipping alliances – CKHYE and G6 – have laid out their plans to upgrade the size of ships used on the Asia-US East Coast via Panama route. In November last year Container Insight Weekly noted that Drewry expected carriers to resist the urge to flood the trade with the biggest ships possible and that vessel upgrades will be incremental and in line with demand growth. That prediction seems to have come true based on the immediate plans that have been communicated thus far.

Container Market - Between a Rock and a Hard Place

The pain of the current container market downturn extends beyond carriers, says Drewry's Container Insight Weekly. Some independent ship-owners are faced with either lowering charter rates to help save ailing carriers or risking their assets going idle. Much of the focus on the recent slump in the container shipping market has focused on the bottom lines of the operators moving cargo on the water, with ever-diminishing profits (that have now almost universally turned to losses) being the driver of a new round of M&A and alliance forming. However, less is known about the financial health of the roughly other half of ship owners who charter their assets out.

Drewry: HMM, Hanjin Mull Merger

A merger between Hyundai Merchant Marine (HMM) and Hanjin Shipping remains a real possibility, says the London-based analyst firmDrewry, who has looked at how such a company will look like. The research firm said in its Container Insight Weekly previous merger talks between HMM and Hanjin were put to rest by the Korean government last year, but the debt situation in both companies was causing serious concern in local circles and could bring the companies back to the table. “A merger would propel both carriers from being on the peripheries of the Top 20 to the become the fourth largest operator in the world (before the merger of Cosco and CSCL into China Lines) with combined worldwide volumes of 8 million teu from a fleet capacity of just over 1 million teu…

Idling Fleet Continues to Surge

Owners are rapidly laying up containerships as the market slows. The size of the idle fleet will get bigger while rates and profits slide, says Drewry Shipping Consultants Limited. The number of idle container vessels has gained momentum in November and hasjumped 52 percent from October, Drewry said in its Container Insight Weekly. Idled ships are defined by Drewry as those which have been inactive for at least 14 days. The crisis weighs heavily on the global container freight market, which continues to be dominated by massive overcapacity, low demand and historically low freight rates. The world’s idle containership fleet swelled to 238 vessels and topped 900,000 TEU in November as owners rapidly lay up containerships as the market slows.

DMR Examines Container Terminal Congestion Issues

Container port congestion has been hitting the headlines recently, but the reasons for it vary widely and in many cases it is only a short term issue. Certain world regions though may be at greater risk of persistent congestion in the longer term, considers Drewry Maritime Research in this extract from the latest 'Container Insight Weekly'. The map shown here provides a snapshot of some of the main container ports which have reportedly experienced congestion issues in recent months. Asia features strongly, as does North Africa, along with North Europe and the US. The issue of congestion is not restricted to one part of the world therefore, nor is it solely an emerging or developed market problem.

Specialised Reefer Container Operators can Thrive: DMR

Despite growing competition from container lines, specialised reefer operators can still thrive, according to Drewry’s latest Reefer Shipping Market Annual Review & Forecast, referred to here in an extract from DMR's latest 'Container Insight Weekly'. Specialised reefer operators peaked some years ago in terms of cargo volumes and are now having to contend with falling volumes and market shares as container lines move further into their territory. However, this does not necessarily mean they cannot survive and looking at the limited number of public companies reporting financial returns, profitability is indeed achievable. To protect their future viability, specialised reefer companies must now reinvent themselves to protect their undoubted expertise in this field.

Ocean Three Containership Alliance v the Rest: DMR Analysis

Last Tuesday’s announcement of the formation of the “Ocean Three” alliance – actually a combination of vessel sharing, slot exchange and slot charter agreements – confirmed one of the worst kept industry secrets. But what will be its impact on the competition? Drewry Maritime Research consider in this excerpt from their latest 'Container Insight Weekly''. The coming together from late 2014 of CMA CGM with CSCL and UASC was widely anticipated after the decision in June of Maersk Line and MSC to jettison CMA CGM in their 10-year “2M” VSA that replaced the original P3 Network plan. Having been left out in the cold by its erstwhile P3 partners…

GDP v TEU: DMR Analyses the Interplay

The strength of first-half 2014 container flows from Asia to Europe flies in the face of the macro-economic data coming out of Europe, says Drewry Maritime Research (DMR) in their latest ‘Container Insight Weekly’, excerpted here. As highlighted in last week’s analysis by DMR of the Asia-North Europe trade, disappointing recent economic news coming out of Europe does not chime with the robust growth reported for some of the big ocean container markets. Eurozone GDP flat-lined in the second-quarter as its three largest economies; Germany, France and Italy all stuttered. Germany, which accounts for roughly one-third of the entire Eurozone economy…

No Sign of Ultra-Large Containership Mega Hubs: Analysis

Contrary to the views of some in the industry, Ultra Large Container Vessels are continuing to call at multiple North European ports per loop and are not concentrating on a mega-hub, according to Drewry’s latest Container Insight Weekly, excerpted here. Despite containerships doubling in size in the past 10 years on the Far East-North Europe route, there has not been a reduction in the number of North European ports called by each service. The average number of North European port calls per loop has remained broadly unchanged, at four per service string. As in the past, container services follow a traditional multi-port itinerary and call at about four separate North European ports.

DMR Sees US Container Terminal Sector M&A Flurry

M&A (Merger & Acquisition) activity in the US container terminal sector is currently at its highest level since the boom time of the mid-2000s. However, whilst the type of buyer is largely similar to what it was, the rationale for pursuing today’s deals is different, considers Drewry Maritime Research (DMR) in their latest 'Container Insight Weekly'. The US container terminal sector has seen numerous high profile deals so far this year.Most of the parties on the buy side of the deals are infrastructure and financial players – the same type of buyers that were most active in acquiring US terminals in the mid-2000s. Their aims and motivations today though are somewhat different to what they were.

Proposed Mega-Containerships Alliance 2M: Analysis

Maersk and MSC have just announced a mega vessel sharing agreement that will replace their failed P3 alliance early next year. It will be smaller, and compare well in size with the G6 and CKYH alliances – but what about CMA CGM? Maersk and MSC have taken on board China’s objections to the P3 alliance by coming up with a new vessel sharing arrangement called 2M that they hope will be agreed by all regulatory authorities before the beginning of next year. Out has gone CMA CGM, in order to bring the agreement’s market share down to more acceptable levels, and in has come a much simpler joint co-ordination committee to monitor the carriers’ network on a daily basis.

More Slow Boats to China Following P3 Flop: Analysis

With Maersk, MSC and CMA CGM now in damage limitation mode following their failure to get P3 agreed in China, what else can they do to cut costs? Following China’s rejection of P3 last month, Maersk, MSC and CMA CGM are under pressure to find alternative ways to cut costs. In Drewry’s view, one of these must be by reducing fuel consumption through increased slow steaming, as bunker costs account for well over half of all vessel running costs. It is not the only way, as clarified in ‘Life without P3’. Cash strapped competitors could easily follow suit on slow steaming as the carrier industry is still struggling with over-capacity, and shareholders are clamouring for remedial action.

Spectre of European Container Port Congestion: Analysis

The North European ports of Rotterdam and Hamburg are experiencing significant congestion, an echo of the issues last seen around the world during the boom of the early/mid 2000s – before the global financial crash took over. The causes of the current congestion are numerous, but poor carrier schedule reliability is high on the list. Are these port congestion problems just temporary, or indicative of a new paradigm for the industry? Drewry Maritime Research considers possibilities in their latest 'Container Insight Weekly'. The current congestion difficulties of Rotterdam and Hamburg are partly because terminal capacity is being affected by work to upgrade existing facilities (such as installing new cranes at the ECT Delta terminal) and also because…

Containership Alliance P3 Abandoned: Implications Analysed

So, Maersk, MSC and CMA CGM will not be allowed to form what would have been the largest mega-alliance in the shipping industry. But what are the implications, and what is likely to happen next? Drewry Martime Research consider these questions in their latest Container Insight Weekly. China’s regulators have blocked the P3 mega-alliance between Maersk, MSC and CMA CGM on the grounds that it infringes the country’s competition laws between Asia and Europe, particularly with respect to the lines’ combined market share of 46.7%. The law enforcers appear to believe that the cost reductions gained by the P3 carriers would either have been offset by this unacceptably high risk of market concentration, or would not have been passed back to shippers satisfactorily.

Deep Sea Carriers Attracted to Intra-Asia Routes: Analysis

Cargo growth on intra-Asia routes is attracting deep-sea carriers due to the availability of cheap charter vessels and economies of scale between China and SE Asia, but regional players also know how to form defensive alliances, reports Drewry Maritime Research in its latest 'Container Insight Weekly'. Financially troubled deep-sea ocean carriers are increasingly seeking salvation in the intra-Asia market due to higher than usual cargo growth and the availability of cheap vessel charter rates. Seldom does a month pass without the announcement of at least one new regional service, some of which now deploy vessels over 4,000 teu. Maersk-owned MCC Transport/NYK’s weekly Japan-China-Thailand schedule calling at Tokyo, Yokohama, Nagoya, Kobe, Hong Kong, Shekou, Laem Chabang, Xiamen and Tokyo.

East Coast India Ports Climb in the Ring: Analysis

Adani Ports has acquired an interest in Dhamra Port, situated between the major ports of Haldia and Paradip. Adani Ports and Special Economic Zone recently announced the much-anticipated acquisition of Dhamra Port Company Limited (DPCL), a joint and equal ownership by Larsen and Toubro and Tata Steel. DPCL is a concessionaire at Dhamra Port (in the state of Odisha on the east coast of India) and has been entrusted with the responsibility of building and operating a multi-user, multi-cargo port. DPCL holds a 34-year concession which can be renewed for two additional 10-year periods. Adani Port reportedly had been awaiting environmental clearances (received early this year) for Phase 2 expansion at the port and has also been serving as management consultants to the port.

Mega-Containerships Trigger Terminal Shake-ups

Bigger container ships are resulting in much greater peaks in container terminal activity, which together with the ever larger combined volumes of bigger alliances, demands fewer, larger terminals in each port. Terminal operators are reacting by consolidating terminal layouts and ownership – and by working more closely together – but what are the consequences for their customers? Drewry Maritime Research discuss in this extract from their latest 'Container Insight Weekly'. A recent visit to the Eurogate terminal in Hamburg by China Shipping’s post-Panamax vessel CSCL Le Havre involved an exchange of 11,600 teu, illustrating the sheer scale of volumes per call that terminals increasingly have to deal with. The vessel is shared with CMA CGM and UASC.

Ship Scrapping Increases, but in Wrong Trades

Although the number of vessels being scrapped this year has increased dramatically, and looks set to continue rising, it is having little impact on the current excess of supply over demand where it matters most – in the East-West trades, according to the latest edition of Drewry's 'Container Insight Weekly'. All of the vessels scrapped so far remain below 6,000 teu, whereas the worst excess is in the sector over 10,000 teu, where most vessels are deployed between Asia and Europe. This means that unwanted ULCVs will continue to be cascaded into other routes, thereby maintaining pressure on freight rates. Out of the 73 vessels scrapped up to the end of April…

New Container Terminal May Transform Indonesia Trade: Analysis

During the past five years, trade between Indonesia and the rest of Asia has mushroomed, particularly when compared to trade with North America and Europe (see the graph shown here). How much of this is due to proximity, or Indonesian goods being re-labelled by another Asian country, is beyond the scope of this analysis, but the lack of deep-sea services to the main consumer markets of Europe and North America must play a part, considers the analysis. Although Indonesia is the world’s fourth most populous nation and South East Asia’s largest economy, ocean carriers currently offer no direct mainline services to either Europe or the US due to port capacity shortages.

Desert Ports for Ocean Carriers: New Analysis

ICTSI’s announcement earlier this month that it is investing over $130m in a long term deal with Iraq’s Port Authority to operate and enhance container handling capacity at Umm Qasr illustrates the opportunities ahead for ocean carriers, says Drewry's 'Container Insight Weekly'. Investment by major terminal operators in Umm Qasr shows growing confidence in Iraq’s container growth potential, whilst sanctions continue to bite in neighbouring Iran. Iraq’s sole container port already saw volumes jump by more than 65% in 2013, up to 570,000 teu. Admittedly this is from a relatively low base but it remains impressive growth and suggests that the country’s cargo base is expanding from military cargoes and construction materials to consumer goods and manufactured items.

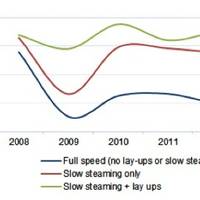

Cargo Sits Waiting a Fortnight in Asia: Analysts Seek Reasons

Jochen Gutschmidt, head of global transport procurement at Nestle, asked the Global Liner Shipping Conference in Hamburg last week: “Why is cargo waiting in Asia for two weeks?” Using data from Drewry’s latest 'Container Forecaster', just published, this week’s 'Container Insight Weekly' attempts to answer that question and quantify how much capacity has been taken out of the system by slow steaming and lay-ups. There was a time when vessel optimisation was achieved by simply deploying the biggest ships at full speed so to minimise the number of vessels required.